General Partners (GPs) actively manage investment funds, making key decisions and assuming unlimited liability, while Limited Partners (LPs) provide capital with liability confined to their contributions and typically lack management control. GPs are responsible for sourcing deals, executing strategies, and distributing returns, whereas LPs are passive investors seeking diversification and risk mitigation. Understanding the distinct roles and risk profiles of GPs and LPs is crucial for aligning interests and optimizing investment outcomes.

Table of Comparison

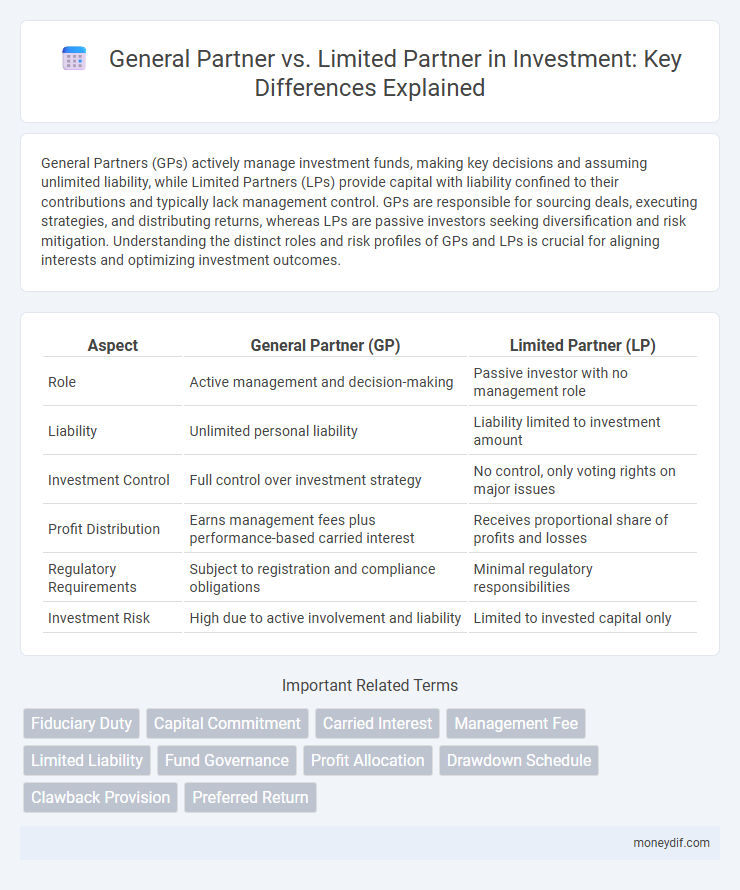

| Aspect | General Partner (GP) | Limited Partner (LP) |

|---|---|---|

| Role | Active management and decision-making | Passive investor with no management role |

| Liability | Unlimited personal liability | Liability limited to investment amount |

| Investment Control | Full control over investment strategy | No control, only voting rights on major issues |

| Profit Distribution | Earns management fees plus performance-based carried interest | Receives proportional share of profits and losses |

| Regulatory Requirements | Subject to registration and compliance obligations | Minimal regulatory responsibilities |

| Investment Risk | High due to active involvement and liability | Limited to invested capital only |

Understanding the Roles: General Partner vs Limited Partner

General Partners (GPs) actively manage investment funds, making strategic decisions and assuming unlimited liability, while Limited Partners (LPs) contribute capital without engaging in daily operations or risking personal assets beyond their investment. GPs typically earn management and performance fees, aligning their interests with fund success, whereas LPs benefit primarily from passive income distributions and return on investment. Understanding these distinct roles is critical for assessing risk, control, and potential returns in private equity and venture capital partnerships.

Key Responsibilities of General Partners

General Partners (GPs) manage the day-to-day operations and strategic decisions of investment funds, including sourcing deals, conducting due diligence, and managing portfolio companies. They bear unlimited liability and are responsible for fund compliance, investor reporting, and capital deployment to maximize returns. GPs also structure fund terms, negotiate agreements, and oversee exit strategies to ensure alignment with Limited Partners' interests.

Limited Partner: Functions and Limitations

Limited Partners (LPs) in investment funds primarily provide capital and enjoy limited liability, meaning their financial risk is confined to their investment amount. They do not participate in day-to-day management or decision-making, which are responsibilities of the General Partner (GP). This passive role limits LPs' exposure to operational risks while allowing them to benefit from the fund's returns and diversification opportunities.

