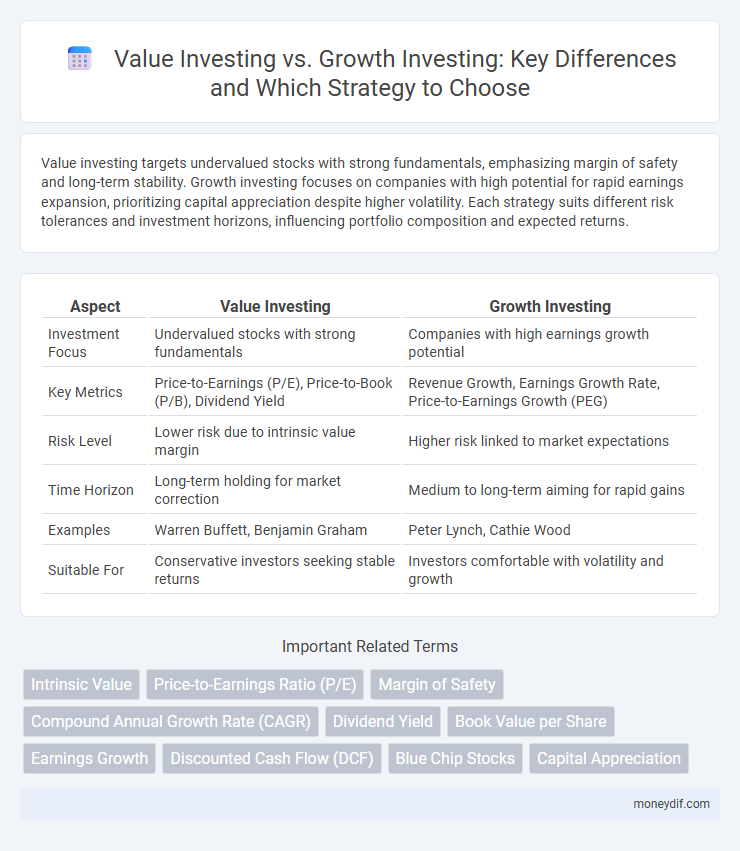

Value investing targets undervalued stocks with strong fundamentals, emphasizing margin of safety and long-term stability. Growth investing focuses on companies with high potential for rapid earnings expansion, prioritizing capital appreciation despite higher volatility. Each strategy suits different risk tolerances and investment horizons, influencing portfolio composition and expected returns.

Table of Comparison

| Aspect | Value Investing | Growth Investing |

|---|---|---|

| Investment Focus | Undervalued stocks with strong fundamentals | Companies with high earnings growth potential |

| Key Metrics | Price-to-Earnings (P/E), Price-to-Book (P/B), Dividend Yield | Revenue Growth, Earnings Growth Rate, Price-to-Earnings Growth (PEG) |

| Risk Level | Lower risk due to intrinsic value margin | Higher risk linked to market expectations |

| Time Horizon | Long-term holding for market correction | Medium to long-term aiming for rapid gains |

| Examples | Warren Buffett, Benjamin Graham | Peter Lynch, Cathie Wood |

| Suitable For | Conservative investors seeking stable returns | Investors comfortable with volatility and growth |

Understanding Value Investing: Core Principles

Value investing focuses on identifying undervalued stocks trading below their intrinsic value by analyzing fundamental metrics such as price-to-earnings (P/E) ratio, book value, and dividend yield. Core principles emphasize a margin of safety, long-term holding periods, and investing in companies with strong financial health and stable earnings. This approach seeks to minimize risk by purchasing quality assets at discounted prices, capitalizing on market inefficiencies.

Growth Investing Explained: Key Characteristics

Growth investing prioritizes companies with high earnings potential and above-average revenue growth, often found in innovative sectors like technology and healthcare. Investors target stocks with strong capital appreciation prospects rather than immediate dividends, relying heavily on future market expansion and disruptive advancements. This strategy involves higher risk due to potential volatility but offers substantial upside as growth stocks can outperform during economic upswings.

Historical Performance: Value vs Growth

Historical performance data reveals that value investing traditionally outperforms growth investing during market recoveries and periods of economic expansion, as undervalued stocks tend to revert to their intrinsic worth. Growth investing generally excels in low-interest-rate environments and strong technological innovation phases, delivering higher returns through capital appreciation. Long-term analysis shows cyclical shifts where value stocks lead in bear markets, while growth stocks dominate during bull markets, emphasizing the importance of market timing and economic conditions in portfolio strategy.

Risk Profiles of Value and Growth Strategies

Value investing typically carries lower risk due to its focus on undervalued stocks with stable earnings and strong fundamentals, providing a margin of safety. Growth investing involves higher risk as it targets companies with rapid revenue and earnings expansion, often in emerging industries with more market volatility. Risk profiles differ with value strategies favoring capital preservation and growth strategies emphasizing potential for significant capital appreciation despite greater uncertainty.

