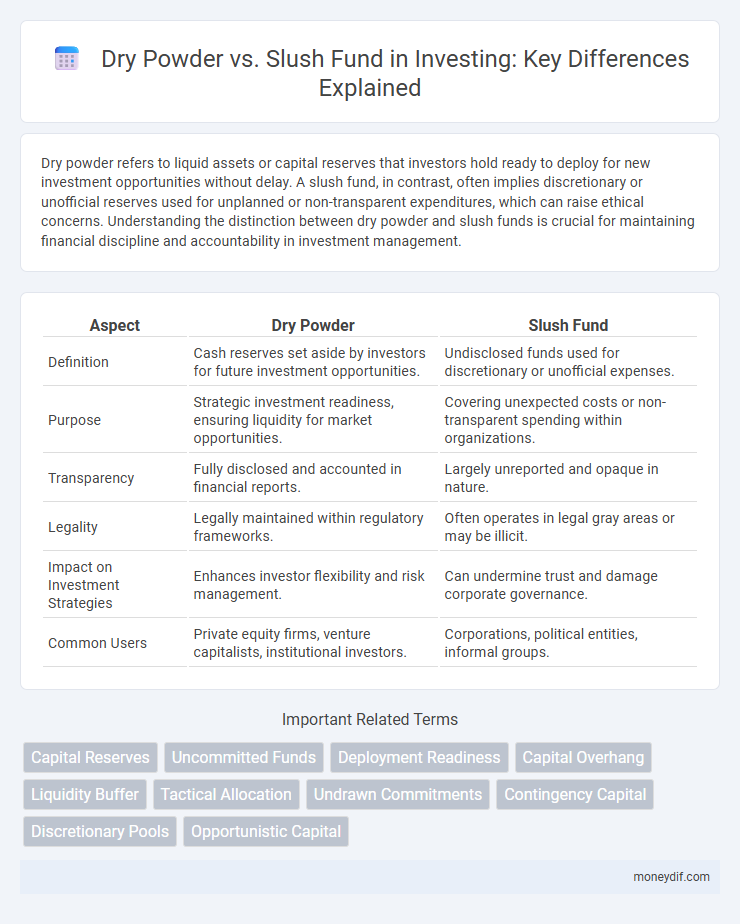

Dry powder refers to liquid assets or capital reserves that investors hold ready to deploy for new investment opportunities without delay. A slush fund, in contrast, often implies discretionary or unofficial reserves used for unplanned or non-transparent expenditures, which can raise ethical concerns. Understanding the distinction between dry powder and slush funds is crucial for maintaining financial discipline and accountability in investment management.

Table of Comparison

| Aspect | Dry Powder | Slush Fund |

|---|---|---|

| Definition | Cash reserves set aside by investors for future investment opportunities. | Undisclosed funds used for discretionary or unofficial expenses. |

| Purpose | Strategic investment readiness, ensuring liquidity for market opportunities. | Covering unexpected costs or non-transparent spending within organizations. |

| Transparency | Fully disclosed and accounted in financial reports. | Largely unreported and opaque in nature. |

| Legality | Legally maintained within regulatory frameworks. | Often operates in legal gray areas or may be illicit. |

| Impact on Investment Strategies | Enhances investor flexibility and risk management. | Can undermine trust and damage corporate governance. |

| Common Users | Private equity firms, venture capitalists, institutional investors. | Corporations, political entities, informal groups. |

Defining Dry Powder and Slush Fund: Key Differences

Dry powder refers to the liquid assets or cash reserves that investors or firms set aside to capitalize on future investment opportunities or market downturns. A slush fund, by contrast, is an unregulated reserve of money often used for discretionary or unofficial purposes, lacking transparency and formal oversight. The key difference lies in dry powder being earmarked for strategic investments with clear intentions, while slush funds typically serve non-transparent, ad-hoc financial uses.

Origins and Evolution in Investment Strategy

Dry powder in investment originated as a metaphor from gunpowder kept dry for immediate use, symbolizing reserved capital ready for opportunistic deployment, evolving into a key strategic asset during market downturns. Slush fund, originally referring to surplus shipboard funds used for discretionary expenses, transformed in investment contexts to describe off-balance resources available for unplanned or strategic expenditures. Both concepts have evolved to influence liquidity management, risk mitigation, and timing strategies in portfolio and fund management.

Role of Dry Powder in Private Equity

Dry powder in private equity refers to the reserved capital that firms hold to deploy for future investments, enabling swift acquisition opportunities and strategic flexibility in volatile markets. Unlike slush funds, which often imply discretionary or unallocated money used without formal approval, dry powder is transparently accounted for and actively managed to optimize portfolio growth and risk management. Maintaining adequate dry powder levels ensures private equity firms can capitalize on market dislocations and support portfolio companies through economic downturns.

