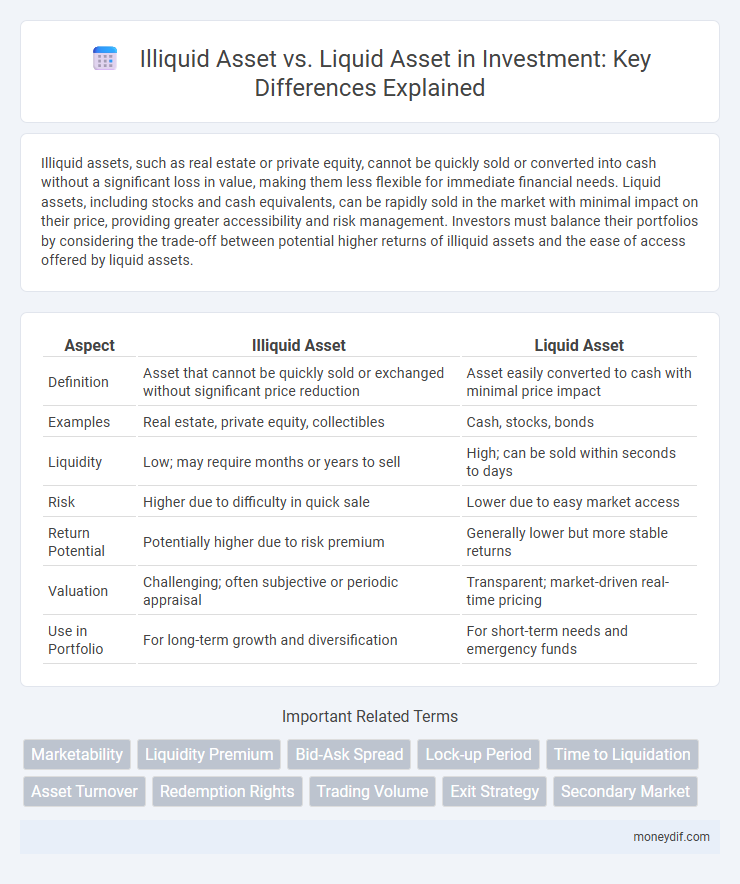

Illiquid assets, such as real estate or private equity, cannot be quickly sold or converted into cash without a significant loss in value, making them less flexible for immediate financial needs. Liquid assets, including stocks and cash equivalents, can be rapidly sold in the market with minimal impact on their price, providing greater accessibility and risk management. Investors must balance their portfolios by considering the trade-off between potential higher returns of illiquid assets and the ease of access offered by liquid assets.

Table of Comparison

| Aspect | Illiquid Asset | Liquid Asset |

|---|---|---|

| Definition | Asset that cannot be quickly sold or exchanged without significant price reduction | Asset easily converted to cash with minimal price impact |

| Examples | Real estate, private equity, collectibles | Cash, stocks, bonds |

| Liquidity | Low; may require months or years to sell | High; can be sold within seconds to days |

| Risk | Higher due to difficulty in quick sale | Lower due to easy market access |

| Return Potential | Potentially higher due to risk premium | Generally lower but more stable returns |

| Valuation | Challenging; often subjective or periodic appraisal | Transparent; market-driven real-time pricing |

| Use in Portfolio | For long-term growth and diversification | For short-term needs and emergency funds |

Definition of Liquid and Illiquid Assets

Liquid assets are financial resources that can be quickly converted into cash without significant loss of value, such as stocks, bonds, and money market instruments. Illiquid assets include investments like real estate, private equity, and collectibles, which cannot be easily sold or exchanged without a substantial price reduction or time delay. Understanding the liquidity of assets is crucial for portfolio management and risk assessment in investment strategies.

Key Characteristics of Liquid Assets

Liquid assets possess high marketability and can be quickly converted into cash without significant loss of value, making them ideal for meeting short-term financial obligations. Examples include cash, money market instruments, and publicly traded stocks, which have low transaction costs and high price transparency. Their primary characteristic is the ability to provide immediate liquidity, ensuring investors maintain flexibility and access to funds when needed.

Key Characteristics of Illiquid Assets

Illiquid assets are investment holdings that cannot be quickly sold or exchanged for cash without a significant loss in value, often due to a limited market or complexity of the asset. Key characteristics include lower marketability, longer holding periods, and difficulty in valuation compared to liquid assets like stocks or bonds. These assets typically require a higher risk tolerance and a longer investment horizon due to their restricted convertibility and potential price volatility.

