Top-down investment strategies prioritize macroeconomic trends and sector analysis before selecting individual stocks, offering a broad market perspective. Bottom-up approaches emphasize detailed company fundamentals and financial health, often uncovering undervalued stocks regardless of market conditions. Combining both methods can enhance portfolio diversification and identify opportunities across different market environments.

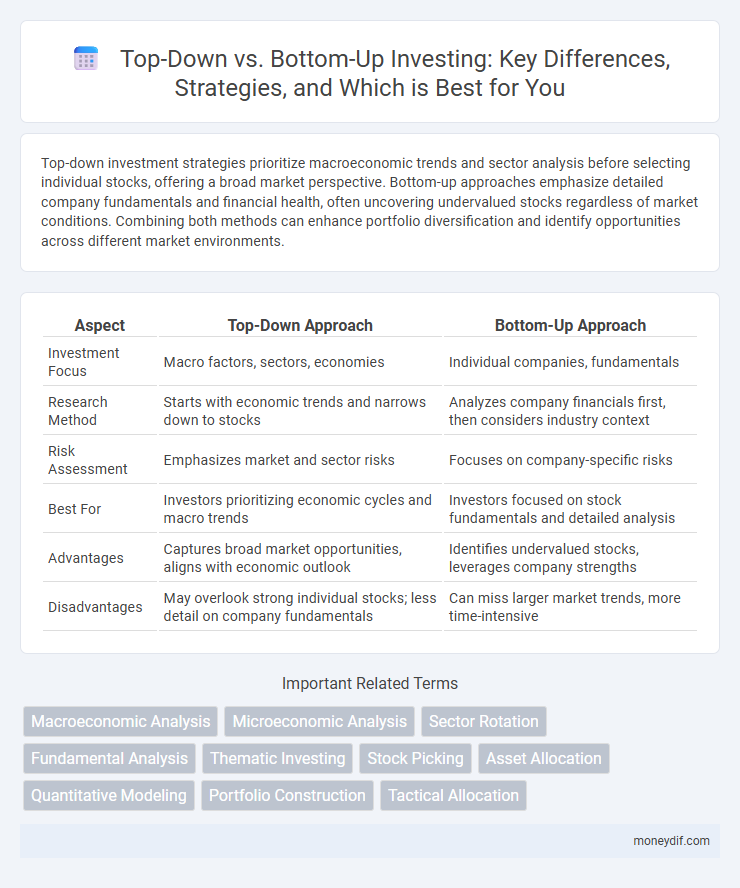

Table of Comparison

| Aspect | Top-Down Approach | Bottom-Up Approach |

|---|---|---|

| Investment Focus | Macro factors, sectors, economies | Individual companies, fundamentals |

| Research Method | Starts with economic trends and narrows down to stocks | Analyzes company financials first, then considers industry context |

| Risk Assessment | Emphasizes market and sector risks | Focuses on company-specific risks |

| Best For | Investors prioritizing economic cycles and macro trends | Investors focused on stock fundamentals and detailed analysis |

| Advantages | Captures broad market opportunities, aligns with economic outlook | Identifies undervalued stocks, leverages company strengths |

| Disadvantages | May overlook strong individual stocks; less detail on company fundamentals | Can miss larger market trends, more time-intensive |

Introduction to Top-Down vs Bottom-Up Investing

Top-Down investing begins with macroeconomic analysis, evaluating global and national economic trends, interest rates, and geopolitical factors to identify promising sectors before selecting individual stocks. Bottom-Up investing emphasizes detailed evaluation of individual companies' fundamentals, such as earnings growth, competitive advantages, and management quality, regardless of broader economic conditions. Understanding the distinction between these approaches is crucial for investors aiming to align strategy with market dynamics and personal risk tolerance.

Defining the Top-Down Investment Approach

The top-down investment approach begins with analyzing macroeconomic factors such as global economic trends, interest rates, and geopolitical events to identify attractive sectors or industries. Investors then narrow their focus to select specific companies within these sectors that demonstrate strong fundamentals and growth potential. This strategy emphasizes understanding the broader economic environment before making individual stock decisions, aiming to capitalize on large-scale market movements.

Understanding the Bottom-Up Investment Strategy

The bottom-up investment strategy emphasizes analyzing individual companies based on their fundamentals, such as earnings growth, revenue stability, and competitive advantages, rather than macroeconomic factors or sector trends. This approach enables investors to identify undervalued stocks with strong potential for long-term growth by thoroughly examining financial statements, management quality, and product innovation. Bottom-up investors often prioritize intrinsic value and company-specific catalysts to build a portfolio that can outperform broader market movements.

Key Differences Between Top-Down and Bottom-Up Methods

Top-Down investment analysis begins with macroeconomic factors, assessing global and national economic trends before identifying promising sectors and individual stocks. Bottom-Up investing focuses directly on company fundamentals, such as financial health, management quality, and competitive advantages, often disregarding broader economic conditions. The key difference lies in the starting point of analysis: Top-Down emphasizes external economic drivers, while Bottom-Up prioritizes internal corporate metrics.

