Self-billing allows businesses to streamline the invoicing process by generating and issuing invoices on behalf of their customers, enhancing accuracy and reducing administrative burden. Customer-billing requires the customer to create and send invoices, which can lead to delays and inconsistencies in payment processing. Implementing self-billing can improve cash flow management and strengthen supplier-customer relationships by ensuring timely and precise invoicing.

Table of Comparison

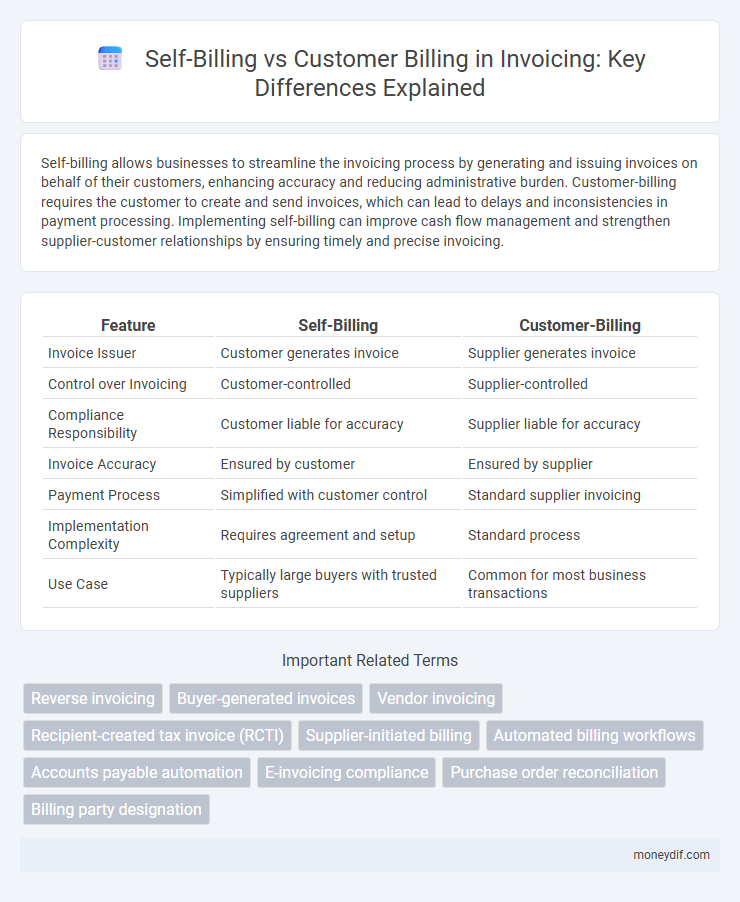

| Feature | Self-Billing | Customer-Billing |

|---|---|---|

| Invoice Issuer | Customer generates invoice | Supplier generates invoice |

| Control over Invoicing | Customer-controlled | Supplier-controlled |

| Compliance Responsibility | Customer liable for accuracy | Supplier liable for accuracy |

| Invoice Accuracy | Ensured by customer | Ensured by supplier |

| Payment Process | Simplified with customer control | Standard supplier invoicing |

| Implementation Complexity | Requires agreement and setup | Standard process |

| Use Case | Typically large buyers with trusted suppliers | Common for most business transactions |

Introduction to Self-Billing and Customer-Billing

Self-billing is an invoicing process where the customer generates the supplier's invoice, enabling streamlined payment and record-keeping. Customer-billing refers to the traditional method where the supplier issues the invoice directly to the customer, maintaining control over invoice accuracy and timing. Both self-billing and customer-billing play crucial roles in financial management and compliance across various industries.

Key Differences Between Self-Billing and Customer-Billing

Self-billing shifts the responsibility of invoice creation from the seller to the buyer, streamlining accounts payable and reducing invoice disputes. Customer-billing requires the seller to generate and send invoices, maintaining control over billing accuracy and timing. Key differences include invoice generation responsibility, control over data, and impact on cash flow management.

How Self-Billing Works in Practice

Self-billing works in practice by the customer preparing the invoice on behalf of the supplier, detailing goods or services received along with agreed prices and quantities. This method requires a prior agreement between both parties to ensure accurate record-keeping and compliance with tax regulations. Automating self-billing can streamline invoice processing, reduce errors, and improve cash flow management for both supplier and customer.

The Customer-Billing Process Explained

The customer-billing process involves the supplier issuing invoices directly to the customer based on agreed terms and delivered goods or services. This process requires accurate documentation, timely invoicing, and clear communication to ensure proper payment tracking and compliance with tax regulations. Customers typically review and approve invoices before processing payment, which helps maintain transparency and reduces billing disputes.

