Angel investors typically provide early-stage funding using personal finances, often supporting startups through mentorship and network connections. Seed investors usually contribute larger sums from organized funds or venture capital firms, aiming to accelerate growth and prepare companies for subsequent funding rounds. Both play crucial roles in early business development but differ in scale, involvement, and funding sources.

Table of Comparison

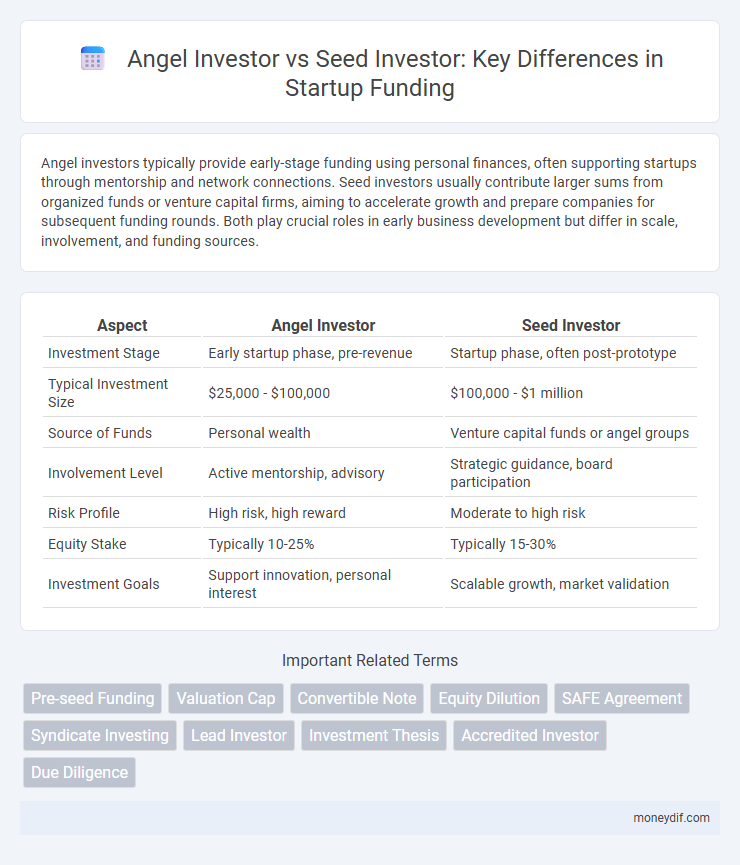

| Aspect | Angel Investor | Seed Investor |

|---|---|---|

| Investment Stage | Early startup phase, pre-revenue | Startup phase, often post-prototype |

| Typical Investment Size | $25,000 - $100,000 | $100,000 - $1 million |

| Source of Funds | Personal wealth | Venture capital funds or angel groups |

| Involvement Level | Active mentorship, advisory | Strategic guidance, board participation |

| Risk Profile | High risk, high reward | Moderate to high risk |

| Equity Stake | Typically 10-25% | Typically 15-30% |

| Investment Goals | Support innovation, personal interest | Scalable growth, market validation |

Understanding Angel Investors vs Seed Investors

Angel investors are high-net-worth individuals who provide early-stage capital to startups, often contributing not only funds but also mentorship and strategic guidance. Seed investors, which can include angel investors, venture capital firms, or seed funds, focus on the initial phase of funding aimed at product development and market validation. Understanding the distinctions between angel and seed investors helps entrepreneurs target the right sources of capital based on the startup's development stage and financial needs.

Key Differences Between Angel and Seed Investing

Angel investors provide early-stage capital, typically offering smaller investments and mentorship to startups in exchange for equity. Seed investors, often institutional or venture funds, invest larger sums during the initial development phase with a focus on scalable business models and higher growth potential. The key differences include investment size, involvement level, and funding stage, with angel investors being more hands-on and seed investors emphasizing rapid growth and market validation.

Investment Stages: Angel vs Seed Funding

Angel investors typically provide early funding during the pre-seed or very early seed stage, often investing personal capital to support startups before formal seed rounds. Seed investors participate in the subsequent seed stage, offering larger capital injections to validate product-market fit and scale initial operations. Understanding the distinctions in investment timing and amounts helps startups align with appropriate funding sources for growth momentum.

Typical Profiles of Angel Investors and Seed Investors

Angel investors typically are high-net-worth individuals with entrepreneurial backgrounds or industry expertise who invest their personal funds at the early stages of startups, often providing strategic guidance alongside capital. Seed investors, which may include early-stage venture capital firms or institutional investors, focus on startups with scalable business models and emerging market potential, offering larger capital infusions than angels in exchange for equity stakes. Both profiles play critical roles in the startup ecosystem, with angel investors emphasizing mentorship and seed investors prioritizing structured growth and financial returns.

Funding Amounts: Angel vs Seed Investors

Angel investors typically invest between $25,000 and $100,000 in early-stage startups, providing crucial initial funding to validate business ideas. Seed investors, including seed venture capital firms, often contribute larger amounts ranging from $100,000 to $2 million, supporting startups through product development and market entry phases. The funding differences reflect the varying risk levels and involvement expectations between individual angels and institutional seed investors.

