The efficient frontier represents the set of optimal portfolios offering the highest expected return for a given level of risk, constructed solely from risky assets. The capital market line extends this concept by incorporating a risk-free asset, showing the best possible risk-return combinations achievable through mixing the risk-free asset with the market portfolio. Investors seeking maximum Sharpe ratios will select portfolios along the capital market line rather than on the efficient frontier alone.

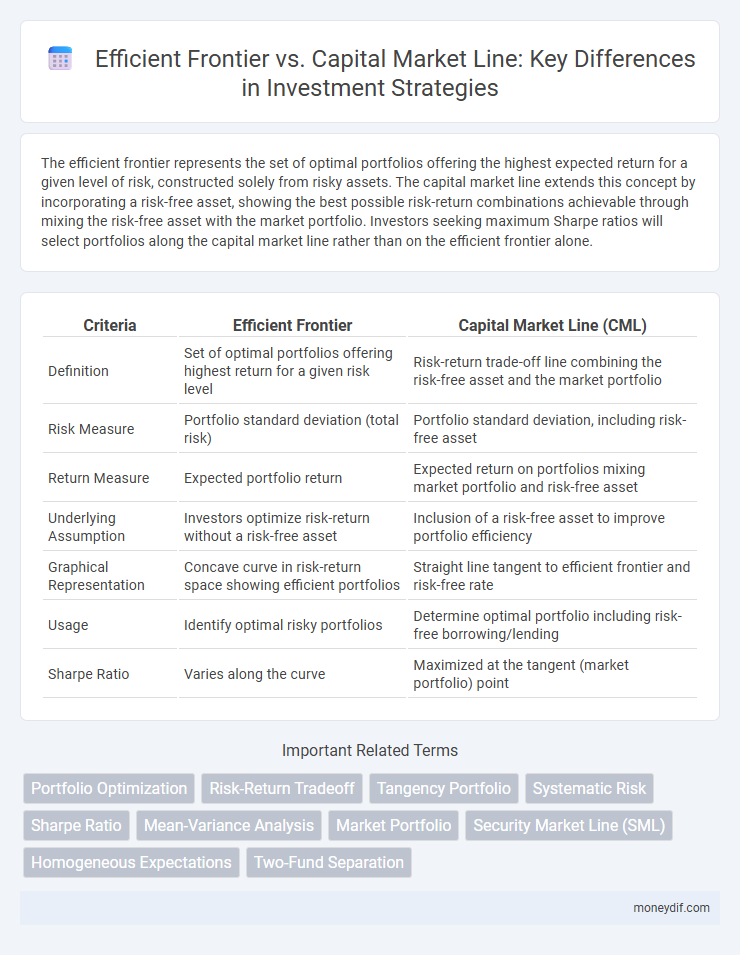

Table of Comparison

| Criteria | Efficient Frontier | Capital Market Line (CML) |

|---|---|---|

| Definition | Set of optimal portfolios offering highest return for a given risk level | Risk-return trade-off line combining the risk-free asset and the market portfolio |

| Risk Measure | Portfolio standard deviation (total risk) | Portfolio standard deviation, including risk-free asset |

| Return Measure | Expected portfolio return | Expected return on portfolios mixing market portfolio and risk-free asset |

| Underlying Assumption | Investors optimize risk-return without a risk-free asset | Inclusion of a risk-free asset to improve portfolio efficiency |

| Graphical Representation | Concave curve in risk-return space showing efficient portfolios | Straight line tangent to efficient frontier and risk-free rate |

| Usage | Identify optimal risky portfolios | Determine optimal portfolio including risk-free borrowing/lending |

| Sharpe Ratio | Varies along the curve | Maximized at the tangent (market portfolio) point |

Introduction to the Efficient Frontier and Capital Market Line

The Efficient Frontier represents the set of optimal portfolios offering the highest expected return for a given level of risk, based on Modern Portfolio Theory. The Capital Market Line (CML) extends this concept by incorporating a risk-free asset, illustrating the best possible risk-return combinations available to investors through a mix of the risk-free asset and the market portfolio. Understanding the distinction between the Efficient Frontier and the CML is essential for constructing portfolios that maximize returns while managing risk effectively.

