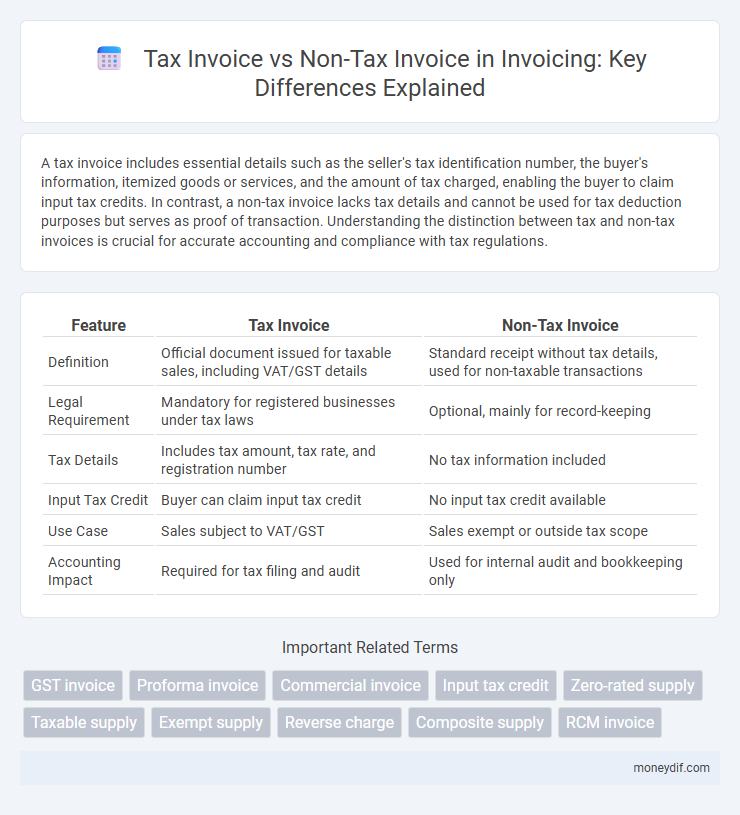

A tax invoice includes essential details such as the seller's tax identification number, the buyer's information, itemized goods or services, and the amount of tax charged, enabling the buyer to claim input tax credits. In contrast, a non-tax invoice lacks tax details and cannot be used for tax deduction purposes but serves as proof of transaction. Understanding the distinction between tax and non-tax invoices is crucial for accurate accounting and compliance with tax regulations.

Table of Comparison

| Feature | Tax Invoice | Non-Tax Invoice |

|---|---|---|

| Definition | Official document issued for taxable sales, including VAT/GST details | Standard receipt without tax details, used for non-taxable transactions |

| Legal Requirement | Mandatory for registered businesses under tax laws | Optional, mainly for record-keeping |

| Tax Details | Includes tax amount, tax rate, and registration number | No tax information included |

| Input Tax Credit | Buyer can claim input tax credit | No input tax credit available |

| Use Case | Sales subject to VAT/GST | Sales exempt or outside tax scope |

| Accounting Impact | Required for tax filing and audit | Used for internal audit and bookkeeping only |

Definition of Tax Invoice

A tax invoice is an official document issued by a registered seller containing detailed information such as the seller's and buyer's tax identification numbers, the date of supply, description and quantity of goods or services, and the amount charged including applicable taxes like VAT or GST. This document serves as proof that tax has been collected and is essential for buyers to claim input tax credits or tax deductions. Unlike non-tax invoices, tax invoices comply with government tax regulations and are required for transactions subject to sales tax or value-added tax.

Definition of Non-Tax Invoice

A non-tax invoice is a financial document issued for transactions that do not involve value-added tax (VAT) or sales tax, typically used in exempted or non-taxable sales. It records the essential details of a sale, such as date, buyer and seller information, description of goods or services, and the total amount payable without including any tax amount. Non-tax invoices are crucial for proper accounting and proof of transaction in sectors or cases where tax liability does not apply.

Key Differences Between Tax Invoice and Non-Tax Invoice

A tax invoice includes detailed tax information such as GST or VAT registration numbers, tax rates, and the exact amount of tax charged, which is essential for legal compliance and tax credit claims. A non-tax invoice, however, lacks tax details and is typically used for transactions not subject to tax or for internal record-keeping. The key difference lies in the tax compliance requirements and the ability to claim input tax credits, making tax invoices mandatory for taxable supplies.

Legal Requirements for Tax Invoices

Tax invoices must comply with specific legal requirements, including the display of the seller's tax identification number, invoice date, unique invoice number, and clear description of taxable goods or services. Non-tax invoices are not bound by these regulations and generally lack mandatory tax details, making them unsuitable for input tax credit claims. Compliance with tax invoice regulations ensures valid documentation for tax reporting and deduction purposes under applicable tax laws.

