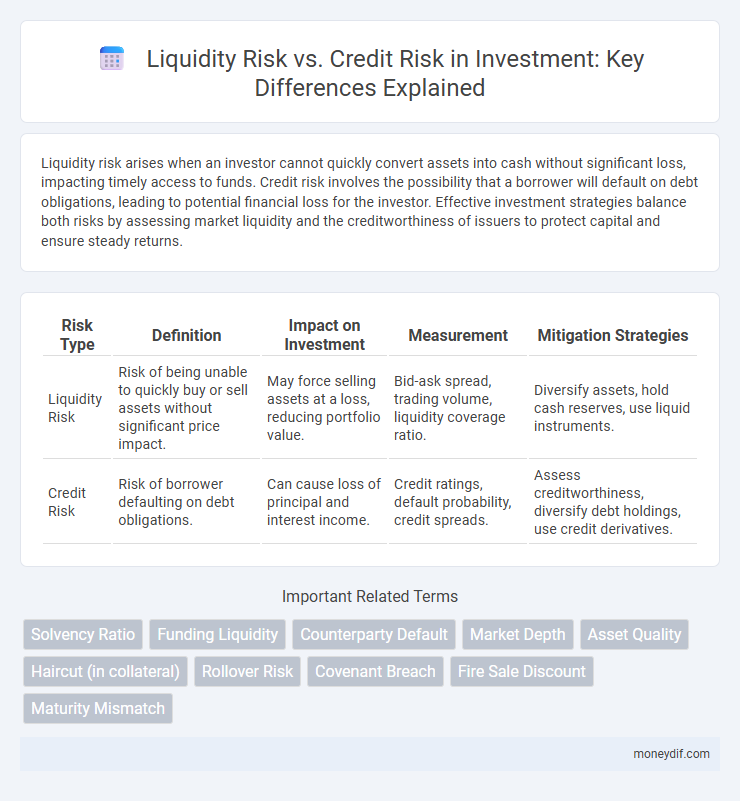

Liquidity risk arises when an investor cannot quickly convert assets into cash without significant loss, impacting timely access to funds. Credit risk involves the possibility that a borrower will default on debt obligations, leading to potential financial loss for the investor. Effective investment strategies balance both risks by assessing market liquidity and the creditworthiness of issuers to protect capital and ensure steady returns.

Table of Comparison

| Risk Type | Definition | Impact on Investment | Measurement | Mitigation Strategies |

|---|---|---|---|---|

| Liquidity Risk | Risk of being unable to quickly buy or sell assets without significant price impact. | May force selling assets at a loss, reducing portfolio value. | Bid-ask spread, trading volume, liquidity coverage ratio. | Diversify assets, hold cash reserves, use liquid instruments. |

| Credit Risk | Risk of borrower defaulting on debt obligations. | Can cause loss of principal and interest income. | Credit ratings, default probability, credit spreads. | Assess creditworthiness, diversify debt holdings, use credit derivatives. |

Understanding Liquidity Risk in Investments

Liquidity risk in investments refers to the potential difficulty of quickly converting assets into cash without significant loss in value. It affects the ability to meet short-term financial obligations and can lead to forced selling at depressed prices, especially in volatile markets. Investors must evaluate an asset's market depth, transaction costs, and bid-ask spreads to accurately assess liquidity risk.

Defining Credit Risk: Key Concepts

Credit risk refers to the possibility that a borrower or counterparty will fail to meet their financial obligations, leading to a loss for the lender or investor. Key concepts include default probability, exposure at default (EAD), and loss given default (LGD), which quantify the potential impact of credit events. Understanding credit risk involves assessing the borrower's creditworthiness and the economic environment to predict and mitigate potential losses in an investment portfolio.

Core Differences Between Liquidity and Credit Risk

Liquidity risk refers to the possibility that an investor cannot quickly convert assets into cash without significant loss in value, impacting short-term financial stability. Credit risk involves the likelihood that a borrower will default on debt obligations, affecting the long-term creditworthiness and potential returns of investment portfolios. The core difference lies in liquidity risk emphasizing marketability and cash flow timing, whereas credit risk centers on counterparty payment performance and credit quality.

How Liquidity Risk Impacts Portfolio Performance

Liquidity risk reduces a portfolio's ability to quickly convert assets into cash without significant price discounts, leading to potential losses during market downturns. When liquidity dries up, investors may be forced to sell at unfavorable prices, eroding overall portfolio returns. This risk is particularly critical in volatile markets or with illiquid assets, where delayed transactions can negatively impact portfolio performance and increase funding costs.

Assessing Credit Risk in Financial Instruments

Assessing credit risk in financial instruments involves analyzing the borrower's creditworthiness, including their payment history, debt levels, and overall financial stability. Credit risk measurement tools such as credit ratings, credit default swaps, and credit scoring models provide quantifiable insights into the likelihood of default. Accurate assessment of credit risk enables investors to make informed decisions, balancing potential returns against the probability of loss due to counterparty default.

Factors That Amplify Liquidity and Credit Risks

Factors that amplify liquidity risk include market volatility, limited trading volumes, and the concentration of assets in illiquid securities. Credit risk intensifies with deteriorating borrower credit quality, increased leverage, and economic downturns impacting debt servicing ability. Interconnectedness of financial institutions and lack of transparency in asset valuation further exacerbate both liquidity and credit risks.

