Capital gains result from the profit earned when selling an asset at a higher price than its purchase cost, offering potential for significant growth but subject to market fluctuations. Dividend income provides regular payouts from a company's earnings, delivering steady cash flow and often appealing to income-focused investors. Understanding the tax implications and risk profiles of both capital gains and dividend income is crucial for optimizing an investment portfolio.

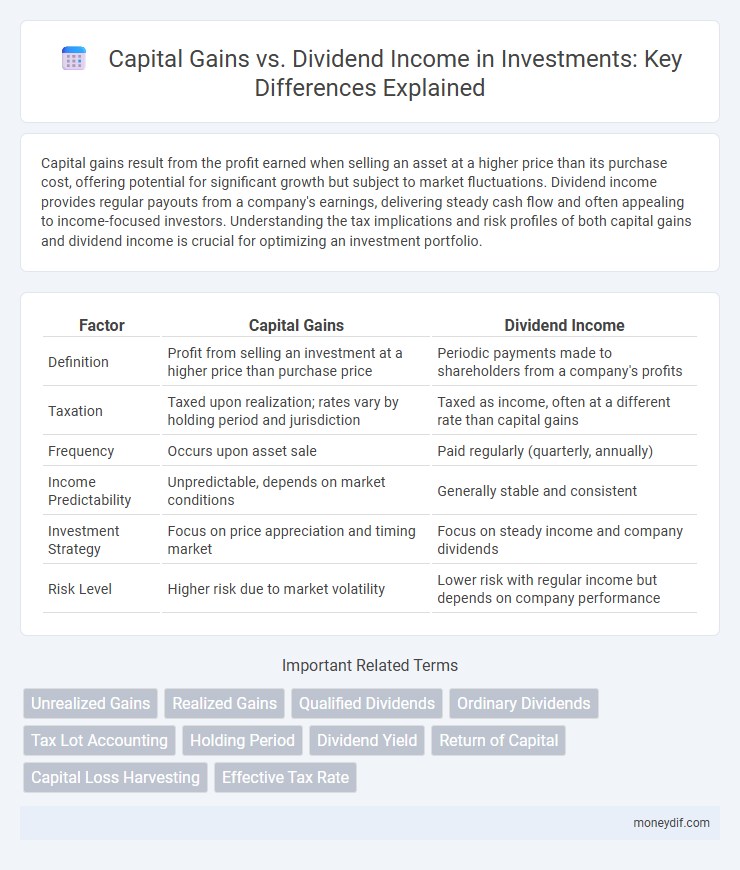

Table of Comparison

| Factor | Capital Gains | Dividend Income |

|---|---|---|

| Definition | Profit from selling an investment at a higher price than purchase price | Periodic payments made to shareholders from a company's profits |

| Taxation | Taxed upon realization; rates vary by holding period and jurisdiction | Taxed as income, often at a different rate than capital gains |

| Frequency | Occurs upon asset sale | Paid regularly (quarterly, annually) |

| Income Predictability | Unpredictable, depends on market conditions | Generally stable and consistent |

| Investment Strategy | Focus on price appreciation and timing market | Focus on steady income and company dividends |

| Risk Level | Higher risk due to market volatility | Lower risk with regular income but depends on company performance |

Understanding Capital Gains and Dividend Income

Capital gains represent the profit earned from selling an investment asset at a higher price than its purchase value, often subject to favorable tax rates depending on the holding period. Dividend income is the distribution of a company's earnings to shareholders, typically paid in cash or additional shares, providing a regular income stream. Investors evaluate capital gains and dividend income based on their financial goals, tax implications, and the investment's overall growth potential.

Key Differences Between Capital Gains and Dividend Income

Capital gains represent the profit realized from the sale of an asset, such as stocks, while dividend income is the portion of a company's earnings distributed to shareholders. Capital gains are usually subject to capital gains tax rates, which vary based on the holding period, whereas dividend income may be taxed at qualified dividend rates or ordinary income tax rates depending on the type of dividend. Investors prioritize capital gains for growth-focused strategies, while dividend income suits those seeking regular cash flow and income stability.

How Capital Gains Are Generated

Capital gains are generated when an investor sells an asset, such as stocks or real estate, at a price higher than the original purchase price, realizing a profit from the appreciation in value. This form of income depends on market fluctuations, asset performance, and timing of the sale, making it a dynamic way to build wealth through investments. Unlike dividend income, capital gains are typically realized only upon transaction, offering potential for significant returns during bullish market periods.

Sources and Types of Dividend Income

Dividend income primarily originates from stock holdings in corporations, categorized into qualified and non-qualified dividends, each taxed differently based on holding periods and corporate residency. Capital gains stem from the sale of investments like stocks, real estate, or mutual funds, realized when the asset's sale price exceeds its purchase price. Understanding these distinct income types aids investors in optimizing tax strategies and balancing portfolio income streams.

Tax Implications: Capital Gains vs Dividend Income

Capital gains are typically taxed at a lower rate than ordinary income, with long-term capital gains rates ranging from 0% to 20% depending on income level and holding period, offering potential tax efficiency for investors. Dividend income can be classified as qualified or non-qualified, where qualified dividends enjoy preferential tax rates similar to capital gains, while non-qualified dividends are taxed at ordinary income rates. Understanding the specific tax treatment of capital gains versus dividend income is crucial for optimizing after-tax investment returns and making informed portfolio decisions.

