Capital gain refers to the actual profit earned from selling an investment at a higher price than its purchase price, triggering a taxable event. Capital appreciation signifies the increase in the market value of an asset over time, which may not be realized until the asset is sold. Understanding the distinction between unrealized appreciation and realized gains is crucial for effective investment planning and tax management.

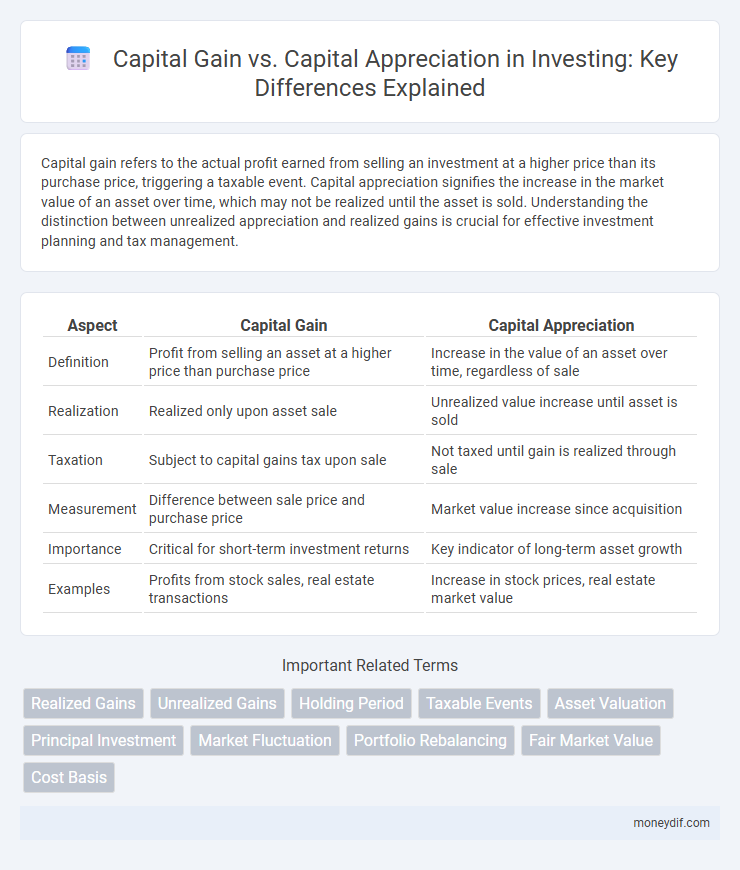

Table of Comparison

| Aspect | Capital Gain | Capital Appreciation |

|---|---|---|

| Definition | Profit from selling an asset at a higher price than purchase price | Increase in the value of an asset over time, regardless of sale |

| Realization | Realized only upon asset sale | Unrealized value increase until asset is sold |

| Taxation | Subject to capital gains tax upon sale | Not taxed until gain is realized through sale |

| Measurement | Difference between sale price and purchase price | Market value increase since acquisition |

| Importance | Critical for short-term investment returns | Key indicator of long-term asset growth |

| Examples | Profits from stock sales, real estate transactions | Increase in stock prices, real estate market value |

Defining Capital Gain and Capital Appreciation

Capital gain refers to the profit realized from the sale of an asset, such as stocks or real estate, when the selling price exceeds the original purchase price. Capital appreciation is the increase in the value of an asset over time, reflecting growth in market price without a transaction occurring. Both concepts are essential in investment strategies for measuring returns and assessing asset performance.

Key Differences Between Capital Gain and Capital Appreciation

Capital gain refers to the actual profit earned from the sale of an asset, calculated as the difference between the selling price and the original purchase price. Capital appreciation represents the increase in the market value of an asset over time, regardless of whether the asset has been sold. The key difference lies in capital gain being a realized profit upon sale, while capital appreciation reflects unrealized growth in asset value.

How Capital Gains Are Realized in Investments

Capital gains are realized when an investor sells an asset, such as stocks or real estate, at a price higher than the original purchase cost, resulting in a taxable profit. Capital appreciation refers to the increase in the asset's market value over time but remains unrealized until the asset is sold. Understanding the distinction is crucial for tax planning and investment strategies, as capital gains trigger tax obligations, while capital appreciation only impacts potential future gains.

Factors Driving Capital Appreciation

Factors driving capital appreciation include strong economic growth, increasing demand for real estate or stocks, and low interest rates that boost investment potential. Improvements in infrastructure, favorable government policies, and limited supply further enhance asset value over time. Market sentiment and corporate earnings growth also play crucial roles in sustaining capital appreciation in financial markets.

