Accrual accounting records revenues and expenses when they are earned or incurred, providing a more accurate picture of a company's financial health over a period of time. Cash accounting, on the other hand, recognizes transactions only when cash changes hands, which can simplify bookkeeping but may not reflect the true financial position during a specific period. Investors often prefer accrual accounting for its detailed insight into earnings and liabilities, enabling better investment decisions.

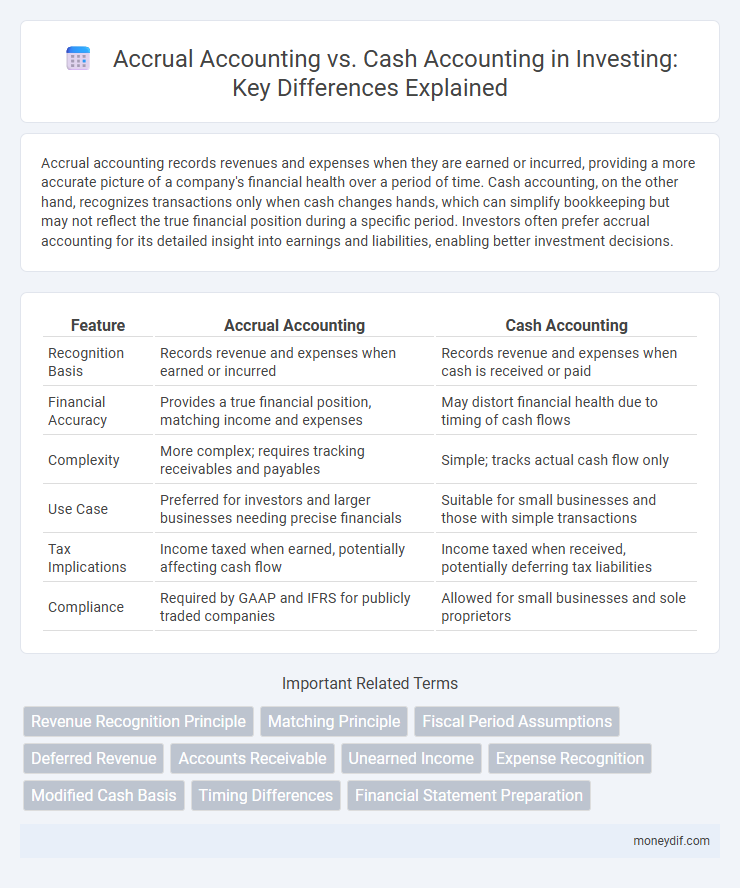

Table of Comparison

| Feature | Accrual Accounting | Cash Accounting |

|---|---|---|

| Recognition Basis | Records revenue and expenses when earned or incurred | Records revenue and expenses when cash is received or paid |

| Financial Accuracy | Provides a true financial position, matching income and expenses | May distort financial health due to timing of cash flows |

| Complexity | More complex; requires tracking receivables and payables | Simple; tracks actual cash flow only |

| Use Case | Preferred for investors and larger businesses needing precise financials | Suitable for small businesses and those with simple transactions |

| Tax Implications | Income taxed when earned, potentially affecting cash flow | Income taxed when received, potentially deferring tax liabilities |

| Compliance | Required by GAAP and IFRS for publicly traded companies | Allowed for small businesses and sole proprietors |

Understanding Accrual Accounting

Accrual accounting records revenue and expenses when they are earned or incurred, regardless of when cash transactions occur, providing a more accurate financial picture for investment analysis. This method aligns income recognition with the actual business activities, enabling investors to assess company performance and profitability in real time. Understanding accrual accounting is essential for evaluating cash flow timing and making informed investment decisions.

What Is Cash Accounting?

Cash accounting records revenue and expenses only when cash is actually received or paid, providing a clear view of cash flow for small businesses and sole proprietors. This method simplifies tax reporting by recognizing income and deductions in the period when transactions occur, rather than when earned or incurred. Cash accounting is favored for its straightforwardness but may not accurately reflect long-term financial health compared to accrual accounting.

Key Differences Between Accrual and Cash Accounting

Accrual accounting records revenues and expenses when they are earned or incurred, regardless of when cash transactions occur, providing a more accurate financial picture for businesses with complex operations. Cash accounting, by contrast, recognizes transactions only when cash changes hands, offering simplicity but potentially obscuring long-term financial performance. Key differences include timing of revenue recognition, expense matching, and financial statement accuracy, with accrual accounting aligning income and expenses within the same period to reflect true profitability.

Impact on Investment Decision-Making

Accrual accounting provides a comprehensive view of a company's financial health by recognizing revenues and expenses when they are incurred, offering investors more accurate insights into profitability and future cash flows. Cash accounting, on the other hand, records transactions only when cash changes hands, which can obscure the true timing of financial events and mislead investment decisions. Investors relying on accrual-based financial statements can better assess long-term value and risks, leading to more informed and strategic investment choices.

Revenue Recognition: Accrual vs Cash

Accrual accounting recognizes revenue when earned, regardless of cash receipt, providing a comprehensive view of financial performance by matching income with related expenses. Cash accounting records revenue only when cash is received, offering a simpler, more immediate snapshot of cash flow but potentially distorting long-term profitability. Investors rely on accrual-based revenue recognition for accurate financial analysis and forecasting, while cash accounting suits small businesses emphasizing cash liquidity.

Managing Expenses: Which Method Works Best?

