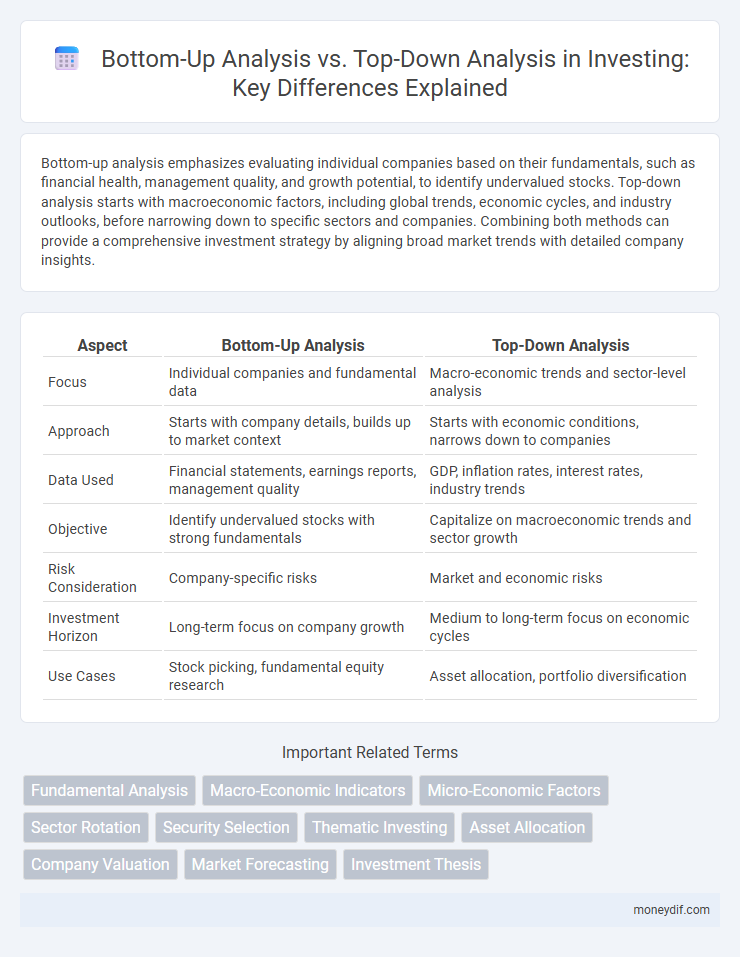

Bottom-up analysis emphasizes evaluating individual companies based on their fundamentals, such as financial health, management quality, and growth potential, to identify undervalued stocks. Top-down analysis starts with macroeconomic factors, including global trends, economic cycles, and industry outlooks, before narrowing down to specific sectors and companies. Combining both methods can provide a comprehensive investment strategy by aligning broad market trends with detailed company insights.

Table of Comparison

| Aspect | Bottom-Up Analysis | Top-Down Analysis |

|---|---|---|

| Focus | Individual companies and fundamental data | Macro-economic trends and sector-level analysis |

| Approach | Starts with company details, builds up to market context | Starts with economic conditions, narrows down to companies |

| Data Used | Financial statements, earnings reports, management quality | GDP, inflation rates, interest rates, industry trends |

| Objective | Identify undervalued stocks with strong fundamentals | Capitalize on macroeconomic trends and sector growth |

| Risk Consideration | Company-specific risks | Market and economic risks |

| Investment Horizon | Long-term focus on company growth | Medium to long-term focus on economic cycles |

| Use Cases | Stock picking, fundamental equity research | Asset allocation, portfolio diversification |

Understanding Bottom-Up vs. Top-Down Analysis

Bottom-Up analysis emphasizes evaluating individual companies based on financial health, management quality, and growth potential to identify promising investment opportunities. Top-Down analysis starts with macroeconomic factors such as GDP growth, interest rates, and industry trends before narrowing down to specific sectors and stocks. Combining both approaches can provide a comprehensive investment strategy by aligning fundamental company insights with broader economic conditions.

Key Principles of Bottom-Up Analysis

Bottom-up analysis prioritizes analyzing individual companies based on their financial health, management quality, and competitive advantages rather than macroeconomic factors. This approach emphasizes detailed scrutiny of earnings reports, cash flow statements, and growth potential to identify undervalued stocks with strong fundamental metrics. Investors relying on bottom-up analysis seek investment opportunities by evaluating company-specific data to achieve superior long-term capital appreciation.

Core Concepts of Top-Down Analysis

Top-Down Analysis in investment begins with evaluating macroeconomic factors such as GDP growth, interest rates, and inflation to identify attractive sectors or industries. This approach prioritizes understanding broad market trends and geopolitical events that influence asset classes before selecting individual securities. Investors using this method emphasize economic indicators and global market conditions to guide portfolio allocation and risk management.

Strengths of Bottom-Up Investing

Bottom-up investing excels by emphasizing in-depth research of individual companies, enabling investors to identify undervalued stocks with strong fundamentals. This approach minimizes macroeconomic assumptions, reducing risk from broad market fluctuations. Detailed focus on company-specific data such as financial health, competitive advantages, and management quality enhances precision in stock selection.

Advantages of Top-Down Investment Strategies

Top-down investment strategies offer a macroeconomic perspective, allowing investors to identify overarching market trends and economic cycles that influence asset performance. By focusing on sectors and industries with strong growth potential, this approach enhances portfolio diversification and risk management. It also streamlines decision-making by prioritizing high-level economic indicators before drilling down into individual securities.

