Risk-on and risk-off describe market sentiment where investors respectively seek higher returns by embracing risk or prioritize capital preservation by reducing exposure to volatile assets. Risk-on periods typically see increased investments in equities, commodities, and high-yield bonds, reflecting confidence in economic growth. Conversely, risk-off phases drive flows toward safe-haven assets like government bonds, gold, and cash, indicating heightened uncertainty or market stress.

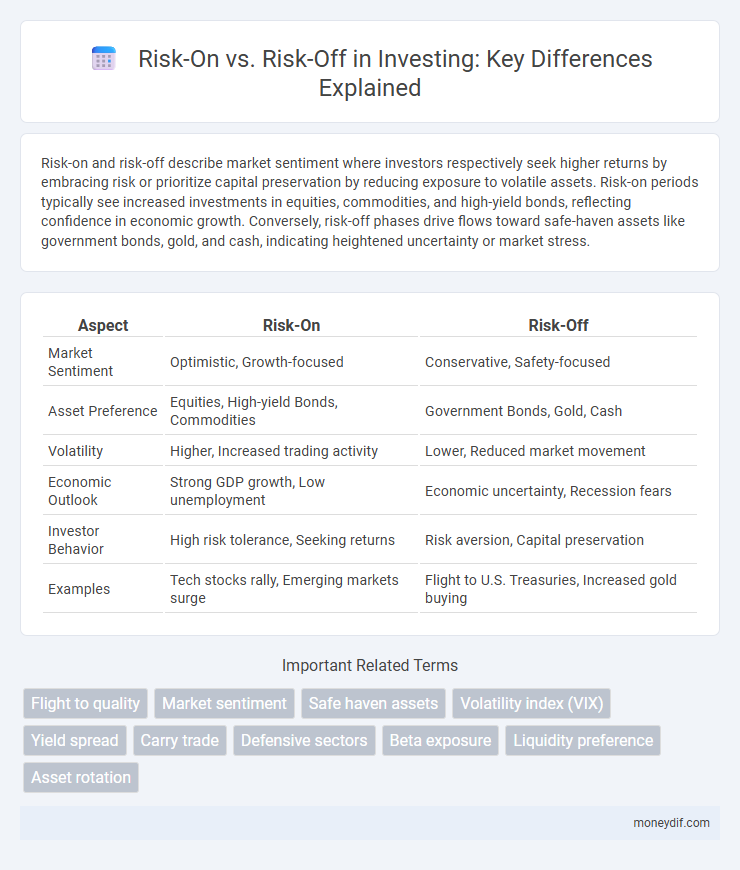

Table of Comparison

| Aspect | Risk-On | Risk-Off |

|---|---|---|

| Market Sentiment | Optimistic, Growth-focused | Conservative, Safety-focused |

| Asset Preference | Equities, High-yield Bonds, Commodities | Government Bonds, Gold, Cash |

| Volatility | Higher, Increased trading activity | Lower, Reduced market movement |

| Economic Outlook | Strong GDP growth, Low unemployment | Economic uncertainty, Recession fears |

| Investor Behavior | High risk tolerance, Seeking returns | Risk aversion, Capital preservation |

| Examples | Tech stocks rally, Emerging markets surge | Flight to U.S. Treasuries, Increased gold buying |

Understanding Risk-On vs Risk-Off Sentiment

Risk-on vs risk-off sentiment reflects investor appetite for risk, where risk-on indicates confidence in higher returns from equities and cyclical assets, while risk-off signals a preference for safety in bonds and gold amid market uncertainty. Understanding these attitudes helps predict market movements and allocation shifts during volatility or economic changes. Accurate interpretation of risk sentiment supports strategic portfolio balancing to optimize returns and mitigate potential losses.

Key Drivers Behind Risk-On Behavior

Key drivers behind risk-on behavior include strong economic indicators such as rising GDP growth, low unemployment rates, and robust corporate earnings, which boost investor confidence. Monetary policy easing by central banks, like lowering interest rates or quantitative easing, often encourages risk-taking by reducing the cost of borrowing. Additionally, positive geopolitical developments and stable financial markets enhance appetite for higher-yielding assets such as equities and high-yield bonds.

Factors Triggering Risk-Off Environments

Risk-off environments are typically triggered by heightened geopolitical tensions, unexpected economic downturns, or sharp declines in corporate earnings that increase market uncertainty. Central bank interest rate hikes and tightening monetary policies amplify investor caution, driving a shift towards safer assets like government bonds and gold. Market volatility indexes such as the VIX spiking above 25 signals increased fear and a move away from riskier investment classes like equities and high-yield bonds.

Asset Classes Favored During Risk-On Markets

Risk-on markets typically favor asset classes such as equities, high-yield bonds, and commodities, which tend to offer higher returns amid investor optimism. Equities in cyclical sectors like technology, consumer discretionary, and industrials often outperform due to increased economic growth expectations. Commodities like oil and metals see price appreciation as demand rises, while emerging market assets also attract inflows driven by a global appetite for risk.

Safe Havens in Risk-Off Scenarios

Safe havens such as gold, U.S. Treasury bonds, and the Swiss franc typically attract investors during risk-off scenarios, providing stability amid market turbulence. These assets tend to preserve capital by offering lower volatility and reliable returns when equities and high-yield investments decline. Understanding the behavior of safe havens is crucial for portfolio diversification and risk management in uncertain economic environments.

