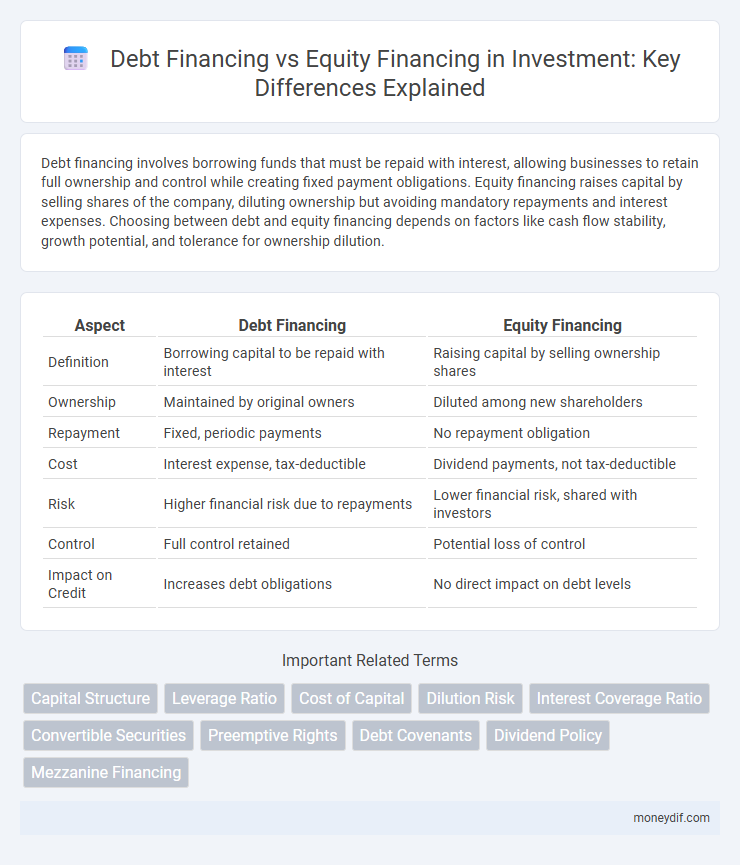

Debt financing involves borrowing funds that must be repaid with interest, allowing businesses to retain full ownership and control while creating fixed payment obligations. Equity financing raises capital by selling shares of the company, diluting ownership but avoiding mandatory repayments and interest expenses. Choosing between debt and equity financing depends on factors like cash flow stability, growth potential, and tolerance for ownership dilution.

Table of Comparison

| Aspect | Debt Financing | Equity Financing |

|---|---|---|

| Definition | Borrowing capital to be repaid with interest | Raising capital by selling ownership shares |

| Ownership | Maintained by original owners | Diluted among new shareholders |

| Repayment | Fixed, periodic payments | No repayment obligation |

| Cost | Interest expense, tax-deductible | Dividend payments, not tax-deductible |

| Risk | Higher financial risk due to repayments | Lower financial risk, shared with investors |

| Control | Full control retained | Potential loss of control |

| Impact on Credit | Increases debt obligations | No direct impact on debt levels |

Introduction to Debt Financing vs Equity Financing

Debt financing involves borrowing funds that must be repaid with interest, offering businesses immediate capital without diluting ownership, whereas equity financing entails selling shares of the company to investors in exchange for capital, which can dilute ownership but does not require repayment. Key distinctions include the obligations to creditors in debt financing versus the shared ownership and profit distribution in equity financing. Understanding these differences helps businesses strategically decide based on cash flow stability, growth potential, and risk tolerance.

Key Differences Between Debt and Equity Financing

Debt financing requires borrowers to repay the principal with interest over time, creating a fixed financial obligation without diluting ownership, while equity financing involves selling ownership shares to investors, sharing control and profits without the obligation to repay. Debt financing impacts cash flow due to interest payments and can improve credit ratings if managed well, whereas equity financing can dilute existing ownership but provides capital without immediate repayment pressures. Choosing between debt and equity financing depends on factors such as the company's cash flow stability, growth prospects, risk tolerance, and the desire to maintain control.

Pros and Cons of Debt Financing

Debt financing provides companies with immediate capital without relinquishing ownership, enabling business expansion while maintaining control. Interest payments on debt are tax-deductible, which can reduce overall tax liability, but the obligation to repay principal and interest introduces fixed financial risk, especially during downturns. Excessive debt increases leverage, potentially harming credit ratings and limiting future borrowing capacity.

Pros and Cons of Equity Financing

Equity financing allows companies to raise capital without incurring debt, reducing financial risk and improving cash flow stability through the absence of mandatory repayments. However, it dilutes ownership and control among existing shareholders and may result in sharing future profits with new investors. The process often involves complex regulatory compliance and can be time-consuming and costly compared to debt financing alternatives.

Cost Implications: Debt vs Equity Financing

Debt financing typically involves fixed interest payments, which can lower the overall cost of capital due to tax-deductible interest expenses, but increases financial risk through mandatory repayment schedules. Equity financing, while eliminating repayment obligation, often incurs higher long-term costs as investors expect dividend payouts and capital gains, diluting ownership and control. Companies must weigh the trade-off between cheaper debt interest and the potential dilution and cost of equity to optimize capital structure and minimize overall financing expenses.