Limitations and Challenges of Bottom-Up Analysis

Bottom-up analysis faces challenges such as time-consuming research processes and the complexity of evaluating numerous individual companies. It may overlook broader macroeconomic trends or sector-wide risks that top-down analysis captures. Reliance on company-specific data can lead to biases and a lack of diversification if systemic factors are underemphasized.

Drawbacks of Top-Down Approaches

Top-down analysis often overlooks niche market trends and undervalues emerging sectors due to its reliance on macroeconomic indicators and broad market cycles. This approach can lead to missed investment opportunities and greater exposure to systemic risks, as it predominantly focuses on country-level, industry, or economic data without granular company-level insights. The reduced adaptability to specific company fundamentals limits precision in stock selection and portfolio management compared to bottom-up analysis.

Comparative Performance: Bottom-Up vs. Top-Down

Bottom-up analysis often leads to superior stock selection by emphasizing individual company fundamentals such as earnings growth, management quality, and competitive positioning, which can uncover undervalued opportunities missed by top-down approaches. Top-down analysis provides a macroeconomic perspective, prioritizing sector and country allocation based on economic trends, which may result in broader diversification but sometimes overlooks strong company-specific potential. Studies indicate that bottom-up strategies generally outperform top-down methods in long-term equity returns due to their detailed focus on intrinsic business performance and differentiation.

When to Use Bottom-Up or Top-Down Analysis

Bottom-up analysis is ideal when investors seek to uncover undervalued companies through detailed examination of individual financial statements, management quality, and competitive advantages. Top-down analysis suits macro-focused strategies, where economic indicators, industry trends, and geopolitical factors guide portfolio allocation decisions. Combining both methods enhances investment decisions by balancing granular company insights with broader market dynamics.

Integrating Bottom-Up and Top-Down Strategies in Portfolio Management

Integrating bottom-up and top-down strategies in portfolio management enhances investment decision-making by combining granular company analysis with macroeconomic and sector trends. This hybrid approach enables portfolio managers to identify undervalued securities within strong economic environments, optimizing risk-adjusted returns. Effective integration requires aligning macroeconomic forecasts with fundamental company insights to create a balanced, diversified portfolio.

Important Terms

Fundamental Analysis

Fundamental analysis involves evaluating a company's financial health, industry position, and economic conditions to determine its intrinsic value, with Bottom-Up Analysis focusing on individual company metrics and Top-Down Analysis starting from macroeconomic factors to sector and company selection. Investors using Bottom-Up prioritize detailed financial statements and management quality, while Top-Down emphasizes GDP growth, interest rates, and sector trends to guide investment decisions.

Macro-Economic Indicators

Macro-economic indicators such as GDP growth rate, inflation rate, and unemployment rate critically influence both bottom-up and top-down investment analysis by providing context for assessing company performance and industry trends. Bottom-up analysis focuses on firm-specific fundamentals like earnings and management quality, while top-down analysis prioritizes macroeconomic conditions and sector dynamics to guide investment decisions.

Micro-Economic Factors

Micro-economic factors such as consumer behavior, firm-level cost structures, and supply-demand dynamics are critical in bottom-up analysis to evaluate individual companies' performance and growth potential. In contrast, top-down analysis relies on broader macroeconomic indicators but uses microeconomic data to refine sector-specific investment decisions.

Sector Rotation

Sector rotation strategies leverage top-down analysis to identify macroeconomic trends and cycle phases, guiding investment shifts among sectors for optimized returns. Bottom-up analysis complements this approach by focusing on individual company fundamentals within targeted sectors, enhancing the precision of sector rotation decisions through detailed financial and operational insights.

Security Selection

Security selection involves bottom-up analysis focusing on individual company fundamentals such as financial statements, management quality, and competitive advantages, enabling investors to identify undervalued stocks. In contrast, top-down analysis begins with macroeconomic factors, sector trends, and market conditions to narrow down investment choices before evaluating specific securities.

Thematic Investing

Thematic investing leverages bottom-up analysis by focusing on individual companies that align with specific global trends or themes such as renewable energy or technology innovation, enabling investors to identify high-growth opportunities at the micro level. In contrast, top-down analysis evaluates broad macroeconomic factors and sector momentum to select themes before narrowing down to individual securities, emphasizing a macro-to-micro investment approach.

Asset Allocation

Asset allocation guided by bottom-up analysis emphasizes selecting individual securities based on company fundamentals, financial health, and growth potential, while top-down analysis allocates assets by evaluating macroeconomic factors, industry trends, and geopolitical conditions. Combining both approaches optimizes portfolio diversification, balancing micro-level insights with broad market dynamics to enhance risk-adjusted returns.

Company Valuation

Bottom-up analysis in company valuation focuses on examining individual financial metrics, such as cash flow projections and operational efficiency, to derive intrinsic value, while top-down analysis starts with macroeconomic factors and industry trends to estimate potential market position and growth prospects. Combining both approaches enhances valuation accuracy by integrating granular company data with broader economic contexts, supporting more informed investment decisions.

Market Forecasting

Bottom-up analysis in market forecasting involves evaluating individual components, such as company performance and product-level data, to build comprehensive sector or market predictions, enhancing accuracy through granular insights. Top-down analysis starts with macroeconomic trends and broad market conditions, then narrows down to specific segments, providing a high-level perspective crucial for understanding overall market direction.

Investment Thesis

Bottom-Up Analysis focuses on evaluating individual companies' financial health, management quality, and competitive position to identify undervalued stocks with strong growth potential. Top-Down Analysis prioritizes macroeconomic trends, sector performance, and market conditions to allocate investments strategically across industries and regions for optimized portfolio diversification.

Bottom-Up Analysis vs Top-Down Analysis Infographic

moneydif.com

moneydif.com