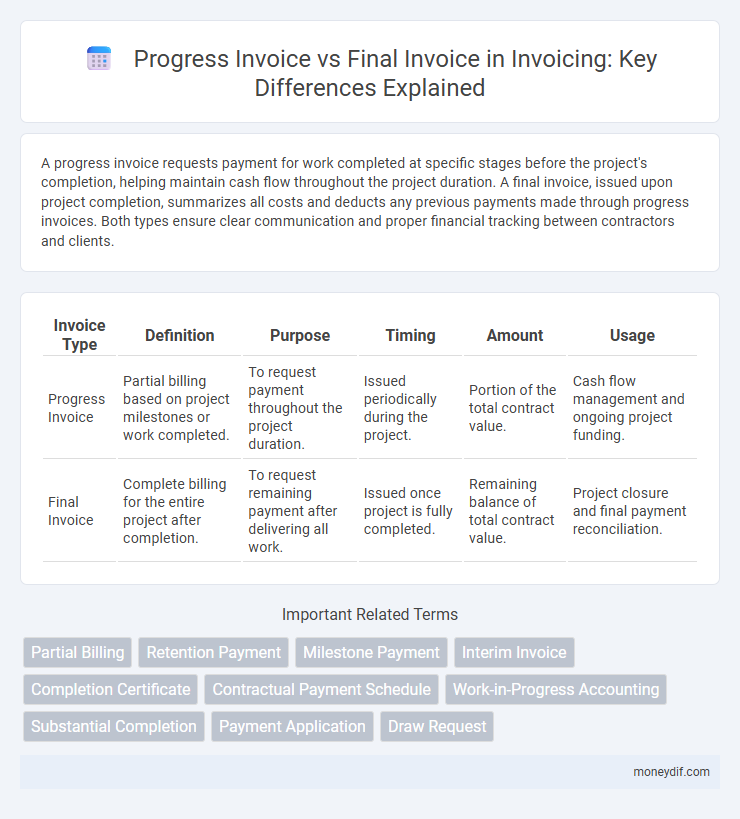

A progress invoice requests payment for work completed at specific stages before the project's completion, helping maintain cash flow throughout the project duration. A final invoice, issued upon project completion, summarizes all costs and deducts any previous payments made through progress invoices. Both types ensure clear communication and proper financial tracking between contractors and clients.

Table of Comparison

| Invoice Type | Definition | Purpose | Timing | Amount | Usage |

|---|---|---|---|---|---|

| Progress Invoice | Partial billing based on project milestones or work completed. | To request payment throughout the project duration. | Issued periodically during the project. | Portion of the total contract value. | Cash flow management and ongoing project funding. |

| Final Invoice | Complete billing for the entire project after completion. | To request remaining payment after delivering all work. | Issued once project is fully completed. | Remaining balance of total contract value. | Project closure and final payment reconciliation. |

Understanding Progress Invoices

Progress invoices provide a detailed record of work completed and costs incurred at specific stages of a project, enabling clients to manage cash flow and track ongoing expenses effectively. These invoices typically specify the percentage of total work finished and correspond to agreed-upon milestone payments within a contract. Unlike final invoices, progress invoices are issued multiple times before project completion, ensuring transparency and continuous financial alignment between service providers and clients.

What is a Final Invoice?

A final invoice is a comprehensive billing document issued at the completion of a project or service, summarizing all costs incurred and payments made. It confirms the total amount due after deducting any progress invoice payments, ensuring clarity and closure for both parties. This invoice includes all outstanding charges, taxes, and adjustments, serving as the official request for the remaining balance.

Key Differences Between Progress and Final Invoices

Progress invoices request partial payments based on completed work or delivered goods, allowing businesses to maintain cash flow during ongoing projects. Final invoices consolidate all previous progress payments and request the remaining balance, marking the completion of the project. Key differences include timing, payment structure, and their role in project milestones or completion verification.

