Hedge funds employ aggressive strategies, including leverage and short selling, to achieve higher returns, targeting accredited investors and often requiring high minimum investments. Mutual funds, in contrast, offer diversified portfolios with lower risk and are accessible to the general public through smaller minimum investments. While hedge funds aim for absolute returns regardless of market conditions, mutual funds typically track market indices or seek to outperform them within regulatory constraints.

Table of Comparison

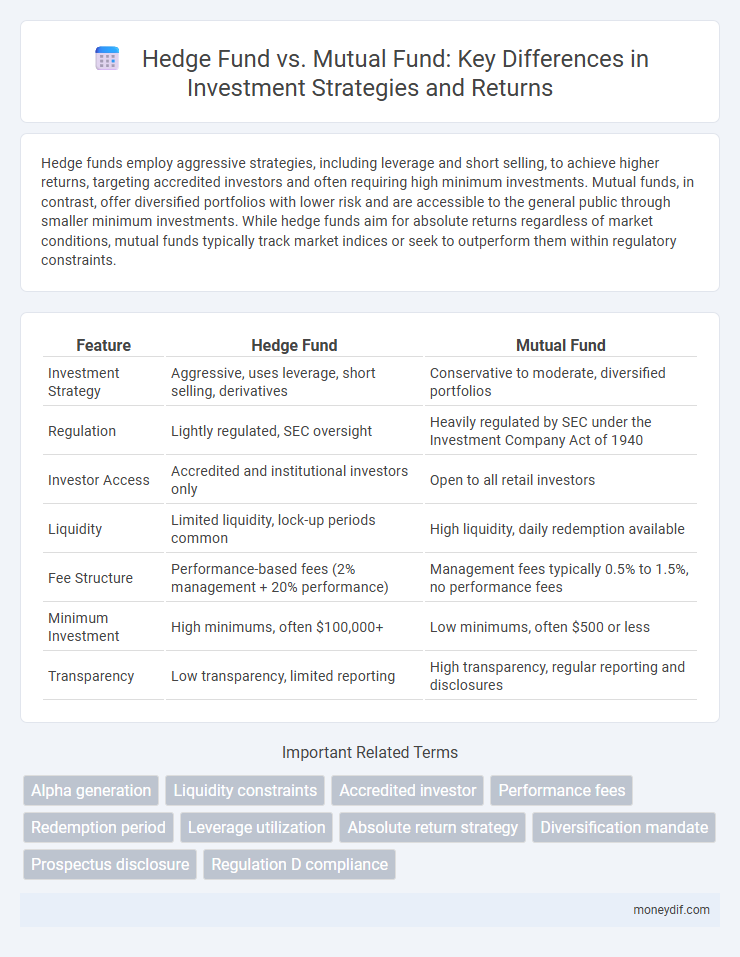

| Feature | Hedge Fund | Mutual Fund |

|---|---|---|

| Investment Strategy | Aggressive, uses leverage, short selling, derivatives | Conservative to moderate, diversified portfolios |

| Regulation | Lightly regulated, SEC oversight | Heavily regulated by SEC under the Investment Company Act of 1940 |

| Investor Access | Accredited and institutional investors only | Open to all retail investors |

| Liquidity | Limited liquidity, lock-up periods common | High liquidity, daily redemption available |

| Fee Structure | Performance-based fees (2% management + 20% performance) | Management fees typically 0.5% to 1.5%, no performance fees |

| Minimum Investment | High minimums, often $100,000+ | Low minimums, often $500 or less |

| Transparency | Low transparency, limited reporting | High transparency, regular reporting and disclosures |

Understanding Hedge Funds and Mutual Funds

Hedge funds are private investment partnerships that employ diverse strategies, including leverage, derivatives, and short selling, to generate high returns, often with higher risk and less liquidity compared to mutual funds. Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities, offering liquidity and regulatory oversight under the Securities and Exchange Commission (SEC). Understanding the differences in structure, investment strategies, risk tolerance, and accessibility is crucial for investors when choosing between hedge funds and mutual funds.

