Covenant-lite loans feature fewer restrictions and less borrower oversight, offering greater flexibility but increasing risk for lenders. In contrast, covenant-heavy loans impose strict financial and operational requirements, providing lenders with stronger protections and earlier intervention opportunities. Investors must weigh the trade-off between higher risk and potential returns when choosing between covenant-lite and covenant-heavy investments.

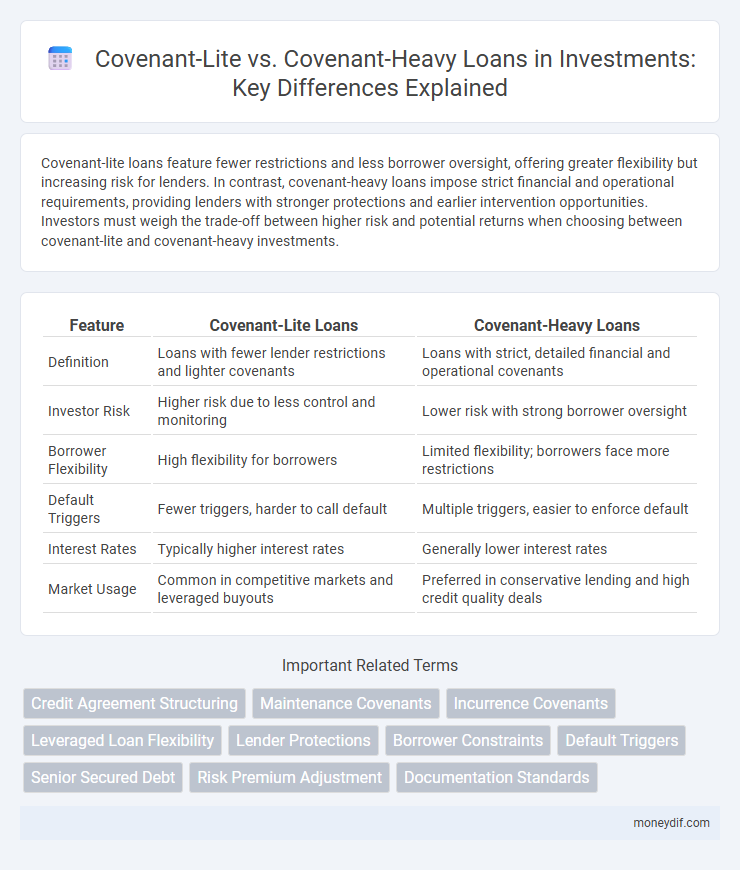

Table of Comparison

| Feature | Covenant-Lite Loans | Covenant-Heavy Loans |

|---|---|---|

| Definition | Loans with fewer lender restrictions and lighter covenants | Loans with strict, detailed financial and operational covenants |

| Investor Risk | Higher risk due to less control and monitoring | Lower risk with strong borrower oversight |

| Borrower Flexibility | High flexibility for borrowers | Limited flexibility; borrowers face more restrictions |

| Default Triggers | Fewer triggers, harder to call default | Multiple triggers, easier to enforce default |

| Interest Rates | Typically higher interest rates | Generally lower interest rates |

| Market Usage | Common in competitive markets and leveraged buyouts | Preferred in conservative lending and high credit quality deals |

Understanding Covenant-Lite and Covenant-Heavy Loans

Covenant-lite loans feature fewer borrower restrictions and less stringent financial maintenance requirements, increasing risk for lenders but providing more flexibility to borrowers. Covenant-heavy loans impose strict financial covenants and regular reporting obligations, enhancing creditor protections and monitoring but limiting borrower freedom. Understanding the trade-offs between covenant-lite and covenant-heavy structures is crucial for investors managing credit risk and optimizing loan performance.

Key Differences Between Covenant-Lite and Covenant-Heavy Structures

Covenant-lite loans feature fewer restrictions on borrowers, offering greater flexibility and lower oversight, while covenant-heavy loans impose strict financial covenants and regular compliance tests to protect lenders. Covenant-heavy structures typically require maintenance covenants related to leverage ratios, interest coverage, and net worth, enhancing credit monitoring and risk mitigation. In contrast, covenant-lite agreements minimize borrower constraints, often omitting maintenance covenants and relying mainly on incurrence covenants triggered by specific events.

Historical Evolution of Loan Covenants

Loan covenants have evolved significantly, transitioning from covenant-heavy agreements prevalent in the 1980s and 1990s to the rise of covenant-lite loans in the post-2008 financial crisis era. Covenant-heavy loans typically imposed strict financial maintenance requirements and operational restrictions, offering greater protection to lenders, whereas covenant-lite loans reduce these constraints, concentrating on incurrence covenants to facilitate borrower flexibility. This historical shift has influenced risk profiles and pricing in leveraged loan markets, reflecting changing borrower-lender dynamics and broader economic conditions.

Impact on Investor Risk and Return

Covenant-lite loans reduce borrower restrictions, increasing investor risk by limiting protections in default scenarios and potentially leading to higher default rates. In contrast, covenant-heavy loans impose strict financial covenants, enhancing investor security through early warning signals and negotiation leverage but may limit borrower flexibility and returns. Investors must balance the risk-return tradeoff, with covenant-lite structures offering higher yields compensating for elevated risk, while covenant-heavy lending prioritizes capital preservation and potentially lower, more stable returns.