Accrual accounting provides a more accurate picture of expenses by recognizing costs when they are incurred, ensuring better matching of revenue and expenses for improved financial analysis and budgeting. Cash accounting records expenses only when payments are made, offering simplicity and cash flow clarity but potentially distorting profitability during periods of delayed transactions. Businesses with complex operations and long-term financial planning benefit from accrual accounting, while smaller entities or those prioritizing cash availability may prefer the cash accounting method for managing expenses.

Tax Implications for Investors

Accrual accounting recognizes income and expenses when they are earned or incurred, impacting investors by potentially accelerating taxable income and deferring deductions, which may increase current tax liability. Cash accounting records transactions only when cash changes hands, allowing investors to control the timing of income recognition and deductions, often resulting in more flexible tax planning. Understanding these differences is crucial for investors to optimize tax strategies and manage cash flow effectively.

Financial Reporting and Transparency

Accrual accounting provides a more accurate financial reporting framework by recognizing revenues and expenses when they are incurred, enhancing transparency for stakeholders and enabling better decision-making. In contrast, cash accounting records transactions only when cash changes hands, which can obscure the true financial position and operational performance of a business. Companies seeking comprehensive financial transparency and compliance with Generally Accepted Accounting Principles (GAAP) typically adopt accrual accounting for regulatory reporting and investor communication.

Choosing the Right Method for Your Investment Strategy

Selecting between accrual accounting and cash accounting significantly impacts investment strategy clarity and tax planning. Accrual accounting provides a comprehensive view by recording income and expenses when earned or incurred, offering real-time financial insights crucial for proactive decision-making. Cash accounting, focusing on actual cash flow, simplifies monitoring liquidity, making it ideal for investors prioritizing immediate cash management and straightforward tax reporting.

Real-World Examples: Accrual vs Cash in Investment

Accrual accounting in investment tracks income and expenses when they are earned or incurred, providing a more accurate picture of financial health, such as recognizing dividends and interest income as they accrue regardless of cash receipt. Cash accounting records transactions only when cash changes hands, which can obscure ongoing obligations or earnings, often seen in rental property investments where rents received define income timing. For investors managing portfolios, accrual accounting offers better insight into asset performance and liabilities, while cash accounting can simplify tax reporting but may limit visibility into true financial status.

Important Terms

Revenue Recognition Principle

The Revenue Recognition Principle mandates recording revenue when earned, aligning with accrual accounting that recognizes transactions irrespective of cash flow, unlike cash accounting which recognizes revenue only upon cash receipt; this principle ensures financial statements reflect true economic activity and provide accurate profitability insights. Adherence to this principle under accrual accounting enhances comparability and compliance with GAAP and IFRS standards.

Matching Principle

The Matching Principle in accrual accounting requires recognizing expenses in the same period as the revenues they help generate, enhancing accuracy in financial reporting. Cash accounting, in contrast, records revenues and expenses only when cash transactions occur, potentially distorting the timing of financial performance.

Fiscal Period Assumptions

Fiscal period assumptions in accrual accounting recognize revenues and expenses when earned or incurred within specific accounting periods, providing a more accurate financial picture over time; cash accounting records transactions only when cash is received or paid, potentially distorting financial performance during fiscal periods due to timing differences. Choosing the appropriate fiscal period assumption impacts financial reporting accuracy, tax calculations, and compliance with accounting standards such as GAAP or IFRS.

Deferred Revenue

Deferred revenue represents payments received for goods or services not yet delivered, recognized as a liability under accrual accounting until earned, whereas cash accounting records revenue only when cash is received, often causing mismatches in revenue timing. Accrual accounting aligns revenue recognition with earned services or goods delivery, providing a more accurate financial position by reflecting deferred revenue as a current liability on the balance sheet.

Accounts Receivable

Accounts receivable represents amounts owed by customers for goods or services delivered but not yet paid, playing a critical role in accrual accounting by recording revenues when earned regardless of cash receipt. In cash accounting, accounts receivable are not reported since revenues are only recognized when cash is received, impacting the timing of financial statement reporting.

Unearned Income

Unearned income represents payments received before services are delivered or goods are provided, recorded as a liability in accrual accounting until earned revenue is recognized. In contrast, cash accounting immediately records unearned income as revenue when the cash is received, regardless of service or delivery status.

Expense Recognition

Expense recognition in accrual accounting records expenses when they are incurred, matching costs with related revenues regardless of cash flow timing, enhancing financial accuracy. In contrast, cash accounting recognizes expenses only when cash payments are made, which can delay expense reporting and affect financial analysis.

Modified Cash Basis

Modified Cash Basis accounting combines elements of accrual and cash accounting by recognizing revenues when received and expenses when incurred, while allowing certain accrual adjustments for better financial accuracy. It provides a more comprehensive financial picture than pure cash accounting, yet simpler than full accrual accounting, making it ideal for small to medium-sized businesses seeking balance between precision and simplicity.

Timing Differences

Timing differences arise because accrual accounting records revenues and expenses when they are earned or incurred, while cash accounting recognizes them only when cash is received or paid. These differences affect financial statements and tax liabilities, as certain income or expenses may be recognized in different periods under each method.

Financial Statement Preparation

Financial statement preparation under accrual accounting records revenues and expenses when they are earned or incurred, providing a more accurate picture of a company's financial position through accounts receivable, accounts payable, and accrued expenses. In contrast, cash accounting recognizes transactions only when cash changes hands, which can result in timing differences that affect the evaluation of profitability and liquidity.

Accrual Accounting vs Cash Accounting Infographic

moneydif.com

moneydif.com