Short selling involves borrowing and selling assets with the expectation of repurchasing them at a lower price to profit from a decline in value. Long buying, on the other hand, entails purchasing assets outright to benefit from potential price appreciation over time. Investors use short selling to hedge risks or speculate, while long buying aligns with traditional strategies focused on growth and income generation.

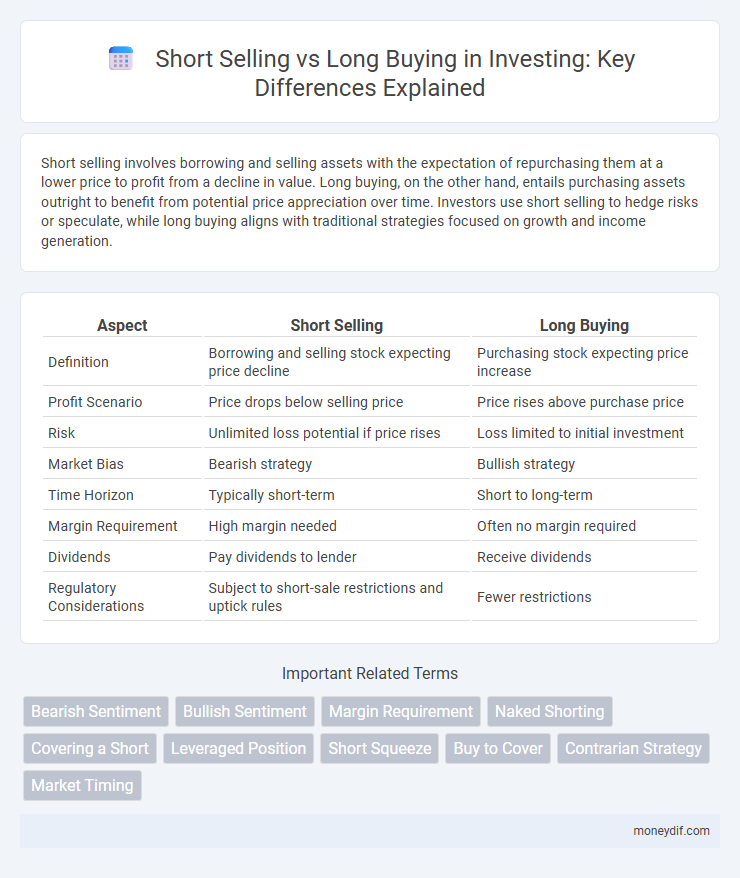

Table of Comparison

| Aspect | Short Selling | Long Buying |

|---|---|---|

| Definition | Borrowing and selling stock expecting price decline | Purchasing stock expecting price increase |

| Profit Scenario | Price drops below selling price | Price rises above purchase price |

| Risk | Unlimited loss potential if price rises | Loss limited to initial investment |

| Market Bias | Bearish strategy | Bullish strategy |

| Time Horizon | Typically short-term | Short to long-term |

| Margin Requirement | High margin needed | Often no margin required |

| Dividends | Pay dividends to lender | Receive dividends |

| Regulatory Considerations | Subject to short-sale restrictions and uptick rules | Fewer restrictions |

Short Selling vs Long Buying: Key Differences Explained

Short selling involves borrowing shares to sell at the current price, aiming to buy them back later at a lower price for profit, while long buying means purchasing shares outright to benefit from price appreciation. The key difference lies in the market outlook: short sellers profit from declining prices, whereas long buyers gain from rising prices. Risk profiles also differ significantly; short selling carries unlimited loss potential due to price increases, whereas losses in long buying are limited to the initial investment.

Understanding Market Mechanics: How Short Selling Works

Short selling involves borrowing shares to sell at the current price, aiming to buy them back later at a lower price to profit from a decline in the stock's value. This strategy relies on anticipating downward market movement and requires understanding margin requirements and potential risks like unlimited losses if the stock price rises. Unlike long buying, which profits from price appreciation, short selling profits specifically from price depreciation, providing a way to hedge or speculate in bearish market conditions.

The Fundamentals of Long Buying in Investing

Long buying in investing involves purchasing securities with the expectation that their value will increase over time, allowing investors to profit from capital appreciation. This strategy is grounded in fundamental analysis, focusing on evaluating a company's financial health, earnings growth, and market position to make informed investment decisions. Investors using long buying prioritize assets with strong fundamentals, aiming for sustained long-term returns rather than short-term gains.

Risk Profiles: Short Selling Compared to Long Buying

Short selling carries higher risk due to unlimited potential losses if the asset price rises, whereas long buying risks are limited to the initial investment since the asset price cannot fall below zero. Short sellers face risks such as margin calls and short squeezes, which can force liquidation at unfavorable prices. Long buyers benefit from potential capital appreciation and dividend income with comparatively lower downside risk, making their risk profile more manageable.

Profit Potential: Short Selling vs Long Buying Strategies

Short selling offers profit potential when asset prices decline, allowing investors to capitalize on market downturns by borrowing and selling securities with the intention of repurchasing them at lower prices. Long buying strategies generate profits primarily through asset appreciation and dividend income as investors purchase and hold securities expecting price increases over time. Understanding market trends and timing is crucial, as short selling profits are limited by price floors while long positions benefit from unlimited upside potential.