Defining the Efficient Frontier in Portfolio Theory

The Efficient Frontier in portfolio theory represents a set of optimal portfolios offering the highest expected return for a given level of risk or the lowest risk for a given expected return, derived from the mean-variance optimization framework by Harry Markowitz. It visually maps the trade-off between portfolio risk, measured by standard deviation, and expected return, guiding investors toward efficient asset allocation without including risk-free assets. Contrastingly, the Capital Market Line (CML) extends this concept by incorporating a risk-free asset, showing the optimal portfolios achievable through a combination of the market portfolio and risk-free borrowing or lending.

Understanding the Capital Market Line (CML)

The Capital Market Line (CML) represents portfolios that optimally combine risk-free assets with the market portfolio, offering the highest expected return for a given level of risk. Unlike the Efficient Frontier, which includes only risky assets, the CML incorporates a risk-free rate, enhancing portfolio diversification by blending risk-free assets and market risk. Investors use the CML to identify the best possible risk-return trade-off, maximizing Sharpe ratio and optimizing capital allocation in investment decisions.

Key Differences: Efficient Frontier vs Capital Market Line

The Efficient Frontier represents the set of optimal portfolios offering the highest expected return for a given level of risk based on diversification principles, while the Capital Market Line (CML) depicts portfolios combining a risk-free asset with the market portfolio, showing the best risk-return trade-off achievable through borrowing or lending. The CML has a linear relationship between risk (standard deviation) and expected return, whereas the Efficient Frontier is typically curved, highlighting portfolios solely composed of risky assets. Key differences include that the Efficient Frontier considers only risky assets, while the CML incorporates a risk-free asset, enabling investors to achieve superior risk-adjusted returns via leverage or risk-free lending.

Role of Risk and Return on the Efficient Frontier

The efficient frontier represents the optimal set of portfolios offering the highest expected return for a given level of risk, defined by portfolio variance or standard deviation. Risk on the efficient frontier is measured as total portfolio risk without distinguishing between systematic and unsystematic components. In contrast, the Capital Market Line incorporates the risk-free rate and illustrates portfolios combining the market portfolio with riskless assets, focusing on systematic risk and maximizing the Sharpe ratio.

How the Capital Market Line Incorporates the Risk-Free Asset

The Capital Market Line (CML) expands on the efficient frontier by incorporating the risk-free asset, enabling investors to achieve higher expected returns for a given level of risk through portfolio combinations. While the efficient frontier represents portfolios consisting solely of risky assets, the CML illustrates the optimal risk-return trade-off when blending the risk-free asset with the market portfolio. This integration of the risk-free asset allows for capital allocation line strategies that improve portfolio diversification and efficiency beyond the Markowitz optimal frontier.

Portfolio Optimization: Using the Efficient Frontier

The Efficient Frontier represents the set of optimal portfolios offering the highest expected return for a given risk level, serving as a foundational tool in portfolio optimization. The Capital Market Line (CML) extends this concept by incorporating a risk-free asset, illustrating the best possible risk-return combinations achievable through mixing the market portfolio with risk-free securities. Investors use the Efficient Frontier to identify diversified portfolios that maximize returns while managing volatility, aligning investments with their risk tolerance and financial goals.

The Significance of the Tangency Point on the CML

The tangency point on the Capital Market Line (CML) represents the optimal risky portfolio that maximizes the Sharpe ratio, marking the most efficient trade-off between risk and return for investors. This point lies on the efficient frontier, where the combination of the market portfolio with the risk-free asset achieves the highest expected return per unit of risk. Understanding this tangency allows investors to construct portfolios that outperform any other combination of risky assets by blending risk-free assets with the market portfolio along the CML.

Practical Implications for Investors: Choosing Between the Frontier and the CML

The efficient frontier represents the set of optimal portfolios offering the highest expected return for a given level of risk, guiding investors in diversification without considering risk-free assets. In contrast, the Capital Market Line (CML) incorporates a risk-free asset, enabling investors to achieve better risk-return combinations through borrowing or lending at the risk-free rate, effectively improving portfolio efficiency. For practical investment decisions, choosing between the frontier and CML depends on access to risk-free assets and investor preferences for leveraging or risk mitigation, directly impacting portfolio construction and expected performance.

Summary: Integrating the Efficient Frontier and CML in Investment Strategy

The Efficient Frontier represents the set of optimal portfolios offering the highest expected return for a given level of risk, while the Capital Market Line (CML) depicts the risk-return trade-off of efficient portfolios that combine a risk-free asset with the market portfolio. Integrating the Efficient Frontier and CML enables investors to identify portfolios that maximize Sharpe ratios by incorporating a risk-free asset, enhancing portfolio optimization. This synthesis guides informed asset allocation decisions to achieve superior risk-adjusted returns in investment strategies.