Key Structural Differences

Hedge funds typically employ private investment strategies with less regulatory oversight, allowing for greater flexibility in asset selection and leveraging techniques compared to mutual funds, which are highly regulated and focus on diversified portfolios accessible to retail investors. Mutual funds offer daily liquidity with strict portfolio diversification rules, whereas hedge funds often have lock-up periods and can invest in a broader range of assets, including derivatives and short positions. The fee structures also differ significantly, with hedge funds commonly charging performance-based fees (e.g., "2 and 20"), while mutual funds charge a fixed percentage of assets under management as expense ratios.

Investment Strategies Compared

Hedge funds employ aggressive investment strategies such as leverage, short selling, and derivatives to generate high returns, often targeting absolute performance regardless of market conditions. Mutual funds primarily use long-only strategies, investing in diversified portfolios of stocks and bonds aiming for steady growth aligned with benchmark indices. Hedge funds typically pursue active management with flexible mandates, while mutual funds emphasize risk-averse, regulated approaches suitable for retail investors.

Risk Profiles and Tolerance

Hedge funds often target high-net-worth investors willing to accept elevated risk levels through complex strategies like leverage and short selling, aiming for higher returns. Mutual funds provide diversified portfolios with regulatory oversight, appealing to investors seeking moderate risk and consistent performance. Understanding individual risk tolerance is crucial when choosing between hedge funds' aggressive approaches and mutual funds' conservative investment profiles.

Fee Structures and Costs

Hedge funds typically charge a management fee of around 2% of assets under management plus a performance fee of 20% on profits, which can significantly impact net returns. Mutual funds usually charge lower fees, averaging 0.5% to 1% for expense ratios, without performance-based fees, making them more cost-effective for long-term investors. The higher fee structure of hedge funds reflects active management strategies and potential for higher returns but demands careful consideration of cost versus benefit.

Regulation and Transparency

Hedge funds operate under less stringent regulatory frameworks compared to mutual funds, typically registering with the SEC only if managing assets above $150 million, allowing them greater flexibility in investment strategies but less transparency to investors. Mutual funds are heavily regulated by the Investment Company Act of 1940, ensuring rigorous disclosure requirements and frequent reporting, which enhances transparency and investor protection. This regulatory disparity results in mutual funds offering higher transparency and investor safeguards, while hedge funds cater to accredited investors seeking complex strategies with less regulatory oversight.

Liquidity and Redemption Policies

Hedge funds typically impose stricter liquidity constraints, with lock-up periods ranging from six months to several years and redemption windows that may occur quarterly or annually. Mutual funds offer higher liquidity, allowing investors to redeem shares daily at the net asset value (NAV), making them more accessible for frequent transactions. These differing redemption policies significantly influence investor access to capital and risk tolerance.

Suitability for Different Investors

Hedge funds typically suit high-net-worth investors seeking aggressive strategies with higher risk tolerance and less liquidity, while mutual funds cater to a broader audience by offering diversified portfolios with lower minimum investments and greater liquidity. Mutual funds are regulated under the Investment Company Act of 1940, providing transparency and investor protections, whereas hedge funds, often registered as private investment partnerships, operate with fewer restrictions, allowing more complex and leveraged tactics. Investors prioritizing capital preservation and regulated oversight generally prefer mutual funds, whereas those pursuing absolute returns and willing to accept higher volatility may find hedge funds more appropriate.

Performance Potential and Historical Returns

Hedge funds often deliver higher performance potential due to active management strategies, leverage, and access to diverse asset classes, targeting absolute returns regardless of market conditions. Mutual funds typically provide more stable historical returns by investing in diversified portfolios of stocks or bonds with regulatory constraints and lower risk profiles. While hedge funds can outperform during volatile markets, their returns vary significantly, whereas mutual funds generally offer consistent, long-term growth aligned with benchmark indices.

Choosing the Right Fund for Your Portfolio

Choosing the right fund for your portfolio involves understanding the key differences between hedge funds and mutual funds, including risk tolerance, investment goals, and liquidity needs. Hedge funds often target high-net-worth investors seeking aggressive growth with strategies like leverage and short selling, while mutual funds offer diversified, regulated options suitable for retail investors looking for steady returns. Evaluating factors such as fees, minimum investment requirements, and regulatory oversight can help align the fund choice with your overall investment strategy.