Impact on Ownership and Control

Debt financing maintains full ownership and control for existing shareholders since lenders do not gain voting rights or ownership stakes. Equity financing dilutes ownership percentages and may reduce control as new shareholders acquire voting rights and influence decision-making. Companies must weigh the trade-off between retaining control and raising capital through equity issuance.

Risk Factors in Debt and Equity Financing

Risk factors in debt financing primarily include the obligation to make regular interest payments regardless of business performance, increasing the likelihood of default and potential insolvency. Equity financing carries risks related to ownership dilution and potential loss of control, as issuing new shares reduces existing shareholders' influence. Investors must weigh the financial strain of debt against the strategic implications of equity when structuring capital.

Suitability for Different Business Stages

Debt financing suits established businesses with steady cash flow seeking to preserve ownership while leveraging fixed repayment schedules. Early-stage startups often favor equity financing, exchanging ownership stakes for capital without immediate repayment pressure, aligning with unpredictable revenue streams. Growth-stage companies may adopt a hybrid approach, balancing debt and equity to optimize capital structure and support expansion objectives.

Debt Financing vs Equity Financing: Case Studies

Debt financing offers companies fixed repayment schedules and maintains ownership control, as demonstrated in Amazon's use of bonds to fund expansion without diluting shares. In contrast, Tesla's equity financing rounds provided substantial capital influx but resulted in notable shareholder dilution and increased market volatility. Case studies highlight that debt financing suits firms prioritizing control and predictable costs, while equity financing benefits those needing flexible capital with shared risk.

Choosing the Right Financing Option for Your Business

Selecting the appropriate financing method hinges on your business's growth stage, risk tolerance, and capital needs. Debt financing offers fixed repayment terms and retains ownership but increases financial risk, while equity financing dilutes ownership but provides risk-sharing and potential strategic partners. Analyzing cash flow stability and long-term goals helps determine whether debt or equity financing aligns best with your business strategy.

Important Terms

Capital Structure

Capital structure balances debt financing, which involves borrowing funds through loans or bonds, and equity financing, which raises capital by issuing shares to investors; debt financing often offers tax benefits due to interest deductibility but increases financial risk, while equity financing dilutes ownership but provides flexibility without obligatory repayments. Optimal capital structure considers cost of capital, firm's risk tolerance, and growth opportunities to maximize overall firm value and shareholder wealth.

Leverage Ratio

The leverage ratio measures the proportion of debt to equity in a company's capital structure, indicating financial risk and the extent of debt financing compared to equity financing. Higher leverage ratios signify increased reliance on debt financing, which can amplify returns but also elevate default risk, while lower ratios suggest a more conservative approach favoring equity financing.

Cost of Capital

Cost of capital varies significantly between debt financing and equity financing, with debt typically benefiting from tax-deductible interest, resulting in a lower after-tax cost compared to equity. Equity financing demands higher returns to compensate investors for risk, often increasing the overall weighted average cost of capital (WACC) when equity proportion rises.

Dilution Risk

Dilution risk in equity financing occurs when issuing new shares reduces existing shareholders' ownership percentages, potentially decreasing their control and earnings per share. Debt financing avoids ownership dilution but increases financial risk due to fixed interest obligations, impacting cash flow and creditworthiness.

Interest Coverage Ratio

Interest coverage ratio measures a company's ability to meet interest payments on its debt, indicating the risk level associated with debt financing compared to equity financing. A higher ratio signifies stronger earnings relative to interest obligations, favoring debt financing as it reflects lower default risk and increased financial stability.

Convertible Securities

Convertible securities blend debt financing benefits like fixed interest payments with equity financing's potential for capital appreciation by allowing holders to convert debt into shares. This hybrid instrument provides companies flexibility in raising capital, reducing immediate dilution while offering investors upside through equity conversion options.

Preemptive Rights

Preemptive rights protect existing shareholders by allowing them to purchase additional shares in future equity financing rounds to maintain their ownership percentage, which is crucial during equity financing but typically not applicable in debt financing. In contrast, debt financing involves borrowing funds without diluting ownership, so preemptive rights do not apply, focusing instead on repayment obligations and covenants.

Debt Covenants

Debt covenants are contractual clauses in debt financing agreements that impose restrictions on the borrower's financial activities to protect lenders' interests, often including limits on additional debt, minimum liquidity ratios, and restrictions on asset sales. Unlike equity financing, which involves selling ownership stakes without such covenants, debt financing with covenants can influence a company's operational flexibility and financial decision-making.

Dividend Policy

Dividend policy impacts a company's preference between debt financing and equity financing by influencing cash flow availability and shareholder expectations; firms with stable dividend policies may favor debt to avoid diluting ownership, while those prioritizing growth and flexibility often prefer equity to conserve cash and minimize financial risk. Understanding the trade-offs in dividend distribution helps optimize capital structure by balancing the cost of debt, cost of equity, and the signaling effects to investors.

Mezzanine Financing

Mezzanine financing combines features of debt financing and equity financing by providing subordinated debt that often includes warrants or conversion options enhancing returns for lenders while imposing less dilution than pure equity. This hybrid capital structure bridges the gap between senior debt and equity, offering companies flexible funding with higher interest rates than traditional debt but lower cost and dilution compared to issuing new equity.

Debt Financing vs Equity Financing Infographic

moneydif.com

moneydif.com