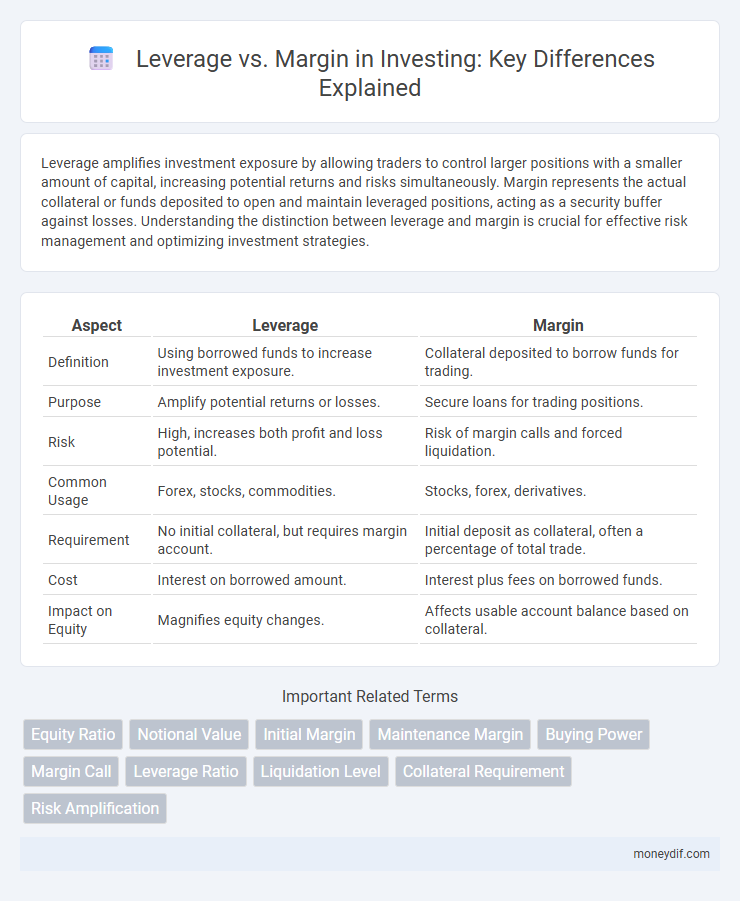

Leverage amplifies investment exposure by allowing traders to control larger positions with a smaller amount of capital, increasing potential returns and risks simultaneously. Margin represents the actual collateral or funds deposited to open and maintain leveraged positions, acting as a security buffer against losses. Understanding the distinction between leverage and margin is crucial for effective risk management and optimizing investment strategies.

Table of Comparison

| Aspect | Leverage | Margin |

|---|---|---|

| Definition | Using borrowed funds to increase investment exposure. | Collateral deposited to borrow funds for trading. |

| Purpose | Amplify potential returns or losses. | Secure loans for trading positions. |

| Risk | High, increases both profit and loss potential. | Risk of margin calls and forced liquidation. |

| Common Usage | Forex, stocks, commodities. | Stocks, forex, derivatives. |

| Requirement | No initial collateral, but requires margin account. | Initial deposit as collateral, often a percentage of total trade. |

| Cost | Interest on borrowed amount. | Interest plus fees on borrowed funds. |

| Impact on Equity | Magnifies equity changes. | Affects usable account balance based on collateral. |

Understanding Leverage and Margin in Investing

Leverage in investing refers to using borrowed funds to amplify potential returns, allowing investors to control larger positions with less capital. Margin represents the amount of an investor's own money required as collateral to borrow funds for leveraged trading, typically expressed as a percentage of the total investment. Understanding the relationship between leverage and margin is essential for managing risk and maximizing growth opportunities in financial markets.

Key Differences Between Leverage and Margin

Leverage amplifies the total exposure of an investment by using borrowed funds, whereas margin refers to the actual collateral or funds an investor must deposit to open and maintain a leveraged position. Leverage is expressed as a ratio, such as 5:1, indicating the multiple of the investor's capital being controlled, while margin is typically a percentage of the trade value that acts as a security deposit. Understanding the distinction is crucial for risk management, since leverage increases both potential gains and losses, and margin requirements ensure the investor maintains adequate equity to cover those risks.

How Leverage Works in Financial Markets

Leverage in financial markets allows investors to control a larger position with a smaller amount of capital by borrowing funds or using derivatives, amplifying both potential gains and losses. It multiplies exposure to asset price movements without requiring full capital outlay, effectively increasing buying power and risk. Understanding leverage ratios and margin requirements is crucial for managing the heightened volatility and margin calls associated with leveraged positions.

The Role of Margin in Trading Strategies

Margin plays a critical role in trading strategies by allowing investors to control larger positions with a fraction of the total investment, amplifying both potential gains and losses. Effective use of margin requires careful risk management to avoid margin calls and forced liquidation, which can erode capital rapidly. Traders often combine margin with leverage to enhance portfolio exposure, but must monitor market volatility and maintain sufficient collateral to sustain positions.

