Intercompany invoices involve transactions between different legal entities within the same corporate group, ensuring compliance with tax regulations and accurate financial reporting. Intracompany invoices occur within a single legal entity, typically representing allocations or internal chargebacks without affecting external accounting. Understanding the distinction between these invoice types is essential for managing intercompany reconciliations and maintaining transparent interdepartmental costing.

Table of Comparison

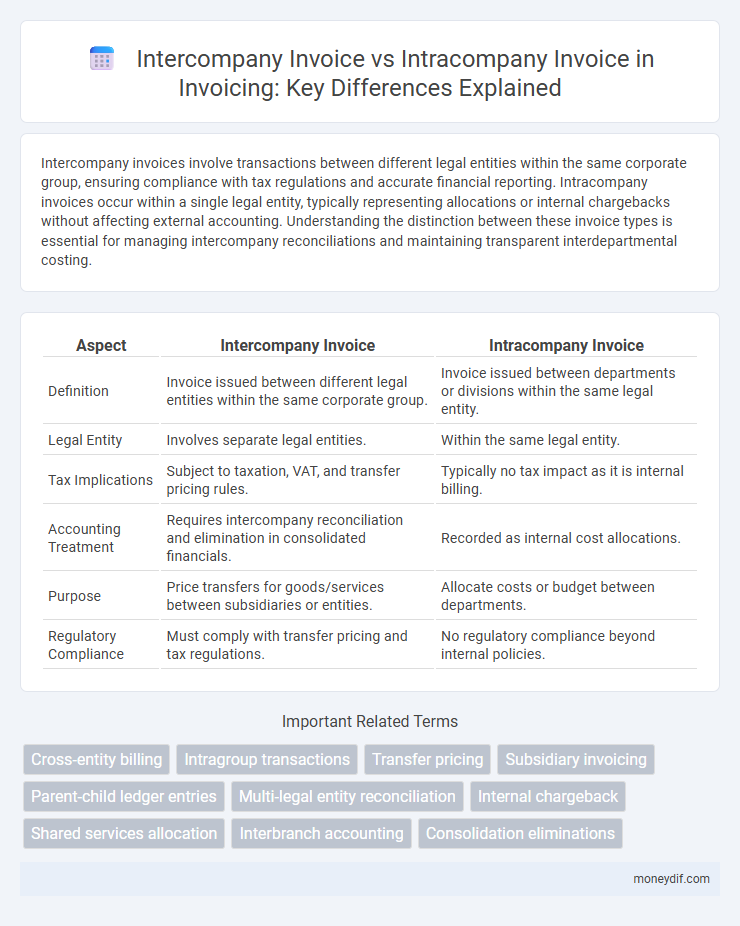

| Aspect | Intercompany Invoice | Intracompany Invoice |

|---|---|---|

| Definition | Invoice issued between different legal entities within the same corporate group. | Invoice issued between departments or divisions within the same legal entity. |

| Legal Entity | Involves separate legal entities. | Within the same legal entity. |

| Tax Implications | Subject to taxation, VAT, and transfer pricing rules. | Typically no tax impact as it is internal billing. |

| Accounting Treatment | Requires intercompany reconciliation and elimination in consolidated financials. | Recorded as internal cost allocations. |

| Purpose | Price transfers for goods/services between subsidiaries or entities. | Allocate costs or budget between departments. |

| Regulatory Compliance | Must comply with transfer pricing and tax regulations. | No regulatory compliance beyond internal policies. |

Understanding Intercompany and Intracompany Invoices

Intercompany invoices occur between separate legal entities within the same corporate group, ensuring proper accounting and compliance with tax regulations across jurisdictions. Intracompany invoices, on the other hand, happen within the same legal entity but across different departments or divisions, facilitating internal cost allocation and budget tracking. Clear distinction and accurate processing of both invoice types optimize financial transparency and internal control in corporate finance management.

Key Differences Between Intercompany and Intracompany Invoices

Intercompany invoices occur between separate legal entities within the same corporate group, facilitating transactions that require clear tax and regulatory compliance, while intracompany invoices are internal chargebacks within a single entity used for cost allocation and internal budgeting. Intercompany invoices often involve formal documentation, currency conversion, and intercompany agreements, whereas intracompany invoices typically streamline internal processes without the complexity of external reporting. Understanding these distinctions is critical for accurate financial consolidation, tax reporting, and transfer pricing management.

Purpose and Importance of Intercompany Invoicing

Intercompany invoicing facilitates the accurate allocation of costs and revenues between different legal entities within a corporate group, ensuring compliance with tax regulations and transfer pricing policies. It is crucial for maintaining transparent financial records, supporting consolidated financial statements, and optimizing tax liabilities across jurisdictions. Proper intercompany invoicing minimizes audit risks and enhances accountability by clearly documenting internal transactions between separate companies.

When to Use Intracompany Invoices

Intracompany invoices are used when transactions occur between different departments or divisions within the same legal entity, facilitating internal cost allocation and budget tracking. These invoices ensure transparency in resource usage and support accurate internal financial reporting without involving external tax implications. Use intracompany invoices to monitor internal services, transfer assets, or allocate shared expenses efficiently.

