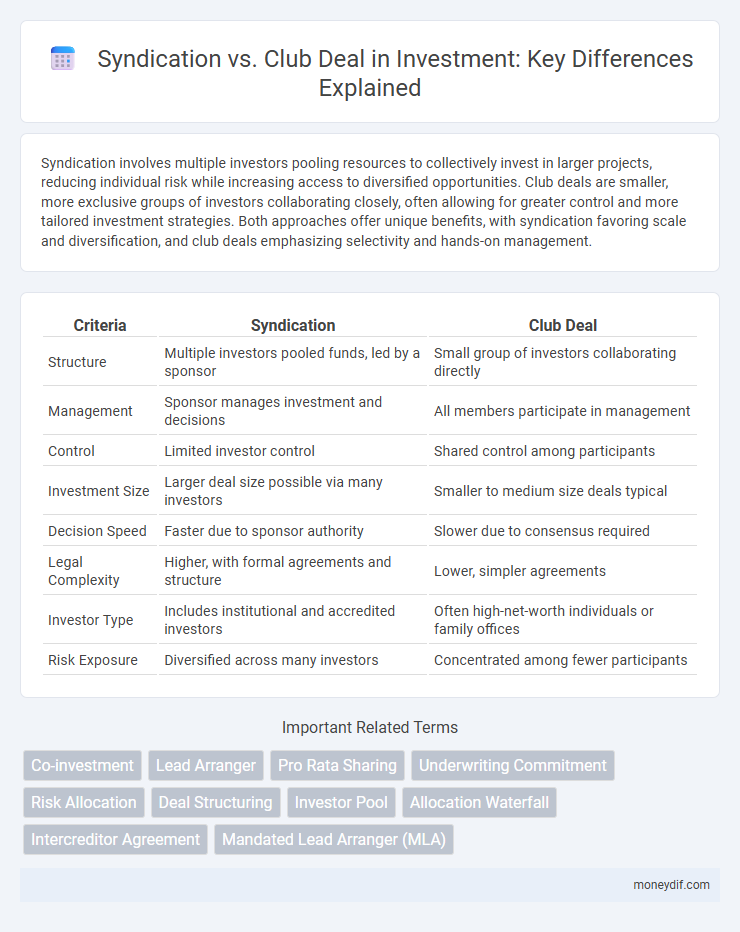

Syndication involves multiple investors pooling resources to collectively invest in larger projects, reducing individual risk while increasing access to diversified opportunities. Club deals are smaller, more exclusive groups of investors collaborating closely, often allowing for greater control and more tailored investment strategies. Both approaches offer unique benefits, with syndication favoring scale and diversification, and club deals emphasizing selectivity and hands-on management.

Table of Comparison

| Criteria | Syndication | Club Deal |

|---|---|---|

| Structure | Multiple investors pooled funds, led by a sponsor | Small group of investors collaborating directly |

| Management | Sponsor manages investment and decisions | All members participate in management |

| Control | Limited investor control | Shared control among participants |

| Investment Size | Larger deal size possible via many investors | Smaller to medium size deals typical |

| Decision Speed | Faster due to sponsor authority | Slower due to consensus required |

| Legal Complexity | Higher, with formal agreements and structure | Lower, simpler agreements |

| Investor Type | Includes institutional and accredited investors | Often high-net-worth individuals or family offices |

| Risk Exposure | Diversified across many investors | Concentrated among fewer participants |

Understanding Syndication: Key Features and Structure

Syndication in investment involves multiple investors pooling capital to jointly finance a project, typically led by a syndicator who manages due diligence, negotiations, and asset management. This structure allows participants to access larger deals and diversify risk while benefiting from the lead investor's expertise and network. Key features include profit-sharing according to equity stakes, limited liability for passive investors, and formal agreements that outline roles, responsibilities, and exit strategies.

What is a Club Deal? Definition and Essentials

A Club Deal is a private investment structure where a small group of investors collaborate to pool resources for acquiring assets or companies, often in real estate or private equity. This arrangement allows participants to share risks, governance, and returns while maintaining a closer relationship with one another compared to larger syndications. Key essentials include limited membership, defined investment terms, and active involvement in decision-making processes.

Syndication vs Club Deal: Core Differences

Syndication in investment involves a lead investor organizing multiple parties to pool capital for large deals, distributing both risk and decision-making authority across a broad group. In contrast, a club deal features a smaller, more exclusive group of investors collaborating closely with shared control and often more direct involvement in management. The core difference lies in syndications offering broader participation and risk sharing, while club deals emphasize tighter partnerships and unified investment strategies.

Pros and Cons of Syndicated Investments

Syndicated investments pool capital from multiple investors to access larger deals, offering diversification and reduced individual risk but potentially limiting control and decision-making speed. This structure benefits from shared expertise and resources, yet may face challenges in aligning investor interests and managing complex legal arrangements. Syndications provide scalability and risk mitigation but require strong coordination and clear communication to be effective.

Advantages and Drawbacks of Club Deals

Club deals in investment offer advantages such as greater control by a smaller group of investors, allowing more tailored decision-making and often faster execution compared to syndication. They facilitate closer collaboration and aligned interests, which can enhance governance and reduce conflicts among partners. However, club deals may limit capital raising potential and expose investors to higher concentration risk due to fewer participants.