Tax Implications: Capital Gain vs Capital Appreciation

Capital gains are realized profits from the sale of an asset and are subject to capital gains tax, which varies based on the holding period and tax jurisdiction. Capital appreciation refers to the increase in the value of an asset over time but is not taxable until the asset is sold, triggering a taxable capital gain event. Understanding the distinction between taxable capital gains and untaxed capital appreciation is crucial for effective tax planning and investment strategy optimization.

Measuring Performance: Capital Gain Versus Capital Appreciation

Capital gain measures the actual profit realized from the sale of an investment, calculated as the difference between the purchase price and the selling price. Capital appreciation refers to the increase in the market value of an asset over time, reflecting unrealized gains until the asset is sold. Investors monitoring portfolio performance use capital gain for tax implications and realized returns, while capital appreciation indicates potential growth and market value trends.

Impact on Portfolio Management

Capital gain represents the realized profit from selling an asset at a higher price than its purchase cost, directly affecting short-term portfolio performance and tax liabilities. Capital appreciation refers to the increase in an asset's market value over time, contributing to long-term portfolio growth and wealth accumulation without immediate tax consequences. Effective portfolio management balances these aspects to optimize returns while considering risk tolerance and tax efficiency.

Common Examples: Capital Gain vs Capital Appreciation in Real Assets

Capital gain occurs when an investor sells a real asset, such as real estate or precious metals, for a price higher than the purchase cost, immediately realizing profit from the transaction. Capital appreciation refers to the gradual increase in the asset's market value over time, exemplified by property or land appreciating due to location development or inflation. Real estate investment commonly illustrates capital appreciation, while capital gain manifests upon the sale or disposition of these assets.

Strategies to Maximize Both Capital Gain and Capital Appreciation

Maximizing capital gain and capital appreciation involves strategic asset allocation and long-term investment planning. Incorporating a diversified portfolio with a mix of growth stocks, dividend-paying equities, and real estate investments can enhance both immediate capital gains and sustained appreciation. Regular portfolio rebalancing and tax-efficient investment vehicles further optimize after-tax returns while minimizing market volatility impact.

Risks Involved: Capital Gain vs Capital Appreciation

Capital gain realizations involve tax liabilities and market timing risks, as investors must sell assets to realize profits, potentially triggering unfavorable tax events or selling during downturns. Capital appreciation represents the increase in asset value over time but carries market volatility risks and no guarantee of liquidity until a sale occurs. Both strategies expose investors to market fluctuations, yet capital gains emphasize transactional risk while appreciation underscores long-term value uncertainty.

Important Terms

Realized Gains

Realized gains refer to the profitable difference between the purchase price and the selling price of an asset, while capital gain is the taxable profit from that sale and capital appreciation represents the increase in the asset's market value before sale.

Unrealized Gains

Unrealized gains represent the increase in the value of an investment that has not been sold, reflecting capital appreciation, while realized capital gains occur when the asset is sold for a profit exceeding its purchase price.

Holding Period

Holding period directly impacts capital gain by determining the tax rate applied, while capital appreciation reflects the overall increase in asset value regardless of the sale timing.

Taxable Events

A taxable event occurs when capital gains are realized through the sale or transfer of an asset, whereas capital appreciation refers to the increase in the asset's value that is not taxed until the gain is realized.

Asset Valuation

Asset valuation measures the current market value of an asset, which influences capital gain realized upon sale, whereas capital appreciation refers to the increase in asset value over time regardless of sale.

Principal Investment

Principal investment focuses on capital appreciation, which represents the increase in asset value over time, while capital gain is the realized profit from selling the investment at a higher price than its original purchase cost.

Market Fluctuation

Market fluctuation directly impacts capital gain, which is realized from the sale of assets, whereas capital appreciation reflects the increase in asset value over time without transaction.

Portfolio Rebalancing

Portfolio rebalancing strategically adjusts asset allocations to optimize capital appreciation while managing capital gains tax impact.

Fair Market Value

Fair Market Value determines the base price for calculating capital gain, which reflects the actual profit from an asset sale, while capital appreciation measures the increase in the asset's market value over time without considering transaction events.

Cost Basis

Cost basis determines the original value of an asset used to calculate capital gain, which is the taxable profit realized upon sale, whereas capital appreciation refers to the increase in the asset's value over time without immediate tax implications.

Capital Gain vs Capital Appreciation Infographic

moneydif.com

moneydif.com