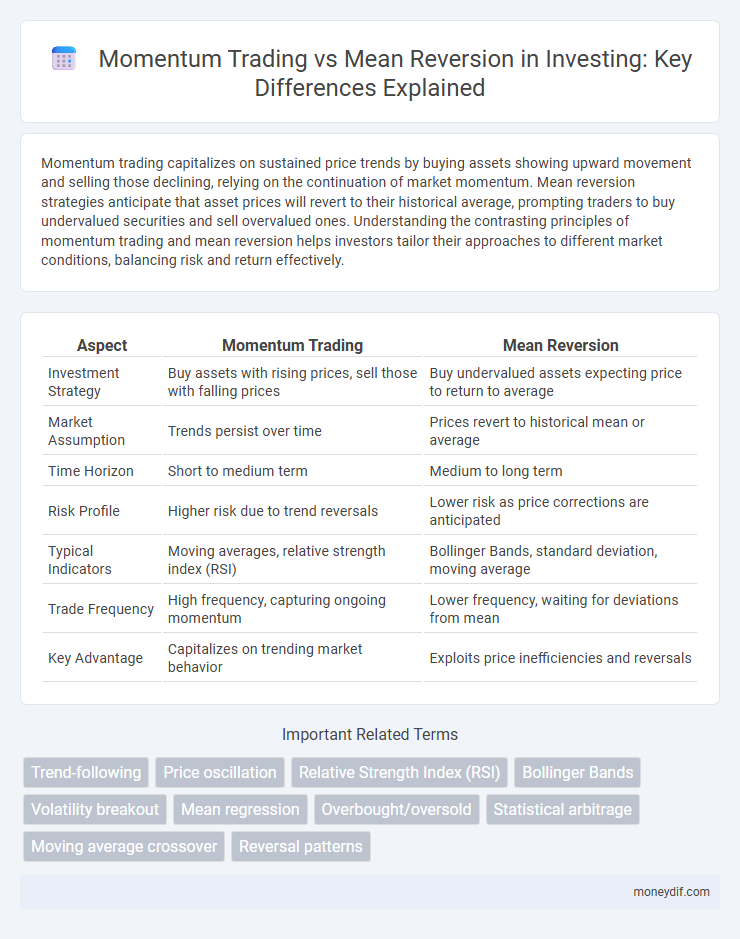

Momentum trading capitalizes on sustained price trends by buying assets showing upward movement and selling those declining, relying on the continuation of market momentum. Mean reversion strategies anticipate that asset prices will revert to their historical average, prompting traders to buy undervalued securities and sell overvalued ones. Understanding the contrasting principles of momentum trading and mean reversion helps investors tailor their approaches to different market conditions, balancing risk and return effectively.

Table of Comparison

| Aspect | Momentum Trading | Mean Reversion |

|---|---|---|

| Investment Strategy | Buy assets with rising prices, sell those with falling prices | Buy undervalued assets expecting price to return to average |

| Market Assumption | Trends persist over time | Prices revert to historical mean or average |

| Time Horizon | Short to medium term | Medium to long term |

| Risk Profile | Higher risk due to trend reversals | Lower risk as price corrections are anticipated |

| Typical Indicators | Moving averages, relative strength index (RSI) | Bollinger Bands, standard deviation, moving average |

| Trade Frequency | High frequency, capturing ongoing momentum | Lower frequency, waiting for deviations from mean |

| Key Advantage | Capitalizes on trending market behavior | Exploits price inefficiencies and reversals |

Introduction to Momentum Trading and Mean Reversion

Momentum trading capitalizes on the continuation of existing market trends by buying assets that show upward price momentum and selling those with downward momentum, driven by investor psychology and market sentiment. Mean reversion strategies assume that asset prices will revert to their historical average or intrinsic value after significant deviations, relying on statistical measures such as moving averages or Bollinger Bands to identify entry points. Both approaches depend on different market dynamics, with momentum trading exploiting trend persistence and mean reversion targeting price corrections.

