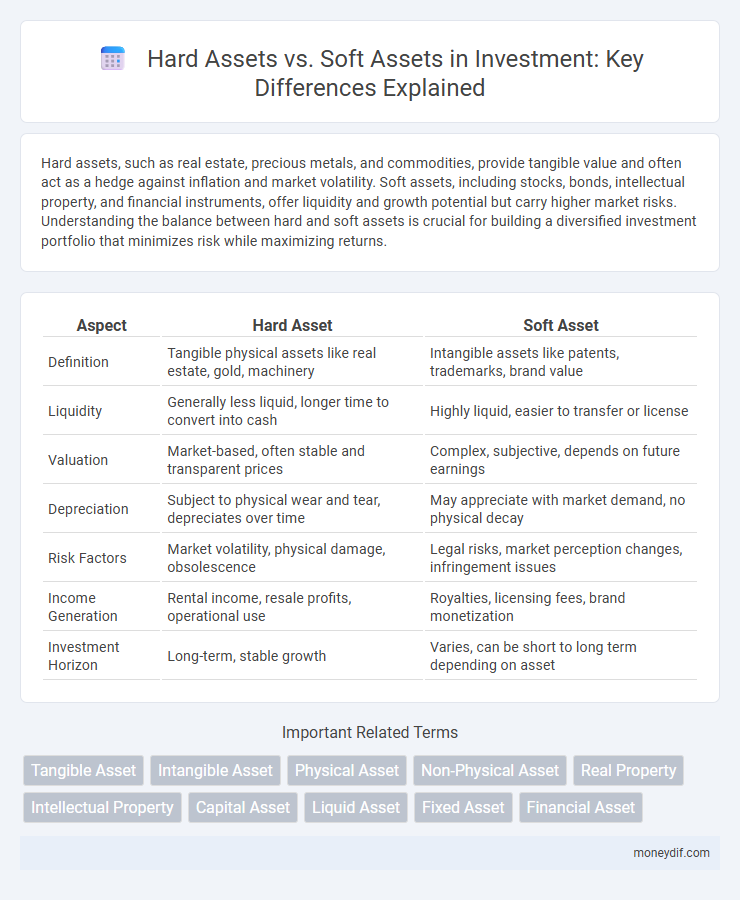

Hard assets, such as real estate, precious metals, and commodities, provide tangible value and often act as a hedge against inflation and market volatility. Soft assets, including stocks, bonds, intellectual property, and financial instruments, offer liquidity and growth potential but carry higher market risks. Understanding the balance between hard and soft assets is crucial for building a diversified investment portfolio that minimizes risk while maximizing returns.

Table of Comparison

| Aspect | Hard Asset | Soft Asset |

|---|---|---|

| Definition | Tangible physical assets like real estate, gold, machinery | Intangible assets like patents, trademarks, brand value |

| Liquidity | Generally less liquid, longer time to convert into cash | Highly liquid, easier to transfer or license |

| Valuation | Market-based, often stable and transparent prices | Complex, subjective, depends on future earnings |

| Depreciation | Subject to physical wear and tear, depreciates over time | May appreciate with market demand, no physical decay |

| Risk Factors | Market volatility, physical damage, obsolescence | Legal risks, market perception changes, infringement issues |

| Income Generation | Rental income, resale profits, operational use | Royalties, licensing fees, brand monetization |

| Investment Horizon | Long-term, stable growth | Varies, can be short to long term depending on asset |

Understanding Hard Assets: Definition and Examples

Hard assets are tangible physical items with intrinsic value, such as real estate, precious metals, and commodities like oil or agricultural products. These assets provide a hedge against inflation and market volatility due to their limited supply and inherent utility. Investors often favor hard assets for portfolio diversification and long-term wealth preservation.

What Are Soft Assets? Key Characteristics

Soft assets are intangible investments such as patents, trademarks, brand reputation, and intellectual property that do not have a physical form but hold significant value for businesses. These assets often enhance competitive advantage, contribute to revenue generation, and play a crucial role in a company's long-term growth and market positioning. Unlike hard assets, soft assets are harder to quantify but are essential for innovation, customer loyalty, and corporate identity.

Hard Assets vs Soft Assets: Core Differences

Hard assets, such as real estate, precious metals, and machinery, provide tangible value with inherent physical properties, making them less susceptible to inflation. Soft assets primarily include financial instruments like stocks, bonds, and intellectual property, which derive value from contractual claims or market demand. The core difference lies in tangibility and inflation resilience; hard assets offer a hedge against inflation, while soft assets offer liquidity and income potential but higher volatility.

Advantages of Investing in Hard Assets

Investing in hard assets, such as real estate, precious metals, and commodities, provides tangible value and serves as a hedge against inflation and currency devaluation. Hard assets often exhibit lower volatility compared to stocks and bonds, offering portfolio diversification that can reduce overall investment risk. Their intrinsic physical presence ensures investor protection during economic downturns by maintaining value when financial markets fluctuate.