When to Short Sell and When to Go Long

Short selling is most effective in bearish markets or when specific stocks are expected to decline due to overvaluation, poor earnings, or negative news, allowing investors to profit from falling prices. Long buying is optimal in bullish conditions, during economic growth or when a company's fundamentals indicate strong future performance and potential stock appreciation. Timing these strategies requires market analysis, trend identification, and risk assessment to maximize returns and manage potential losses.

Impact on Portfolio Diversification

Short selling introduces inverse market exposure, enabling investors to profit from declining asset prices and hedge against portfolio risks, which enhances diversification by reducing overall market correlation. Long buying focuses on asset appreciation, contributing to portfolio growth but often increasing exposure to market downturns. Combining short selling and long buying strategies optimizes risk management and improves diversification by balancing positive and negative market movements.

Regulatory Considerations for Short Selling and Long Buying

Short selling faces stringent regulatory considerations such as the requirement to locate and borrow shares before sale, compliance with the SEC's Regulation SHO to prevent naked short selling, and restrictions during market volatility like short-sale bans. Long buying has fewer regulatory constraints, primarily governed by standard trading rules, margin requirements, and disclosure obligations for significant share purchases. Understanding these regulations is crucial for investors to manage risks and ensure compliance in different market conditions.

Common Mistakes in Short Selling and Long Buying

Common mistakes in short selling include underestimating the risk of unlimited losses and failing to set stop-loss orders, which can lead to significant financial setbacks. In long buying, investors often fall into the trap of holding onto losing positions too long or ignoring proper diversification, increasing exposure to market volatility. Both strategies require disciplined risk management and thorough market analysis to avoid costly errors.

Which Strategy Suits Your Investment Goals?

Short selling involves borrowing shares to sell at a high price and repurchasing them later at a lower price, aiming to profit from declining markets, while long buying entails purchasing stocks with the expectation of price appreciation over time. Investors seeking aggressive, short-term gains with higher risk tolerance may prefer short selling, whereas those focused on long-term wealth accumulation and lower risk often choose long buying. Aligning these strategies with your risk profile, market outlook, and investment timeframe is crucial to achieving your financial objectives.

Important Terms

Bearish Sentiment

Bearish sentiment intensifies short selling as investors anticipate declining prices, aiming to profit from falling market conditions. In contrast, long buying is less favored during bearish trends, reflecting skepticism about future asset appreciation and increased market risk.

Bullish Sentiment

Bullish sentiment indicates investor confidence that asset prices will rise, often driving increased long buying as traders anticipate profits from upward trends. Short selling typically declines during bullish sentiment since expectations of price drops diminish, reducing the incentive to bet against the market.

Margin Requirement

Margin requirement for short selling typically involves borrowing shares and maintaining a minimum equity percentage, often around 150% of the short position's value, to cover potential losses. In contrast, margin requirement for long buying usually requires only a 50% initial margin of the purchase price, reflecting lower risk since investors own the shares outright.

Naked Shorting

Naked shorting involves selling shares short without first borrowing the stock or ensuring it can be borrowed, increasing risks of market manipulation and settlement failures. Unlike traditional short selling, which requires borrowing shares to sell and betting on price declines, long buying entails purchasing shares expecting their value to rise, representing fundamentally different trading strategies.

Covering a Short

Covering a short involves buying back borrowed shares to close a short position and realize profits or limit losses, contrasting with long buying where investors purchase shares expecting price appreciation. Short selling capitalizes on declining stock prices by selling high and repurchasing low, while long buying focuses on owning assets to benefit from rising market values.

Leveraged Position

A leveraged position amplifies gains and losses by borrowing capital to increase exposure in both short selling and long buying strategies. In short selling, leverage intensifies risks as losses are theoretically unlimited when prices rise, whereas in long buying, leverage magnifies returns when asset prices increase but exposes investors to margin calls if prices fall.

Short Squeeze

A short squeeze occurs when short sellers are forced to buy shares to cover their positions due to a rapid increase in the stock price, intensifying upward momentum and causing significant losses for shorts. This phenomenon contrasts with long buying, where investors purchase shares expecting price appreciation, but during a short squeeze, the pressure from short covering amplifies demand beyond typical long buying activity.

Buy to Cover

Buy to Cover is an essential action in short selling, where investors purchase securities to close out an existing short position, effectively returning borrowed shares to the lender. Unlike long buying, which involves purchasing stocks to own and benefit from price appreciation, buy to cover aims to limit losses or realize profits from a decline in the asset's price.

Contrarian Strategy

Contrarian strategy involves taking positions opposite to prevailing market trends by short selling overvalued assets and buying undervalued ones, capitalizing on market reversals. This approach leverages market sentiment extremes to identify opportunities where short selling benefits from anticipated price declines while long buying targets assets poised for recovery.

Market Timing

Market timing strategies focus on predicting short-term price movements to maximize profits by either short selling overvalued stocks or long buying undervalued ones. Success in market timing depends on analyzing technical indicators, market sentiment, and economic data to identify optimal entry and exit points in both bearish and bullish trends.

Short Selling vs Long Buying Infographic

moneydif.com

moneydif.com