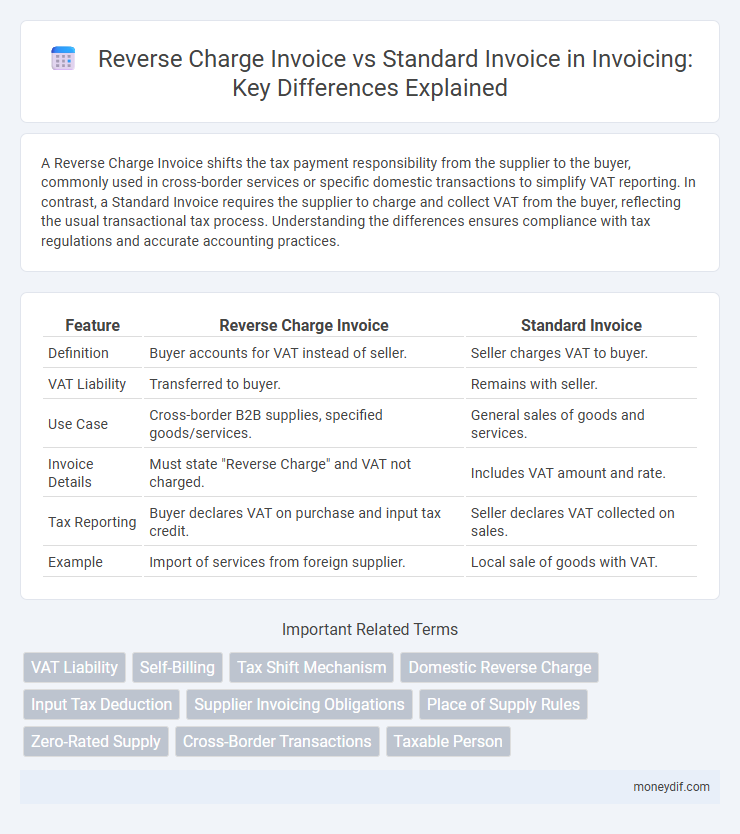

A Reverse Charge Invoice shifts the tax payment responsibility from the supplier to the buyer, commonly used in cross-border services or specific domestic transactions to simplify VAT reporting. In contrast, a Standard Invoice requires the supplier to charge and collect VAT from the buyer, reflecting the usual transactional tax process. Understanding the differences ensures compliance with tax regulations and accurate accounting practices.

Table of Comparison

| Feature | Reverse Charge Invoice | Standard Invoice |

|---|---|---|

| Definition | Buyer accounts for VAT instead of seller. | Seller charges VAT to buyer. |

| VAT Liability | Transferred to buyer. | Remains with seller. |

| Use Case | Cross-border B2B supplies, specified goods/services. | General sales of goods and services. |

| Invoice Details | Must state "Reverse Charge" and VAT not charged. | Includes VAT amount and rate. |

| Tax Reporting | Buyer declares VAT on purchase and input tax credit. | Seller declares VAT collected on sales. |

| Example | Import of services from foreign supplier. | Local sale of goods with VAT. |

Understanding Reverse Charge Invoice

Reverse charge invoice shifts VAT payment responsibility from the supplier to the recipient, streamlining tax compliance in cross-border or specific domestic transactions. This mechanism helps prevent VAT fraud by ensuring the buyer accounts for the tax directly to the revenue authorities, rather than the supplier charging VAT upfront. Understanding reverse charge invoices is essential for businesses operating under VAT regimes to correctly process tax liabilities and avoid penalties.

What is a Standard Invoice?

A standard invoice is a commercial document issued by a seller to a buyer that details the products or services provided, including quantities, prices, taxes, and payment terms. It serves as a formal request for payment and typically includes the seller's tax identification number, invoice date, and payment due date. Standard invoices are used in regular transactions where the seller is responsible for charging and remitting VAT to tax authorities.

Key Differences Between Reverse Charge and Standard Invoices

Reverse charge invoices shift the tax liability from the supplier to the buyer, requiring the buyer to self-assess and pay VAT directly to the tax authorities, unlike standard invoices where the supplier charges and collects VAT. Standard invoices include VAT charged by the supplier, which the buyer can usually reclaim as input tax, whereas reverse charge invoices omit VAT amounts since the buyer accounts for VAT independently. This key difference affects bookkeeping, compliance, and cash flow management for businesses operating under VAT systems.

Legal Framework for Reverse Charge Invoices

The legal framework for reverse charge invoices mandates that the buyer, rather than the supplier, is responsible for reporting and paying the VAT to the tax authorities, as outlined in VAT Directive 2006/112/EC within the European Union. This mechanism applies primarily to cross-border transactions and specific domestic cases to prevent VAT fraud and ensure proper tax collection. Compliance with local tax laws and accurate documentation are crucial to validate reverse charge invoicing and avoid penalties.