Legal Structure and Liability Differences

General Partners (GPs) hold unlimited liability and are responsible for managing the investment fund, making all operational and financial decisions, which exposes them to potential personal asset risk. Limited Partners (LPs) have liability limited to their invested capital and do not participate in daily management, providing them protection from debts beyond their investment. This legal structure incentivizes GPs to actively manage the fund while giving LPs passive investor status with controlled risk exposure.

Capital Commitment: GP vs LP

General Partners (GPs) typically commit a smaller portion of the total capital, often ranging from 1% to 5%, but they actively manage the fund and make investment decisions. Limited Partners (LPs) provide the majority of the capital commitment, frequently exceeding 90%, yet they remain passive investors without involvement in daily management. This structure balances operational control with financial backing, aligning interests through capital contributions and profit-sharing agreements.

Decision-Making Power in Fund Management

General Partners hold primary decision-making authority in fund management, actively overseeing investment strategies and operational activities. Limited Partners have restricted control, mainly providing capital without directly influencing daily management or investment choices. This division ensures that General Partners steer fund operations while Limited Partners benefit from passive investment exposure.

Profit Distribution and Incentives

In investment partnerships, General Partners (GPs) manage the fund and typically receive a carried interest, often around 20% of the profits, aligning their incentives with the fund's success. Limited Partners (LPs) contribute capital but have limited liability and receive the majority of profit distributions, usually 80% after returning their initial investment. This structure ensures GPs are motivated to maximize returns while LPs benefit from steady income with minimized risk exposure.

Risk Exposure: General Partners vs Limited Partners

General Partners face unlimited personal liability, exposing their personal assets to losses beyond their capital contribution, while Limited Partners risk only their initial investment amount with no personal liability for the partnership's debts. This difference in risk exposure fundamentally influences decision-making authority, as General Partners manage operations and bear higher responsibility, whereas Limited Partners serve as passive investors. Understanding these distinctions is crucial for investors assessing potential financial commitments and liability in private equity or venture capital funds.

Regulatory and Compliance Considerations

General Partners (GPs) hold fiduciary responsibilities and are subject to stringent regulatory requirements under the Investment Advisers Act of 1940, including registration and ongoing compliance obligations. Limited Partners (LPs) typically have passive roles with fewer direct regulatory burdens but must conduct due diligence to ensure the fund's compliance framework aligns with SEC regulations. Compliance frameworks mandate transparent reporting, adherence to anti-money laundering (AML) policies, and investor accreditation verification, primarily impacting the GP's operational responsibilities.

Choosing the Right Partnership Structure for Investments

Selecting the appropriate partnership structure for investments hinges on evaluating the roles and responsibilities of General Partners (GPs) and Limited Partners (LPs). GPs assume management control and unlimited liability, making them suitable for active involvement in decision-making and operations. Conversely, LPs enjoy limited liability and passive involvement, ideal for investors seeking to minimize risk while benefiting from potential returns.

Important Terms

Fiduciary Duty

General partners owe fiduciary duties of loyalty and care to the partnership and limited partners, whereas limited partners typically do not have fiduciary obligations but invest without active management roles.

Capital Commitment

Capital commitment refers to the agreed amount of money that Limited Partners (LPs) pledge to invest in a fund, while General Partners (GPs) manage and deploy these funds into investment opportunities. GPs typically contribute a smaller portion of capital but take on full management responsibility and fiduciary duties, whereas LPs provide the bulk of funding with limited liability and no active role in daily operations.

Carried Interest

Carried interest is the share of profits, typically 20%, earned by the General Partner as a performance incentive, while Limited Partners receive returns based on their initial capital contributions without carried interest.

Management Fee

The management fee is typically paid by the limited partners to the general partner as compensation for managing the investment fund's day-to-day operations and strategic decisions.

Limited Liability

Limited partners have liability limited to their investment amount, while general partners bear unlimited personal liability for business debts.

Fund Governance

Fund governance establishes clear roles and responsibilities, delineating the General Partner's active management and fiduciary duties from the Limited Partner's passive investment and oversight rights.

Profit Allocation

Profit allocation between General Partners and Limited Partners typically grants General Partners a larger share due to management responsibilities and risk exposure, while Limited Partners receive proportionate returns based on their capital contributions.

Drawdown Schedule

The Drawdown Schedule outlines the timeline and amounts limited partners commit capital to the fund, which the general partner calls upon for investments and operational expenses.

Clawback Provision

A clawback provision ensures that General Partners return excess carried interest to Limited Partners if the fund's overall profits fail to meet agreed thresholds.

Preferred Return

The Preferred Return guarantees Limited Partners a prioritized minimum profit distribution before General Partners receive any carried interest in private equity investments.

General Partner vs Limited Partner Infographic

moneydif.com

moneydif.com