The bid-ask spread represents the immediate transaction cost investors face when buying or selling an asset, reflecting market liquidity and trading activity. Liquidity premium, on the other hand, is the extra expected return investors demand for holding less liquid assets that cannot be quickly converted to cash without significant price concessions. Understanding the relationship between bid-ask spreads and liquidity premiums helps investors assess the true cost and risk of illiquid investments in their portfolios.

Table of Comparison

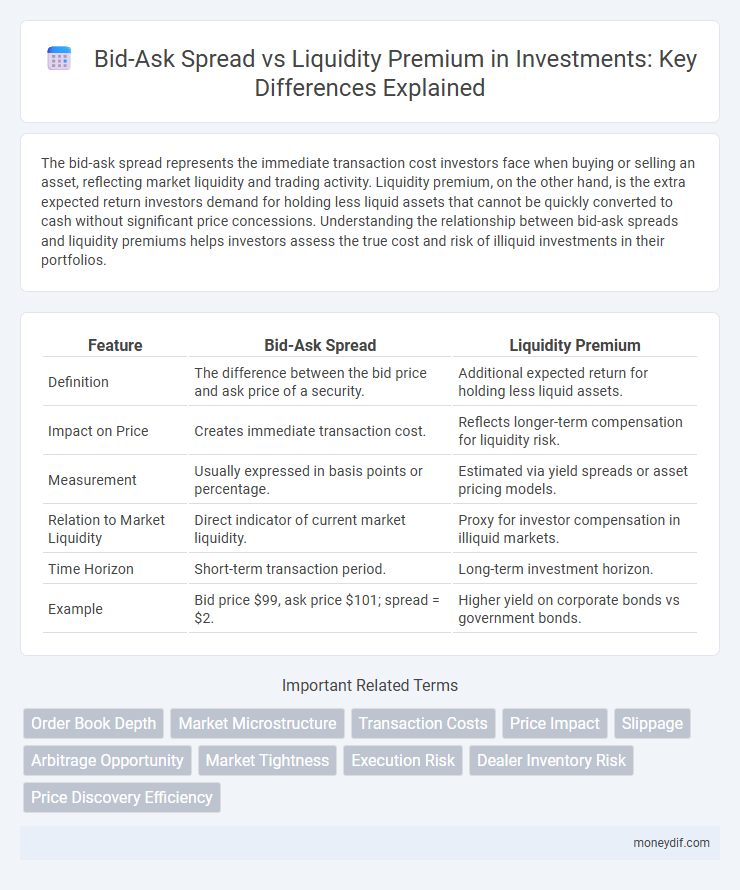

| Feature | Bid-Ask Spread | Liquidity Premium |

|---|---|---|

| Definition | The difference between the bid price and ask price of a security. | Additional expected return for holding less liquid assets. |

| Impact on Price | Creates immediate transaction cost. | Reflects longer-term compensation for liquidity risk. |

| Measurement | Usually expressed in basis points or percentage. | Estimated via yield spreads or asset pricing models. |

| Relation to Market Liquidity | Direct indicator of current market liquidity. | Proxy for investor compensation in illiquid markets. |

| Time Horizon | Short-term transaction period. | Long-term investment horizon. |

| Example | Bid price $99, ask price $101; spread = $2. | Higher yield on corporate bonds vs government bonds. |

Understanding Bid-Ask Spread: A Core Market Concept

The bid-ask spread represents the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept, serving as a key indicator of market liquidity and transaction costs. A narrower spread typically signals higher liquidity, allowing investors to execute trades quickly and with minimal price impact, while a wider spread suggests lower liquidity and greater trading costs. Understanding bid-ask spreads enables investors to better assess market efficiency and optimize trading strategies by accounting for liquidity premiums embedded in asset prices.

Defining Liquidity Premium in Financial Markets

Liquidity premium in financial markets refers to the extra yield investors demand for holding assets that cannot be quickly sold without a significant price concession. It compensates for the risk of delayed sales or potential losses due to low market liquidity, often reflected in wider bid-ask spreads. Understanding liquidity premiums helps investors assess the true cost of trading securities and optimize portfolio risk management.

Key Differences Between Bid-Ask Spread and Liquidity Premium

The bid-ask spread represents the immediate transaction cost reflecting the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept, whereas the liquidity premium is an additional expected return investors demand for holding less liquid assets. Bid-ask spreads tend to fluctuate frequently with market conditions and trading volumes, while liquidity premiums are embedded in long-term asset pricing models and compensation for potential difficulty in asset liquidation. Understanding these distinctions is crucial for evaluating trading costs versus investment returns in securities like stocks, bonds, and derivatives.

Factors Influencing Bid-Ask Spreads

Bid-ask spreads are primarily influenced by market liquidity, trading volume, and the volatility of the underlying asset, with wider spreads indicating lower liquidity and higher transaction costs. Information asymmetry between buyers and sellers significantly impacts bid-ask spreads, as market makers adjust spreads to compensate for potential adverse selection risks. Additionally, market structure factors such as the presence of high-frequency traders and competition among market makers play critical roles in determining the tightness of bid-ask spreads.

What Drives Liquidity Premium in Investments?

Liquidity premium in investments is primarily driven by the market's demand-supply imbalance and the asset's trading frequency, where less liquid assets command higher premiums to compensate investors for the difficulty in quickly converting them to cash. Factors such as market depth, transaction costs, and information asymmetry elevate the liquidity premium, reflecting the added risk and cost associated with lower liquidity. Bid-ask spreads serve as a direct indicator of liquidity, with wider spreads signaling higher liquidity premiums due to increased trading frictions.

