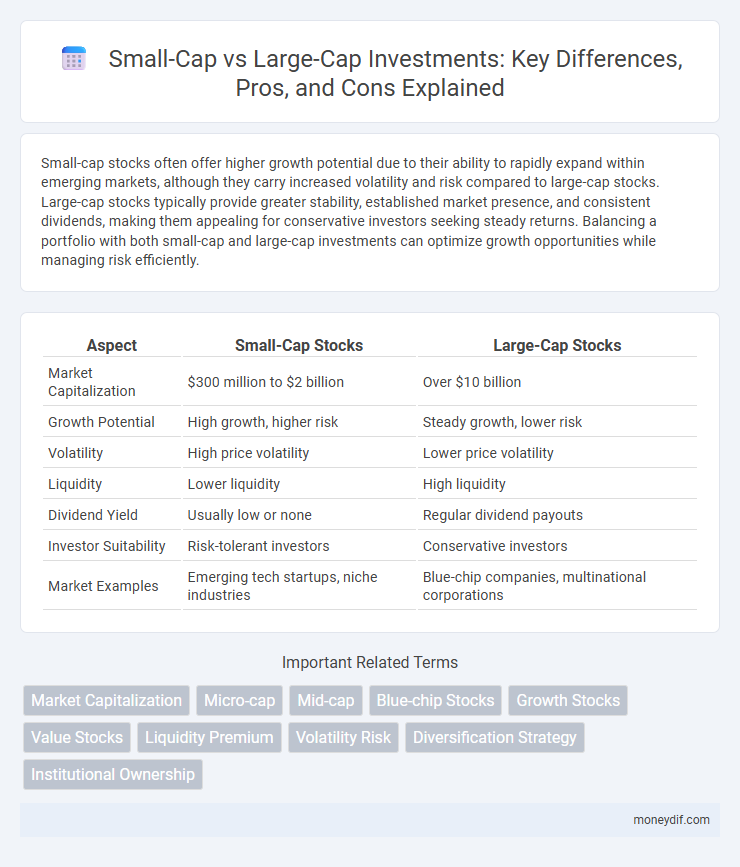

Small-cap stocks often offer higher growth potential due to their ability to rapidly expand within emerging markets, although they carry increased volatility and risk compared to large-cap stocks. Large-cap stocks typically provide greater stability, established market presence, and consistent dividends, making them appealing for conservative investors seeking steady returns. Balancing a portfolio with both small-cap and large-cap investments can optimize growth opportunities while managing risk efficiently.

Table of Comparison

| Aspect | Small-Cap Stocks | Large-Cap Stocks |

|---|---|---|

| Market Capitalization | $300 million to $2 billion | Over $10 billion |

| Growth Potential | High growth, higher risk | Steady growth, lower risk |

| Volatility | High price volatility | Lower price volatility |

| Liquidity | Lower liquidity | High liquidity |

| Dividend Yield | Usually low or none | Regular dividend payouts |

| Investor Suitability | Risk-tolerant investors | Conservative investors |

| Market Examples | Emerging tech startups, niche industries | Blue-chip companies, multinational corporations |

Defining Small-Cap and Large-Cap Stocks

Small-cap stocks typically refer to companies with a market capitalization between $300 million and $2 billion, characterized by higher growth potential and increased volatility compared to larger firms. Large-cap stocks have market capitalizations exceeding $10 billion, often representing established, stable companies with more predictable earnings and dividend histories. Investors assess these categories to balance growth opportunities against risk tolerance within diversified portfolios.

Historical Performance: Small-Cap vs Large-Cap

Small-cap stocks have historically delivered higher average annual returns compared to large-cap stocks, driven by greater growth potential and market inefficiencies. However, small-cap investments tend to exhibit higher volatility and risk, with performance more sensitive to economic cycles. Long-term data suggests large-cap stocks provide more stability and consistent dividends, making them a favored choice for risk-averse investors seeking steady returns.

Risk Profile and Volatility Comparison

Small-cap stocks typically exhibit higher volatility and greater risk compared to large-cap stocks due to less established market presence and lower liquidity. Large-cap stocks tend to offer more stability and lower risk, benefiting from established business models and stronger financial fundamentals. Investors seeking growth might prefer small-cap equities despite the higher risk, while those prioritizing capital preservation often choose large-cap investments.

Growth Potential in Different Market Caps

Small-cap stocks typically offer higher growth potential due to their agility and market niche opportunities, often outperforming large-cap stocks during economic expansions. Large-cap stocks provide more stability and consistent returns, driven by established market presence and steady cash flows. Investors seeking aggressive growth may favor small-caps, while those prioritizing risk management often allocate to large-caps for portfolio balance.

Dividend Yields: What to Expect

Small-cap stocks often exhibit lower dividend yields compared to large-cap stocks due to their aggressive reinvestment strategies aimed at growth rather than immediate income. Large-cap companies typically offer higher and more stable dividend yields, reflecting their established profitability and cash flow stability. Investors seeking regular income might prefer large-cap dividend-paying stocks, while those targeting capital appreciation may lean toward small-cap equities with lower dividend payouts.

