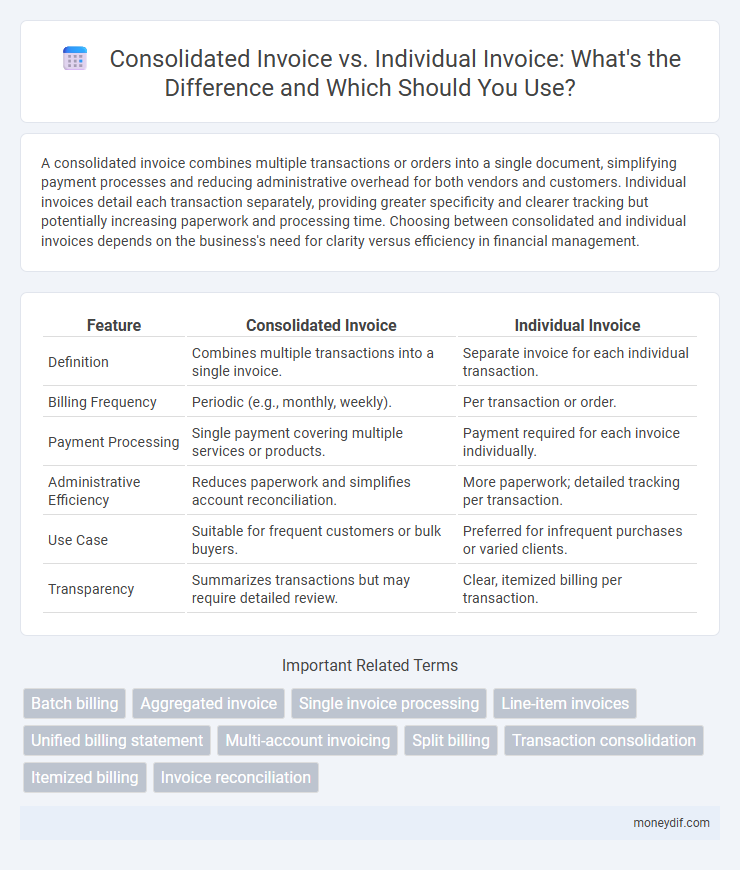

A consolidated invoice combines multiple transactions or orders into a single document, simplifying payment processes and reducing administrative overhead for both vendors and customers. Individual invoices detail each transaction separately, providing greater specificity and clearer tracking but potentially increasing paperwork and processing time. Choosing between consolidated and individual invoices depends on the business's need for clarity versus efficiency in financial management.

Table of Comparison

| Feature | Consolidated Invoice | Individual Invoice |

|---|---|---|

| Definition | Combines multiple transactions into a single invoice. | Separate invoice for each individual transaction. |

| Billing Frequency | Periodic (e.g., monthly, weekly). | Per transaction or order. |

| Payment Processing | Single payment covering multiple services or products. | Payment required for each invoice individually. |

| Administrative Efficiency | Reduces paperwork and simplifies account reconciliation. | More paperwork; detailed tracking per transaction. |

| Use Case | Suitable for frequent customers or bulk buyers. | Preferred for infrequent purchases or varied clients. |

| Transparency | Summarizes transactions but may require detailed review. | Clear, itemized billing per transaction. |

Understanding Consolidated vs Individual Invoices

Consolidated invoices combine multiple transactions or orders into a single document, simplifying payment processing and reducing administrative efforts for both businesses and clients. Individual invoices, on the other hand, are issued for each specific transaction, offering clearer tracking of expenses and detailed transaction records. Choosing between consolidated and individual invoices depends on billing frequency, client preferences, and the complexity of the services or products involved.

Key Differences Between Consolidated and Individual Invoices

Consolidated invoices combine multiple transactions or orders into a single document, simplifying payment processing for clients by reducing the number of invoices they need to manage. Individual invoices detail each transaction separately, providing granular clarity and ease of tracking for specific purchases or services. Businesses choose between these formats based on volume, client preference, and the need for detailed financial reporting.

Benefits of Using Consolidated Invoices

Consolidated invoices streamline payment processing by combining multiple charges into a single document, reducing administrative workload and minimizing errors. This approach enhances cash flow management by providing a clear overview of all outstanding payments, facilitating faster reconciliation and improved budgeting. Businesses benefit from cost savings on postage and paper while promoting sustainable practices through reduced paper usage.

Advantages of Individual Invoicing

Individual invoicing offers precise tracking and management of each transaction, enhancing accuracy in financial records and simplifying dispute resolution. It enables clients to review detailed charges for specific goods or services, improving transparency and trust in business relationships. This method also supports better cash flow control by allowing targeted payment terms and schedules for each invoice.

