Front running involves a broker executing orders based on advance knowledge of pending trades to profit from price movements, whereas insider trading entails trading securities using non-public, material information about a company. Both practices violate market regulations by undermining fairness and transparency, leading to significant legal consequences. Investors should remain vigilant and report any suspicious trading activities to protect market integrity.

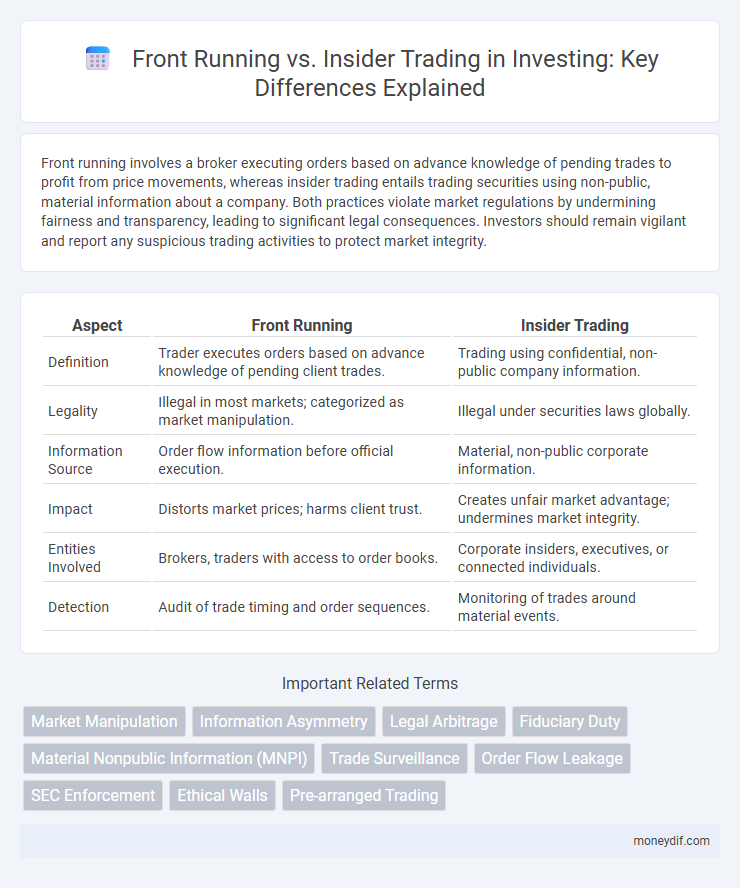

Table of Comparison

| Aspect | Front Running | Insider Trading |

|---|---|---|

| Definition | Trader executes orders based on advance knowledge of pending client trades. | Trading using confidential, non-public company information. |

| Legality | Illegal in most markets; categorized as market manipulation. | Illegal under securities laws globally. |

| Information Source | Order flow information before official execution. | Material, non-public corporate information. |

| Impact | Distorts market prices; harms client trust. | Creates unfair market advantage; undermines market integrity. |

| Entities Involved | Brokers, traders with access to order books. | Corporate insiders, executives, or connected individuals. |

| Detection | Audit of trade timing and order sequences. | Monitoring of trades around material events. |

Understanding Front Running and Insider Trading

Front running involves a broker executing orders on a security for its own account while taking advantage of advance knowledge of pending orders from clients, which can distort market fairness. Insider trading occurs when individuals trade stocks or other securities based on non-public, material information, violating securities laws designed to ensure equal access to market data. Both practices undermine market integrity and are subject to strict regulatory scrutiny and penalties.

Key Differences Between Front Running and Insider Trading

Front running involves a broker executing orders for their own account ahead of a client's pending order to capitalize on the anticipated price movement, whereas insider trading entails trading based on non-public, material information about a company. The key difference lies in the source of the advantage: front running exploits knowledge of pending client trades, while insider trading leverages confidential corporate information. Regulatory bodies, such as the SEC, strictly prohibit both practices, classifying insider trading as a breach of fiduciary duty and front running as market manipulation.

Legal Framework Governing Front Running and Insider Trading

The legal framework governing front running and insider trading is primarily enforced through securities laws such as the Securities Exchange Act of 1934 in the United States, which prohibits the use of non-public information for trading advantages. Regulatory bodies like the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) impose strict penalties, including fines and imprisonment, to deter these practices. Clear distinctions exist where insider trading involves trading based on confidential information from within a company, while front running constitutes executing orders based on advance knowledge of pending client transactions.

How Front Running Works in Financial Markets

Front running in financial markets occurs when a broker or trader executes orders on a security for their own account while taking advantage of advance knowledge of pending orders from their clients. This practice exploits non-public information about upcoming large trades to buy or sell securities ahead of the market, often leading to unfair price advantages. Regulatory bodies like the SEC strictly monitor front running as it undermines market integrity and investor trust.

The Mechanics of Insider Trading Explained

Insider trading involves buying or selling securities based on material, non-public information obtained by corporate insiders, such as executives or employees, before the information is publicly released. This practice manipulates market fairness by exploiting confidential knowledge that directly impacts a company's stock price, leading to an uneven playing field for regular investors. Regulatory bodies like the SEC enforce strict laws and penalties to detect and prevent insider trading, preserving market integrity and investor trust.

