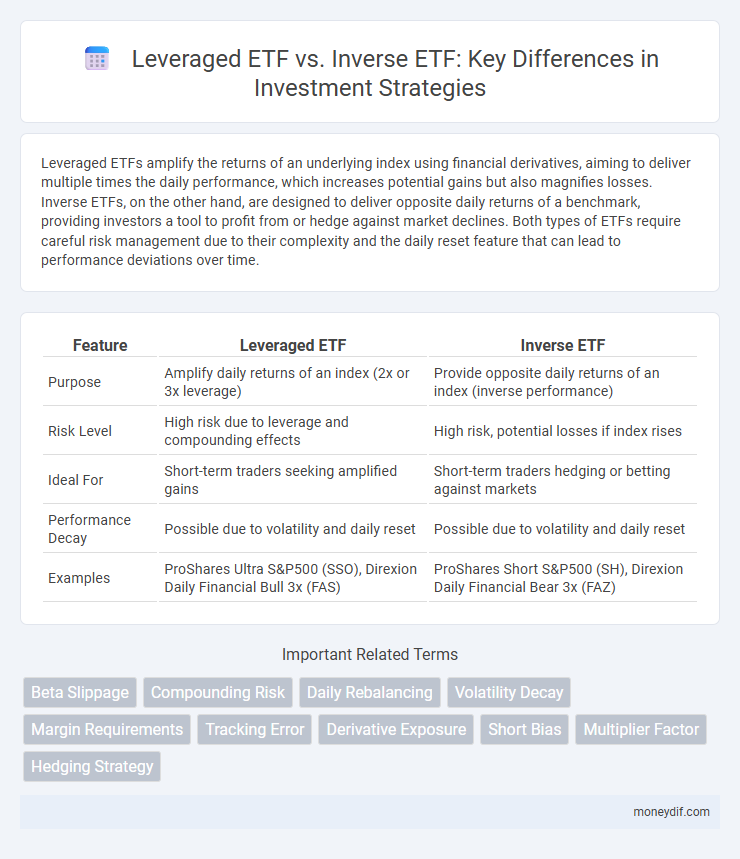

Leveraged ETFs amplify the returns of an underlying index using financial derivatives, aiming to deliver multiple times the daily performance, which increases potential gains but also magnifies losses. Inverse ETFs, on the other hand, are designed to deliver opposite daily returns of a benchmark, providing investors a tool to profit from or hedge against market declines. Both types of ETFs require careful risk management due to their complexity and the daily reset feature that can lead to performance deviations over time.

Table of Comparison

| Feature | Leveraged ETF | Inverse ETF |

|---|---|---|

| Purpose | Amplify daily returns of an index (2x or 3x leverage) | Provide opposite daily returns of an index (inverse performance) |

| Risk Level | High risk due to leverage and compounding effects | High risk, potential losses if index rises |

| Ideal For | Short-term traders seeking amplified gains | Short-term traders hedging or betting against markets |

| Performance Decay | Possible due to volatility and daily reset | Possible due to volatility and daily reset |

| Examples | ProShares Ultra S&P500 (SSO), Direxion Daily Financial Bull 3x (FAS) | ProShares Short S&P500 (SH), Direxion Daily Financial Bear 3x (FAZ) |

Understanding Leveraged ETFs: Key Features

Leveraged ETFs use financial derivatives and debt to amplify the returns of an underlying index, often targeting a multiple like 2x or 3x of daily performance. These funds provide investors with opportunities for enhanced gains in short-term trading but also carry higher volatility and risk due to daily reset mechanisms. Understanding the compounding effects and decay in leveraged ETFs is essential for managing exposure and avoiding unexpected losses over extended holding periods.