Common Metrics Used in Value Investing

Value investing primarily relies on metrics such as the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield to identify undervalued stocks with strong fundamentals. These metrics help investors assess a company's intrinsic value by comparing its market price to earnings, book value, and income generated for shareholders. This approach contrasts with growth investing, which emphasizes metrics like revenue growth rate and earnings per share (EPS) acceleration.

Key Indicators for Growth Stock Selection

Key indicators for growth stock selection include consistent revenue and earnings growth rates exceeding 15%-20% annually, high return on equity (ROE) typically above 20%, and strong free cash flow generation to support expansion. Price-to-earnings growth (PEG) ratio below 1 signifies undervaluation relative to growth prospects, while robust profit margins and increasing market share highlight competitive advantages. Monitoring innovation pipeline, customer acquisition rates, and management effectiveness further refines identification of sustainable growth opportunities.

Notable Investors: Value vs Growth Icons

Warren Buffett epitomizes value investing with a disciplined focus on undervalued companies exhibiting strong fundamentals and consistent earnings. In contrast, growth investing is famously championed by Peter Lynch, who targets companies with robust revenue expansion and market potential despite high valuations. These investment icons highlight strategic differences: value investors seek intrinsic worth and margin of safety, while growth investors prioritize future earnings acceleration and market share gains.

Market Conditions Favoring Value or Growth

Value investing thrives in market conditions characterized by economic recovery, rising interest rates, and undervalued stocks with strong fundamentals. Growth investing outperforms in low interest rate environments with robust economic expansion, where companies exhibit high earnings growth and innovation potential. Market volatility often favors value stocks due to their stability, while bullish markets support growth stocks driven by momentum and future earnings projections.

Portfolio Diversification: Blending Value and Growth

Combining value investing and growth investing enhances portfolio diversification by balancing the stability of undervalued stocks with the potential high returns of rapidly expanding companies. This blend reduces overall risk and volatility, as value stocks typically outperform in market downturns while growth stocks drive capital appreciation in bullish phases. Incorporating both strategies aligns with long-term investment objectives, optimizing risk-adjusted returns and improving resilience against market fluctuations.

Choosing the Right Approach for Your Investment Goals

Value investing emphasizes purchasing undervalued stocks with strong fundamentals and stable dividends, aiming for long-term capital appreciation and risk reduction. Growth investing targets companies with high revenue and earnings potential, prioritizing capital gains through accelerating market expansion and innovation. Selecting the right approach depends on your risk tolerance, investment horizon, and income requirements, ensuring alignment with financial objectives and market conditions.

Important Terms

Intrinsic Value

Intrinsic value represents the true, fundamental worth of an asset, guiding value investors to seek undervalued stocks while growth investors prioritize future earnings potential over current intrinsic metrics.

Price-to-Earnings Ratio (P/E)

The Price-to-Earnings Ratio (P/E) is a key metric in Value Investing favoring low P/E stocks for undervalued companies, while Growth Investing targets higher P/E ratios reflecting expected earnings growth.

Margin of Safety

Margin of Safety in value investing minimizes investment risk by purchasing undervalued assets below intrinsic value, contrasting with growth investing's focus on future earnings potential despite higher valuations.

Compound Annual Growth Rate (CAGR)

Compound Annual Growth Rate (CAGR) measures the annualized return of value investing strategies typically yielding steady, moderate gains, compared to growth investing strategies that often deliver higher CAGRs driven by rapid revenue and earnings expansion.

Dividend Yield

Dividend yield is a key metric in value investing that emphasizes consistent income from undervalued stocks, whereas growth investing typically prioritizes capital appreciation through reinvested earnings over dividend payouts.

Book Value per Share

Book Value per Share is a key metric favored by value investors to assess a company's intrinsic worth, contrasting with growth investors who prioritize earnings potential and future cash flow projections.

Earnings Growth

Earnings growth is a key metric that distinguishes growth investing, which focuses on companies with high projected earnings increases, from value investing, which targets undervalued companies with stable or improving earnings potential.

Discounted Cash Flow (DCF)

Discounted Cash Flow (DCF) analysis is central to value investing by estimating intrinsic value through future cash flows, whereas growth investing prioritizes revenue and earnings growth projections often beyond traditional DCF models.

Blue Chip Stocks

Blue chip stocks offer stable dividends and strong fundamentals, making them ideal for value investing, while growth investing targets high-potential companies that may not yet be blue chip.

Capital Appreciation

Capital appreciation in value investing focuses on acquiring undervalued stocks with intrinsic worth below market price, while growth investing targets companies with high potential for rapid earnings expansion and price increase.

Value Investing vs Growth Investing Infographic

moneydif.com

moneydif.com