How Slush Funds Operate in Financial Markets

Slush funds operate in financial markets as discretionary reserves often used by corporations or investment firms to capitalize quickly on emerging opportunities without formal approval processes. These funds are typically unallocated or less restricted capital sources, allowing for agile investment decisions in volatile market conditions. Unlike dry powder, which is explicitly reserved for future investments, slush funds may also finance off-the-book activities or cover unexpected expenses, influencing market dynamics through their flexible deployment.

Liquidity Management: Dry Powder vs Slush Fund

Dry powder represents committed capital reserved by investment firms or private equity funds for future opportunities, maintaining high liquidity to enable swift deployment. Slush funds, often informal reserves, hold excess cash with less clear allocation, potentially impairing disciplined liquidity management. Effective liquidity management differentiates dry powder by ensuring optimal readiness for strategic investments while slush funds risk inefficient capital use.

Strategic Advantages of Maintaining Dry Powder

Maintaining dry powder provides investors with strategic advantages by ensuring liquidity to capitalize on market downturns and seize high-conviction opportunities promptly. Dry powder enhances portfolio flexibility and risk management by enabling timely asset reallocation without the need for distress selling. This controlled reserve contrasts with a slush fund, which may lack transparency and undermine disciplined investment management.

Risks and Regulatory Considerations of Slush Funds

Slush funds pose significant risks due to their opaque nature, often circumventing legal and regulatory frameworks, which can result in financial mismanagement and reputational damage. Unlike dry powder, which is transparently allocated capital reserved for future investments, slush funds lack formal oversight, increasing the potential for fraud and corruption. Regulatory bodies impose strict compliance requirements to mitigate these risks, emphasizing the need for clear documentation and justification of all associated expenditures.

Impact on Portfolio Performance and Flexibility

Dry powder provides investors with readily available capital to seize high-potential opportunities quickly, enhancing portfolio performance through timely asset acquisition. In contrast, slush funds, often less transparent and allocated without stringent investment criteria, may reduce flexibility by tying up resources in ambiguous expenditures. Efficient management of dry powder maximizes strategic agility, directly influencing returns, whereas poorly controlled slush funds can detract from portfolio discipline and long-term growth.

When to Use Dry Powder or a Slush Fund

Dry powder is ideal for investors looking to capitalize on market downturns or seize high-conviction opportunities requiring quick capital deployment. A slush fund is more suited for unforeseen expenses or discretionary spending within an organization, providing flexible liquidity without formal approval processes. Choosing between dry powder and a slush fund depends on whether the focus is strategic investment readiness or operational financial agility.

Investor Perspectives: Best Practices and Common Pitfalls

Investors managing dry powder and slush funds should prioritize clear allocation strategies to maximize capital efficiency and minimize idle cash. Best practices include maintaining disciplined deployment schedules for dry powder to seize high-conviction opportunities while avoiding the temptation to overcommit slush funds to speculative ventures. Common pitfalls involve underutilizing dry powder due to market hesitation and misclassifying reserves, which can lead to suboptimal investment outcomes and liquidity constraints.

Important Terms

Capital Reserves

Capital reserves represent funds set aside by companies or investors as dry powder for strategic opportunities, distinct from slush funds which are unregulated reserves often used for discretionary or unauthorized expenditures.

Uncommitted Funds

Uncommitted funds, often referred to as dry powder, represent readily available capital for investment, while slush funds imply unallocated reserves with less transparent usage.

Deployment Readiness

Deployment readiness hinges on maintaining an optimal balance between dry powder for immediate investment opportunities and a slush fund reserved for unforeseen contingencies.

Capital Overhang

Capital Overhang, defined as uninvested Dry Powder, often leads to the accumulation of a Slush Fund, representing idle capital that pressures private equity firms to accelerate deployments.

Liquidity Buffer

Liquidity buffer represents readily available cash reserves, differentiating from dry powder, which is capital specifically allocated for investments, and a slush fund, which is unregulated discretionary cash often used for operational flexibility.

Tactical Allocation

Tactical allocation strategically manages dry powder as liquid reserves for market opportunities, contrasting with slush funds that are uncommitted capital often used for discretionary spending.

Undrawn Commitments

Undrawn commitments refer to the portion of capital that limited partners have pledged but not yet invested, representing dry powder available for future investments, whereas a slush fund typically denotes unallocated or discretionary reserves within a fund used for unexpected expenses or opportunities.

Contingency Capital

Contingency capital refers to reserved financial resources designed to cover unexpected expenses, distinct from dry powder which represents readily deployable funds for strategic investments, while a slush fund typically denotes unregulated or hidden reserves used for discretionary purposes.

Discretionary Pools

Discretionary pools represent flexible capital reserves distinct from dry powder, which is fully committed capital awaiting deployment, whereas slush funds are informal or unauthorized reserves often used outside standard investment protocols.

Opportunistic Capital

Opportunistic Capital refers to readily available dry powder that investors strategically reserve to deploy quickly, differentiating it from a slush fund, which often implies unregulated or discretionary reserves without specific investment mandates.

Dry Powder vs Slush Fund Infographic

moneydif.com

moneydif.com