Advantages of Self-Billing for Businesses

Self-billing streamlines the invoicing process by reducing administrative overhead and minimizing errors associated with manual input. This method improves cash flow management as suppliers receive timely payments, enhancing supplier relationships and operational efficiency. Automated invoice generation through self-billing ensures accurate tax compliance and audit trails, supporting better financial control for businesses.

Benefits of Customer-Billing for Suppliers

Customer-billing empowers suppliers with greater control over invoice accuracy and timing, reducing disputes and accelerating payment cycles. This method fosters improved cash flow management and enhances supplier-customer transparency by providing clear, consistent documentation. Enhanced trust and stronger business relationships arise as customers verify charges before payment, minimizing errors and administrative overhead.

Common Challenges in Self-Billing and Customer-Billing

Self-billing often encounters challenges such as data accuracy issues, vendor compliance, and reconciliation difficulties, impacting invoice validation and payment processes. Customer-billing struggles typically involve disputes over invoice correctness, delayed approvals, and integration problems with financial systems, affecting cash flow efficiency. Both billing methods require robust communication and clear agreement terms to minimize discrepancies and ensure transparent transaction records.

Compliance and Legal Considerations

Self-billing requires strict adherence to tax regulations, including obtaining prior approval from tax authorities and maintaining detailed records to ensure compliance. Customer-billing places the responsibility of invoice accuracy and tax reporting on the customer, which may reduce legal risks for the supplier but increases accountability for the buyer. Both methods demand clear contractual agreements to avoid disputes and ensure alignment with local jurisdictional requirements.

Choosing the Right Billing Method for Your Business

Selecting the appropriate billing method hinges on your business model and operational efficiency, with self-billing offering streamlined invoicing by having the customer generate invoices based on delivered goods or services. Customer-billing maintains traditional control where your business issues invoices directly to clients, ensuring accuracy in pricing and terms. Evaluating factors such as cash flow management, administrative capacity, and regulatory compliance helps determine whether self-billing or customer-billing maximizes financial control and reduces billing disputes.

Future Trends in Invoicing: Self-Billing vs Customer-Billing

Future trends in invoicing indicate a rising preference for self-billing due to automation and real-time data accuracy, enabling suppliers to generate invoices that reflect actual transactions immediately. Customer-billing remains relevant in sectors with complex approval workflows, but innovations like AI-driven invoice reconciliation and blockchain-based verification are narrowing the efficiency gap. Integration of cloud-based platforms enhances transparency and traceability, supporting both self-billing and customer-billing models in increasingly digital supply chains.

Important Terms

Reverse invoicing

Reverse invoicing enables the buyer to generate supplier invoices internally, streamlining accounting processes compared to traditional customer-billing methods where the supplier issues the invoice.

Buyer-generated invoices

Buyer-generated invoices in self-billing systems streamline payment processes by allowing customers to create invoices on behalf of suppliers, contrasting with customer-billing where suppliers issue invoices directly to buyers.

Vendor invoicing

Vendor invoicing via self-billing shifts invoice generation responsibility to the customer, enhancing accuracy and payment speed compared to traditional customer-billing methods.

Recipient-created tax invoice (RCTI)

Recipient-created tax invoices (RCTIs) enable recipients to issue self-billing invoices on behalf of suppliers, streamlining customer-billing processes and ensuring accurate tax compliance.

Supplier-initiated billing

Supplier-initiated billing involves the supplier generating invoices which can be compared with self-billing where the customer prepares the invoice, contrasting with customer-billing where the customer initiates payment requests.

Automated billing workflows

Automated billing workflows streamline invoicing by integrating self-billing systems, where customers generate supplier invoices, with customer-billing processes, enhancing accuracy and reducing payment delays.

Accounts payable automation

Accounts payable automation streamlines invoice processing by enabling self-billing, where suppliers generate invoices based on customer data, reducing errors and payment delays compared to traditional customer-billing methods.

E-invoicing compliance

E-invoicing compliance mandates accurate alignment between self-billing and customer-billing processes to ensure tax audit readiness and reduce invoice discrepancies.

Purchase order reconciliation

Purchase order reconciliation ensures accuracy by matching self-billing invoices generated by suppliers with customer-billing records to resolve discrepancies and streamline accounts payable processes.

Billing party designation

Billing party designation determines whether the supplier issues the invoice (self-billing) or the customer generates the invoice on behalf of the supplier (customer-billing) based on agreed contractual terms.

self-billing vs customer-billing Infographic

moneydif.com

moneydif.com