Core Principles of Momentum Trading

Momentum trading relies on the core principle that assets demonstrating strong upward or downward trends are likely to continue moving in the same direction due to investor psychology and market inertia. This strategy emphasizes buying securities that show high relative strength and selling or shorting those with weak performance to capitalize on sustained price movements. Momentum traders often use technical indicators like moving averages and volume to identify entry and exit points, leveraging the persistence of market trends for profit.

Fundamentals of Mean Reversion Strategies

Mean reversion strategies in investment rely on the principle that asset prices tend to return to their historical average or intrinsic value after deviations. This approach utilizes fundamental indicators such as earnings, dividends, and cash flow to identify overvalued or undervalued securities likely to revert to their mean. By analyzing financial statements and valuation metrics like the price-to-earnings ratio, mean reversion traders capitalize on market inefficiencies driven by temporary price fluctuations.

Key Differences Between Momentum and Mean Reversion

Momentum trading capitalizes on the continuation of existing market trends by buying assets showing upward price momentum or selling those in decline, relying heavily on trend persistence and market sentiment. Mean reversion strategies assume that asset prices will revert to their historical averages, prompting traders to buy undervalued securities and sell overvalued ones based on statistical indicators like moving averages or Bollinger Bands. Key differences include momentum's focus on trend continuation versus mean reversion's expectation of price reversal, affecting risk management approaches and time horizons in investment decisions.

Analyzing Market Conditions for Each Strategy

Momentum trading thrives in trending markets where price movements exhibit strong directional persistence, capitalizing on continued asset price acceleration. Mean reversion strategies perform best in range-bound or sideways markets, exploiting price deviations from historical averages for potential reversals. Analyzing volatility, trend strength indicators, and market cycles helps investors determine the optimal conditions for implementing either momentum or mean reversion approaches.

Risk Management in Momentum vs Mean Reversion

Momentum trading involves riding strong price trends, which can lead to significant gains but requires strict risk management strategies like trailing stops and position scaling to protect against sharp reversals. Mean reversion trading assumes prices will return to an average level, often demanding tighter stop-loss orders and smaller position sizes to limit drawdowns during extended trends against the position. Effective risk management in momentum trading prioritizes capturing sustained movements, while mean reversion emphasizes minimizing losses during trend failures.

Tools and Indicators for Momentum Traders

Momentum traders rely heavily on tools such as Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and volume-based indicators to identify strong trends and confirm price movements. They prioritize indicators that highlight price acceleration, like the Rate of Change (ROC) and Moving Averages, to capture sustained upward or downward momentum. Chart patterns and breakout signals combined with real-time market data enhance their ability to enter trades that capitalize on trending asset behavior.

Signals and Setups for Mean Reversion

Mean reversion trading setups rely on identifying price deviations from historical averages, signaling opportunities when assets are oversold or overbought compared to their mean value. Key signals include Bollinger Bands contraction and expansion, RSI levels indicating extreme market conditions, and moving average crossovers that suggest a return to average prices. Effective mean reversion strategies capitalize on market inefficiencies by entering trades near support or resistance zones, anticipating a price correction toward the established mean.

Real-world Examples and Performance Comparison

Momentum trading capitalizes on asset price trends by buying securities exhibiting upward momentum and selling those with downward momentum, as evidenced by the consistent outperformance of momentum-based ETFs like the iShares MSCI USA Momentum Factor ETF (MTUM). Mean reversion strategies, which assume prices will revert to their historical averages, are exemplified by statistical arbitrage funds such as AQR Capital Management's mean reversion portfolios that exploit temporary price deviations. Performance comparisons reveal momentum strategies generally outperform in trending markets, while mean reversion excels during volatile or range-bound periods, highlighting the importance of market regime adaptation for investors.