Important Terms

Alpha generation

Alpha generation measures a fund manager's ability to outperform benchmark returns, a key metric distinguishing hedge funds, which pursue high alpha through aggressive strategies like short selling and leverage, from mutual funds that typically aim for steadier alpha via diversified, long-only portfolios. Hedge funds often achieve higher alpha by exploiting market inefficiencies and utilizing flexible investment mandates, whereas mutual funds focus on risk-adjusted returns within regulatory constraints.

Liquidity constraints

Liquidity constraints significantly impact hedge funds, which often impose lock-up periods and redemption restrictions to manage illiquid assets, contrasting with mutual funds that generally offer daily liquidity to investors. Hedge funds' strategies in private equity, real estate, or distressed assets create longer investment horizons, whereas mutual funds primarily hold publicly traded securities to ensure prompt liquidity.

Accredited investor

Accredited investors meet specific income or net worth criteria, granting them access to hedge funds, which typically involve higher risk and less regulatory oversight compared to mutual funds. Mutual funds accept investments from the general public and offer greater liquidity and regulatory protections but often come with lower minimum investment requirements and more standardized investment strategies.

Performance fees

Performance fees in hedge funds typically range from 15% to 20% of profits, aligning manager incentives with investor returns, whereas mutual funds generally do not charge performance fees and rely on management fees based on assets under management. Hedge fund performance fees often include a high-water mark provision to ensure fees are only paid on net gains, contrasting with mutual funds' fee structures that focus on fixed annual expense ratios.

Redemption period

Redemption period for hedge funds typically ranges from 30 to 90 days, reflecting limited liquidity and strategic investment horizons, whereas mutual funds offer daily liquidity with same-day or next-day redemption processing, catering to retail investors' need for quick access to funds. Hedge funds impose lock-up periods and gates to manage redemptions and protect portfolio stability, contrasting with mutual funds' redemption fees and shorter notice periods designed for broader market accessibility.

Leverage utilization

Leverage utilization in hedge funds often exceeds that in mutual funds, as hedge funds employ debt and derivatives to amplify returns and manage risk across diverse strategies. Mutual funds typically maintain lower leverage levels to comply with regulatory constraints and prioritize capital preservation and liquidity.

Absolute return strategy

Absolute return strategies focus on generating positive returns regardless of market conditions, a common approach in hedge funds utilizing techniques like short selling, derivatives, and leverage. Mutual funds primarily aim to outperform benchmarks with market-correlated returns, often lacking the flexibility and risk management tools found in hedge funds employing absolute return strategies.

Diversification mandate

Diversification mandates for hedge funds often adopt flexible strategies across asset classes, aiming to optimize risk-adjusted returns through concentrated or niche investments, while mutual funds typically follow regulatory requirements to maintain broad market exposure and limit risk via standardized diversification rules. Hedge funds utilize various instruments including derivatives and leverage to enhance diversification, whereas mutual funds predominantly invest in publicly traded securities within predefined sector and geographic allocations.

Prospectus disclosure

Prospectus disclosure for hedge funds is typically limited due to private placement exemptions, resulting in less detailed information on investment strategies, risks, and fees, whereas mutual funds are required by the SEC to provide comprehensive, standardized prospectuses that offer full transparency on portfolio holdings, performance, and costs. This regulatory distinction impacts investor access to crucial data, with mutual funds emphasizing strict compliance and retail investor protection, while hedge funds prioritize flexibility and confidentiality for accredited investors.

Regulation D compliance

Regulation D compliance governs private placements allowing hedge funds to raise capital from accredited investors without registering with the SEC, whereas mutual funds must register and adhere to stricter regulatory disclosures under the Investment Company Act of 1940. Hedge funds leverage Regulation D exemptions to maintain operational flexibility and limit investor eligibility, while mutual funds prioritize transparency and investor protection through detailed prospectus filings.

Hedge Fund vs Mutual Fund Infographic

moneydif.com

moneydif.com