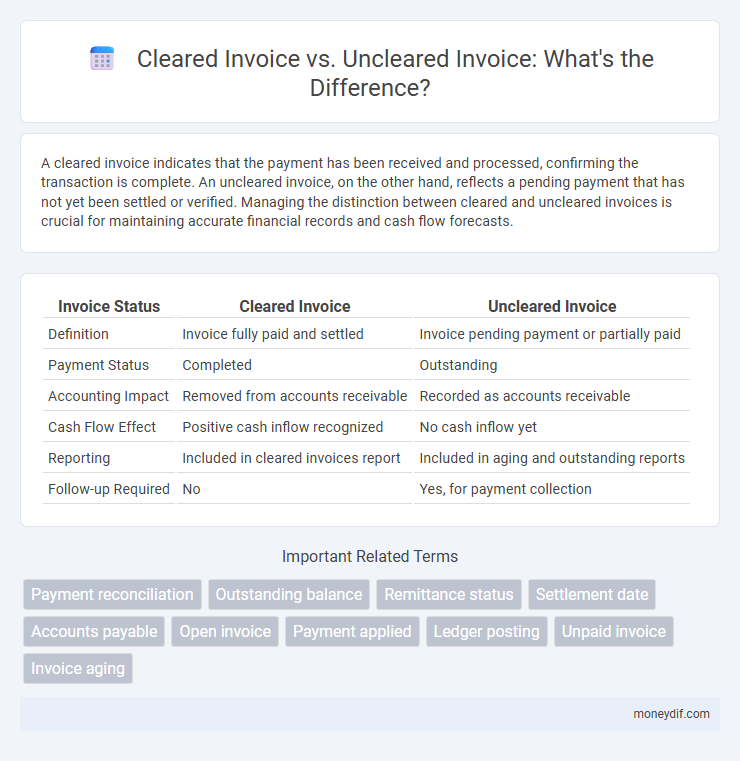

A cleared invoice indicates that the payment has been received and processed, confirming the transaction is complete. An uncleared invoice, on the other hand, reflects a pending payment that has not yet been settled or verified. Managing the distinction between cleared and uncleared invoices is crucial for maintaining accurate financial records and cash flow forecasts.

Table of Comparison

| Invoice Status | Cleared Invoice | Uncleared Invoice |

|---|---|---|

| Definition | Invoice fully paid and settled | Invoice pending payment or partially paid |

| Payment Status | Completed | Outstanding |

| Accounting Impact | Removed from accounts receivable | Recorded as accounts receivable |

| Cash Flow Effect | Positive cash inflow recognized | No cash inflow yet |

| Reporting | Included in cleared invoices report | Included in aging and outstanding reports |

| Follow-up Required | No | Yes, for payment collection |

Introduction to Cleared and Uncleared Invoices

Cleared invoices represent payments that have been fully processed and confirmed by financial institutions, indicating the completion of a transaction. Uncleared invoices, on the other hand, remain pending payment verification or processing, which can affect cash flow and accounting accuracy. Efficient management of cleared and uncleared invoices is crucial for maintaining accurate financial records and ensuring timely revenue recognition.

Defining Cleared Invoices

Cleared invoices refer to those payments that have been fully processed and settled, reflecting a zero outstanding balance in the accounts receivable ledger. These invoices confirm that the buyer has remitted the agreed amount, and the funds are successfully transferred and reconciled in the seller's financial records. In contrast, uncleared invoices remain unpaid or partially paid, indicating pending collection or reconciliation issues requiring further follow-up.

What Are Uncleared Invoices?

Uncleared invoices are bills that have been issued but not yet paid or fully processed in the accounting system. These outstanding invoices represent amounts owed by customers, impacting cash flow management and financial reporting accuracy. Monitoring uncleared invoices helps businesses track receivables, identify payment delays, and maintain effective credit control.