Pros and Cons of Using Leverage

Using leverage in investment amplifies potential returns by borrowing capital to increase the position size, allowing investors to maximize profits with limited initial funds. However, leverage also magnifies losses, increasing risk exposure and the possibility of margin calls that can force the liquidation of assets. Proper risk management and understanding margin requirements are crucial to avoid significant financial damage when using leverage.

Risks Associated with Margin Accounts

Margin accounts amplify potential losses by allowing investors to borrow funds to purchase securities, increasing exposure beyond initial capital. This leverage intensifies risk, as market downturns can trigger margin calls requiring immediate additional funds or forced liquidation of assets. Failure to meet margin calls can lead to significant financial losses and damage to credit standing.

Leverage vs Margin: Impact on Portfolio Performance

Leverage amplifies both gains and losses by allowing investors to control larger positions with borrowed capital, significantly increasing portfolio volatility. Margin represents the collateral required to maintain leveraged positions and acts as a risk management tool by enforcing margin calls when equity drops below maintenance levels. Understanding the dynamic between leverage ratios and margin requirements is crucial for optimizing portfolio performance and mitigating downside risk.

Regulatory Requirements for Margin and Leverage

Regulatory requirements for margin and leverage aim to maintain market stability by limiting excessive risk-taking through defined capital thresholds and margin maintenance rules imposed by authorities like the SEC or ESMA. Margin regulations ensure investors hold a minimum percentage of their own funds in a leveraged position, while leverage limits restrict the maximum borrowing capacity relative to the investor's capital. Compliance with these rules mitigates systemic risks, protects retail investors, and promotes transparency in trading practices.

Common Mistakes Investors Make with Leverage and Margin

Investors often confuse leverage and margin, mistakenly assuming they are interchangeable, which can lead to excessive risk exposure. A common error is over-leveraging, where investors borrow beyond their risk tolerance, magnifying potential losses during market volatility. Failure to understand margin calls and maintenance requirements frequently results in forced liquidations, eroding capital instead of enhancing returns.

Best Practices for Managing Leverage and Margin

Effective management of leverage and margin involves setting strict risk limits to prevent overexposure and potential liquidation. Investors should regularly monitor margin levels and adjust positions based on market volatility and personal risk tolerance. Utilizing stop-loss orders and maintaining a diversified portfolio are essential practices to safeguard against rapid losses when trading on margin or leveraging assets.

Important Terms

Equity Ratio

Equity Ratio measures the proportion of a company's total assets financed by shareholders' equity, directly impacting financial leverage by indicating reliance on debt versus equity financing. A higher Equity Ratio signifies lower financial risk and greater margin stability, as less leverage reduces vulnerability to fluctuations in profit margins.

Notional Value

Notional value represents the total value of an asset controlled through leverage, calculated by multiplying the asset price by the contract size, which is crucial for understanding exposure in margin trading. Leverage amplifies buying power by allowing traders to control a larger notional value with a smaller margin deposit, thereby increasing potential profits and risks.

Initial Margin

Initial Margin represents the minimum collateral required to open a leveraged trading position, directly influencing the leverage ratio an investor can access. Higher initial margin demands reduce leverage capacity, while lower initial margin allows for greater leverage but increases risk exposure.

Maintenance Margin

Maintenance margin is the minimum equity a trader must maintain in a leveraged position to avoid liquidation, ensuring sufficient collateral against potential losses; leverage amplifies both exposure and risk, requiring careful margin management. Higher leverage reduces the initial margin but increases the likelihood that margin levels fall below the maintenance threshold, triggering margin calls or forced position closure.

Buying Power

Buying power reflects the maximum amount of capital an investor can access in a trading account, factoring in leverage, which amplifies potential exposure by borrowing funds beyond cash deposits. Margin represents the collateral required to open and maintain leveraged positions, directly influencing the available buying power and risk management in trading activities.

Margin Call

A margin call occurs when the equity in a trading account falls below the required maintenance margin due to unfavorable leverage effects, forcing traders to deposit additional funds or liquidate positions. High leverage amplifies both potential gains and losses, increasing the likelihood of margin calls when market movements turn against leveraged positions.

Leverage Ratio

The leverage ratio measures the proportion of debt used to finance assets relative to equity, directly influencing the degree of financial leverage. Margin refers to the collateral required to support leveraged positions, affecting the risk and return profile by determining how much capital is needed to maintain trades under varying leverage ratios.

Liquidation Level

Liquidation Level represents the specific price point at which a trader's position is automatically closed to prevent further losses, directly influenced by the leverage and margin used. Higher leverage reduces the margin requirement but lowers the liquidation threshold, increasing the risk of liquidation in volatile markets.

Collateral Requirement

Collateral requirement quantifies the minimum assets needed to secure a leveraged position, ensuring margin adequacy to cover potential losses. Higher leverage ratios increase collateral demands, reducing free margin and amplifying risk exposure in trading accounts.

Risk Amplification

Risk amplification occurs when leverage increases exposure beyond margin requirements, magnifying potential losses relative to the initial investment. High leverage intensifies market volatility impacts, making margin calls more likely and increasing the probability of forced liquidations.

Leverage vs Margin Infographic

moneydif.com

moneydif.com