A short squeeze occurs when heavily shorted stocks experience a rapid price increase, forcing short sellers to buy back shares to cover losses, which further drives up the price. In contrast, a long squeeze happens when long investors are pressured to sell their holdings as prices fall sharply, exacerbating the downward trend. Understanding these dynamics is crucial for investors managing risk during volatile market conditions.

Table of Comparison

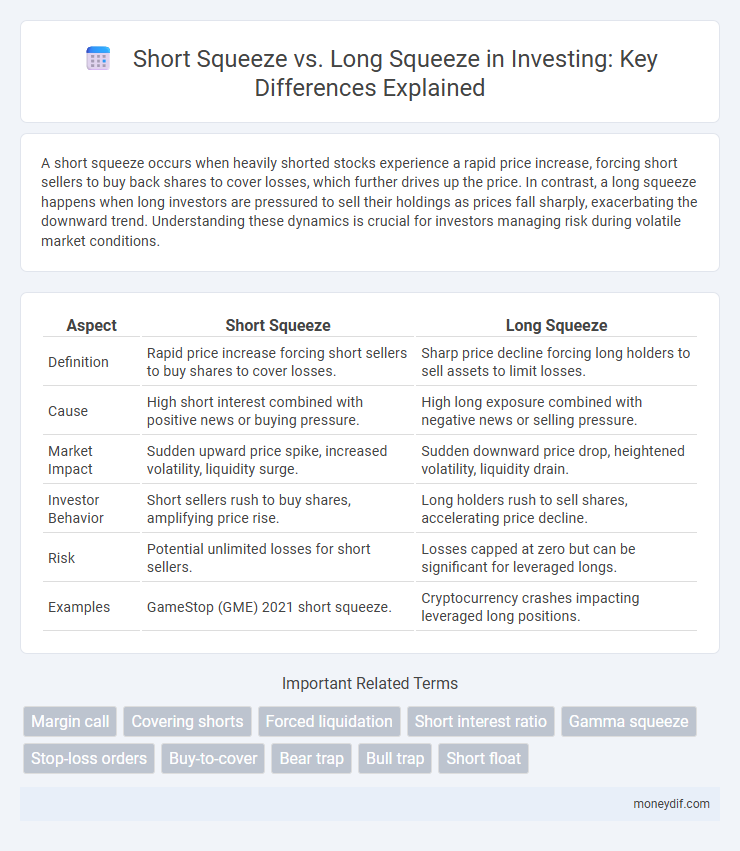

| Aspect | Short Squeeze | Long Squeeze |

|---|---|---|

| Definition | Rapid price increase forcing short sellers to buy shares to cover losses. | Sharp price decline forcing long holders to sell assets to limit losses. |

| Cause | High short interest combined with positive news or buying pressure. | High long exposure combined with negative news or selling pressure. |

| Market Impact | Sudden upward price spike, increased volatility, liquidity surge. | Sudden downward price drop, heightened volatility, liquidity drain. |

| Investor Behavior | Short sellers rush to buy shares, amplifying price rise. | Long holders rush to sell shares, accelerating price decline. |

| Risk | Potential unlimited losses for short sellers. | Losses capped at zero but can be significant for leveraged longs. |

| Examples | GameStop (GME) 2021 short squeeze. | Cryptocurrency crashes impacting leveraged long positions. |

Understanding Short Squeeze and Long Squeeze

A short squeeze occurs when heavily shorted stocks experience a rapid price increase, forcing short sellers to buy shares to cover positions, further driving up the price. Conversely, a long squeeze happens when long investors quickly sell off assets due to falling prices, intensifying the downward momentum. Recognizing market sentiment, trading volume, and position sizes helps investors anticipate potential short and long squeezes.

Key Differences Between Short Squeeze and Long Squeeze

A short squeeze occurs when heavily shorted stocks experience a rapid price increase, forcing short sellers to buy shares to cover losses, which further drives up the price. In contrast, a long squeeze happens when investors holding long positions face a sudden price decline, compelling them to sell and intensifying the downward pressure. Key differences lie in market sentiment, with short squeezes triggered by bullish rallies and long squeezes resulting from bearish downturns.

How a Short Squeeze Happens in the Market

A short squeeze occurs when a heavily shorted stock experiences a rapid price increase, forcing short sellers to buy shares to cover their positions and limit losses. This surge in buying pressure drives the stock price even higher, amplifying the squeeze effect. Key triggers include positive news, unexpected earnings, or coordinated buying that disrupts bearish bets.

Mechanics Behind a Long Squeeze

A long squeeze occurs when investors holding long positions are forced to sell their assets rapidly due to falling prices, which amplifies downward momentum. This selling pressure triggers margin calls and forced liquidations, intensifying the decline and often leading to significant losses for long holders. The mechanics hinge on sudden negative market sentiment and leverage, escalating the volume of sell orders beyond typical market levels.

Real-World Examples of Short Squeeze Events

The GameStop short squeeze in early 2021 stands as a landmark event where retail investors triggered a massive price surge, forcing hedge funds with large short positions to cover at significant losses. Another example, Volkswagen's 2008 short squeeze, saw the stock briefly become the world's most valuable as Porsche's announcement of controlling shares caused short sellers to scramble. These real-world instances highlight how concentrated short interest and unexpected market moves can drive rapid and extreme price volatility in equity markets.

