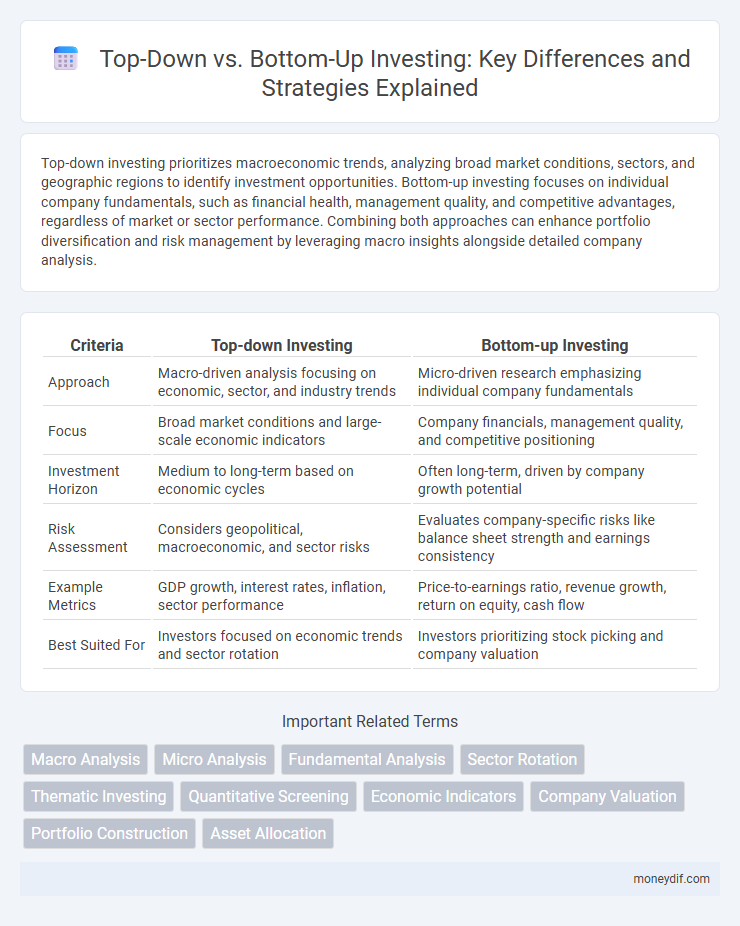

Top-down investing prioritizes macroeconomic trends, analyzing broad market conditions, sectors, and geographic regions to identify investment opportunities. Bottom-up investing focuses on individual company fundamentals, such as financial health, management quality, and competitive advantages, regardless of market or sector performance. Combining both approaches can enhance portfolio diversification and risk management by leveraging macro insights alongside detailed company analysis.

Table of Comparison

| Criteria | Top-down Investing | Bottom-up Investing |

|---|---|---|

| Approach | Macro-driven analysis focusing on economic, sector, and industry trends | Micro-driven research emphasizing individual company fundamentals |

| Focus | Broad market conditions and large-scale economic indicators | Company financials, management quality, and competitive positioning |

| Investment Horizon | Medium to long-term based on economic cycles | Often long-term, driven by company growth potential |

| Risk Assessment | Considers geopolitical, macroeconomic, and sector risks | Evaluates company-specific risks like balance sheet strength and earnings consistency |

| Example Metrics | GDP growth, interest rates, inflation, sector performance | Price-to-earnings ratio, revenue growth, return on equity, cash flow |

| Best Suited For | Investors focused on economic trends and sector rotation | Investors prioritizing stock picking and company valuation |

Understanding Top-Down Investing

Top-down investing starts with analyzing macroeconomic factors such as GDP growth, interest rates, and geopolitical conditions to identify attractive markets and sectors. Investors then narrow their focus to specific industries with strong growth potential before selecting individual securities. This approach helps allocate capital based on broader economic trends, optimizing portfolio performance through strategic sector exposure.

Key Features of Bottom-Up Investing

Bottom-up investing emphasizes analyzing individual companies based on their fundamentals such as earnings growth, management quality, and competitive advantages, rather than relying on macroeconomic trends. This approach involves detailed financial statement analysis and identifying undervalued stocks with strong long-term potential. It prioritizes company-specific insights and often appeals to investors seeking opportunities in overlooked or niche markets.

Main Differences Between Top-Down and Bottom-Up Approaches

Top-down investing begins with macroeconomic analysis, focusing on global trends, economic indicators, and sector performance to identify promising markets before selecting individual stocks. Bottom-up investing prioritizes company-specific fundamentals such as financial health, management quality, and competitive advantages, disregarding broader economic conditions. The main difference lies in the scope of analysis: top-down emphasizes external economic factors to guide investment choices, while bottom-up relies on in-depth evaluation of individual companies.

Pros and Cons of Top-Down Strategies

Top-down investing emphasizes macroeconomic factors, enabling investors to identify broad market trends and sector opportunities, which can lead to diversified portfolio allocation and risk mitigation. However, this approach may overlook the intrinsic value of individual companies, potentially causing missed opportunities in undervalued securities. Top-down strategies rely heavily on accurate global economic analysis, making them vulnerable to rapid market shifts and geopolitical uncertainties.

Advantages and Drawbacks of Bottom-Up Techniques

Bottom-up investing emphasizes analyzing individual companies' fundamentals, enabling investors to identify undervalued stocks with strong growth potential regardless of macroeconomic trends. This approach offers the advantage of discovering unique opportunities often overlooked by broader market analysis but can be time-consuming and riskier if industry or economic conditions shift unfavorably. A key drawback is that bottom-up investors might miss systemic risks or sector-wide downturns, making portfolio diversification and continuous monitoring essential.