Benefits of Building Soft Asset Portfolios

Building soft asset portfolios offers investors the advantage of scalability and adaptability, as intangible assets like intellectual property, brand reputation, and digital content can grow exponentially without the physical limitations of hard assets. These portfolios often provide higher returns through innovation-driven value creation and enhanced competitive differentiation in rapidly evolving markets. Soft assets also promote flexibility in strategic partnerships and licensing opportunities, enabling diversified revenue streams beyond traditional asset utilization.

Risk Factors: Hard Assets Compared to Soft Assets

Hard assets such as real estate, precious metals, and commodities typically exhibit lower volatility and provide a tangible value buffer against inflation compared to soft assets like stocks and bonds, which are more susceptible to market fluctuations and economic downturns. The physical nature of hard assets offers intrinsic security, shielding investors from counterparty risks and currency devaluation. However, liquidity risk is higher for hard assets, as they usually require longer time horizons for buying or selling, while soft assets offer greater market liquidity but entail greater exposure to systemic financial risks.

Liquidity Considerations: Hard Asset vs Soft Asset

Hard assets, such as real estate and precious metals, typically have lower liquidity due to the time and transaction costs required to convert them into cash. Soft assets, including stocks and bonds, offer higher liquidity, enabling quicker sales on established exchange platforms with minimal price impact. Investors prioritize liquidity considerations to balance portfolio flexibility against asset stability and growth potential.

Market Trends Impacting Hard and Soft Assets

Market trends such as inflation spikes and geopolitical instability often increase demand for hard assets like real estate, precious metals, and commodities due to their intrinsic value and inflation-hedging properties. In contrast, soft assets, including stocks, bonds, and intellectual property, exhibit higher volatility and sensitivity to interest rate changes and technological advancements. Recent shifts towards digital transformation and sustainability also drive valuations, with hard assets benefiting from scarcity and utility, while soft assets reflect investor confidence in innovation and regulatory frameworks.

Hard and Soft Asset Allocation Strategies

Hard asset allocation strategies emphasize tangible investments like real estate, precious metals, and infrastructure to hedge against inflation and market volatility. Soft asset allocation focuses on intangible assets such as equities, bonds, and intellectual property, offering liquidity and growth potential. Balancing hard and soft assets optimizes portfolio diversification, risk management, and long-term returns.

Choosing the Right Asset Type for Your Investment Goals

Hard assets like real estate, precious metals, and commodities offer tangible value and inflation protection, making them ideal for long-term wealth preservation. Soft assets, including stocks, bonds, and intellectual property, provide liquidity and potential for higher returns, suiting investors seeking growth and income diversification. Align your choice with investment goals, risk tolerance, and time horizon to optimize portfolio performance and achieve financial objectives.

Important Terms

Tangible Asset

Tangible assets, also known as hard assets, include physical items like real estate and machinery, whereas soft assets refer to intangible properties such as patents and trademarks.

Intangible Asset

Intangible assets, unlike hard assets such as machinery and buildings, represent non-physical resources like intellectual property and brand reputation that provide long-term value to a company.

Physical Asset

Physical assets, often referred to as hard assets, include tangible items like machinery, real estate, and equipment, whereas soft assets encompass intangible resources such as intellectual property, brand reputation, and software.

Non-Physical Asset

Non-physical assets, such as intellectual property or brand reputation, differ from hard assets like machinery and buildings, and soft assets like software or customer relationships, by their intangible nature and value derived from rights or competitive advantage rather than physical form.

Real Property

Real property, classified as a hard asset, offers tangible value through physical land and structures, distinguishing it from soft assets such as intellectual property and financial securities.

Intellectual Property

Intellectual property, classified as a soft asset, encompasses intangible creations like patents and trademarks, differing from hard assets such as machinery and real estate that have physical substance and tangible value.

Capital Asset

Capital assets include both hard assets like machinery, buildings, and equipment, and soft assets such as intellectual property, trademarks, and patents, each contributing differently to a company's long-term value.

Liquid Asset

Liquid assets like cash and marketable securities offer higher liquidity compared to hard assets such as real estate and equipment or soft assets like patents and trademarks, which are less easily converted into cash.

Fixed Asset

Fixed assets, categorized as hard assets, are tangible physical properties like machinery and buildings, whereas soft assets encompass intangible resources such as intellectual property and brand value.

Financial Asset

Financial assets, such as stocks and bonds, represent ownership or claims with liquidity advantages compared to hard assets like real estate and precious metals, which provide tangible value and inflation protection.

Hard Asset vs Soft Asset Infographic

moneydif.com

moneydif.com