When to Use a Reverse Charge Invoice

A Reverse Charge Invoice must be used when the liability to pay VAT shifts from the supplier to the recipient, commonly in cross-border B2B transactions within the EU or for certain domestic services like construction. This mechanism ensures VAT compliance when the supplier is not established in the recipient's country or when specific goods and services fall under reverse charge regulations. Businesses must verify local tax laws and transaction nature to determine the correct invoicing method and avoid VAT discrepancies.

Impact on VAT Reporting and Compliance

Reverse charge invoices shift the VAT liability from the supplier to the recipient, significantly affecting VAT reporting by requiring buyers to self-account for VAT, streamlining cross-border transactions and reducing supplier compliance burden. Standard invoices include VAT charged by the supplier, necessitating precise recording and remittance of VAT collected, which increases the administrative responsibility on the supplier. Accurate VAT reporting under reverse charge ensures compliance with tax authorities, minimizing risks of penalties or audits related to misreported VAT liabilities.

Required Fields in Reverse Charge vs Standard Invoices

Reverse charge invoices require specific fields such as the mention of "reverse charge," supplier's and recipient's VAT identification numbers, and the tax amount must be indicated as payable by the customer, while standard invoices include details like invoice number, date, supplier and buyer information, description of goods or services, quantity, price, tax rates, and total amount payable by the supplier. Reverse charge invoices do not display the VAT amount charged by the supplier; instead, the recipient is responsible for reporting VAT in their tax return. Both invoice types must comply with local tax regulations, but reverse charge invoices emphasize clear identification of the VAT liability shift to the purchaser.

Common Mistakes and How to Avoid Them

Common mistakes in Reverse Charge Invoice include incorrectly applying VAT rates, failing to state the reverse charge mechanism clearly, and omitting necessary supplier and customer details, leading to tax compliance issues. Standard Invoice errors often involve inaccurate tax calculations, missing invoice numbers or dates, and incomplete descriptions of goods or services, resulting in delayed payments or audits. Avoid these issues by cross-checking VAT regulations, using invoice templates tailored for reverse charge or standard invoicing, and verifying all mandatory fields before issue.

Industry Examples: Reverse Charge and Standard Invoice Usage

In the construction and manufacturing industries, reverse charge invoices are commonly used to shift VAT payment responsibility to the buyer, minimizing tax evasion and simplifying audits. Standard invoices dominate retail and service sectors where suppliers charge VAT directly to customers, ensuring transparent tax collection. E-commerce and cross-border transactions increasingly apply reverse charge mechanisms to comply with complex VAT regulations across jurisdictions.

Best Practices for Managing Both Invoice Types

Implement clear documentation protocols to distinguish reverse charge invoices from standard invoices, ensuring compliance with VAT regulations and audit readiness. Automate invoice processing using accounting software that supports VAT reverse charge mechanisms to reduce errors and improve efficiency. Regularly train finance teams on the specific requirements and legal obligations associated with both invoice types to maintain accuracy and streamline tax reporting.

Important Terms

VAT Liability

Reverse charge invoices shift VAT liability from the supplier to the buyer, whereas standard invoices require the supplier to account for and remit VAT to tax authorities.

Self-Billing

Self-billing shifts invoicing responsibility to the buyer, requiring accurate handling of reverse charge invoices to ensure VAT compliance compared to standard supplier-issued invoices.

Tax Shift Mechanism

The Tax Shift Mechanism reallocates VAT liability from supplier to buyer, making Reverse Charge Invoices crucial for compliance by shifting tax payment responsibility unlike Standard Invoices where the supplier accounts for VAT.

Domestic Reverse Charge

Domestic Reverse Charge invoices shift VAT payment responsibility from the supplier to the customer, contrasting with standard invoices where the supplier accounts for VAT.

Input Tax Deduction

Input tax deduction on a reverse charge invoice requires the recipient to account for both the output and input tax, whereas a standard invoice allows the supplier to charge and the recipient to claim input tax directly.

Supplier Invoicing Obligations

Supplier invoicing obligations require issuing a reverse charge invoice for services subject to VAT reverse charge mechanism, whereas a standard invoice applies for regular VAT transactions without reverse charge requirements.

Place of Supply Rules

Place of Supply rules determine the tax jurisdiction for transactions, requiring reverse charge invoices when the recipient is liable for GST payment instead of the supplier, unlike standard invoices where the supplier charges and remits the tax.

Zero-Rated Supply

Zero-rated supply involves goods or services taxed at 0%, requiring reverse charge invoices when the recipient accounts for VAT, unlike standard invoices where the supplier charges VAT directly.

Cross-Border Transactions

Cross-border transactions often require careful application of reverse charge invoice mechanisms to shift VAT liability to the recipient, contrasting with standard invoices where the supplier accounts for VAT.

Taxable Person

A taxable person must apply the reverse charge mechanism on cross-border services by issuing a reverse charge invoice, whereas a standard invoice is used for regular domestic transactions where the supplier charges VAT.

Reverse Charge Invoice vs Standard Invoice Infographic

moneydif.com

moneydif.com