Key Differences Between Cleared and Uncleared Invoices

Cleared invoices are those for which payment has been fully received and recorded in the accounting system, confirming the transaction is complete. Uncleared invoices remain outstanding, indicating the payment is pending or processing, and require follow-up for reconciliation. The key differences include the impact on cash flow reporting, accounts receivable accuracy, and the timing of revenue recognition.

Importance of Clearing Invoices in Accounting

Clearing invoices ensures accurate financial records by confirming payments are received and outstanding balances are updated, which directly impacts cash flow management. Uncleared invoices can cause discrepancies in accounts receivable, leading to potential audit issues and delayed financial reporting. Maintaining cleared invoices improves transparency, supports regulatory compliance, and enhances the reliability of financial statements.

Common Reasons for Uncleared Invoices

Uncleared invoices often result from missing or incorrect payment details, discrepancies in invoice amounts, or delays in payment processing. Common reasons include disputed charges, incomplete documentation, or failure to apply payments to the correct account. Identifying these issues promptly helps maintain accurate financial records and improves cash flow management.

Impact of Uncleared Invoices on Cash Flow

Uncleared invoices directly reduce available cash flow by representing outstanding receivables that have not yet been converted into liquid assets. These pending payments increase working capital requirements and can strain operational budgets, making it difficult to meet short-term financial obligations. Efficient invoice clearance accelerates cash inflow, stabilizing liquidity and supporting sustained business operations.

Best Practices for Managing Invoice Clearance

Cleared invoices indicate successful payment and accurate account reconciliation, ensuring up-to-date financial records and improved cash flow management. Maintaining a systematic follow-up process and utilizing automated reminder systems help prevent delays in clearing invoices and reduce outstanding receivables. Implementing regular audits and clear communication with vendors streamlines invoice clearance, enhancing overall financial transparency and operational efficiency.

Tools and Software for Tracking Invoice Status

Tools and software such as QuickBooks, FreshBooks, and Xero offer robust features for tracking cleared and uncleared invoices, enabling businesses to monitor payment status in real-time. These platforms utilize automated reminders, status updates, and integration with banking systems to distinguish between outstanding and settled invoices efficiently. Leveraging these tools reduces manual errors and improves cash flow management by providing clear visibility into invoice payment progress.

Tips to Reduce Uncleared Invoices in Your Business

To reduce uncleared invoices in your business, implement clear payment terms specifying deadlines and consequences for late payments. Utilize automated invoicing software to send timely reminders and track outstanding balances efficiently. Offering multiple payment options and incentivizing early payments can also improve cash flow and minimize uncleared invoices.

Important Terms

Payment reconciliation

Payment reconciliation accurately matches cleared invoices against uncleared invoices to ensure correct accounting balances and identify outstanding payments.

Outstanding balance

Outstanding balance reflects the total amount due from uncleared invoices after subtracting payments on cleared invoices.

Remittance status

Remittance status indicates whether payment has been received and applied to a cleared invoice or remains pending for an uncleared invoice.

Settlement date

The settlement date marks when payment is finalized, distinguishing cleared invoices--which reflect completed transactions--from uncleared invoices that await payment processing.

Accounts payable

Accounts payable consists of cleared invoices that have been paid and recorded versus uncleared invoices that remain outstanding and pending payment processing.

Open invoice

Open invoices represent amounts yet to be paid, contrasting cleared invoices which have been fully settled and recorded as paid in accounting systems.

Payment applied

Payment applied to a cleared invoice reduces outstanding balance immediately, while payment applied to an uncleared invoice remains pending until invoice validation is completed.

Ledger posting

Ledger posting distinguishes cleared invoices, which have matched payments recorded, from uncleared invoices that remain outstanding without corresponding payment entries.

Unpaid invoice

Unpaid invoices represent outstanding amounts, with cleared invoices indicating settled payments while uncleared invoices denote pending or disputed payments.

Invoice aging

Invoice aging analysis compares cleared invoices, which have been fully paid, against uncleared invoices that remain outstanding over specified time intervals to assess cash flow and credit risk.

cleared invoice vs uncleared invoice Infographic

moneydif.com

moneydif.com