Impact of Economic Cycles on Market Caps

Small-cap stocks often experience greater volatility and higher sensitivity to economic cycles, typically outperforming during early expansion phases due to their growth potential and agility. Large-cap stocks generally provide stability and steady returns, benefiting from established market positions and resilient cash flows, especially during economic downturns and recessions. Investors balance portfolios by leveraging small-cap growth prospects during recoveries and large-cap defensive traits in contraction periods to optimize risk-adjusted returns.

Portfolio Diversification Strategies

Small-cap stocks offer higher growth potential and greater volatility, making them essential for aggressive portfolio diversification strategies. Large-cap stocks provide stability and consistent dividends, balancing risk and enhancing portfolio resilience during market downturns. Integrating both small-cap and large-cap equities optimizes risk-adjusted returns and strengthens long-term investment performance.

Liquidity Considerations in Small vs Large Caps

Liquidity in large-cap stocks is typically higher due to greater trading volumes and market depth, enabling investors to buy or sell shares quickly without significantly affecting the price. Small-cap stocks often experience lower liquidity, which can lead to wider bid-ask spreads and increased price volatility, posing challenges for timely trade execution. Investors should carefully assess liquidity risk when allocating assets to small-cap versus large-cap investments to optimize portfolio flexibility and minimize potential transaction costs.

Factors Influencing Market Cap Choices

Market capitalization choices between small-cap and large-cap stocks are influenced by factors such as risk tolerance, growth potential, and investment horizon. Small-cap stocks typically offer higher growth opportunities but come with increased volatility and liquidity risks. Large-cap stocks provide stability, established market presence, and consistent dividends, appealing to conservative investors seeking steady income.

Which is Right for Your Investment Goals?

Small-cap stocks typically offer higher growth potential but come with increased volatility and risk, making them ideal for investors with a higher risk tolerance and a long-term investment horizon. Large-cap stocks provide more stability, established market presence, and regular dividends, suiting conservative investors seeking steady income and capital preservation. Choosing between small-cap and large-cap depends on your financial goals, risk appetite, and time frame for investment returns.

Important Terms

Market Capitalization

Small-cap companies typically have a market capitalization between $300 million and $2 billion, offering higher growth potential but increased volatility compared to large-cap firms. Large-cap stocks, valued over $10 billion, provide greater stability and liquidity, often attracting conservative investors seeking steady dividends and lower risk.

Micro-cap

Micro-cap stocks have market capitalizations typically ranging from $50 million to $300 million, often presenting higher volatility and growth potential compared to small-cap stocks, which generally fall between $300 million and $2 billion. Larger-cap stocks, exceeding $10 billion in market value, tend to offer greater stability and liquidity, making micro-cap investments riskier yet potentially more rewarding in niche sectors.

Mid-cap

Mid-cap stocks typically have market capitalizations between $2 billion and $10 billion, offering a balanced risk-reward profile that sits between the higher volatility of small-cap stocks, which are valued under $2 billion, and the stability of large-cap stocks exceeding $10 billion. Investors often target mid-cap companies for their growth potential combined with more established business models compared to small-caps, while benefiting from greater market liquidity and less risk than large-cap equities.

Blue-chip Stocks

Blue-chip stocks typically belong to large-cap companies known for stable earnings, strong market presence, and reliable dividends, contrasting with small-cap stocks, which represent smaller companies with higher growth potential but greater volatility. Investors often prefer blue-chip stocks for portfolio stability and long-term value, while small-cap stocks may offer increased risk and opportunity for significant capital appreciation.

Growth Stocks

Growth stocks in small-cap companies often exhibit higher volatility but offer substantial long-term capital appreciation potential due to rapid expansion phases. Large-cap growth stocks provide more stability and consistent earnings growth, attracting investors seeking lower risk alongside moderate appreciation.

Value Stocks

Value stocks in the small-cap segment often present higher growth potential but come with increased volatility compared to large-cap value stocks, which typically offer greater stability and consistent dividend payouts. Investors seeking long-term appreciation might prefer small-cap value stocks for their underappreciated assets and earnings growth, while those favoring lower risk may lean toward large-cap value stocks known for established market presence and resilience during economic downturns.

Liquidity Premium

Liquidity premium refers to the higher expected return demanded by investors for holding small-cap stocks due to their lower market liquidity compared to large-cap stocks. Small-cap stocks typically exhibit wider bid-ask spreads and less frequent trading, which increases the liquidity risk premium relative to more liquid large-cap stocks.

Volatility Risk

Volatility risk in small-cap stocks is typically higher than in large-cap stocks due to lower market liquidity, less established business models, and greater sensitivity to economic fluctuations. Large-cap stocks generally exhibit lower volatility risk, benefiting from more stable earnings, diversified operations, and greater institutional investor participation.

Diversification Strategy

Diversification strategy in investing involves balancing small-cap stocks, known for higher growth potential and volatility, with large-cap stocks, valued for stability and consistent dividends, to optimize portfolio risk and return. Incorporating a mix of these market capitalizations enhances exposure to various market segments, mitigating risk through varied volatility and growth prospects.

Institutional Ownership

Institutional ownership in small-cap stocks typically ranges from 10% to 30%, reflecting less analyst coverage and higher volatility compared to large-cap stocks, where institutional ownership often exceeds 70%, indicating greater market stability and liquidity. Large-cap companies attract more institutional investors due to established financial performance and lower risk, while small-cap firms appeal to institutions seeking higher growth potential despite increased uncertainty.

Small-cap vs Large-cap Infographic

moneydif.com

moneydif.com