Legal and Tax Implications

Intercompany invoices involve transactions between separate legal entities within a corporate group, triggering distinct legal and tax obligations such as transfer pricing compliance, VAT registration, and potential cross-border tax liabilities. Intracompany invoices occur within the same legal entity, generally simplifying tax reporting and eliminating inter-entity transfer pricing requirements but still requiring accurate internal cost allocation for financial transparency. Understanding the legal boundaries and tax regulations governing these invoices is essential to avoid penalties, double taxation, and ensure audit readiness.

Documentation and Compliance Requirements

Intercompany invoices require detailed documentation including transfer pricing agreements, tax compliance records, and adherence to international trade regulations to ensure transparency and avoid double taxation. Intracompany invoices primarily focus on internal audit trails and cost allocation documentation within the same legal entity, simplifying compliance by avoiding external tax reporting. Proper maintenance of these documents ensures regulatory compliance, supports financial accuracy, and mitigates legal risks related to intercompany and intracompany transactions.

Common Challenges in Intercompany vs Intracompany Invoicing

Intercompany invoicing often faces complexities such as transfer pricing compliance, currency conversion discrepancies, and cross-border tax regulations, unlike intracompany invoicing which deals primarily with internal cost allocations and budget tracking within a single legal entity. Intercompany transactions require stringent documentation and reconciliation processes to prevent audit risks and ensure regulatory adherence, whereas intracompany invoices focus on internal chargebacks and resource utilization monitoring. Both demand integrated financial systems, but intercompany invoicing necessitates more robust controls due to the involvement of multiple jurisdictions and accounting standards.

Best Practices for Efficient Invoice Management

Intercompany invoices involve transactions between separate legal entities within the same corporate group, requiring strict adherence to compliance, accurate tax treatment, and clear documentation to avoid audit issues. Intracompany invoices, on the other hand, occur within different departments or divisions of the same legal entity, focusing on internal cost allocation and budget control. Best practices for efficient invoice management include automating invoice processing, implementing centralized approval workflows, and maintaining transparent record-keeping to ensure accuracy and timely reconciliation.

Technology Solutions for Invoice Automation

Intercompany invoices involve transactions between different legal entities within the same corporate group, requiring advanced technology solutions for accurate reconciliation, tax compliance, and currency conversion in invoice automation. Intracompany invoices occur between departments or divisions within a single legal entity, where automated workflows streamline internal chargebacks and resource allocation without complex external reporting. Invoice automation platforms leveraging AI and machine learning optimize both intercompany and intracompany invoicing by reducing manual errors, accelerating approval cycles, and enhancing audit trails.

Case Studies: Real-World Examples

Case studies reveal that intercompany invoices commonly occur between legally separate entities within the same corporate group, facilitating transparent cost allocation and compliance with transfer pricing regulations, such as multinational firms like Siemens managing cross-border transactions. Intracompany invoices, by contrast, are used internally within a single legal entity to track department-specific expenses or internal services, exemplified by companies like IBM implementing internal chargebacks to optimize departmental budgeting. These real-world examples underscore the importance of accurate invoicing practices to ensure regulatory compliance and enhance financial visibility in complex organizational structures.

Important Terms

Cross-entity billing

Cross-entity billing involves generating intercompany invoices for transactions between separate legal entities, whereas intracompany invoices manage internal charges within the same legal entity.

Intragroup transactions

Intragroup transactions involve intercompany invoices between separate legal entities within a corporate group, while intracompany invoices typically refer to internal chargebacks or cost allocations within the same legal entity.

Transfer pricing

Transfer pricing governs pricing strategies for intercompany invoices between distinct legal entities within a multinational corporation, whereas intracompany invoices pertain to transactions within a single legal entity and typically do not involve transfer pricing regulations.

Subsidiary invoicing

Subsidiary invoicing involves intercompany invoices for transactions between separate legal entities within a corporate group, whereas intracompany invoices are internal charges within the same legal entity.

Parent-child ledger entries

Parent-child ledger entries differentiate intercompany invoices, which involve transactions between separate legal entities within a corporate group, from intracompany invoices that occur within divisions of the same entity, ensuring accurate intercompany reconciliation and consolidated financial reporting.

Multi-legal entity reconciliation

Multi-legal entity reconciliation ensures accuracy by matching intercompany invoices between separate legal entities and differentiating them from intracompany invoices within a single entity for streamlined financial reporting.

Internal chargeback

Internal chargeback involves allocating costs between departments within the same company, while intercompany invoices refer to transactions between separate legal entities of a corporate group, and intracompany invoices apply to transactions within the same legal entity.

Shared services allocation

Shared services allocation involves distributing costs of centralized functions like IT or HR across multiple business units, often requiring clear distinction between intercompany invoices--transactions between separate legal entities within a corporate group--and intracompany invoices, which occur within the same legal entity but different departments or cost centers. Accurate allocation ensures compliance with transfer pricing regulations for intercompany invoices and facilitates internal cost management for intracompany invoicing.

Interbranch accounting

Interbranch accounting distinguishes intercompany invoices, which record transactions between separate legal entities within a corporate group, from intracompany invoices that track internal transactions between different departments or branches of the same legal entity. Accurate classification of these invoices ensures compliance with tax regulations and enhances financial transparency by clearly reflecting cost allocation and revenue recognition across corporate structures.

Consolidation eliminations

Consolidation eliminations require removing intercompany invoices between distinct legal entities to prevent double-counting, whereas intracompany invoices within the same legal entity do not require elimination.

intercompany invoice vs intracompany invoice Infographic

moneydif.com

moneydif.com