Impact of Market Liquidity on Bid-Ask Spreads

Market liquidity significantly influences bid-ask spreads, with higher liquidity typically resulting in narrower spreads due to increased trading activity and reduced transaction costs. In contrast, low liquidity markets exhibit wider spreads as dealers demand a liquidity premium to compensate for the risk and cost of holding less liquid assets. This liquidity premium effectively raises the cost of trading, impacting overall asset pricing and investor returns.

How Liquidity Premium Affects Asset Valuation

Liquidity premium directly impacts asset valuation by increasing the expected return investors demand for holding less liquid assets, reflecting compensation for potential difficulties in quickly converting these assets into cash without price concessions. Assets with higher liquidity premiums tend to trade at lower prices compared to more liquid counterparts, as the market factors in the added cost and risk of illiquidity. The bid-ask spread, closely linked to liquidity conditions, often widens alongside the liquidity premium, signaling higher transaction costs and influencing investors' valuation assessments.

Bid-Ask Spread and Liquidity Premium: Risk Implications

The bid-ask spread reflects the immediate transaction cost and market liquidity, indicating the ease with which investors can trade assets without impacting prices significantly. A wider bid-ask spread often signals lower liquidity and higher risk, compelling investors to demand a liquidity premium as compensation for potential difficulties in executing trades. The liquidity premium represents the additional expected return investors require for holding less liquid assets, directly correlating with the bid-ask spread and underscoring the risk implications of trading in markets with varying liquidity levels.

Practical Examples: Comparing Spreads and Liquidity Premiums

Bid-ask spreads in highly liquid stocks like Apple Inc. are typically narrow, often just a few cents, reflecting minimal transaction costs and strong market participation, while less liquid assets such as corporate bonds or thinly traded small-cap stocks exhibit wider spreads that account for higher liquidity premiums. For instance, U.S. Treasury bonds usually have bid-ask spreads close to zero due to deep liquidity, contrasting with high-yield bonds that show bid-ask spreads reflecting liquidity premiums sometimes exceeding 1%. Measuring these spreads alongside liquidity premiums helps investors assess transaction costs and compensation required for bearing liquidity risk in different asset classes.

Strategies to Manage Bid-Ask Spread and Liquidity Premium

Effective strategies to manage bid-ask spread and liquidity premium include trading during high-volume periods to reduce transaction costs and selecting securities with narrower spreads and higher market depth. Utilizing limit orders instead of market orders can minimize costs associated with wide bid-ask spreads, while diversifying across multiple liquid assets helps mitigate liquidity risk. Advanced algorithmic trading techniques also optimize execution by dynamically adjusting order size and timing based on real-time market liquidity conditions.

Important Terms

Order Book Depth

Order book depth directly influences bid-ask spread by reflecting market liquidity, where deeper order books typically result in narrower spreads due to higher liquidity and lower transaction costs. This relationship highlights the liquidity premium, as assets with greater order book depth exhibit reduced liquidity premiums by minimizing price impact and trading frictions.

Market Microstructure

Market microstructure investigates how bid-ask spreads reflect liquidity premiums, where narrower spreads indicate higher market liquidity and lower trading costs. A wider bid-ask spread typically signals greater liquidity risk, requiring a higher liquidity premium as compensation for potential price impact and trading delays.

Transaction Costs

Transaction costs directly impact the bid-ask spread, where wider spreads indicate higher costs for trading securities, reflecting lower market liquidity. Liquidity premium compensates investors for the risk of holding less liquid assets, often correlating with increased bid-ask spreads as market makers adjust prices to offset illiquidity risks.

Price Impact

Price impact reflects how large trades influence asset prices, closely linked to the bid-ask spread as narrower spreads typically indicate higher liquidity and lower price impact. Liquidity premium represents the extra return investors demand for holding less liquid assets, often resulting in wider bid-ask spreads that increase transaction costs and magnify price impact.

Slippage

Slippage occurs when the actual execution price deviates from the expected price, often influenced by the bid-ask spread and liquidity premium; a wider bid-ask spread typically increases slippage due to lower market liquidity and higher transaction costs. Liquidity premium reflects the extra return investors demand for assets that are harder to trade, directly impacting slippage by causing more significant price shifts during order execution in less liquid markets.

Arbitrage Opportunity

Arbitrage opportunities arise when discrepancies exist between the bid-ask spread and the liquidity premium, allowing traders to exploit price differences for risk-free profits. A narrower bid-ask spread combined with a higher liquidity premium often signals inefficiencies in market pricing, creating conditions favorable for arbitrageurs to execute simultaneous buy and sell orders.

Market Tightness

Market tightness, measured by the bid-ask spread, reflects the cost of trading and is inversely related to liquidity premium, which represents the additional return investors require for holding less liquid assets. Narrow bid-ask spreads indicate high market tightness and lower liquidity premiums, signaling efficient markets with abundant liquidity and lower trading costs.

Execution Risk

Execution risk increases as the bid-ask spread widens, reflecting lower market liquidity and higher transaction costs. A larger liquidity premium compensates investors for this risk, indicating difficulty in swiftly executing large orders without significant price impact.

Dealer Inventory Risk

Dealer inventory risk increases when bid-ask spreads widen due to lower market liquidity, forcing dealers to hold assets that may rapidly depreciate. This risk is directly linked to the liquidity premium investors demand for holding less liquid securities, as wider spreads compensate dealers for potential inventory losses.

Price Discovery Efficiency

Price discovery efficiency improves when bid-ask spreads narrow, reflecting lower transaction costs and higher market liquidity. A narrower bid-ask spread reduces the liquidity premium required by investors, signaling more accurate and timely incorporation of information into asset prices.

Bid-Ask Spread vs Liquidity Premium Infographic

moneydif.com

moneydif.com