A White Knight is an investor or company that acquires a target firm to prevent a hostile takeover, offering a more favorable alternative to the target's management and shareholders. In contrast, a Poison Pill is a defensive strategy employed by the target company to dilute shares and make a takeover prohibitively expensive for the aggressor. Both tactics aim to protect the company's interests but differ fundamentally in their approach, with White Knights involving friendly acquisition and Poison Pills creating financial deterrents.

Table of Comparison

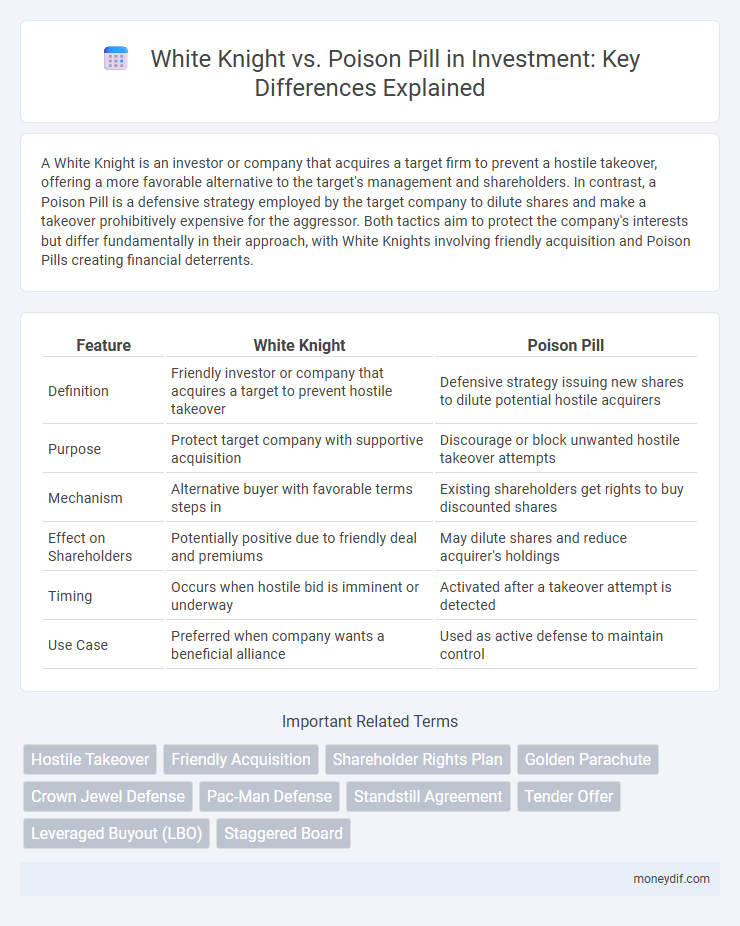

| Feature | White Knight | Poison Pill |

|---|---|---|

| Definition | Friendly investor or company that acquires a target to prevent hostile takeover | Defensive strategy issuing new shares to dilute potential hostile acquirers |

| Purpose | Protect target company with supportive acquisition | Discourage or block unwanted hostile takeover attempts |

| Mechanism | Alternative buyer with favorable terms steps in | Existing shareholders get rights to buy discounted shares |

| Effect on Shareholders | Potentially positive due to friendly deal and premiums | May dilute shares and reduce acquirer's holdings |

| Timing | Occurs when hostile bid is imminent or underway | Activated after a takeover attempt is detected |

| Use Case | Preferred when company wants a beneficial alliance | Used as active defense to maintain control |

Understanding White Knight and Poison Pill Strategies

White Knight and Poison Pill are defensive strategies used by companies to prevent hostile takeovers. A White Knight involves finding a more favorable company to acquire the target, preserving management and strategic goals, while a Poison Pill allows existing shareholders to purchase additional shares at a discount, diluting the potential acquirer's stake. These tactics protect corporate control by either introducing a friendly investor or making a takeover prohibitively expensive, ensuring the target company maintains leverage during acquisition attempts.

Key Differences Between White Knight and Poison Pill

A White Knight is a friendly investor who acquires a company to prevent a hostile takeover, offering a more favorable alternative to the target company's management. In contrast, a Poison Pill is a defensive strategy implemented by the target company to make itself less attractive or more costly to the hostile bidder, often by diluting shares or granting rights to existing shareholders. The key difference lies in the White Knight's role as an ally seeking to preserve company control, while the Poison Pill acts as a deterrent mechanism designed to repel unwanted acquisition attempts.

How White Knights Rescue Target Companies

White Knights intervene during hostile takeovers by offering a friendly acquisition that preserves the target company's values and management. They provide crucial financial support and strategic guidance, enabling the target to avoid hostile bidders and maintain market stability. This approach safeguards shareholder interests while ensuring continuity in the company's operations.

Poison Pill Tactics: Safeguarding Against Hostile Takeovers

Poison pill tactics are defensive strategies used by companies to prevent hostile takeovers by diluting the value of shares, making the acquisition prohibitively expensive for the attacker. These tactics often involve issuing new stock options or rights to existing shareholders, excluding the potential acquirer, thereby safeguarding corporate control. The implementation of poison pills serves as a critical countermeasure in hostile takeover scenarios, protecting shareholder interests and maintaining management's strategic direction.