Choosing the Right Strategy for Your Investment Goals

Momentum trading capitalizes on sustained price trends by buying assets exhibiting upward movement and selling those showing downward momentum, aligning with investors seeking rapid gains in volatile markets. Mean reversion strategies anticipate asset prices returning to their historical averages, appealing to risk-averse investors aiming for stability and long-term value. Selecting the appropriate strategy depends on individual risk tolerance, investment horizon, and market conditions, ensuring alignment with specific financial goals.

Important Terms

Trend-following

Trend-following strategies exploit momentum trading by capitalizing on sustained price movements and market inertia, aiming to ride existing trends for profit. Mean reversion approaches, contrastingly, anticipate price corrections by identifying overbought or oversold conditions, betting on asset prices reverting to historical averages.

Price oscillation

Price oscillation in momentum trading capitalizes on sustained trends by identifying strong directional movements, whereas mean reversion strategies exploit price fluctuations by anticipating reversals toward historical averages. Momentum traders focus on persistent upward or downward trends measured by indicators like the Relative Strength Index (RSI), while mean reversion relies on statistical measures such as Bollinger Bands to detect overbought or oversold conditions.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) measures the speed and change of price movements, serving as a key indicator in momentum trading by identifying overbought or oversold conditions that suggest trend continuation. In mean reversion strategies, RSI signals potential price reversals by highlighting extreme values where prices are expected to revert to the mean, enabling traders to capitalize on temporary price deviations.

Bollinger Bands

Bollinger Bands, consisting of a moving average and two standard deviation bands, are crucial in momentum trading to identify strong price trends when prices break above or below the bands. In mean reversion strategies, Bollinger Bands help detect overbought or oversold conditions, signaling potential price reversals as prices revert toward the moving average.

Volatility breakout

Volatility breakout strategies capitalize on significant price movements accompanied by increased volume, aligning closely with momentum trading by seeking continuation of strong trends beyond recent volatility thresholds. In contrast, mean reversion strategies focus on price retracements toward historical averages, exploiting temporary deviations caused by volatility spikes to anticipate reversals.

Mean regression

Mean regression in finance refers to the statistical tendency of asset prices to move back towards their historical average or mean value, serving as the foundational concept for mean reversion trading strategies that capitalize on price deviations from this average. Momentum trading contrasts with mean reversion by exploiting the continuation of existing price trends, relying on the persistence of asset price momentum rather than expecting a return to the mean.

Overbought/oversold

Overbought and oversold conditions are key indicators in momentum trading, signaling strong price trends that may continue, whereas mean reversion strategies interpret these conditions as potential reversal points where prices return to the average. Traders using momentum focus on sustained directional moves driven by high relative strength index (RSI) levels above 70 or below 30, while mean reversion relies on oscillators like RSI or stochastic to identify extreme price deviations suggesting upcoming corrections.

Statistical arbitrage

Statistical arbitrage exploits price inefficiencies by identifying patterns in asset price movements, often contrasting momentum trading, which bets on the continuation of trends, with mean reversion strategies that assume prices will revert to their historical averages. Quantitative models in statistical arbitrage quantify and capitalize on these opposing dynamics, using advanced data analysis and high-frequency trading algorithms to optimize risk-adjusted returns.

Moving average crossover

Moving average crossover strategies in momentum trading focus on identifying trends by using the intersection of short-term and long-term moving averages to signal entry and exit points, capturing sustained price movements. In contrast, mean reversion strategies utilize moving averages to detect price deviations from the mean, anticipating a reversal to the average price, thus profiting from temporary price corrections.

Reversal patterns

Reversal patterns signal potential shifts in price direction, crucial for momentum traders aiming to capitalize on strong trends as they weaken, while mean reversion traders use these patterns to identify overextended assets likely to revert to their average price. Recognizing key reversal patterns such as double tops, head and shoulders, and hammer candlesticks enhances decision-making by aligning entry and exit points with momentum shifts or mean reversion opportunities.

Momentum trading vs Mean reversion Infographic

moneydif.com

moneydif.com