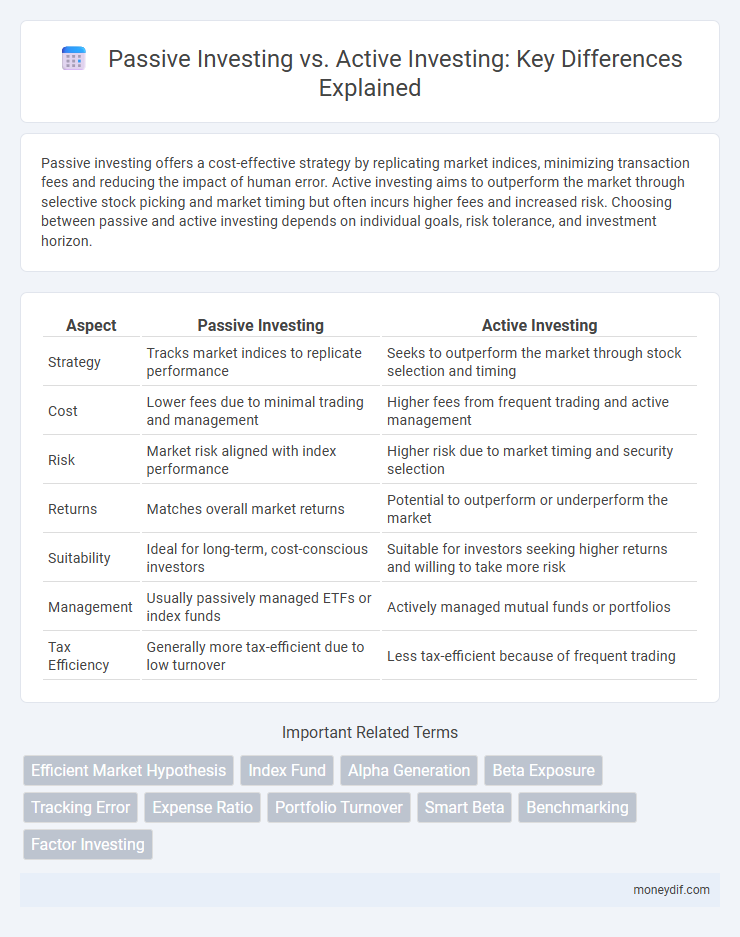

Passive investing offers a cost-effective strategy by replicating market indices, minimizing transaction fees and reducing the impact of human error. Active investing aims to outperform the market through selective stock picking and market timing but often incurs higher fees and increased risk. Choosing between passive and active investing depends on individual goals, risk tolerance, and investment horizon.

Table of Comparison

| Aspect | Passive Investing | Active Investing |

|---|---|---|

| Strategy | Tracks market indices to replicate performance | Seeks to outperform the market through stock selection and timing |

| Cost | Lower fees due to minimal trading and management | Higher fees from frequent trading and active management |

| Risk | Market risk aligned with index performance | Higher risk due to market timing and security selection |

| Returns | Matches overall market returns | Potential to outperform or underperform the market |

| Suitability | Ideal for long-term, cost-conscious investors | Suitable for investors seeking higher returns and willing to take more risk |

| Management | Usually passively managed ETFs or index funds | Actively managed mutual funds or portfolios |

| Tax Efficiency | Generally more tax-efficient due to low turnover | Less tax-efficient because of frequent trading |

Understanding Passive vs Active Investing

Passive investing involves replicating market indexes with minimal buying and selling, aiming for steady long-term growth and lower management fees. Active investing requires frequent trading and market analysis to outperform benchmarks, often incurring higher costs and increased risk. Understanding the trade-offs between cost efficiency, performance potential, and risk tolerance is crucial for aligning investment strategies with financial goals.

Key Differences Between Passive and Active Strategies

Passive investing involves tracking market indexes with lower fees and less frequent trading, emphasizing long-term growth and diversification. Active investing requires frequent buying and selling, aiming to outperform the market through market timing, stock picking, and analysis. Key differences include cost efficiency, risk levels, management style, and potential returns, with passive strategies offering predictability and active strategies seeking higher gains.

The Pros and Cons of Passive Investing

Passive investing offers low-cost, diversified exposure to broad market indices, minimizing management fees and reducing tax consequences through fewer trades. However, its rigid adherence to index performance limits opportunities to outperform the market during volatile or bear phases, potentially resulting in lower returns compared to active strategies. Investors face risks from market downturns and lack the flexibility to respond to rapid macroeconomic changes or exploit individual security mispricings.

The Pros and Cons of Active Investing

Active investing offers the potential for higher returns by capitalizing on market inefficiencies through frequent trading and expert analysis. However, it involves higher costs such as management fees and transaction expenses, which can erode overall gains. The strategy requires significant time and expertise, and its success is often challenged by market volatility and the difficulty of consistently outperforming passive benchmarks.

Cost Comparison: Fees and Expenses

Passive investing typically incurs lower fees and expenses due to its streamlined approach of tracking market indexes, resulting in minimal management costs. Active investing often involves higher fees stemming from frequent trading, research, and portfolio management, which can erode overall returns. Investors should consider expense ratios, transaction fees, and tax implications when comparing the cost efficiency of passive versus active investment strategies.