Notable Instances of Long Squeeze in Investing

Notable instances of long squeezes in investing include the 2008 oil market crash, where a sharp price decline forced long positions to liquidate rapidly, exacerbating losses. Another example is the 2020 collapse of Archegos Capital, which caused major banks to unwind substantial long equity positions under pressure. These events highlight how sudden market reversals can trigger forced selling, amplifying downward price spirals in long-held assets.

Investor Strategies During Short and Long Squeezes

Investors facing a short squeeze often implement rapid buying strategies to cover short positions and limit losses, exploiting forced liquidations that drive prices upward. During a long squeeze, investors may employ stop-loss orders and reduce exposure to minimize risk from sudden price declines caused by aggressive sell-offs. Both scenarios require vigilant market monitoring and agile decision-making to navigate extreme volatility and protect portfolio value.

Risks Involved in Short Squeeze and Long Squeeze Scenarios

Short squeezes involve significant risk as investors who short sell shares face rapid price increases, forcing them to buy back at higher prices, resulting in substantial losses and market volatility. Long squeezes present risks when long investors are pressured to sell during price drops, potentially triggering a cascade of selling and accelerating price declines. Both scenarios can lead to liquidity crises and exacerbate market instability, demanding careful risk management and monitoring of market sentiment.

Role of Market Sentiment in Triggering Squeezes

Market sentiment plays a pivotal role in triggering both short squeezes and long squeezes by influencing investor behavior and price movements. A short squeeze occurs when bullish sentiment causes rapid buying, forcing short sellers to cover positions and driving prices higher, while a long squeeze happens amid bearish sentiment, prompting long holders to sell rapidly and exacerbating price declines. Understanding shifts in sentiment through indicators like fear and greed indexes or social media trends helps investors anticipate potential squeezes and manage risk effectively.

Protecting Your Portfolio from Market Squeezes

Market squeezes, including short squeezes and long squeezes, can dramatically impact portfolio stability by forcing rapid price movements due to forced buying or selling. Employing risk management strategies such as diversification, stop-loss orders, and monitoring short interest ratios helps mitigate exposure to these volatile conditions. Staying informed about market sentiment and liquidity levels enables investors to anticipate potential squeezes and protect their portfolio from sudden losses.

Important Terms

Margin call

A margin call occurs when an investor's account value falls below the broker's required maintenance margin, forcing the investor to either deposit additional funds or liquidate positions to cover losses. In a short squeeze, margin calls on short sellers accelerate buying pressure as they rush to cover positions, while in a long squeeze, margin calls on long holders trigger forced selling, intensifying downward price pressure.

Covering shorts

Covering shorts involves buying back borrowed shares to close a short position, which can trigger a short squeeze when rapid buybacks force prices upward, intensifying losses for remaining short sellers. In contrast, a long squeeze occurs when long investors sell off quickly, driving prices down and pressuring remaining longs to cover positions to limit losses.

Forced liquidation

Forced liquidation occurs when traders are unable to meet margin requirements, triggering automatic closure of positions, often exacerbating market volatility in short squeezes where short sellers rush to cover losses. Conversely, long squeezes involve forced liquidations of long positions, causing rapid price declines as longs sell off assets under margin calls, highlighting contrasting dynamics between supply-driven price surges and demand-driven collapses.

Short interest ratio

The short interest ratio, calculated by dividing the number of shares shorted by the average daily trading volume, serves as a critical indicator for potential short squeezes, where high short interest combined with limited liquidity can force short sellers to cover positions rapidly, driving prices upward. In contrast, a long squeeze occurs when a large number of long investors exit positions amid falling prices, which can be less directly predicted by the short interest ratio but often correlates with technical breakdowns or negative market sentiment.

Gamma squeeze

A gamma squeeze occurs when option market makers must buy underlying shares to hedge their positions, intensifying upward price momentum, often overlapping with a short squeeze where short sellers rapidly cover positions, driving prices higher. Unlike a long squeeze, which involves long holders selling to cut losses, a gamma squeeze specifically relates to option dynamics amplifying price movements beyond typical short covering.

Stop-loss orders

Stop-loss orders trigger automatic selling to limit losses, intensifying price movements during short squeezes as forced short-covering drives prices up rapidly. In long squeezes, stop-loss orders can accelerate sell-offs by triggering margin calls and liquidations, causing sharp downward price spikes due to panic selling.

Buy-to-cover

Buy-to-cover orders are crucial for short sellers to close positions by repurchasing borrowed shares, often intensifying a short squeeze when rapid buying drives prices sharply higher. In contrast, long squeezes occur when long holders sell off positions amid falling prices, but buy-to-cover mainly exacerbates short squeezes by forcing shorts to cover at escalating costs.

Bear trap

A bear trap occurs when a stock price falsely signals a downward trend, luring short sellers into opening positions that quickly reverse, triggering a short squeeze as they rush to cover losses. In contrast, a long squeeze forces long investors to sell off positions rapidly under sudden price drops, often exacerbated by liquidity pressures and margin calls.

Bull trap

A bull trap occurs when a false breakout lures traders into buying, anticipating a continued price rise, but the market quickly reverses downward, often triggering a short squeeze where short sellers scramble to cover losses. Conversely, a long squeeze happens when long holders rush to sell as prices fall, but unlike a bull trap, it typically follows sustained downward pressure rather than a deceptive upward move.

Short float

Short float represents the percentage of a company's outstanding shares currently sold short and is a critical metric in assessing short squeeze potential, where rapid buying pressure can force short sellers to cover. In contrast, a long squeeze occurs when excessive long positions lead to sharp price declines, triggering widespread selling and amplifying downward momentum.

Short squeeze vs Long squeeze Infographic

moneydif.com

moneydif.com