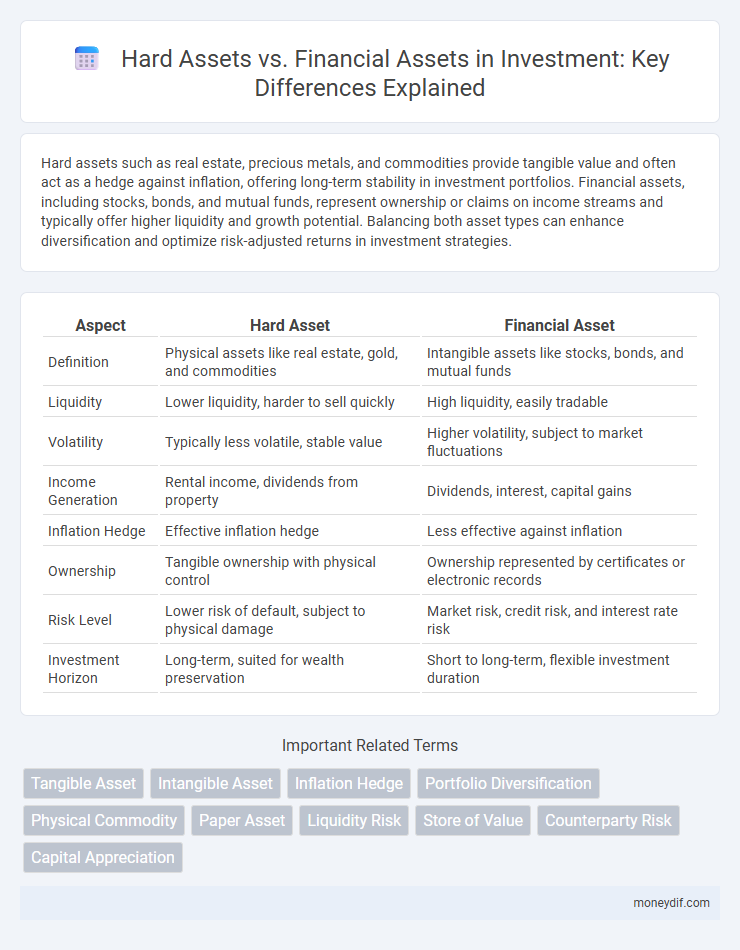

Hard assets such as real estate, precious metals, and commodities provide tangible value and often act as a hedge against inflation, offering long-term stability in investment portfolios. Financial assets, including stocks, bonds, and mutual funds, represent ownership or claims on income streams and typically offer higher liquidity and growth potential. Balancing both asset types can enhance diversification and optimize risk-adjusted returns in investment strategies.

Table of Comparison

| Aspect | Hard Asset | Financial Asset |

|---|---|---|

| Definition | Physical assets like real estate, gold, and commodities | Intangible assets like stocks, bonds, and mutual funds |

| Liquidity | Lower liquidity, harder to sell quickly | High liquidity, easily tradable |

| Volatility | Typically less volatile, stable value | Higher volatility, subject to market fluctuations |

| Income Generation | Rental income, dividends from property | Dividends, interest, capital gains |

| Inflation Hedge | Effective inflation hedge | Less effective against inflation |

| Ownership | Tangible ownership with physical control | Ownership represented by certificates or electronic records |

| Risk Level | Lower risk of default, subject to physical damage | Market risk, credit risk, and interest rate risk |

| Investment Horizon | Long-term, suited for wealth preservation | Short to long-term, flexible investment duration |

Defining Hard Assets and Financial Assets

Hard assets refer to tangible physical items such as real estate, precious metals, and commodities that hold intrinsic value and can provide a hedge against inflation. Financial assets include stocks, bonds, and bank deposits, representing ownership or contractual claims on future cash flows without physical substance. Understanding the distinct characteristics of hard and financial assets helps investors diversify portfolios and manage risk effectively.

Key Differences Between Hard and Financial Assets

Hard assets, such as real estate, gold, and commodities, possess intrinsic value and tend to offer protection against inflation and market volatility. Financial assets, including stocks, bonds, and mutual funds, represent ownership or contractual claims and provide liquidity and income through dividends or interest. The key differences lie in their tangibility, risk profiles, and market behavior, with hard assets generally viewed as tangible investments with long-term value stability, while financial assets offer greater flexibility and potential for capital appreciation.

Examples of Hard Assets in Investment Portfolios

Hard assets in investment portfolios commonly include real estate properties, precious metals like gold and silver, and physical commodities such as oil and agricultural products. These tangible assets serve as a hedge against inflation and currency fluctuations, providing intrinsic value independent of market volatility. Investors often allocate a portion of their portfolio to hard assets to diversify risk and enhance long-term capital preservation.

Common Types of Financial Assets Explained

Financial assets include common types such as stocks, bonds, and mutual funds, each representing ownership or creditor relationships with entities that generate income. Stocks provide equity stakes in companies, offering potential dividends and capital appreciation, while bonds act as loans to governments or corporations, generating fixed interest income. Mutual funds pool investor capital to diversify holdings across multiple securities, reducing risk compared to individual financial instruments.

Risk and Return: Hard Assets vs Financial Assets

Hard assets, such as real estate and commodities, typically offer lower liquidity but provide tangible value and act as a hedge against inflation, resulting in moderate but stable returns with reduced volatility. Financial assets, including stocks and bonds, offer higher liquidity and the potential for greater returns but come with increased market risk and price fluctuations. Understanding the risk-return tradeoff between hard assets and financial assets is essential for building a diversified investment portfolio that balances stability with growth potential.