Legal Requirements for Non-Tax Invoices

Non-tax invoices must comply with specific legal requirements including clear identification of the seller and buyer, detailed description of goods or services, transaction date, and total amount payable without tax breakdown. They are essential for businesses exempt from VAT registration or transactions outside VAT scope, ensuring transparency and compliance with local fiscal regulations. Failure to issue legally compliant non-tax invoices can result in penalties and hinder financial record accuracy.

Components of a Tax Invoice

A tax invoice contains essential components such as the supplier's name, address, and tax identification number, the invoice date, and a unique invoice number for tracking. It must detail the description, quantity, and unit price of goods or services provided, along with the total amount excluding and including applicable taxes like VAT or GST. The tax amount charged and the buyer's information are mandatory elements that distinguish a tax invoice from a non-tax invoice, ensuring compliance with tax regulations and enabling tax credits.

Components of a Non-Tax Invoice

A non-tax invoice includes essential components such as the seller's and buyer's names and addresses, a unique invoice number, the date of issue, a detailed description of goods or services provided, quantity, unit price, and the total amount payable without tax breakdowns. Unlike a tax invoice, it does not display tax identification numbers or VAT/GST amounts, making it unsuitable for tax credit claims. This document serves as a proof of transaction primarily for record-keeping and payment purposes in non-taxable or exempt sales.

When to Issue a Tax Invoice

A tax invoice must be issued when a business supplies goods or services subject to Value Added Tax (VAT) or Goods and Services Tax (GST), ensuring compliance with tax regulations and enabling input tax credit claims. Failure to provide a tax invoice can result in penalties and the inability for the buyer to claim VAT or GST credits. Non-tax invoices are appropriate for transactions exempt from VAT/GST or for internal records that do not require tax authority validation.

When to Use a Non-Tax Invoice

A non-tax invoice is used when the transaction is exempt from value-added tax (VAT) or involves a supplier not registered for VAT, ensuring compliance with tax regulations. It is essential for documenting sales where VAT is not applicable, such as sales to non-taxable entities or exports. Proper issuance of non-tax invoices helps businesses maintain accurate records and avoid penalties during tax audits.

Implications for Businesses and Tax Compliance

Tax invoices are essential for businesses to claim input tax credits and comply with VAT or GST regulations, ensuring proper documentation for tax authorities. Non-tax invoices do not qualify for input tax credit claims and may lead to compliance issues or penalties if used incorrectly in taxable transactions. Accurate differentiation between tax and non-tax invoices is critical for maintaining transparent financial records and meeting legal tax obligations.

Important Terms

GST invoice

A GST invoice must include specific tax details such as GSTIN, invoice number, and tax amount, distinguishing it from a non-tax invoice which lacks these mandatory components for tax compliance.

Proforma invoice

A Proforma invoice serves as a preliminary bill of sale and does not qualify as a tax invoice, which is legally required for tax reporting and input tax credit claims, while a non-tax invoice lacks tax details and cannot be used for tax deductions.

Commercial invoice

A commercial invoice serves as a tax invoice when it includes detailed tax information, such as GST or VAT, whereas a non-tax invoice lacks such tax details and is used solely for transactional documentation.

Input tax credit

Input tax credit (ITC) can only be claimed when a valid tax invoice is received from a registered supplier, as it serves as proof of the tax paid on purchases. Transactions supported by non-tax invoices, such as receipts or bills without GST details, do not qualify for ITC under the Goods and Services Tax regulations.

Zero-rated supply

Zero-rated supplies require a tax invoice to claim input tax credits, whereas non-tax invoices do not fulfill this requirement and cannot be used for tax credit claims.

Taxable supply

A taxable supply refers to a transaction subject to value-added tax (VAT) or goods and services tax (GST), requiring a tax invoice that details the supplier, recipient, amount, and tax charged for compliance and input tax credit claims. Non-tax invoices lack the required tax details, rendering them invalid for claiming input tax credits and failing to meet tax authority documentation standards.

Exempt supply

Exempt supply transactions do not require a tax invoice because they are outside the scope of GST, unlike taxable supplies that must be documented with a tax invoice for tax credit claims.

Reverse charge

Reverse charge mandates the recipient to account for VAT on a non-tax invoice transaction, shifting tax liability from the supplier to the buyer.

Composite supply

Composite supply involves bundling multiple goods or services taxed as a single supply under GST regulations, requiring issuance of a tax invoice to ensure accurate tax credit claims by recipients. In contrast, non-tax invoices are used for transactions exempt from GST or outside its scope, thus not impacting input tax credits or taxable turnover reporting.

RCM invoice

RCM invoices distinguish tax invoices, which include applicable GST for reverse charge mechanisms, from non-tax invoices that do not attract GST liability.

tax invoice vs non-tax invoice Infographic

moneydif.com

moneydif.com