Examples of Liquid Assets

Cash, money market funds, and publicly traded stocks exemplify liquid assets due to their ease of conversion to cash without significant loss of value. Treasury bills and savings accounts also rank highly in liquidity, enabling quick access to funds. These assets contrast with illiquid investments like real estate or private equity, which typically require more time to sell and convert into cash.

Examples of Illiquid Assets

Real estate properties, private equity stakes, and collectibles such as art or rare coins exemplify illiquid assets that cannot be quickly sold without a significant price concession. Investments in venture capital funds and ownership in small businesses also represent illiquid assets due to the lengthy process of finding buyers and the complex valuation involved. These assets often require extended holding periods, making them less suitable for investors needing immediate access to cash.

Advantages of Investing in Liquid Assets

Investing in liquid assets offers the advantage of quick access to cash, enabling investors to respond promptly to market opportunities or emergencies. Liquid assets like stocks and bonds facilitate efficient portfolio diversification and risk management through ease of buying and selling. Their high marketability and low transaction costs enhance flexibility and support dynamic investment strategies.

Advantages of Investing in Illiquid Assets

Investing in illiquid assets often offers higher potential returns due to reduced market competition and longer-term value appreciation. These assets, such as real estate, private equity, or collectibles, provide portfolio diversification and can act as a hedge against market volatility. Illiquid investments also enable access to unique opportunities unavailable in highly liquid markets, potentially leading to substantial capital gains over time.

Liquidity Risk: What Investors Need to Know

Investors face significant liquidity risk when holding illiquid assets, as these investments cannot be quickly sold or converted into cash without potentially substantial price discounts. In contrast, liquid assets like stocks and bonds offer ease of transaction in active markets, reducing the risk of forced selling at unfavorable prices. Understanding the trade-offs between liquidity and potential returns is critical for effective portfolio management and risk mitigation.

Impact of Liquidity on Investment Strategy

Liquidity significantly influences investment strategy by determining the ease of converting assets into cash without substantial value loss. Illiquid assets, such as real estate or private equity, require longer holding periods and may limit an investor's flexibility in responding to market changes. In contrast, liquid assets like stocks and bonds enable quick portfolio adjustments, enhancing risk management and capital allocation efficiency.

Choosing Between Liquid and Illiquid Assets

Choosing between liquid and illiquid assets depends on investment goals and risk tolerance. Liquid assets, such as stocks and cash equivalents, offer quick access to funds and lower risk, ideal for short-term needs or emergency funds. Illiquid assets, like real estate or private equity, usually provide higher returns over time but require longer holding periods and involve greater risk due to limited marketability.

Important Terms

Marketability

Marketability of liquid assets significantly exceeds that of illiquid assets due to their ease of conversion to cash without substantial loss in value.

Liquidity Premium

Liquidity premium refers to the additional expected return investors demand for holding illiquid assets, which are harder to buy or sell quickly without price concessions. Liquid assets, such as stocks or government bonds, typically have lower liquidity premiums due to their ease of transaction and faster marketability.

Bid-Ask Spread

The bid-ask spread is significantly wider for illiquid assets compared to liquid assets due to lower trading volumes and higher transaction costs.

Lock-up Period

The lock-up period restricts the sale of illiquid assets, contrasting with liquid assets that can be quickly converted to cash without such time constraints.

Time to Liquidation

Time to liquidation for illiquid assets typically spans months or years due to limited market activity, whereas liquid assets can be converted into cash within seconds to days.

Asset Turnover

Asset Turnover ratio improves when a company holds higher proportions of liquid assets compared to illiquid assets, as liquid assets generate revenue more efficiently.

Redemption Rights

Redemption rights grant investors the ability to reclaim their investment in liquid assets more readily than in illiquid assets, which often lack immediate market availability.

Trading Volume

Trading volume in liquid assets is significantly higher than in illiquid assets due to greater market demand and ease of transactions.

Exit Strategy

Exit strategies for illiquid assets often require longer time horizons and complex planning compared to liquid assets, which can be quickly sold or converted to cash with minimal loss of value.

Secondary Market

The secondary market enables the trading of liquid assets quickly and at transparent prices, while illiquid assets often face challenges such as lower liquidity and higher transaction costs in this market.

Illiquid Asset vs Liquid Asset Infographic

moneydif.com

moneydif.com