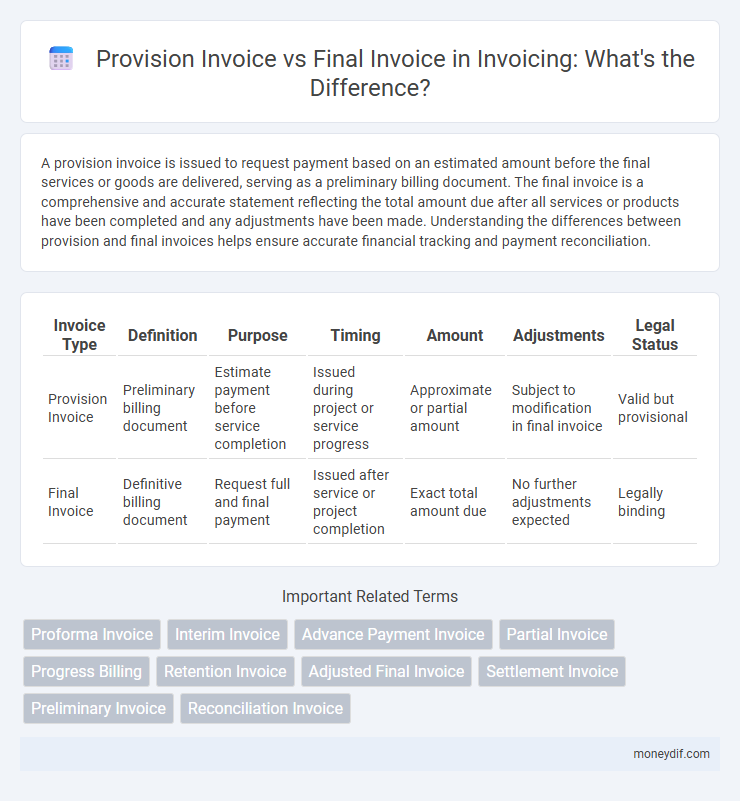

A provision invoice is issued to request payment based on an estimated amount before the final services or goods are delivered, serving as a preliminary billing document. The final invoice is a comprehensive and accurate statement reflecting the total amount due after all services or products have been completed and any adjustments have been made. Understanding the differences between provision and final invoices helps ensure accurate financial tracking and payment reconciliation.

Table of Comparison

| Invoice Type | Definition | Purpose | Timing | Amount | Adjustments | Legal Status |

|---|---|---|---|---|---|---|

| Provision Invoice | Preliminary billing document | Estimate payment before service completion | Issued during project or service progress | Approximate or partial amount | Subject to modification in final invoice | Valid but provisional |

| Final Invoice | Definitive billing document | Request full and final payment | Issued after service or project completion | Exact total amount due | No further adjustments expected | Legally binding |

Understanding Provision Invoice: Definition and Purpose

A provision invoice is a preliminary billing document issued before the completion of goods or services, estimating the expected payment based on partial delivery or work progress. It helps manage cash flow and financial planning by providing an early indication of costs. Unlike a final invoice, a provision invoice is adjustable and reconciled once the project or delivery is fully completed.

What is a Final Invoice? Key Characteristics

A final invoice is a conclusive billing document issued after the completion of goods or services, reflecting the total amount due, inclusive of any prior provisional invoices and adjustments. It confirms that all agreed-upon work has been completed, providing a definitive record for both the seller and buyer. Key characteristics include a detailed summary of total charges, clear payment terms, and the conclusive status of the transaction.

Core Differences Between Provision Invoice and Final Invoice

Provision invoices are issued as preliminary billing documents estimating the cost of goods or services before project completion, serving as advance payments or partial charges. Final invoices include the exact amount due after all goods have been delivered or services rendered, reflecting adjustments, discounts, or additional charges. The core differences lie in timing, accuracy of amounts, and their role in the payment process within financial transactions.

When to Issue a Provision Invoice in the Billing Cycle

A provision invoice is issued during the billing cycle to document estimated charges before the final amount is confirmed, typically used when services or goods are partially delivered or work is in progress. This invoice helps organizations record anticipated revenue and manage cash flow by providing an interim billing statement. Issuing a provision invoice early ensures transparency and aids in financial planning while awaiting the accurate figures for the final invoice.