Involvement Level: Angel Investors vs Seed Investors

Angel investors typically engage at an early startup stage, providing not only capital but also mentorship, industry connections, and strategic guidance to foster growth. Seed investors, while also investing early, often participate with a more structured approach, focusing on validating the business model and scaling operations, sometimes with board involvement. The level of involvement from angel investors tends to be more hands-on and personalized, whereas seed investors usually emphasize measurable milestones and performance metrics.

Risk Tolerance: Angel vs Seed Investment

Angel investors typically exhibit higher risk tolerance by investing early in startups with unproven business models, seeking equity in exchange for capital during initial funding rounds. Seed investors generally adopt a more calculated risk approach, focusing on startups with some market validation or prototypes to minimize uncertainty. The variance in risk tolerance influences investment amounts, expected returns, and involvement in company growth trajectories.

How Startups Attract Angel vs Seed Investors

Startups attract angel investors by showcasing innovative ideas with high growth potential and a passionate founding team, often leveraging personal networks and early traction to build trust. Seed investors require evidence of market validation and scalable business models, frequently demanding detailed financial projections and concrete milestones before committing capital. Effective startup pitches emphasize both visionary goals for angel investors and measurable progress indicators for seed investors to secure funding at different growth stages.

Pros and Cons: Angel Investment vs Seed Investment

Angel investors typically provide early-stage funding with flexible terms and valuable mentorship, but they may require significant equity and involve higher personal risk. Seed investors often bring structured funding rounds with potential for larger capital and strategic support, yet their involvement can lead to more rigorous due diligence and early pressure on growth metrics. Choosing between angel and seed investments depends on startup needs for control, funding amount, and growth expectations.

Choosing Between Angel and Seed Investors for Your Startup

Angel investors provide early-stage funding often accompanied by mentorship and industry connections, typically investing their own capital in startups with high growth potential. Seed investors, including venture capital firms specializing in seed rounds, contribute larger sums and expect scalable business models with clear market validation. Choosing between angel and seed investors depends on your startup's funding needs, growth stage, and desire for strategic support versus institutional backing.

Important Terms

Pre-seed Funding

Pre-seed funding typically involves smaller capital investments from angel investors who provide early-stage support and strategic guidance before a startup has a proven product or market traction. Seed investors, in contrast, contribute larger funds during the initial product development and market validation phase, often including venture capital firms alongside angel investors.

Valuation Cap

A Valuation Cap is a key term in convertible notes or SAFEs that limits the maximum company valuation at which an angel investor or seed investor's investment converts into equity, protecting early investors from excessive dilution. Angel investors often negotiate lower valuation caps compared to seed investors due to higher risk exposure at earlier stages of the startup lifecycle.

Convertible Note

Convertible notes enable angel investors to provide early-stage funding with the potential to convert debt into equity during future financing rounds, often at a discounted valuation or with a valuation cap. Seed investors typically engage in priced equity rounds, preferring direct ownership stakes rather than debt instruments, reflecting a later stage of funding with more established company valuation metrics.

Equity Dilution

Equity dilution occurs when Angel Investors and Seed Investors provide capital, reducing the ownership percentage of existing shareholders to accommodate new equity stakes. Typically, Angel Investors participate earlier with smaller amounts and higher valuation risks, while Seed Investors contribute larger funds later, causing more significant dilution but at a potentially higher company valuation.

SAFE Agreement

SAFE Agreement (Simple Agreement for Future Equity) offers angel investors a streamlined contract to convert their investment into equity at a future priced round, often used in early-stage funding before valuation is established. Seed investors prefer SAFEs for faster closings and lower legal costs, enabling startups to secure essential capital without immediate dilution or complex negotiations.

Syndicate Investing

Syndicate investing pools capital from multiple angel investors to fund early-stage startups, offering diversified risk and access to larger deals beyond individual capacity. Angel investors typically invest personally at the idea or prototype stage, while seed investors may include syndicates providing structured, pooled funding during the initial product development and market entry phases.

Lead Investor

Lead investors play a crucial role in early-stage funding by actively steering investment rounds, often contributing the largest capital among angel investors who provide initial seed funding to startups. Seed investors typically support the business during its nascent stage with smaller amounts compared to lead investors, who bring strategic expertise and credibility that attract other angel investors.

Investment Thesis

An investment thesis for angel investors typically focuses on early-stage startups with high growth potential, emphasizing personal mentorship and smaller, high-risk capital injections, whereas seed investors prioritize scalable business models and market validation, often deploying larger funds to bridge initial development to Series A funding. Understanding the distinct risk tolerance, investment horizon, and value-add strategies of angel versus seed investors is critical for entrepreneurs to align expectations and optimize fundraising success.

Accredited Investor

An Accredited Investor meets specific financial criteria set by regulatory bodies, enabling participation in higher-risk investments such as angel investing, where individuals provide early-stage capital to startups. Seed investors, often Accredited Investors, focus on initial funding rounds to support product development and market entry, differentiating from later-stage angel investments by their emphasis on conceptual business validation.

Due Diligence

Due diligence for angel investors typically focuses on evaluating the founding team's expertise, market potential, and early traction to mitigate high-risk investments in nascent startups. Seed investors conduct in-depth financial analysis, competitive landscape assessment, and validation of product-market fit to ensure scalability and strong return prospects during initial funding rounds.

Angel Investor vs Seed Investor Infographic

moneydif.com

moneydif.com