Real-World Examples of White Knight Interventions

In 2018, Qualcomm successfully employed a white knight strategy when Broadcom attempted a hostile takeover, seeking support from SoftBank and other allies to maintain independence. Another notable white knight intervention involved Vodafone's defense against a hostile bid from Liberty Global by securing backing from India's government and other investors to uphold its market position. These real-world examples demonstrate how white knights can provide strategic capital and shareholder support to fend off hostile acquisitions and protect company value.

Effectiveness of Poison Pill Defense Mechanisms

Poison pill defense mechanisms effectively deter hostile takeovers by diluting the acquirer's shares and increasing acquisition costs, making the target company less attractive. Unlike white knight strategies that seek friendly buyers, poison pills empower management to maintain control and negotiate better terms. Studies indicate that poison pills reduce hostile bids by up to 50%, reinforcing their role as a strong defensive tactic in investment strategies.

Pros and Cons of White Knight Approaches

White Knight investments provide a friendly alternative to hostile takeovers by offering a willing buyer that preserves company value and management stability, thereby protecting shareholder interests and employee morale. However, reliance on a White Knight can limit negotiation power, potentially leading to less favorable terms and higher acquisition costs compared to other defensive strategies. The approach may also delay inevitable restructuring or strategic changes necessary for long-term growth, posing risks to competitiveness and market positioning.

Legal and Regulatory Perspectives on Anti-Takeover Strategies

White Knight and Poison Pill strategies represent contrasting legal defenses against hostile takeovers, with White Knights involving friendly third-party investors who comply with existing regulatory frameworks, ensuring shareholder interests and market stability. Poison Pills legally empower the target company to issue new shares or rights, diluting acquirers' stakes and deterring hostile bids while adhering to securities laws and corporate governance standards. Regulatory bodies rigorously assess these tactics to balance corporate control rights with shareholder protection, often scrutinizing their fairness, disclosure requirements, and potential impacts on market competition.

Impact on Shareholder Value: White Knight vs Poison Pill

A White Knight approach often preserves or enhances shareholder value by offering a friendly acquisition that prevents hostile takeovers and maintains company stability. In contrast, a Poison Pill strategy can dilute shares and deter potential acquirers, potentially lowering stock prices and negatively impacting shareholder wealth. Shareholders may favor White Knight interventions for long-term value retention, while Poison Pill tactics provide short-term defense at the risk of market uncertainty.

Choosing the Right Defense Strategy in Mergers & Acquisitions

Choosing the right defense strategy in mergers and acquisitions hinges on the specific vulnerabilities of the target company and the nature of the hostile bid. A White Knight strategy involves seeking a more favorable company to acquire the target, preserving shareholder value and management control, while a Poison Pill strategy deploys shareholder rights plans to dilute shares and deter hostile takeovers. Evaluating legal implications, shareholder interests, and long-term corporate goals ensures the most effective defense mechanism against unwanted acquisitions.

Important Terms

Hostile Takeover

A hostile takeover can be countered by a white knight acquiring the target company or implementing a poison pill strategy to dilute shares and prevent the acquirer's control.

Friendly Acquisition

A Friendly Acquisition occurs when a target company cooperates with a White Knight buyer to avoid a hostile takeover triggered by a Poison Pill defense strategy.

Shareholder Rights Plan

A Shareholder Rights Plan, also known as a Poison Pill, deters hostile takeovers by diluting shares to prevent acquisition, while a White Knight strategy involves inviting a friendly investor to acquire the company instead.

Golden Parachute

Golden Parachutes provide lucrative executive compensation packages that often influence White Knight defenses by deterring hostile takeovers more effectively than Poison Pill strategies.

Crown Jewel Defense

Crown Jewel Defense strategically prevents hostile takeovers by empowering a white knight to acquire key assets before a poison pill dilutes shareholder value.

Pac-Man Defense

Pac-Man Defense allows a target company to counter a hostile takeover by attempting to acquire the bidder, contrasting with the White Knight strategy where a friendly third party intervenes, and the Poison Pill tactic that dilutes shares to deter the acquirer.

Standstill Agreement

A Standstill Agreement restricts hostile bidders' actions, enabling a White Knight's friendly takeover while countering the acquirer's use of a Poison Pill defense.

Tender Offer

A tender offer as a white knight strategy enables a friendly investor to acquire a controlling stake in a target company, countering hostile takeover attempts often deterred by poison pill defenses.

Leveraged Buyout (LBO)

A leveraged buyout (LBO) often involves a white knight as a friendly third-party acquirer to counter a hostile takeover attempt protected by a poison pill defense strategy.

Staggered Board

A staggered board structure complicates hostile takeovers by limiting the frequency at which directors can be replaced, often interacting strategically with White Knight defenses and Poison Pill tactics to protect against unwelcome bids.

White Knight vs Poison Pill Infographic

moneydif.com

moneydif.com