Risk Distribution in Syndication and Club Deals

Syndication involves multiple investors pooling capital, which diversifies and distributes risk across a broader group, reducing the individual exposure of each participant. In contrast, club deals typically consist of a smaller, tightly-knit group of investors sharing risk more directly, often resulting in higher individual commitments and potentially greater influence on decision-making. Effective risk distribution in syndication can enhance portfolio stability and mitigate financial impacts from single asset underperformance.

Investor Roles and Control: Syndication Compared to Club

In syndication, the lead investor typically manages deal sourcing, due diligence, and ongoing asset management, while passive investors provide capital with limited control. Club deals involve a smaller group of investors who share decision-making responsibilities and exercise greater collective control over the investment. Syndications offer scalability and reduced individual oversight, whereas club deals provide enhanced governance and mutual involvement among participants.

Typical Participants in Syndications vs Club Deals

Typical participants in syndications include multiple individual investors or smaller investment groups pooling capital under a lead sponsor who manages the deal. Club deals usually involve a smaller number of sophisticated investors or institutional partners collaboratively sharing control and decision-making responsibilities. Syndications often attract passive investors, whereas club deals require active involvement from participants.

Ideal Scenarios: When to Choose Syndication or a Club Deal

Syndication is ideal for complex projects requiring diverse expertise and larger capital pools, allowing multiple investors to share risks and resources. Club deals suit smaller, more intimate groups of investors seeking greater control and streamlined decision-making in mid-sized or niche opportunities. Choosing between syndication and club deals depends on the project's scale, risk tolerance, and desired level of investor involvement.

Syndication and Club Deal Trends in Today’s Market

Syndication in today's investment market involves multiple investors pooling capital to diversify risk and access larger deals, increasingly favored for its scalability and flexibility. Club deals, typically smaller groups of investors collaborating on exclusive opportunities, show renewed interest due to enhanced control and streamlined decision-making processes. Market data indicates syndications dominate in volume and deal size, while club deals gain traction in niche sectors requiring specialized expertise.

Important Terms

Co-investment

Co-investment involves multiple investors pooling capital directly into a single deal alongside a lead investor, differing from syndication where a lead investor structures and manages the entire investment while others passively participate. Club deals represent a subset of syndication with fewer, more aligned investors collaborating closely, offering reduced fees and greater control compared to broader syndication models.

Lead Arranger

A lead arranger coordinates the financing structure, negotiating terms and managing relationships among lenders in both syndication and club deals. In syndication, the lead arranger distributes loan portions widely to multiple investors to diversify risk, while in club deals, a smaller group of lenders jointly underwrites the loan, allowing for closer collaboration and simplified administration.

Pro Rata Sharing

Pro Rata Sharing in syndication ensures each investor receives returns proportionate to their ownership percentage, maintaining equitable distribution across all participants. In contrast, club deals typically involve a smaller, more selective group of investors where profit sharing may be customized, often deviating from strict pro rata allocation.

Underwriting Commitment

Underwriting commitment in syndication involves a lead underwriter guaranteeing the full subscription of a securities offering, assuming the risk of distributing the issue among multiple syndicate members, while in a club deal, underwriting is less formal as a small group of lenders jointly commit to portions of the loan, sharing risk without a firm underwriting guarantee. Syndication spreads underwriting risk across numerous participants, whereas club deals rely on a cooperative allocation of risk without an overarching underwriting commitment.

Risk Allocation

Risk allocation in syndication involves distributing financial exposure among multiple lenders, reducing individual risk through shared responsibility, while club deals typically feature fewer participants with more equal risk-sharing and tighter control over deal terms. Syndications offer broader risk diversification and liquidity, whereas club deals emphasize stronger lender relationships and streamlined decision-making processes.

Deal Structuring

Deal structuring in syndication involves multiple lenders or investors sharing risk and funding proportionally, whereas club deals typically consist of a smaller group of closely coordinated participants with equal exposure and more control over decision-making. Syndications offer broader capital access and risk dispersion, while club deals emphasize streamlined collaboration and tighter governance among fewer parties.

Investor Pool

Investor pools in syndication involve multiple investors contributing capital to collectively fund a larger investment, offering diversified risk and shared decision-making; club deals, however, typically feature a smaller, more exclusive group of investors with greater direct control and involvement in the deal structure. Syndication leverages broad market access and scalability, while club deals emphasize alignment of interests and deeper collaboration among participants.

Allocation Waterfall

The allocation waterfall in syndication involves multiple lenders receiving proceeds sequentially based on predefined priority tiers, optimizing risk distribution and payment order. In contrast, club deals feature a more balanced allocation process with fewer participants sharing payments proportionally, enhancing collaborative control and decision-making among the lenders.

Intercreditor Agreement

An Intercreditor Agreement clarifies the rights and priorities between lenders in both Syndication and Club Deal financing structures, ensuring proper allocation of repayments and collateral enforcement. Syndication involves multiple lenders sharing risk but often with a lead arranger controlling terms, while Club Deals consist of a smaller group of lenders collaborating more equally under the Intercreditor Agreement.

Mandated Lead Arranger (MLA)

Mandated Lead Arranger (MLA) plays a crucial role in syndications by organizing and structuring loan facilities, negotiating terms with borrowers and syndicate members, and managing the distribution of risk among multiple lenders. In club deals, the MLA typically facilitates a smaller group of banks with shared underwriting responsibilities, whereas in broader syndications, the MLA coordinates a larger, more diverse group of lenders, optimizing capital mobilization and risk allocation.

Syndication vs Club Deal Infographic

moneydif.com

moneydif.com