Borrower Perspective: Flexibility vs. Discipline

Covenant-lite loans offer borrowers greater flexibility by reducing financial maintenance requirements and limiting lender intervention, which allows for more operational freedom and less risk of technical default. In contrast, covenant-heavy loans impose stricter financial covenants and reporting obligations that encourage borrower discipline and protect lender interests but can restrict business agility. Borrowers must weigh the benefits of covenant-lite structures for growth and cash flow management against the enhanced control and oversight fostered by covenant-heavy agreements.

Market Trends: The Rise of Covenant-Lite Loans

Covenant-lite loans have surged in popularity, representing over 70% of leveraged loan issuance in recent years due to increased investor appetite for higher-yielding, lower-restriction debt. These loans feature fewer financial maintenance covenants, offering borrowers greater operational flexibility compared to covenant-heavy loans, which impose stricter terms and tighter controls. Market trends indicate that the rise of covenant-lite structures aligns with a competitive lending environment and a bullish credit cycle, though this shift raises concerns about heightened credit risk during potential economic downturns.

Effects on Loan Pricing and Terms

Covenant-lite loans typically offer lower interest rates and fewer restrictions, attracting borrowers by reducing compliance costs and enhancing flexibility. Covenant-heavy loans impose stricter financial covenants and maintenance tests, leading to higher pricing to compensate lenders for increased risk and monitoring requirements. The risk profile and lender protection heavily influence loan terms, with covenant-lite structures favoring borrower-friendly conditions, while covenant-heavy agreements impose stronger safeguards on lenders.

Potential Risks of Covenant-Lite Lending

Covenant-lite loans pose increased credit risk due to fewer borrower restrictions and less frequent financial maintenance tests, reducing early warning signals of distress. The absence of stringent covenants limits lenders' ability to intervene proactively, potentially leading to higher default rates during economic downturns. This leniency often attracts riskier borrowers, amplifying potential losses in leveraged loan portfolios.

Case Studies: Performance During Economic Downturns

Covenant-lite loans, characterized by fewer borrower restrictions, often show higher default rates and greater loss severity during economic downturns compared to covenant-heavy loans, which provide stronger creditor protections through stricter financial covenants. Case studies from the 2008 financial crisis reveal that covenant-heavy loans demonstrated greater resilience, with lower default incidences and better recovery rates due to the ability to impose corrective actions early. These findings suggest that covenant-heavy structures mitigate risk exposure more effectively in volatile market conditions by enforcing tighter control over borrower activities.

Future Outlook for Loan Covenants in Investment Markets

Covenant-lite loans, characterized by fewer restrictions and financial maintenance requirements, are gaining traction in the investment market, driven by borrower demand and favorable credit conditions. Conversely, covenant-heavy loans, which impose strict performance metrics and protective clauses, may see resurgence if economic uncertainty rises or lender risk aversion intensifies. The future outlook suggests a dynamic balance where covenant structures will adapt to macroeconomic trends, credit risk assessments, and regulatory evolutions, influencing pricing and investment risk profiles.

Important Terms

Credit Agreement Structuring

Covenant-lite credit agreements feature fewer borrower restrictions and reporting requirements compared to covenant-heavy agreements, which impose stricter financial covenants to protect lenders.

Maintenance Covenants

Maintenance covenants impose strict financial performance requirements on borrowers, making covenant-heavy loans more restrictive and closely monitored compared to covenant-lite loans, which have fewer or no maintenance covenants and offer greater flexibility to borrowers.

Incurrence Covenants

Incurrence covenants in covenant-lite loans impose fewer financial restrictions and allow more borrower flexibility compared to the stringent, performance-based requirements typical of covenant-heavy agreements.

Leveraged Loan Flexibility

Leveraged loan flexibility is greater in covenant-lite structures due to fewer restrictions and financial maintenance covenants compared to covenant-heavy loans, which impose stricter terms and borrower obligations.

Lender Protections

Covenant-lite loans offer lenders fewer protective covenants, increasing risk exposure compared to covenant-heavy loans that include strict financial maintenance requirements to safeguard lender interests.

Borrower Constraints

Covenant-lite loans impose fewer borrower constraints by minimizing restrictive financial covenants compared to covenant-heavy loans that enforce stringent borrower restrictions to protect lender interests.

Default Triggers

Default triggers in covenant-lite loans are fewer and less restrictive compared to covenant-heavy loans, resulting in greater borrower flexibility but increased lender risk.

Senior Secured Debt

Senior secured debt with covenant-lite structures offers fewer borrower restrictions and lower protective covenants compared to covenant-heavy loans, increasing lender risk but enhancing borrower flexibility.

Risk Premium Adjustment

Risk premium adjustment reflects higher compensation demanded by investors for covenant-lite loans due to increased borrower risk compared to covenant-heavy loans with stricter protections.

Documentation Standards

Documentation standards in covenant-lite loan agreements typically feature fewer restrictive clauses and reduced financial maintenance covenants, emphasizing borrower flexibility and streamlined compliance processes. Conversely, covenant-heavy documentation standards impose detailed financial covenants, frequent reporting requirements, and stricter operational constraints, increasing lender control and monitoring rigor.

Covenant-Lite vs Covenant-Heavy Infographic

moneydif.com

moneydif.com