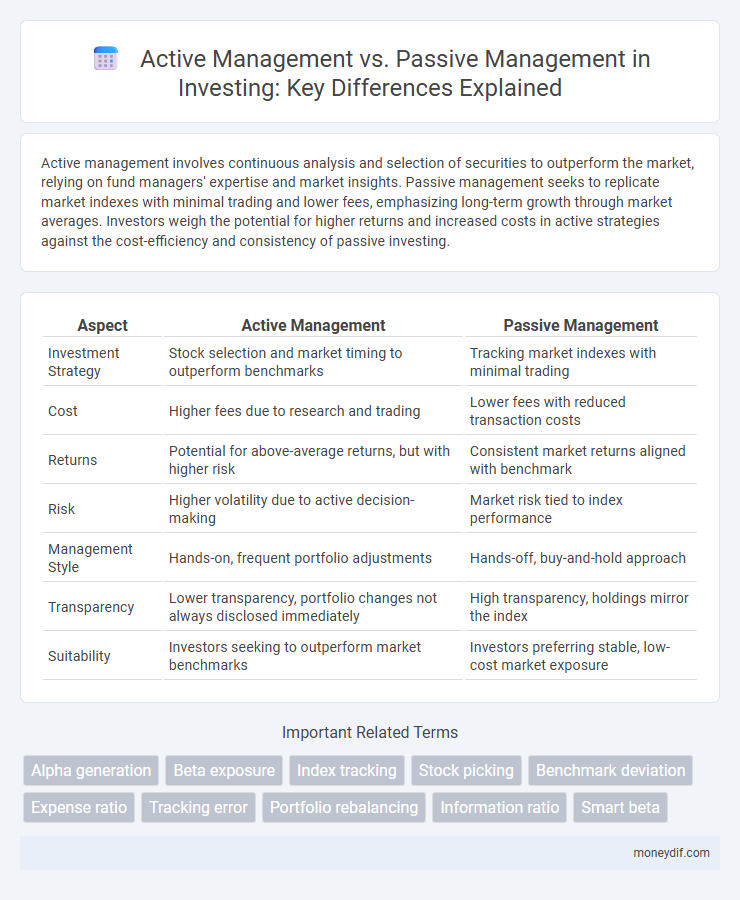

Active management involves continuous analysis and selection of securities to outperform the market, relying on fund managers' expertise and market insights. Passive management seeks to replicate market indexes with minimal trading and lower fees, emphasizing long-term growth through market averages. Investors weigh the potential for higher returns and increased costs in active strategies against the cost-efficiency and consistency of passive investing.

Table of Comparison

| Aspect | Active Management | Passive Management |

|---|---|---|

| Investment Strategy | Stock selection and market timing to outperform benchmarks | Tracking market indexes with minimal trading |

| Cost | Higher fees due to research and trading | Lower fees with reduced transaction costs |

| Returns | Potential for above-average returns, but with higher risk | Consistent market returns aligned with benchmark |

| Risk | Higher volatility due to active decision-making | Market risk tied to index performance |

| Management Style | Hands-on, frequent portfolio adjustments | Hands-off, buy-and-hold approach |

| Transparency | Lower transparency, portfolio changes not always disclosed immediately | High transparency, holdings mirror the index |

| Suitability | Investors seeking to outperform market benchmarks | Investors preferring stable, low-cost market exposure |

Understanding Active and Passive Management

Active management involves portfolio managers making investment decisions based on research, market forecasts, and individual security analysis to outperform benchmarks. Passive management, by contrast, aims to replicate the performance of a specific market index with minimal trading and lower fees. Understanding the differences in strategy, cost, and risk exposure between active and passive management is crucial for aligning investment goals with portfolio performance expectations.

Key Differences Between Active and Passive Strategies

Active management involves portfolio managers making specific investment decisions to outperform benchmarks, utilizing market research, forecasts, and their expertise. Passive management replicates a market index to achieve returns aligned with the overall market performance, emphasizing lower costs and minimal trading activity. The primary differences include cost efficiency, portfolio turnover rates, and the potential for alpha generation versus market-matching returns.

Advantages of Active Management

Active management enables portfolio managers to capitalize on market inefficiencies by selecting undervalued stocks and timing trades strategically, potentially achieving higher returns than passive indexes. This approach allows for swift responses to market volatility and economic changes, providing a tactical advantage during downturns. Customized investment strategies tailored to individual risk tolerance and financial goals further enhance the benefits of active management.

Benefits of Passive Management

Passive management offers lower fees and reduced transaction costs by replicating market indices rather than attempting to outperform them. It provides broad market exposure and diversification, minimizing the impact of individual security risk. Investors benefit from consistent, long-term performance that often surpasses actively managed funds due to lower expenses and less frequent trading.

Cost Comparison: Active vs Passive Investing

Active management typically incurs higher costs due to frequent trading, research expenses, and management fees, often ranging from 0.5% to 2% annually. Passive management, including index funds and ETFs, usually features lower expense ratios around 0.03% to 0.25%, making it a more cost-effective option for long-term investors. The cost difference significantly impacts net returns, with passive investing generally providing better after-fee performance over extended periods.