What Are Inverse ETFs? Fundamental Concepts

Inverse ETFs are specialized exchange-traded funds designed to deliver the opposite daily performance of a specific index or benchmark, often achieved through derivatives like swaps and futures. They enable investors to profit from declining markets without short-selling stocks directly, making them useful for hedging or speculative strategies during market downturns. Understanding the fundamental concept of inverse ETFs is crucial for managing risks and leveraging potential gains in volatile or bearish market conditions.

How Leveraged ETFs Generate Returns

Leveraged ETFs generate returns by using financial derivatives and debt to amplify the daily performance of an underlying index, often targeting multiples such as 2x or 3x. These funds rebalance daily to maintain their leverage ratio, which can lead to compounding effects that magnify gains or losses over time. Understanding the impact of volatility and time decay is crucial for investors using leveraged ETFs in their portfolios.

Mechanisms Behind Inverse ETF Performance

Inverse ETFs achieve their performance by using derivatives such as futures contracts, options, and swaps to bet against the underlying index, amplifying returns when the index declines. These funds reset daily, causing compounding effects that can deviate long-term performance from the inverse of the index's cumulative return. Leveraged ETFs also employ similar derivatives but multiply exposure in either direction, making understanding the daily reset and volatility decay crucial for both investment types.

Risk and Volatility: Leveraged ETFs vs Inverse ETFs

Leveraged ETFs amplify exposure to the underlying asset, increasing both potential returns and volatility, while inverse ETFs aim to profit from declines in an asset's value, often exhibiting substantial risk during market rebounds. The inherent compounding effects in daily rebalancing of leveraged and inverse ETFs can cause performance deviations from the expected multiple over longer periods, heightening volatility risk for investors. Careful risk management is essential as leveraged ETFs may lead to amplified losses in volatile markets, whereas inverse ETFs carry risks of rapid value erosion in upward-trending markets.

Investment Strategies for Leveraged ETFs

Leveraged ETFs use financial derivatives and debt to amplify the returns of an underlying index, making them suitable for aggressive investment strategies with short-term horizons. Investors typically employ leveraged ETFs for tactical trading, capitalizing on market volatility and attempting to maximize gains within a single trading day. Proper risk management is essential due to daily rebalancing, compounding effects, and potential for significant losses in volatile markets.

Using Inverse ETFs for Portfolio Hedging

Inverse ETFs provide a strategic tool for portfolio hedging by delivering returns that move opposite to the underlying index, offering protection against market downturns. Leveraged ETFs amplify investment exposure through borrowed capital, but carry higher risk and volatility, making them less suited for conservative hedging strategies. Utilizing Inverse ETFs allows investors to mitigate losses during market declines without liquidating positions, enhancing risk management in diversified portfolios.

Costs and Fees: A Comparative Analysis

Leveraged ETFs typically incur higher management fees due to frequent rebalancing that amplifies daily returns, often ranging from 0.75% to 1.5%, whereas inverse ETFs generally have lower expense ratios, usually between 0.50% and 1.0%. Both types involve transaction costs that can erode returns, but leveraged ETFs may experience greater decay from compounding effects in volatile markets. Understanding these cost differentials is essential for investors aiming to optimize portfolio efficiency while managing risk exposure effectively.

Suitable Investors: Leveraged vs Inverse ETFs

Leveraged ETFs are suitable for experienced investors seeking amplified exposure to a particular index or asset class, often for short-term trading or hedging strategies. Inverse ETFs cater to investors aiming to profit from or protect against declines in underlying securities, typically during market downturns or volatile periods. Both require active management and a strong understanding of market movements due to their complex risk profiles and daily reset features.

Long-Term Performance: Myths and Realities

Leveraged ETFs aim to amplify daily returns of an underlying index, while inverse ETFs seek to deliver the opposite, both designed primarily for short-term trading rather than long-term holds. Over extended periods, the effects of compounding and volatility decay can cause leveraged and inverse ETFs to significantly deviate from the expected multiple of the benchmark's cumulative return. Investors should understand that these products generally underperform buy-and-hold strategies on a long-term basis, making them unsuitable for long-term portfolio allocations.