Advantages of Top-Down Investing

Top-down investing allows investors to identify macroeconomic trends and sector opportunities, enabling strategic allocation of resources to industries with the highest growth potential. This approach reduces risk by focusing on favorable economic conditions and global market dynamics before selecting individual securities. By prioritizing broad economic factors, top-down investing offers a comprehensive framework for portfolio diversification and risk management.

Benefits of Bottom-Up Investing

Bottom-up investing emphasizes analyzing individual companies based on fundamentals such as financial health, management quality, and competitive advantages, leading to more precise stock selection. This approach allows investors to uncover undervalued opportunities and generate alpha by focusing on company-specific growth potential rather than macroeconomic trends. It also reduces the risk of market timing errors and provides a diversified portfolio built on strong individual equity performance.

Challenges of Each Investment Approach

Top-down investment approaches face challenges such as reliance on macroeconomic forecasts and geopolitical assumptions, which can lead to misjudgments if broad trends shift unexpectedly. Bottom-up strategies, while focused on detailed company analysis, risk missing broader economic shifts that impact sector-wide performance and may incur higher research costs. Both approaches require balancing depth of insight with an awareness of market-wide dynamics to optimize investment decisions.

Suitable Investors for Top-Down vs Bottom-Up Strategies

Top-Down investment strategies suit institutional investors and macroeconomic-focused portfolio managers who analyze economic indicators, sectors, and countries before selecting individual securities. Bottom-Up strategies appeal to fundamental stock pickers and long-term investors who prioritize company-specific financial health and growth potential over broad market trends. Both approaches serve different investor objectives, with Top-Down offering diversified, theme-driven exposures and Bottom-Up enabling concentrated positions in undervalued firms.

Real-World Examples of Top-Down and Bottom-Up Investments

Top-down investing begins with macroeconomic analysis, exemplified by investing in emerging markets based on favorable GDP growth forecasts, such as targeting technology sectors in China during its rapid economic expansion. Bottom-up investing focuses on individual company fundamentals, demonstrated by selecting undervalued stocks like Amazon in its early years by analyzing revenue growth and market share independently of broader market trends. Firms like hedge funds often combine both approaches by using top-down screening to identify attractive sectors followed by bottom-up stock picking within those sectors to optimize portfolio returns.

Choosing the Right Approach for Your Portfolio

Evaluating your portfolio strategy requires understanding the key differences between top-down and bottom-up investment approaches. Top-down focuses on macroeconomic factors like GDP growth, interest rates, and geopolitical trends to identify promising sectors before selecting stocks. Bottom-up emphasizes individual company fundamentals such as financial health, management quality, and competitive advantages to build a portfolio based on stock-specific opportunities.

Important Terms

Macroeconomic Analysis

Macroeconomic analysis contrasts top-down approaches, which start from broad economic indicators to forecast sector or company performance, with bottom-up methods that focus on individual firm fundamentals to assess overall economic trends.

Microeconomic Analysis

Microeconomic analysis evaluates individual agents' behavior and market mechanisms using top-down models that begin with aggregate data or bottom-up approaches that construct insights from detailed, firm-level or consumer-specific information.

Sector Rotation

Sector rotation strategies prioritize top-down macroeconomic analysis to identify outperforming sectors, contrasting with bottom-up approaches that focus on individual company fundamentals within sectors.

Fundamental Analysis

Top-down fundamental analysis begins with macroeconomic indicators and industry trends before selecting individual stocks, whereas bottom-up analysis focuses on evaluating a company's financial health and management regardless of broader market conditions.

Thematic Investing

Thematic investing strategically integrates top-down macroeconomic trends and bottom-up company analysis to identify high-growth opportunities aligned with long-term structural shifts.

Stock Picking

Top-down stock picking analyzes macroeconomic trends to select sectors before individual stocks, while bottom-up stock picking focuses on company fundamentals regardless of broader market conditions.

Asset Allocation

Top-down asset allocation focuses on macroeconomic factors and sector trends to guide investment decisions, while bottom-up asset allocation emphasizes individual security analysis and company fundamentals.

Quantitative Modeling

Quantitative modeling distinguishes Top-Down approaches that analyze aggregate data patterns from Bottom-Up methods that build models based on individual components or micro-level inputs.

Portfolio Construction

Top-down portfolio construction prioritizes macroeconomic trends and sector analysis for asset allocation, while bottom-up focuses on individual security selection based on fundamental company analysis.

Tactical Allocation

Tactical allocation leverages top-down macroeconomic analysis for strategic asset distribution, while bottom-up approaches focus on granular company fundamentals to inform portfolio adjustments.

Top-Down vs Bottom-Up Infographic

moneydif.com

moneydif.com