Impact of Economic Data on Market Sentiment

Economic data significantly influences market sentiment by triggering shifts between risk-on and risk-off environments; strong GDP growth, rising employment rates, and robust consumer spending typically encourage risk-on behavior, leading investors to favor equities and higher-yield assets. Conversely, disappointing economic indicators such as elevated inflation, weaker retail sales, or declining manufacturing output often provoke risk-off sentiment, driving capital toward safe-haven assets like government bonds, gold, and cash equivalents. These sentiment swings affect asset price volatility and portfolio allocation strategies, highlighting the critical role of real-time economic data analysis in optimizing investment decisions.

Global Events Influencing Risk Sentiment

Global events such as geopolitical tensions, central bank policy shifts, and economic data releases significantly influence risk-on and risk-off investment sentiment. Positive developments like trade agreements and strong corporate earnings typically drive risk-on behavior, encouraging investments in equities and commodities. Conversely, uncertainties from conflicts, inflation fears, or financial crises trigger risk-off sentiment, leading investors to seek safe-haven assets like government bonds and gold.

Strategies for Navigating Shifting Risk Appetite

Adapting to shifting risk appetite requires dynamically adjusting portfolio exposure between risk-on assets like equities and risk-off assets such as government bonds and gold. Monitoring market volatility indices, credit spreads, and macroeconomic indicators helps identify transitions, enabling timely rebalancing to manage downside risk while capitalizing on growth opportunities. Utilizing diversified strategies, including tactical asset allocation and hedging instruments, enhances resilience across varying market sentiment phases.

Portfolio Diversification for Volatile Conditions

Risk-on and risk-off strategies demand dynamic portfolio diversification to manage volatile market conditions effectively. Incorporating a blend of equities, fixed income, and alternative assets reduces exposure to systematic risks while optimizing returns. Employing assets with low correlation enhances resilience against market swings, protecting capital during downturns and capturing growth in bullish phases.

Monitoring Indicators of Market Risk Sentiment

Monitoring indicators of market risk sentiment involves analyzing volatility indices like the VIX, credit spreads, and equity market breadth to distinguish between risk-on and risk-off environments. Elevated VIX levels and widening credit spreads typically signal risk-off sentiment, prompting investors to favor safer assets such as government bonds and gold. Conversely, narrowing credit spreads and positive equity breadth often indicate risk-on conditions, encouraging allocation to equities and higher-yielding investments.

Important Terms

Flight to quality

Flight to quality describes investors shifting capital from high-risk assets to safer investments such as government bonds during risk-off phases, reflecting heightened market uncertainty. This behavior contrasts with risk-on periods when investors favor equities and commodities seeking higher returns, highlighting divergent asset allocation strategies based on perceived market risk.

Market sentiment

Market sentiment drives asset price fluctuations as investors shift between risk-on strategies favoring equities and riskier assets during periods of optimism, and risk-off strategies prioritizing safe-haven assets like gold and government bonds during uncertainty or economic downturns. This sentiment is influenced by macroeconomic indicators, geopolitical events, and central bank policies, which collectively shape investor risk appetite and portfolio allocation.

Safe haven assets

Safe haven assets such as gold, U.S. Treasury bonds, and the Swiss franc typically appreciate during risk-off environments when investors seek to preserve capital and avoid market volatility. In contrast, risk-on phases favor equities and high-yield assets as market sentiment shifts toward growth and higher returns.

Volatility index (VIX)

The Volatility Index (VIX) measures market expectations of near-term volatility and often spikes during risk-off periods when investors seek safety amid uncertainty. Lower VIX levels typically correspond with risk-on environments, reflecting investor confidence and appetite for higher-risk assets.

Yield spread

Yield spread, the difference between yields on varying debt instruments, serves as a key indicator of market sentiment shifts between risk-on and risk-off environments. Narrowing yield spreads typically signal increased investor confidence and a risk-on stance, while widening spreads reflect heightened risk aversion and a risk-off market mood.

Carry trade

Carry trade strategies exploit interest rate differentials by borrowing in low-yield currencies and investing in high-yield assets, thriving in risk-on environments characterized by investor appetite for higher returns and increased market liquidity. During risk-off periods, heightened volatility and flight to safety trigger currency depreciations in target high-yield currencies, leading to potential losses and unwinding of carry positions.

Defensive sectors

Defensive sectors such as utilities, consumer staples, and healthcare typically outperform during risk-off market environments due to their stable earnings and lower sensitivity to economic cycles. Investors flock to these sectors to preserve capital and reduce volatility when risk appetite diminishes amid economic uncertainty or market downturns.

Beta exposure

Beta exposure measures an asset's sensitivity to market movements, rising during risk-on environments when investors favor high-beta stocks for higher returns. In risk-off scenarios, beta exposure typically declines as portfolios shift toward low-beta, defensive assets to reduce volatility and preserve capital.

Liquidity preference

Liquidity preference influences investor behavior during risk-on and risk-off market conditions, as investors seek more liquid assets to reduce exposure during risk-off phases and favor higher-yielding, less liquid assets in risk-on environments. Changes in liquidity preference significantly impact asset prices, trading volumes, and market volatility across equities, bonds, and currencies.

Asset rotation

Asset rotation involves shifting investments between risk-on assets like equities and risk-off assets such as government bonds based on market sentiment and economic cycles. This strategy aims to optimize portfolio returns by capitalizing on periods of growth optimism while preserving capital during downturns.

Risk-on vs Risk-off Infographic

moneydif.com

moneydif.com