Important Terms

Beta Slippage

Beta slippage occurs when the daily reset mechanism of Leveraged ETFs and Inverse ETFs causes the funds' cumulative returns to deviate from the intended multiple of the underlying index's performance, especially during volatile or trending markets. This effect leads to amplified tracking errors and can erode returns over time, with Leveraged ETFs typically exhibiting increased beta slippage relative to Inverse ETFs due to compounding of leveraged exposure.

Compounding Risk

Compounding risk in leveraged ETFs often results in amplified losses and gains due to daily resetting of leverage, especially over volatile or extended periods, causing performance to diverge significantly from the underlying index. Inverse ETFs compound risk similarly by amplifying losses during market rebounds, which can erode value more quickly than traditional ETFs, making both products subject to path dependency and time decay effects.

Daily Rebalancing

Daily rebalancing in leveraged ETFs amplifies returns by resetting exposure to a multiple of the daily index movement, while inverse ETFs use daily rebalancing to deliver the opposite daily performance of the underlying asset. Both leveraged and inverse ETFs can experience performance decay over time due to volatility and compounding effects inherent in their daily rebalancing mechanics.

Volatility Decay

Volatility decay significantly impacts both leveraged ETFs and inverse ETFs by eroding returns during periods of high market fluctuation, with leveraged ETFs typically experiencing amplified losses due to daily compounding of multiple times the asset's performance. Inverse ETFs also suffer from volatility decay, but their structure aims to deliver the opposite daily return of an index, making them particularly sensitive to prolonged, sideways market movements which degrade long-term value.

Margin Requirements

Margin requirements for leveraged ETFs typically demand higher initial and maintenance margins due to amplified exposure to underlying assets, reflecting increased risk and volatility in contrast to traditional ETFs. Inverse ETFs also require elevated margin, especially for short-selling strategies, as they aim to deliver opposite returns of the index, necessitating careful risk management to avoid margin calls.

Tracking Error

Tracking error in Leveraged ETFs tends to be higher compared to Inverse ETFs due to daily compounding effects and volatility decay, causing deviations from the expected multiple of the underlying index's performance over time. Inverse ETFs also exhibit tracking error but generally to a lesser extent, influenced by market fluctuations and the cost of maintaining short positions.

Derivative Exposure

Derivative exposure in leveraged ETFs amplifies returns by using futures, swaps, and options to achieve 2x or 3x the daily performance of an underlying index, while inverse ETFs utilize derivatives to deliver the opposite daily return, enabling investors to profit from declining markets. Both leveraged and inverse ETFs carry higher risks due to daily rebalancing and volatility decay, often leading to performance divergence from the index in long-term holdings.

Short Bias

Short bias occurs when investors favor inverse ETFs over leveraged ETFs due to expectations of declining markets, aiming to profit from downward price movements and hedge portfolio risks. Leveraged ETFs amplify market exposure through borrowed capital, while inverse ETFs provide inverse daily returns, making short bias strategies prefer inverse ETFs for bearish market positions with controlled downside risk.

Multiplier Factor

Multiplier Factor represents the targeted multiple of daily returns for leveraged ETFs, typically ranging from 2x to 3x, amplifying the performance of the underlying index. In contrast, inverse ETFs use a multiplier factor of -1x or more, aiming to deliver the opposite daily return of the benchmark, with leveraged inverse ETFs multiplying that inverse exposure by 2x or 3x.

Hedging Strategy

Hedging strategies involving leveraged ETFs and inverse ETFs enable investors to manage market volatility by amplifying gains in bullish trends or mitigating losses during bearish movements, leveraging the multiplier effects of these dynamic funds. Understanding the compounding and decay risks associated with daily rebalancing is crucial for effective use of leveraged and inverse ETFs in portfolio risk management.

Leveraged ETF vs Inverse ETF Infographic

moneydif.com

moneydif.com