Performance Trends: Passive vs Active Returns

Passive investing typically outperforms active investing over the long term due to lower fees and market-matching returns, as evidenced by numerous studies showing index funds beating the majority of actively managed funds. Active investors may generate higher returns in short-term or niche markets, but consistent outperformance is rare once fees and taxes are accounted for. Data from Morningstar and S&P Dow Jones Indices highlights that over a 10-year horizon, more than 80% of active funds underperform their passive benchmarks.

Risk Management in Passive and Active Portfolios

Passive investing emphasizes broad market exposure and low turnover to minimize transaction costs and reduce unsystematic risk, relying on diversification to manage portfolio volatility. Active investing seeks to mitigate risk through strategic asset selection and market timing, aiming for outperformance by exploiting inefficiencies and adapting to changing market conditions. Risk management in active portfolios involves continuous analysis and adjustment, whereas passive portfolios depend on long-term market trends and systematic index tracking to control risk.

Which Strategy Suits Your Financial Goals?

Passive investing focuses on long-term growth by tracking market indices with lower fees and reduced trading, ideal for investors seeking steady returns and minimal involvement. Active investing aims to outperform the market through frequent trades and research, suitable for those willing to take higher risks for potentially greater rewards. Choosing between passive and active strategies depends on your risk tolerance, investment timeline, and target returns.

Popular Passive and Active Investment Vehicles

Popular passive investment vehicles include index funds and exchange-traded funds (ETFs), offering broad market exposure with low fees and diversification across thousands of stocks or bonds. Active investment vehicles often involve mutual funds managed by professional portfolio managers who use research and market analysis to select securities and attempt to outperform benchmarks. ETFs designed for active management and sector-specific funds provide options for investors seeking targeted strategies while maintaining liquidity and transparency.

Making the Right Choice: Passive or Active Investing

Choosing between passive and active investing depends on factors such as risk tolerance, investment goals, and market knowledge. Passive investing typically offers lower fees and consistent market returns through index funds, while active investing aims for higher returns via expert stock selection and market timing. Evaluating past fund performance, expense ratios, and personal commitment to portfolio management helps investors make the right choice aligned with their financial objectives.

Important Terms

Efficient Market Hypothesis

The Efficient Market Hypothesis (EMH) asserts that financial markets instantly and fully reflect all available information, making it challenging for active investing strategies to consistently outperform passive investing. Passive investing, which involves tracking market indexes, aligns with EMH by minimizing costs and risks associated with trying to beat the market, whereas active investing relies on identifying mispricings that EMH suggests are rare or nonexistent.

Index Fund

Index funds represent a core component of passive investing by replicating market indexes with low fees and minimal portfolio turnover, promoting diversified exposure aligned with market performance. In contrast, active investing involves professional managers attempting to outperform benchmarks through stock selection and timing, often incurring higher costs and increased risk without guaranteed superior returns.

Alpha Generation

Alpha Generation measures an investor's ability to outperform a benchmark through active investing strategies that exploit market inefficiencies and securities mispricings. Passive investing aims to replicate index returns with lower costs and minimal risk of underperformance, while active investing seeks superior returns by selecting undervalued stocks and timing market movements, potentially generating positive alpha.

Beta Exposure

Beta exposure measures a portfolio's sensitivity to market movements, serving as a key metric in both passive and active investing strategies. Passive investors typically aim for a beta close to 1 to replicate market performance, while active investors seek to exploit beta deviations to generate alpha and outperform benchmarks.

Tracking Error

Tracking error quantifies the divergence between a passive investment portfolio's returns and its benchmark index, indicating how closely the fund replicates the index performance. Active investing typically exhibits higher tracking error due to portfolio managers deviating from the benchmark to achieve alpha, while passive investing seeks to minimize tracking error through index replication.

Expense Ratio

Expense ratio significantly impacts net returns in passive investing, as these funds typically have lower expense ratios averaging around 0.10% compared to active funds that commonly range between 0.50% and 1.00%. Lower expense ratios in passive investing reduce annual fees, enhancing long-term growth potential relative to active investing where higher expenses can erode gains despite attempts at outperforming the market.

Portfolio Turnover

Portfolio turnover measures the frequency of asset trades within a fund, typically expressed as a percentage of the portfolio's holdings. Passive investing usually results in lower portfolio turnover due to its buy-and-hold strategy, while active investing exhibits higher turnover as managers regularly adjust holdings to capitalize on market opportunities.

Smart Beta

Smart Beta strategies blend passive investing's low-cost execution with active investing's systematic factor exposure, targeting enhanced risk-adjusted returns through rules-based portfolio construction. These approaches leverage factors such as value, momentum, size, and volatility to outperform traditional market-cap-weighted indices while maintaining transparent, rules-driven methodologies.

Benchmarking

Benchmarking in passive investing involves tracking a specific market index like the S&P 500 to replicate its performance, ensuring minimal tracking error and cost efficiency. In active investing, benchmarking serves as a performance yardstick against indices, guiding portfolio managers in asset allocation decisions while highlighting alpha generation relative to market benchmarks.

Factor Investing

Factor investing strategically targets specific securities characteristics, such as value, momentum, or low volatility, to enhance returns and manage risk compared to traditional passive or active strategies. While passive investing replicates market indices and active investing relies on manager discretion, factor investing offers a data-driven, rules-based approach that combines elements of both by systematically capturing persistent return drivers.

Passive Investing vs Active Investing Infographic

moneydif.com

moneydif.com