Steps to Transition from Provision Invoice to Final Invoice

Transitioning from a provision invoice to a final invoice involves verifying the accuracy of all listed items and confirming that the agreed-upon services or goods have been fully delivered. Adjustments should be made to account for any additional charges, discounts, or corrections identified during the service period. Once all details are reconciled, the final invoice is issued to formally document the completed transaction and trigger payment.

Legal Implications of Provision and Final Invoices

Provision invoices create a preliminary legal obligation to pay, but they may not reflect the final agreed amount, leading to potential disputes if discrepancies arise. Final invoices serve as definitive documentation for payment and often trigger the start of statutory payment terms and legal enforcement rights. Understanding the legal implications ensures accurate financial reporting and compliance with contractual and tax regulations.

Impact on Accounting: Provision vs Final Invoice

Provision invoices create estimated liabilities on financial statements, affecting profit and loss recognition before the actual service or goods delivery. Final invoices adjust these estimates by recording the exact amounts, ensuring accurate revenue and expense reporting in accounting periods. Misalignment between provision and final invoices can lead to discrepancies in financial records and impact compliance with accounting standards.

Common Use Cases for Provision Invoices

Provision invoices are frequently used in construction projects to account for work in progress before project completion, allowing businesses to record estimated costs and revenues timely. In service industries, provision invoices help manage partial deliveries by billing clients for services rendered up to a certain point, ensuring steady cash flow. These invoices also serve to align financial records with ongoing contracts, aiding in budgeting and financial forecasting.

Best Practices for Managing Final Invoices

Managing final invoices requires verifying that all provisional invoices and adjustments are accurately consolidated to reflect the total payment due. Ensure clear documentation of any changes made after the provisional invoice to avoid discrepancies and facilitate smoother payment processing. Employ automated invoicing systems to streamline tracking, reduce errors, and maintain consistent communication with clients regarding final invoice status.

Choosing the Right Invoice Type for Your Business

Selecting the appropriate invoice type is crucial for accurate financial tracking and cash flow management. A provision invoice serves as an estimated billing document issued before the final work completion or product delivery, helping businesses secure preliminary payments. The final invoice reflects the exact charges after all services or goods are delivered, ensuring precise accounting and client transparency.

Important Terms

Proforma Invoice

A Proforma Invoice is a preliminary document issued before the final invoice, detailing estimated costs and terms to facilitate order approval and customs clearance.

Interim Invoice

An interim invoice provides a partial payment request during project progress, contrasting with a final invoice that demands full payment upon project completion.

Advance Payment Invoice

An Advance Payment Invoice secures funds before service delivery, while a Provision Invoice accounts for estimated costs during a project, and the Final Invoice confirms actual expenses and settles the remaining balance.

Partial Invoice

A partial invoice represents a portion of the total amount billed, issued during project progress, while a final invoice consolidates all previous partial invoices and captures the full remaining balance due.

Progress Billing

Progress billing requires issuing provision invoices for completed work stages before submitting the final invoice that summarizes the total contract value and adjustments.

Retention Invoice

Retention invoices secure payment guarantees by withholding a percentage from the provision invoice until the completion and approval of the final invoice.

Adjusted Final Invoice

The Adjusted Final Invoice reconciles differences between the Provision Invoice and the Final Invoice by updating amounts to reflect actual costs and completed deliverables.

Settlement Invoice

A settlement invoice reconciles payments by comparing the provision invoice, issued as an initial estimate of costs, with the final invoice that reflects the actual charges after services or goods have been delivered.

Preliminary Invoice

A Preliminary Invoice serves as an initial billing document outlining estimated costs before finalizing services or goods, helping manage cash flow and client expectations. In contrast, a Final Invoice confirms the exact amounts due after all provisions are accounted for, ensuring complete and accurate payment reconciliation.

Reconciliation Invoice

A reconciliation invoice compares provision invoices against final invoices to ensure accurate billing and resolve discrepancies in estimated versus actual costs.

provision invoice vs final invoice Infographic

moneydif.com

moneydif.com