Performance Trends: Active vs Passive Funds

Active management aims to outperform market benchmarks through strategic stock selection and market timing, often resulting in higher fees but potential for above-average returns. Passive management typically tracks a market index, offering lower costs and more consistent performance closely aligned with the benchmark, making it favorable during stable market conditions. Long-term performance trends reveal that passive funds frequently outperform active funds after fees, especially in efficient markets with high competition.

Risk Considerations in Active and Passive Approaches

Active management involves continual portfolio adjustments based on market predictions, which introduces higher risk due to reliance on manager skill and market timing accuracy. Passive management reduces risk by tracking market indices, offering diversification and lower costs, yet it exposes investors to systemic market downturns without the possibility of downside protection. Evaluating risk tolerance and investment goals is crucial when choosing between the active strategy's potential for outperformance and the passive approach's consistent market exposure.

Choosing the Right Strategy for Your Portfolio

Active management involves continuous market analysis and frequent trading to outperform benchmarks, while passive management tracks market indices with lower fees and reduced turnover. Investors seeking potential higher returns and willing to accept increased risk and costs may prefer active strategies, whereas those valuing cost-efficiency and long-term stability often choose passive approaches. Evaluating factors such as investment goals, risk tolerance, time horizon, and expense ratios is essential for selecting the optimal strategy aligned with your portfolio objectives.

The Role of Market Efficiency in Investment Choices

Market efficiency plays a critical role in shaping the choice between active and passive investment management, as highly efficient markets reduce opportunities for active managers to consistently outperform benchmarks. Passive management capitalizes on market efficiency by tracking indexes and minimizing costs, while active management seeks to exploit inefficiencies through research and stock selection. Empirical evidence suggests active management may add value predominantly in less efficient markets where information asymmetry allows for greater alpha generation.

Future Outlook: Trends in Active and Passive Management

The future outlook for investment management indicates a growing integration of active and passive strategies, with active management increasingly leveraging data analytics and AI to enhance stock selection and risk management. Passive management continues to expand due to cost-efficiency and broad market exposure, particularly in ETFs and index funds that appeal to long-term investors. Trends suggest a hybrid approach gaining traction, combining passive core holdings with targeted active opportunities to optimize portfolio performance amid market volatility.

Important Terms

Alpha generation

The Alpha generation measures active management's ability to outperform the market benchmark through skillful security selection and timing, distinguishing it from passive management strategies that aim to replicate index returns. Investors seek positive Alpha as evidence of value-added by active managers, whereas passive management focuses on minimizing costs and tracking error.

Beta exposure

Beta exposure measures the sensitivity of an investment portfolio's returns to market movements, reflecting systematic risk traditionally emphasized in passive management strategies. Active management seeks to adjust beta exposure proactively to outperform benchmarks by either amplifying or mitigating market risk based on tactical insights and market forecasts.

Index tracking

Index tracking involves replicating the performance of a market index by holding the same or a representative sample of its constituents, enabling investors to achieve returns closely aligned with the index's performance. Passive management relies on this strategy to minimize costs and reduce risk, contrasting with active management that attempts to outperform the market through stock selection and timing but often incurs higher fees and greater volatility.

Stock picking

Active management in stock picking involves selecting individual stocks based on research and market analysis to outperform benchmarks, while passive management relies on tracking market indexes to minimize costs and replicate market returns; evidence suggests active managers often struggle to consistently beat passive index funds over the long term. Investors seeking alpha may favor active strategies emphasizing fundamental analysis, whereas passive strategies offer lower fees and broad diversification through vehicles like ETFs and index funds.

Benchmark deviation

Benchmark deviation measures the extent to which an active management portfolio's returns differ from its benchmark, indicating the manager's degree of active risk taken. Passive management aims to minimize benchmark deviation by closely tracking index performance, resulting in lower tracking errors and reduced portfolio volatility relative to the benchmark.

Expense ratio

Expense ratios for actively managed funds typically range from 0.5% to 2%, reflecting higher management fees due to frequent trading and research costs, while passive management expense ratios generally stay below 0.2% because of minimal trading and lower administrative expenses. Higher expense ratios in active management can erode investor returns compared to passive funds that track market indices with lower costs.

Tracking error

Tracking error quantifies the deviation of an actively managed portfolio's returns from its benchmark, reflecting the extent of active risk taken by the manager. Passive management aims to minimize tracking error by closely replicating the benchmark, whereas active management typically accepts higher tracking error to potentially achieve superior returns.

Portfolio rebalancing

Portfolio rebalancing in active management involves frequent adjustments based on market forecasts and security analysis to exploit short-term opportunities, enhancing returns but increasing transaction costs. In passive management, rebalancing occurs periodically to maintain target asset allocation, minimizing costs and tracking a benchmark index for consistent long-term growth.

Information ratio

Information ratio measures the performance of an active manager by comparing excess return to tracking error relative to a benchmark, highlighting skill in generating alpha. Passive management typically has a low information ratio since it aims to replicate benchmark returns with minimal active risk.

Smart beta

Smart beta strategies combine elements of active management by selecting and weighting securities based on specific factors such as value, momentum, or volatility, while maintaining the cost efficiency and transparency typical of passive management. These approaches enhance traditional passive indexing by exploiting market inefficiencies to achieve better risk-adjusted returns than purely passive benchmarks.

Active management vs Passive management Infographic

moneydif.com

moneydif.com