Important Terms

Portfolio Optimization

Portfolio optimization focuses on selecting asset weights to maximize expected return for a given risk level, guided by the efficient frontier representing portfolios with the highest Sharpe ratios achievable without risk-free assets. The Capital Market Line (CML) extends this concept by introducing a risk-free asset, forming a straight line tangent to the efficient frontier, illustrating the optimal risk-return combinations when mixing a risk-free asset with a market portfolio.

Risk-Return Tradeoff

The risk-return tradeoff is illustrated by the efficient frontier, which represents portfolios offering the highest expected return for a given level of risk, while the Capital Market Line (CML) extends this by incorporating a risk-free asset, showing the best possible risk-return combinations achievable through market portfolio investments. Investors use the CML to identify optimal portfolios that balance systematic risk and return, surpassing the efficient frontier portfolios by leveraging risk-free borrowing or lending.

Tangency Portfolio

The Tangency Portfolio maximizes the Sharpe ratio, representing the optimal risky asset mix on the efficient frontier where it touches the Capital Market Line (CML). This portfolio offers the highest expected return per unit of risk, combining a risk-free asset with risky assets to achieve superior risk-adjusted performance compared to any other portfolio on the efficient frontier.

Systematic Risk

Systematic risk, representing market-wide uncertainties, is minimized along the Capital Market Line (CML), which plots portfolios combining the risk-free asset with the market portfolio for optimal return per unit of risk. The Efficient Frontier, in contrast, includes only risky assets, reflecting portfolios with the highest expected return at each level of total risk, but does not incorporate the risk-free rate to achieve the Sharpe-optimal portfolio found on the CML.

Sharpe Ratio

The Sharpe Ratio measures the risk-adjusted return of a portfolio by comparing excess returns to portfolio volatility, serving as a key indicator in portfolio optimization along the Efficient Frontier. The Capital Market Line (CML) represents portfolios that optimally combine risk-free assets and market portfolios, with the highest Sharpe Ratio marking the tangent point between the CML and the Efficient Frontier, indicating the most efficient portfolio selection.

Mean-Variance Analysis

Mean-variance analysis quantifies portfolio risk and return to identify the efficient frontier, representing optimal portfolios with the highest expected return for a given level of risk. The capital market line (CML) extends the efficient frontier by incorporating a risk-free asset, illustrating portfolios that maximize the Sharpe ratio and offering superior risk-adjusted returns compared to portfolios on the efficient frontier alone.

Market Portfolio

The Market Portfolio represents the optimal risky portfolio on the Efficient Frontier, maximizing the Sharpe ratio by combining all investable assets weighted by market value. The Capital Market Line (CML) depicts the risk-return trade-off with a risk-free asset and the Market Portfolio, showing the highest expected return for each level of risk, surpassing any portfolio solely on the Efficient Frontier.

Security Market Line (SML)

The Security Market Line (SML) represents the expected return of individual assets as a function of their systematic risk or beta, serving as a benchmark in the Capital Asset Pricing Model (CAPM). While the Efficient Frontier depicts optimal portfolios maximizing return for given risk levels without considering the risk-free asset, the Capital Market Line (CML) extends this by incorporating the risk-free rate, illustrating the risk-return trade-off for efficient portfolios combining the market portfolio and risk-free asset.

Homogeneous Expectations

Homogeneous Expectations imply all investors share identical estimates for expected returns, variances, and covariances of assets, leading to a unique Efficient Frontier that reflects optimal risky portfolios. This assumption results in the Capital Market Line (CML) tangent to the Efficient Frontier at the market portfolio, maximizing the Sharpe ratio for all investors under risk-return trade-offs.

Two-Fund Separation

Two-Fund Separation theorem states that investors can achieve any desired portfolio on the efficient frontier by combining two mutual funds, typically a risk-free asset and a market portfolio lying on the Capital Market Line. Unlike the Efficient Frontier which represents optimal risky portfolios, the Capital Market Line incorporates a risk-free asset, allowing investors to maximize returns for a given level of risk through linear combinations on the risk-return spectrum.

Efficient frontier vs Capital market line Infographic

moneydif.com

moneydif.com