When to Choose Consolidated Invoicing

Consolidated invoicing is ideal for businesses supplying multiple products or services to the same client within a billing period, simplifying payment processing and reducing administrative costs. It enhances cash flow management by consolidating several transactions into a single invoice, improving client convenience and reducing payment delays. Companies with high transaction volumes or recurring orders benefit from consolidated invoices to streamline accounting and improve financial reporting accuracy.

Best Scenarios for Individual Invoices

Individual invoices are ideal for businesses requiring detailed transaction records per client or project, facilitating precise payment tracking and dispute resolution. They improve cash flow management by allowing clients to pay specific invoices independently, reducing complexity in accounts receivable. Small businesses and freelancers benefit from issuing individual invoices when dealing with multiple clients or varied services, ensuring clarity and simplifying accounting processes.

Impact on Accounting and Bookkeeping

Consolidated invoices streamline accounting and bookkeeping by reducing the number of entries, simplifying transaction tracking, and improving cash flow management. Individual invoices provide detailed transaction records, enhancing accuracy and facilitating audit processes but increase administrative workload. Choosing between consolidated and individual invoices affects the efficiency of financial reporting and the precision of accounts receivable management.

Streamlining Payments with Consolidated Invoices

Consolidated invoices combine multiple charges into a single document, simplifying payment processes and reducing administrative workload for both vendors and clients. This method enhances cash flow management by providing a clear overview of all transactions within a billing period. Businesses leveraging consolidated invoicing experience improved payment accuracy and faster reconciliation compared to handling numerous individual invoices.

Challenges and Risks of Each Invoicing Method

Consolidated invoices reduce administrative burden by combining multiple transactions into a single bill but pose challenges such as payment delays and difficulty in tracking specific charges, increasing the risk of disputes. Individual invoices offer clear transaction details, enhancing accuracy and ease of payment reconciliation; however, they generate higher processing costs and can overwhelm both the issuer and recipient with volume. Businesses must balance these risks against operational capacity, cash flow impact, and customer preferences to select the most efficient invoicing method.

Selecting the Right Invoicing Method for Your Business

Selecting the right invoicing method depends on your business's transaction volume and client preferences. Consolidated invoices combine multiple charges into a single document, streamlining payment processing and reducing administrative overhead, ideal for frequent or bulk transactions. Individual invoices offer detailed billing for each transaction, providing clarity and precise record-keeping, which suits businesses needing granular invoice tracking or dealing with diverse services.

Important Terms

Batch billing

Batch billing streamlines payment by grouping multiple charges into a consolidated invoice, reducing administrative tasks compared to issuing separate individual invoices for each transaction.

Aggregated invoice

Aggregated invoices combine multiple individual invoices into a single consolidated invoice to streamline billing, reduce administrative costs, and improve payment efficiency for businesses managing numerous transactions.

Single invoice processing

Single invoice processing enhances efficiency by consolidating multiple transactions into one comprehensive bill, reducing administrative overhead and minimizing errors compared to handling individual invoices separately. Consolidated invoices provide a streamlined overview of total charges, whereas individual invoices offer detailed records for each transaction, impacting reconciliation and payment workflows.

Line-item invoices

Line-item invoices provide detailed charges for each product or service, enabling clear comparison between consolidated invoices that summarize multiple transactions and individual invoices that itemize single transactions.

Unified billing statement

A unified billing statement consolidates multiple individual invoices into a single document to streamline payment processing and improve financial tracking.

Multi-account invoicing

Multi-account invoicing enables businesses to streamline billing by consolidating charges from multiple accounts into a single invoice, reducing administrative costs and simplifying payment processes. Consolidated invoices aggregate transactions across accounts for a unified billing statement, whereas individual invoices provide separate, detailed billing for each account, offering granular expense tracking.

Split billing

Split billing enables clients to divide charges across multiple accounts or departments, optimizing budget management and expense tracking. Choosing between a consolidated invoice, which aggregates multiple charges into one document, and individual invoices, which itemize each transaction separately, depends on the company's accounting preferences and the complexity of billing requirements.

Transaction consolidation

Transaction consolidation enhances financial efficiency by combining multiple individual invoices into a single consolidated invoice, reducing administrative costs and simplifying payment processing.

Itemized billing

Itemized billing enhances transparency by detailing each charge on a consolidated invoice, allowing clients to review multiple services or purchases in one comprehensive document. In contrast, individual invoices separate charges for each transaction, which can simplify accounting for discrete expenses but may increase administrative workload and reduce clarity in overall spending.

Invoice reconciliation

Invoice reconciliation improves financial accuracy by comparing consolidated invoices, which aggregate multiple charges, against individual invoices for each transaction or service.

Consolidated invoice vs Individual invoice Infographic

moneydif.com

moneydif.com