Methods to Measure Liquidity Risk Versus Credit Risk

Liquidity risk is measured using metrics such as the Liquidity Coverage Ratio (LCR), Net Stable Funding Ratio (NSFR), and cash flow gap analysis to assess a firm's ability to meet short-term obligations without incurring significant losses. Credit risk measurement relies on credit scoring models, Probability of Default (PD), Loss Given Default (LGD), and Exposure at Default (EAD) to estimate the likelihood and potential severity of borrower default. While liquidity risk focuses on cash flow timing and funding stability, credit risk emphasizes borrower creditworthiness and default probabilities, requiring distinct quantitative methods tailored to each risk type.

Strategies to Mitigate Liquidity and Credit Risks

Implementing diversified asset allocation helps mitigate liquidity risk by ensuring access to cash or liquid assets during market stress, while credit risk can be reduced through thorough credit analysis and investing in high-quality securities with strong credit ratings. Utilizing stop-loss orders and setting strict investment limits on illiquid or high-credit-risk assets further controls potential losses. Regular portfolio stress testing and scenario analysis enhance preparedness for adverse market conditions that affect both liquidity and credit quality.

Case Studies: Real-World Examples of Risk Impact

Liquidity risk in investment often manifests in the inability to quickly convert assets to cash without significant loss, as seen in the 2008 financial crisis where mortgage-backed securities became illiquid, causing massive portfolio devaluations. Credit risk, exemplified by the Enron scandal, highlights how borrower default or fraudulent credit reporting can lead to devastating losses for investors relying on corporate debt. Case studies reveal that managing liquidity and credit risks requires rigorous asset valuation methods and continuous monitoring of counterparty creditworthiness to mitigate adverse impacts on investment returns.

Balancing Liquidity and Credit Risk in Investment Decisions

Balancing liquidity and credit risk is crucial for effective investment decisions, as liquidity risk involves the potential difficulty in quickly converting assets to cash without significant loss, while credit risk pertains to the possibility of a borrower's default impacting returns. Investors must assess portfolio composition to maintain sufficient liquid assets that can cover short-term obligations while ensuring exposure to credit instruments offers acceptable risk-adjusted yields. Effective risk management combines stress testing liquidity scenarios with thorough credit analysis to optimize returns without compromising portfolio stability.

Important Terms

Solvency Ratio

The solvency ratio measures a company's ability to meet long-term obligations, reflecting its financial stability and resistance to credit risk by ensuring sufficient equity relative to liabilities. Unlike liquidity risk, which concerns short-term cash flow adequacy, the solvency ratio focuses on maintaining capital structure health to mitigate potential default on debts.

Funding Liquidity

Funding liquidity refers to a financial institution's ability to meet short-term liabilities without incurring significant losses, directly impacting liquidity risk, which is the risk of being unable to liquidate assets quickly at fair value. Unlike credit risk, which involves the possibility of counterparty default, funding liquidity risk centers on the availability and cost of funding to sustain operations during market stress or financial distress.

Counterparty Default

Counterparty default represents a critical intersection of liquidity risk and credit risk, where a counterparty's inability to meet obligations may trigger liquidity shortfalls despite sound credit fundamentals. Managing this risk requires evaluating both the probability of default and the potential liquidity impact on the institution's cash flows and collateral availability.

Market Depth

Market depth directly influences liquidity risk by reflecting the ability to execute large trades without significant price impact, whereas credit risk pertains to the counterparty's default potential regardless of market conditions. High market depth mitigates liquidity risk but does not reduce credit risk, which requires separate assessment of counterparty creditworthiness.

Asset Quality

Asset quality directly impacts liquidity risk by influencing the ease with which assets can be converted to cash without significant loss, while poor asset quality typically elevates credit risk by increasing the likelihood of borrower default. High-quality assets enhance liquidity buffers and reduce potential credit losses, contributing to more resilient risk management frameworks.

Haircut (in collateral)

Haircut in collateral refers to the percentage reduction applied to the market value of an asset to mitigate liquidity risk by ensuring that the collateral can cover potential losses in stressed market conditions. This adjustment differs from credit risk, which assesses the borrower's ability to repay, as the haircut specifically addresses the potential drop in asset value due to market liquidity fluctuations.

Rollover Risk

Rollover risk refers to the potential difficulty a firm faces when refinancing existing debt or securing new funding, which directly impacts liquidity risk by threatening short-term cash availability. Unlike credit risk, which concerns the borrower's ability to meet debt obligations, rollover risk centers on market conditions and investor sentiment affecting the firm's capacity to maintain continuous funding.

Covenant Breach

Covenant breach significantly elevates liquidity risk as it may trigger immediate cash outflows or restrict access to additional funding, thereby straining an entity's short-term financial flexibility. Concurrently, it intensifies credit risk by signaling potential default, leading creditors to reassess the borrower's creditworthiness and potentially demand higher interest rates or accelerated repayment terms.

Fire Sale Discount

Fire sale discounts occur when assets are sold rapidly at significantly reduced prices to quickly generate cash, directly impacting liquidity risk by exacerbating the inability to meet short-term obligations. This distress pricing can indirectly increase credit risk as the diminished asset values weaken a borrower's collateral base, reducing lender confidence and raising default probabilities.

Maturity Mismatch

Maturity mismatch occurs when the maturities of a financial institution's assets and liabilities are misaligned, intensifying liquidity risk as short-term liabilities may need to be repaid before long-term assets mature. This mismatch can also exacerbate credit risk if the institution faces difficulty refinancing or liquidating assets, leading to potential default due to insufficient liquidity.

Liquidity Risk vs Credit Risk Infographic

moneydif.com

moneydif.com