Liquidity Comparison: Hard Assets vs Financial Assets

Hard assets such as real estate, precious metals, and collectibles typically exhibit lower liquidity due to longer transaction times and higher transaction costs compared to financial assets like stocks, bonds, and mutual funds, which can be quickly bought or sold on established exchanges. Financial assets offer superior liquidity, enabling investors to convert holdings into cash rapidly without significant price concessions. This liquidity advantage is critical for portfolio flexibility and managing cash flow needs in dynamic market conditions.

Inflation Protection: Which Asset Class Performs Better?

Hard assets such as real estate, gold, and commodities generally outperform financial assets like stocks and bonds in protecting against inflation due to their intrinsic value and limited supply. Inflation erodes the purchasing power of currency, making tangible assets more resilient as they tend to appreciate or maintain value when prices rise. Historical data shows that hard assets provide stronger inflation hedging, while financial assets may suffer real-value declines during high inflation periods.

Diversification Benefits of Mixing Asset Types

Combining hard assets, such as real estate and commodities, with financial assets like stocks and bonds enhances portfolio diversification by reducing overall risk through low correlation between asset classes. Hard assets often provide inflation protection and tangible value, while financial assets offer liquidity and growth potential, creating a balanced risk-return profile. This strategic asset mix optimizes investment stability and capital preservation, especially during market volatility.

Market Volatility: Impact on Hard and Financial Assets

Market volatility affects hard assets, such as real estate and commodities, by often increasing their perceived value as safe havens during economic uncertainty. Financial assets, including stocks and bonds, tend to experience greater price fluctuations, leading to higher risk and potential returns. Investors diversify portfolios with hard assets to mitigate the impact of market volatility on their overall investment stability.

Choosing the Right Asset Class for Your Investment Goals

Selecting between hard assets and financial assets depends on your investment goals, risk tolerance, and time horizon. Hard assets like real estate and precious metals provide tangible value and serve as hedges against inflation, while financial assets such as stocks and bonds offer liquidity and potential for capital appreciation. Aligning asset class choice with objectives ensures portfolio balance and maximizes returns under varying market conditions.

Important Terms

Tangible Asset

Tangible assets refer to physical items of value such as machinery, buildings, and equipment, distinguishing them from financial assets like stocks and bonds that represent ownership or claims. Hard assets, a subset of tangible assets, typically include commodities like real estate, precious metals, and natural resources, valued for their intrinsic physical properties and long-term stability.

Intangible Asset

Intangible assets represent non-physical resources such as intellectual property, brand reputation, and patents, contrasting with hard assets like real estate or machinery, which are tangible physical objects. Unlike financial assets, including stocks or bonds, intangible assets do not have a direct monetary claim but contribute significant long-term value and competitive advantage to a company's balance sheet.

Inflation Hedge

Hard assets like real estate, precious metals, and commodities serve as effective inflation hedges by maintaining intrinsic value and often appreciating during inflationary periods, unlike financial assets such as stocks and bonds which can lose purchasing power. Investing in tangible assets provides a safeguard against currency depreciation, whereas financial assets may suffer from decreased real returns amid rising inflation.

Portfolio Diversification

Portfolio diversification enhances risk management by combining hard assets such as real estate, precious metals, and commodities with financial assets like stocks, bonds, and mutual funds, reducing overall volatility. Hard assets provide inflation protection and tangible value, while financial assets offer liquidity and income generation, creating a balanced investment strategy.

Physical Commodity

Physical commodities such as oil, gold, and agricultural products are tangible hard assets that hold intrinsic value and can be directly utilized or stored, contrasting with financial assets like stocks or bonds, which represent ownership or claims but lack physical substance. Investing in hard assets provides a hedge against inflation and market volatility, whereas financial assets are often subject to market sentiments and liquidity risks.

Paper Asset

Paper assets, such as stocks and bonds, represent financial ownership or claims but lack physical substance, contrasting with hard assets like real estate or precious metals that have intrinsic tangible value and can serve as inflation hedges. Hard assets generally offer more stability during economic uncertainty, while financial assets provide liquidity and potential for income generation through dividends or interest.

Liquidity Risk

Liquidity risk is significantly higher in hard assets due to their limited marketability and longer transaction times compared to financial assets, which are generally more liquid and can be quickly converted to cash through active markets. Hard assets such as real estate or machinery often require extensive valuation and negotiation, increasing the risk of delayed liquidity during urgent cash needs.

Store of Value

A store of value preserves wealth over time, often realized through hard assets like gold, real estate, or commodities that maintain intrinsic value despite inflation and market fluctuations. Financial assets, such as stocks and bonds, offer potential growth but carry higher volatility and risk, making hard assets generally more reliable for safeguarding purchasing power.

Counterparty Risk

Counterparty risk in hard assets typically involves tangible goods or property with intrinsic value, reducing the likelihood of default compared to financial assets, which are more susceptible due to reliance on contractual obligations and creditworthiness. Hard assets such as real estate or commodities provide collateral benefits, whereas financial assets like derivatives or bonds depend heavily on the counterparty's solvency and market conditions.

Capital Appreciation

Capital appreciation in hard assets, such as real estate or precious metals, often results from physical scarcity and intrinsic value growth, offering inflation protection and tangible ownership benefits. Financial assets like stocks and bonds rely on market performance and economic conditions, providing liquidity and potential dividends but are more susceptible to volatility and market sentiment.

Hard Asset vs Financial Asset Infographic

moneydif.com

moneydif.com