Convertible bonds offer investors the option to convert debt into equity, providing potential upside if the company's stock performs well, while callable bonds grant issuers the right to redeem the bonds before maturity, often to refinance at lower interest rates. Convertible bonds typically feature lower interest rates due to the conversion option's value, whereas callable bonds usually present higher yields to compensate investors for call risk. Understanding these differences helps investors balance growth potential against interest income and call risk in their fixed-income portfolios.

Table of Comparison

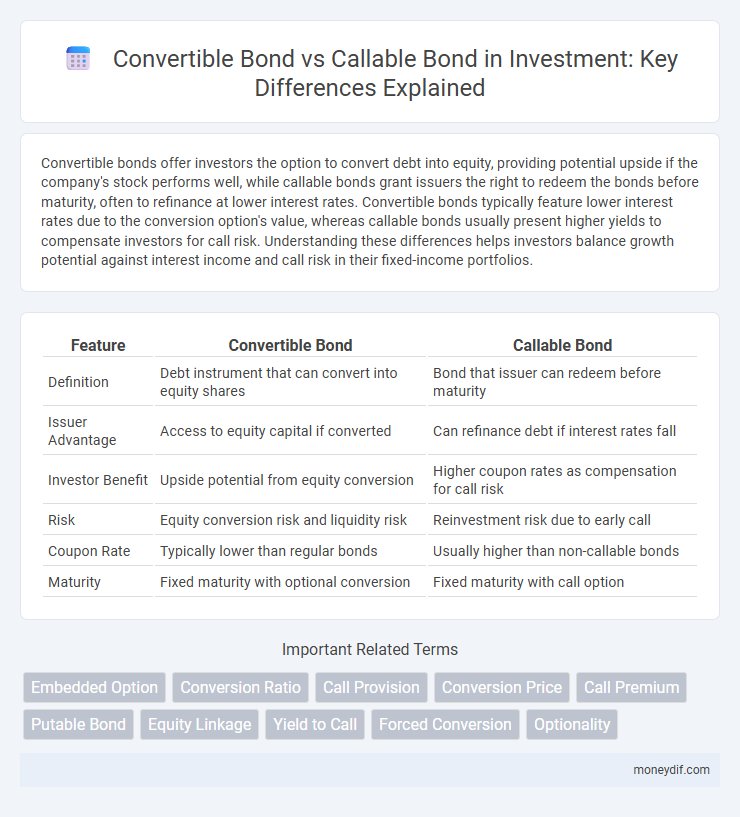

| Feature | Convertible Bond | Callable Bond |

|---|---|---|

| Definition | Debt instrument that can convert into equity shares | Bond that issuer can redeem before maturity |

| Issuer Advantage | Access to equity capital if converted | Can refinance debt if interest rates fall |

| Investor Benefit | Upside potential from equity conversion | Higher coupon rates as compensation for call risk |

| Risk | Equity conversion risk and liquidity risk | Reinvestment risk due to early call |

| Coupon Rate | Typically lower than regular bonds | Usually higher than non-callable bonds |

| Maturity | Fixed maturity with optional conversion | Fixed maturity with call option |

Overview of Convertible Bonds vs Callable Bonds

Convertible bonds offer investors the option to convert their bonds into a predetermined number of company shares, combining debt security with equity potential, whereas callable bonds grant the issuer the right to redeem the bond before maturity, typically to refinance at lower interest rates. Convertible bonds tend to attract investors seeking capital appreciation alongside fixed income, while callable bonds appeal to issuers looking to manage interest rate risk and capital structure flexibility. Understanding the distinct features of convertible versus callable bonds is essential for aligning investment strategies with risk tolerance and return objectives.

Key Features of Convertible Bonds

Convertible bonds offer investors the unique advantage of converting their bonds into a predetermined number of shares, providing potential equity upside while maintaining fixed income characteristics. These bonds typically carry lower interest rates compared to callable bonds due to the embedded conversion option, which enhances their appeal during bullish market conditions. Convertible bonds also mitigate downside risk by ensuring bondholders receive principal repayment if conversion is unfavorable, combining features of both debt and equity instruments.

Key Features of Callable Bonds

Callable bonds grant issuers the right to redeem the bond before maturity, typically at a predetermined call price, providing flexibility to refinance debt when interest rates decline. Investors receive higher yields to compensate for call risk, which limits potential capital appreciation during falling interest rate environments. The call feature introduces reinvestment risk, as bondholders may need to reinvest proceeds at lower rates if the bond is called early.

How Convertible Bonds Work

Convertible bonds provide investors with the option to convert their bonds into a predetermined number of the issuer's common shares, combining fixed income with potential equity upside. These bonds pay regular interest like traditional bonds but allow conversion at specific times or under certain conditions, offering protection against market downturns while benefiting from stock price appreciation. The conversion feature can dilute existing equity but attracts investors seeking a hybrid investment with lower risk than pure stocks.

How Callable Bonds Work

Callable bonds grant issuers the right to redeem the bond before its maturity date, typically at a premium to face value, allowing them to refinance debt when interest rates decline. This embedded call option introduces reinvestment risk for investors, as they may receive their principal back earlier and face the challenge of investing at lower prevailing rates. Pricing callable bonds requires incorporating the likelihood of call events, affecting yield calculations and overall investment strategy compared to non-callable or convertible bonds.

Advantages and Risks of Convertible Bonds

Convertible bonds offer investors the advantage of potential equity upside by allowing conversion into common stock, providing capital appreciation in addition to fixed income. They typically have lower interest rates compared to callable bonds, reflecting the added value of the conversion feature, but carry risks such as dilution of ownership and market volatility affecting share prices. Investors face the risk that the bond may not be converted if stock prices do not rise, and the issuer may redeem the bond before maturity, limiting potential gains.