Suitability for Various Investor Types

Top-down investing suits investors seeking macroeconomic insights and trends, such as institutional investors and portfolio managers focusing on sector or country allocation. Bottom-up investing appeals to those prioritizing individual company fundamentals, including value investors and long-term growth seekers emphasizing stock selection. Each strategy aligns with different risk tolerances, investment horizons, and expertise levels, making the choice critical based on investor objectives.

Performance in Different Market Environments

Top-down investing often excels in macroeconomic shifts, leveraging broad market trends to identify sectors with growth potential, which can enhance performance in volatile or recessionary environments. Bottom-up investing focuses on individual company fundamentals, typically outperforming in stable or growth markets where stock-specific drivers dominate. Combining these approaches can optimize portfolio performance by balancing market-wide insights with detailed company analysis.

Real-World Examples of Each Approach

Top-down investing focuses on analyzing macroeconomic factors, such as GDP growth in China driving demand for commodities, which influenced investors to prioritize resource stocks like BHP Group. Bottom-up investing zeroes in on individual company fundamentals, exemplified by Warren Buffett's investment in Apple, where detailed scrutiny of product innovation and brand loyalty guided his decision. Both strategies offer unique insights: top-down captures broad economic trends, while bottom-up uncovers hidden value in specific companies.

Combining Top-Down and Bottom-Up Methods

Combining top-down and bottom-up investing strategies leverages macroeconomic analysis alongside detailed company fundamentals to enhance portfolio performance and risk management. This hybrid approach enables investors to identify broad market trends while pinpointing high-potential individual stocks, optimizing asset allocation and stock selection. Studies show that integrating both methods often yields more resilient and diversified investment portfolios, adapting effectively to market fluctuations.

Choosing the Right Approach for Your Investment Goals

Top-down investing focuses on analyzing macroeconomic trends and sector performance to identify attractive industries before selecting individual stocks, making it ideal for investors aiming to capitalize on broad market movements. Bottom-up investing emphasizes thorough evaluation of individual companies' financial health and growth potential regardless of sector trends, suitable for those seeking detailed company insights and long-term value. Aligning the chosen approach with specific investment goals and risk tolerance enhances portfolio performance and investment decisions.

Important Terms

Macro Analysis

Macro analysis in top-down investing focuses on evaluating broad economic indicators such as GDP growth rates, inflation, and monetary policies to identify favorable sectors or countries before selecting individual stocks. In contrast, bottom-up investing emphasizes detailed company-specific analysis including financial statements, management quality, and competitive advantage, often disregarding larger economic trends.

Micro Analysis

Micro analysis in investing focuses on evaluating individual companies' fundamentals, financial statements, and competitive positioning, playing a crucial role in bottom-up investing by identifying high-potential stocks. In contrast, top-down investing prioritizes macroeconomic trends and sector performance before selecting individual equities, making micro analysis a secondary step in the decision-making process.

Fundamental Analysis

Fundamental analysis underpins both top-down and bottom-up investing by evaluating macroeconomic indicators and industry trends in the former, while focusing on company-specific financial health and intrinsic value in the latter. Top-down investing leverages economic cycles and sector performance to identify promising markets, whereas bottom-up investing relies on detailed earnings reports, balance sheets, and cash flow statements to select individual stocks.

Sector Rotation

Sector rotation strategy leverages macroeconomic and market cycle analysis, aligning with top-down investing to identify cyclical sector trends before selecting individual securities. Bottom-up investing focuses on fundamental analysis of individual companies, prioritizing stock selection over sector timing, often ignoring broader sector rotations.

Thematic Investing

Thematic investing focuses on identifying macro-level trends and innovations, aligning closely with top-down investing which starts from broad economic, geopolitical, or demographic factors to select sectors or themes. Bottom-up investing complements thematic strategies by emphasizing detailed analysis of individual companies within chosen themes to uncover undervalued assets driven by specific growth catalysts.

Quantitative Screening

Quantitative screening leverages algorithm-driven data analysis to identify investment opportunities based on financial metrics and patterns, facilitating systematic evaluation of stocks in both top-down and bottom-up investing strategies. In top-down investing, quantitative screening filters sectors or markets before selecting individual stocks, while in bottom-up investing, it directly analyzes company-specific fundamentals to uncover undervalued or high-growth stocks.

Economic Indicators

Economic indicators such as GDP growth, inflation rates, and unemployment figures are crucial for top-down investing, guiding investors to assess macroeconomic trends before selecting sectors or stocks. In contrast, bottom-up investors focus primarily on company-specific data like earnings reports and balance sheets, using economic indicators as supplementary context rather than the main decision driver.

Company Valuation

Company valuation in top-down investing emphasizes macroeconomic trends and industry prospects to identify sectors with high growth potential, while bottom-up investing focuses on analyzing individual company fundamentals such as earnings, cash flow, and competitive advantages to determine intrinsic value. Integrating both approaches enhances accuracy by aligning broader market conditions with specific company strengths and weaknesses.

Portfolio Construction

Portfolio construction balances top-down investing, which focuses on macroeconomic factors and sector allocation, with bottom-up investing that emphasizes individual company analysis and stock selection based on fundamentals. Integrating both strategies enhances diversification, risk management, and potential for alpha generation by aligning macro trends with micro-level insights.

Asset Allocation

Asset allocation in top-down investing prioritizes macroeconomic factors and sector trends to determine portfolio distribution, while bottom-up investing focuses on analyzing individual company fundamentals and growth potential to guide asset selection. Understanding these approaches helps investors balance risk and optimize returns by either emphasizing broad market conditions or detailed equity research.

Top-down Investing vs Bottom-up Investing Infographic

moneydif.com

moneydif.com