Risks and Consequences for Investors

Front running involves brokers executing orders on a security for their own account before handling clients' orders, exposing investors to unfair price movements and reduced returns. Insider trading, the illegal use of non-public information to trade stocks, carries severe legal risks including hefty fines and imprisonment, significantly damaging investor trust and market integrity. Both practices undermine fair market conditions, leading to financial losses and heightened regulatory scrutiny for affected investors.

Real-World Cases of Front Running and Insider Trading

Front running involves brokers executing orders based on advance knowledge of pending client trades, as seen in the 2012 UBS scandal where traders manipulated bond prices for profit. Insider trading occurs when individuals trade stocks using non-public, material information, exemplified by the high-profile case of former ImClone Systems CEO Samuel Waksal, who leaked launch details of a cancer drug. These real-world cases highlight the severe legal consequences and market integrity risks tied to these unethical investment practices.

Regulatory Actions and Enforcement against Market Abuse

Regulatory bodies such as the SEC and FINRA rigorously enforce actions against front running and insider trading to maintain market integrity and protect investors. Enforcement includes fines, disgorgement of profits, suspension, and even criminal prosecution to deter these forms of market abuse. Advanced surveillance technologies and whistleblower programs have enhanced detection capabilities, increasing the frequency and severity of penalties for violations.

Preventative Measures for Market Integrity

Market regulators enforce strict surveillance systems and real-time transaction monitoring to detect and prevent front running and insider trading activities. Compliance programs requiring thorough employee training and robust whistleblower protections enhance transparency and deter illicit trading behaviors. Implementation of algorithmic trade pattern analysis and mandatory disclosure policies further safeguard market integrity and investor confidence.

Future Trends in Detecting Financial Misconduct

Advancements in artificial intelligence and machine learning are revolutionizing the detection of front running and insider trading by analyzing vast datasets for anomalous trading patterns in real-time. Regulatory bodies are increasingly deploying blockchain technology to enhance transparency and traceability, making it harder for illicit trades to go undetected. Enhanced data analytics, coupled with cross-border regulatory cooperation, are shaping future trends to proactively identify and mitigate financial misconduct in dynamic investment markets.

Important Terms

Market Manipulation

Market manipulation involves artificially influencing asset prices to create unfair trading advantages, often exploiting non-public information or order flow. Front running specifically entails trading on advance knowledge of pending orders before execution, while insider trading uses confidential corporate information to gain profit, both undermining market integrity and investor confidence.

Information Asymmetry

Information asymmetry occurs when one party possesses material non-public information, enabling front running and insider trading to exploit market advantages unfairly. Front running involves acting on pending orders or trades using privileged order flow knowledge, while insider trading leverages confidential corporate information before public disclosure, both undermining market integrity.

Legal Arbitrage

Legal arbitrage exploits differences in regulatory frameworks across jurisdictions to maximize gains, often navigating complex rules to avoid illegal practices such as insider trading, which involves trading on non-public, material information. In contrast, front running entails trading ahead of pending orders using advance knowledge of market activity, a tactic frequently scrutinized and regulated to prevent market manipulation.

Fiduciary Duty

Fiduciary duty requires financial professionals to act in the best interests of their clients, making front running and insider trading clear violations as they exploit non-public information for personal gain. Both front running and insider trading undermine market integrity and trust by breaching confidentiality and fiduciary responsibilities inherent in investment management.

Material Nonpublic Information (MNPI)

Material Nonpublic Information (MNPI) refers to confidential data that could influence an investor's decision and impact a company's stock price once disclosed. Front running involves trading based on MNPI or pending orders ahead of others to gain profit, whereas insider trading specifically entails buying or selling securities by individuals with privileged access to MNPI, violating fiduciary duties and securities laws.

Trade Surveillance

Trade surveillance systems detect patterns indicating front running by monitoring order flow and price movements prior to large trades, distinguishing it from insider trading which involves trading based on non-public, material information. Advanced analytics and real-time data enable compliance teams to identify suspicious activities, ensuring market integrity and regulatory adherence.

Order Flow Leakage

Order Flow Leakage occurs when sensitive information about pending trades is prematurely revealed, enabling front running by traders who exploit this data to execute orders ahead of clients, thereby gaining unfair advantages. Unlike insider trading, which involves non-public material information about a company's fundamentals, front running specifically exploits leaked order flow data to anticipate market moves and profit from upcoming transactions.

SEC Enforcement

SEC enforcement actions target front running and insider trading as violations undermining market integrity and investor trust; front running involves brokers executing trades based on pending client orders, while insider trading entails trading on material non-public information. Regulatory measures include investigations, civil penalties, disgorgement of profits, and criminal charges to deter such unethical behaviors and maintain fair market conditions.

Ethical Walls

Ethical walls, also known as information barriers, are procedures implemented within financial institutions to prevent the misuse of sensitive information, thereby mitigating risks associated with front running and insider trading. These barriers ensure that non-public, material information accessed by investment professionals is segregated and not exploited for unfair trading advantages.

Pre-arranged Trading

Pre-arranged trading involves parties agreeing in advance to trade specific securities at predetermined prices, which can manipulate market perception and liquidity. While front running exploits non-public order information and insider trading utilizes confidential corporate knowledge for advantage, pre-arranged trading primarily affects market transparency and price integrity but shares regulatory scrutiny due to its potential to distort fair trading practices.

Front Running vs Insider Trading Infographic

moneydif.com

moneydif.com