Risk Factors Associated with Each Income Type

Capital gains carry higher risk due to market volatility and the uncertainty of asset price appreciation, making them more unpredictable for investors. Dividend income offers more stability and consistent cash flow but can be impacted by company performance, dividend cuts, and economic downturns. Both income types require careful risk assessment, with capital gains favoring growth-oriented investors and dividend income appealing to those seeking steady returns.

Short-Term vs Long-Term Capital Gains

Short-term capital gains, realized from assets held less than one year, are taxed at higher ordinary income tax rates, impacting overall investment returns for traders. Long-term capital gains, applicable to assets held over one year, benefit from reduced tax rates, incentivizing longer holding periods for maximizing after-tax profits. Dividend income, often taxed at qualified dividend rates, differs significantly from capital gains tax treatment, influencing investment strategies based on income needs and tax efficiency.

Reinvesting: Dividends Versus Capital Appreciation

Reinvesting dividends provides a steady stream of income that can be compounded over time, enhancing portfolio growth through the purchase of additional shares. Capital appreciation involves the increase in value of the underlying asset, offering potential returns primarily realized upon sale. Comparing these, dividend reinvestment contributes consistent incremental gains, while capital gains rely on market timing and price fluctuations for profit realization.

Which Is Better for Different Investor Profiles?

Capital gains typically benefit growth-oriented investors seeking long-term wealth accumulation through asset appreciation, while dividend income suits income-focused investors desiring regular cash flow from their investments. Tax treatment varies; long-term capital gains often enjoy lower tax rates compared to ordinary income taxes applied to dividends, influencing investor preference based on tax brackets. Risk tolerance also plays a role, with dividend stocks generally providing more stability, and capital gains carrying higher volatility but greater potential returns.

Strategic Portfolio Allocation: Balancing Gains and Dividends

Strategic portfolio allocation involves balancing capital gains and dividend income to optimize overall returns and tax efficiencies. Investors prioritizing capital gains often focus on growth stocks and long-term appreciation, while dividend income strategies emphasize stable cash flow through dividend-paying equities. Diversifying between these asset types allows for risk mitigation and aligns with varying investment goals such as income generation and wealth accumulation.

Important Terms

Unrealized Gains

Unrealized gains refer to the increase in value of an asset that has not yet been sold, contrasting with realized capital gains which are taxable upon asset liquidation. Unlike dividend income, which provides regular taxable cash flow, unrealized gains only impact net worth until the asset is sold, influencing investment strategies and tax planning decisions.

Realized Gains

Realized gains refer to the actual profit earned from the sale of assets such as stocks or real estate, which are subject to capital gains tax rates that vary based on holding period and income level. Capital gains typically benefit from lower tax rates compared to ordinary income tax applied to dividend income, making them a more tax-efficient form of investment return.

Qualified Dividends

Qualified dividends are taxed at the lower long-term capital gains rates, which range from 0% to 20% depending on the taxpayer's income bracket, making them more tax-efficient compared to ordinary dividend income taxed at higher ordinary income rates. Understanding the difference between qualified dividends and capital gains is crucial for optimizing investment tax strategies and maximizing after-tax returns.

Ordinary Dividends

Ordinary dividends are payments made to shareholders from a company's earnings and are typically taxed at the individual's ordinary income tax rate, which can differ significantly from the lower tax rates applied to qualified capital gains. Unlike capital gains, which arise from the appreciation and sale of assets and benefit from preferential tax treatment, ordinary dividends represent regular income distributions that do not receive capital gains tax advantages.

Tax Lot Accounting

Tax lot accounting enables precise tracking of individual securities' purchase dates and costs, optimizing capital gains calculations by identifying specific shares sold. This method differentiates capital gains, taxed at variable rates based on holding periods, from dividend income, which may be qualified for lower rates or taxed as ordinary income.

Holding Period

Holding period significantly influences tax treatment, where long-term capital gains on assets held over one year typically receive favorable tax rates compared to short-term gains taxed as ordinary income; dividend income, classified as qualified or non-qualified, also faces different tax rates depending on holding periods and issuer criteria. Understanding these distinctions helps optimize after-tax returns by aligning investment strategies with specific holding period requirements for capital gains and dividend income.

Dividend Yield

Dividend yield measures the annual dividend income relative to a stock's price, providing insight into income-focused investment returns. Capital gains reflect price appreciation, while dividend income offers regular cash flow, making dividend yield a key metric for balancing total return between growth and income.

Return of Capital

Return of Capital reduces the investor's cost basis in an asset, decreasing capital gains tax liability upon sale rather than being taxed as dividend income. Unlike dividends, which are taxed as ordinary or qualified income, return of capital is treated as a tax-deferred distribution until the investment's adjusted cost basis reaches zero.

Capital Loss Harvesting

Capital loss harvesting strategically offsets capital gains by selling securities at a loss to reduce taxable income, effectively lowering tax liability compared to dividend income, which is taxed at ordinary income rates or qualified dividend rates depending on the holding period. This technique is particularly beneficial for investors with significant capital gains, as it preserves tax efficiency and enhances after-tax portfolio returns by minimizing the impact of dividend income tax.

Effective Tax Rate

Effective Tax Rate on capital gains typically remains lower than that on dividend income due to preferential tax treatment and long-term holding benefits under current tax laws. Investors should analyze the differential impact, as qualified dividends are taxed at similar rates to capital gains, whereas non-qualified dividends may face higher ordinary income tax rates.

Capital Gains vs Dividend Income Infographic

moneydif.com

moneydif.com