When to Use a Progress Invoice

Progress invoices are used during long-term projects to request partial payments based on completed milestones or a percentage of work finished. These invoices help maintain cash flow without waiting for the entire project to be completed, providing financial stability for contractors and clients. Progress invoices are essential when projects span multiple billing periods or require phased payments before final delivery.

When to Issue a Final Invoice

A final invoice should be issued once all products or services have been delivered and agreed upon by both parties, ensuring that all adjustments, such as previous progress payments or credits, are accounted for. It serves as the conclusive billing document that confirms the project's completion and final payment amount. Issuing the final invoice promptly after project completion helps maintain clear financial records and facilitates timely payment.

Advantages of Progress Invoicing

Progress invoicing allows businesses to improve cash flow by receiving payments at various stages of a project, reducing financial strain and enabling better resource management. It enhances transparency with clients by providing detailed billing for completed work, which helps build trust and minimizes disputes. This approach also supports accurate budgeting and forecasting by aligning expenses and revenues with project milestones.

Benefits of a Final Invoice

A final invoice provides a comprehensive summary of all billed amounts, ensuring clear and accurate documentation for both parties. It facilitates efficient financial reconciliation and serves as a definitive record for tax and auditing purposes. Issuing a final invoice also helps confirm project completion, minimizing the risk of disputes and payment delays.

Progress Invoicing Best Practices

Progress invoicing best practices include issuing invoices that reflect completed work phases to improve cash flow and maintain client trust. Detailed descriptions and accurate percentages of project completion help avoid disputes and ensure transparency. Regular communication with clients about billing milestones enhances project management efficiency and financial planning.

Common Mistakes in Invoicing Phases

Progress invoices often face errors such as inaccurate percentage completion calculations and incomplete documentation, leading to disputes or delayed payments. Final invoices commonly suffer from missing final adjustments, failure to reconcile previous payments, or incorrect tax applications, causing reconciliation issues. Ensuring detailed verification during each invoicing phase reduces errors and enhances cash flow accuracy.

Choosing Between Progress and Final Invoices

Choosing between progress invoices and final invoices depends on the project timeline and cash flow needs. Progress invoices are billed at various project milestones, allowing for steady revenue and improved budget management, while final invoices consolidate all charges upon project completion. Selecting the appropriate invoice type ensures accurate financial tracking and enhances client communication throughout the project lifecycle.

Important Terms

Partial Billing

Partial billing allows clients to pay based on completed project milestones through progress invoices before settling the full amount with a final invoice.

Retention Payment

Retention payment secures contract performance by withholding a percentage from progress invoices, which is released upon approval of the final invoice after project completion.

Milestone Payment

Milestone payments are scheduled based on progress invoices reflecting completed project stages, while the final invoice consolidates all milestone payments into a single, comprehensive billing upon project completion.

Interim Invoice

An interim invoice represents partial payment based on work completed at specific project milestones, differing from a progress invoice which tracks ongoing work stages, while a final invoice consolidates all charges for project completion and settles the remaining balance.

Completion Certificate

A Completion Certificate verifies project completion, triggering issuance of the final invoice, which differs from progress invoices submitted during ongoing work stages.

Contractual Payment Schedule

A Contractual Payment Schedule clearly defines the timing and amounts for progress invoices based on project milestones and the final invoice issued upon project completion and acceptance.

Work-in-Progress Accounting

Work-in-Progress (WIP) Accounting tracks the value of partially completed projects, allowing businesses to record revenue through progress invoices based on the percentage of completion. Final invoices reconcile the total project costs and payments, ensuring accurate recognition of revenue and project profitability upon completion.

Substantial Completion

Substantial Completion marks the stage where progress invoices reflect work nearly finished, while final invoices address remaining tasks and contract closeout.

Payment Application

A progress invoice requests partial payment based on completed work stages, while a final invoice demands full payment upon project completion.

Draw Request

A Draw Request specifies the amount billed for completed work at a project stage, distinguishing progress invoices issued periodically from the final invoice that settles the total contract balance.

progress invoice vs final invoice Infographic

moneydif.com

moneydif.com