Advantages and Risks of Callable Bonds

Callable bonds offer issuers the advantage of refinancing debt at lower interest rates, providing flexibility to manage interest expenses when market rates decline. Investors in callable bonds face reinvestment risk, as bonds may be called before maturity, potentially limiting price appreciation and yielding lower returns than expected. Despite higher yields to compensate for call risk, investors must consider the uncertainty of cash flows and potential loss of income.

Factors to Consider When Choosing Between Convertible and Callable Bonds

Convertible bonds offer the potential for equity conversion, attracting investors seeking capital appreciation alongside fixed income, while callable bonds provide issuers flexibility to redeem bonds early, impacting interest rate risk and investor returns. Key factors to consider include the bond's yield, call provisions, conversion ratio, market volatility, and the issuer's credit quality and growth prospects. Understanding these elements helps investors balance income stability against growth potential and redemption risk.

Investor Profiles Suited for Each Bond Type

Convertible bonds suit investors seeking equity upside with downside bond protection, typically appealing to growth-oriented or risk-tolerant profiles. Callable bonds attract income-focused investors comfortable with reinvestment risk, often prioritizing steady interest payments in fluctuating interest rate environments. Understanding these profiles helps tailor bond selections to personal investment goals and risk tolerance.

Market Conditions Impacting Convertible and Callable Bonds

Market volatility and interest rate fluctuations significantly influence the pricing and attractiveness of convertible bonds and callable bonds. Convertible bonds tend to outperform in bullish equity markets due to their conversion feature, allowing investors to benefit from stock price appreciation, whereas callable bonds become less appealing when interest rates decline, as issuers are more likely to call and refinance at lower rates, reducing potential returns. Inflation expectations and credit risk also affect these bonds, with callable bonds bearing higher reinvestment risk during falling rates, and convertible bonds offering downside protection but facing dilution risk if the issuer's stock performs poorly.

Important Terms

Embedded Option

Embedded options in convertible bonds allow investors to convert the bond into a predetermined number of shares, combining debt and equity features, while embedded options in callable bonds grant issuers the right to redeem the bond before maturity, typically to refinance at lower interest rates. Convertible bonds with embedded call options balance investor upside potential through conversion against issuer flexibility, whereas callable bonds primarily benefit issuers by limiting interest costs and managing refinancing risks.

Conversion Ratio

Conversion ratio quantifies the number of common shares an investor can obtain by converting a convertible bond, directly influencing the potential equity dilution and upside participation compared to a callable bond, which does not offer equity conversion but includes issuer-driven redemption features at predetermined prices and dates. Investors prioritize the conversion ratio when valuing convertible bonds since it determines the bond's conversion value and impacts the attractiveness relative to callable bonds that primarily provide fixed income with embedded call risk.

Call Provision

Call provision refers to the issuer's right to redeem a bond before its maturity date, a feature present in callable bonds but not typically in convertible bonds. Convertible bonds combine this call option with the ability to convert debt into equity, offering investors potential upside through stock conversion alongside issuer redemption rights.

Conversion Price

The conversion price in a convertible bond determines the fixed rate at which bondholders can convert their bonds into company shares, impacting potential equity dilution and investor appeal. Callable bonds do not feature a conversion price as they provide the issuer the option to redeem the bond before maturity, influencing yield and refinancing flexibility rather than equity conversion.

Call Premium

Call premium is the extra amount a corporation pays above the bond's face value to redeem a callable bond before maturity, compensating investors for reinvestment risk. Convertible bonds rarely include a call premium because their conversion feature provides potential equity upside, reducing the issuer's need to incentivize early redemption.

Putable Bond

A Putable Bond grants the investor the right to sell the bond back to the issuer at predetermined prices before maturity, providing downside protection compared to a Convertible Bond, which offers the option to convert the bond into equity shares, allowing participation in the issuer's equity upside. Unlike a Callable Bond, where the issuer retains the right to redeem the bond early to manage debt costs, a Putable Bond shifts early redemption control to the investor, balancing risk between issuer and holder.

Equity Linkage

Convertible bonds offer equity linkage by allowing bondholders to convert debt into a predetermined number of shares, providing potential upside from stock price appreciation, while callable bonds grant issuers the right to redeem the bond before maturity, mainly affecting interest rate risk without direct equity conversion features. Convertible bonds effectively blend debt and equity characteristics, enhancing capital structure flexibility, whereas callable bonds primarily serve issuer interests by managing refinancing risk.

Yield to Call

Yield to Call for convertible bonds reflects the return if the bond is called before maturity, accounting for potential conversion into equity, often resulting in lower yields due to added investor upside. Callable bonds typically exhibit higher Yield to Call to compensate for call risk, as issuers can redeem the bond early, limiting investor gains.

Forced Conversion

Forced conversion in convertible bonds occurs when the issuer compels bondholders to convert their bonds into equity, often minimizing debt and enhancing equity capital; callable bonds grant issuers the right to redeem bonds before maturity, typically to refinance debt at lower interest rates, but do not involve equity conversion. Forced conversion strategically benefits issuers by accelerating equity issuance and limiting dilution compared to a standard callable bond redemption.

Optionality

Optionality in convertible bonds grants investors the right to convert debt into equity, allowing participation in stock price appreciation, whereas callable bonds give issuers the option to redeem the bond before maturity, limiting investor upside. Convertible bonds typically embed call and conversion options that affect valuation through complex option pricing models reflecting potential equity upside and early redemption risk.

Convertible bond vs Callable bond Infographic

moneydif.com

moneydif.com