Electronic invoices streamline billing processes by enabling faster delivery and automated data entry, reducing errors and administrative costs compared to paper invoices. Paper invoices often lead to delays in processing and increased risk of loss or damage, making electronic alternatives more reliable and efficient for businesses aiming to enhance cash flow management. Embracing electronic invoicing supports sustainability initiatives by minimizing paper usage and environmental impact.

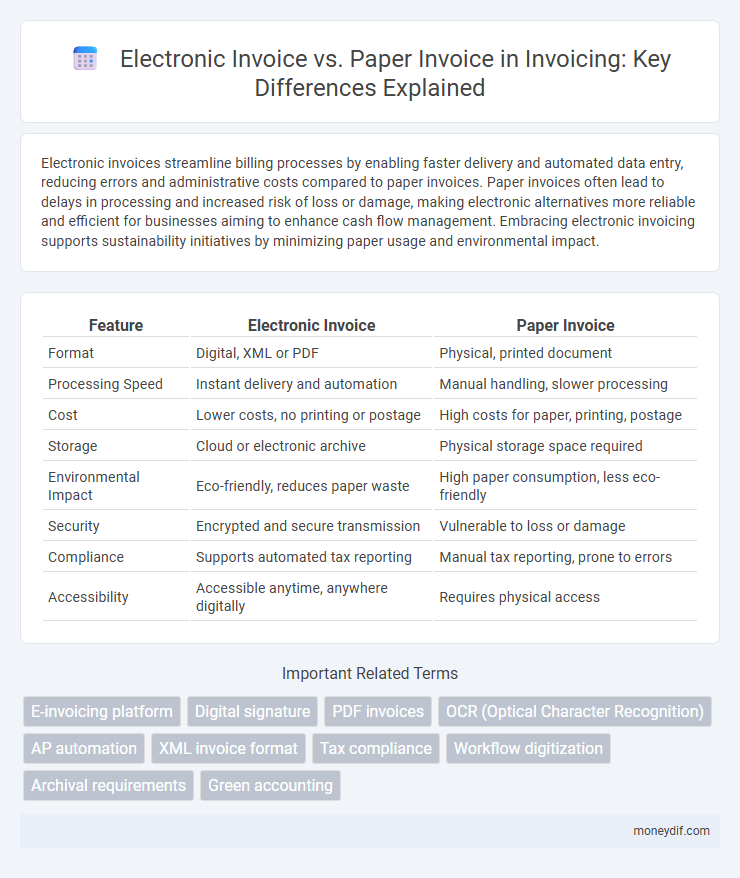

Table of Comparison

| Feature | Electronic Invoice | Paper Invoice |

|---|---|---|

| Format | Digital, XML or PDF | Physical, printed document |

| Processing Speed | Instant delivery and automation | Manual handling, slower processing |

| Cost | Lower costs, no printing or postage | High costs for paper, printing, postage |

| Storage | Cloud or electronic archive | Physical storage space required |

| Environmental Impact | Eco-friendly, reduces paper waste | High paper consumption, less eco-friendly |

| Security | Encrypted and secure transmission | Vulnerable to loss or damage |

| Compliance | Supports automated tax reporting | Manual tax reporting, prone to errors |

| Accessibility | Accessible anytime, anywhere digitally | Requires physical access |

Introduction to Electronic and Paper Invoices

Electronic invoices streamline billing by enabling digital creation, transmission, and storage, reducing errors and accelerating payment processes. Paper invoices rely on physical documents that require manual handling, increasing the risk of loss and processing delays. Transitioning to electronic invoicing enhances accuracy, compliance, and sustainability in financial management.

Key Differences Between Electronic and Paper Invoices

Electronic invoices offer faster processing times, automated data entry, and reduced paper usage compared to paper invoices, which require manual handling and physical storage. Electronic invoices enable real-time tracking and integration with accounting software, enhancing accuracy and efficiency, whereas paper invoices are prone to errors and delays. Cost savings with electronic invoicing stem from reduced printing, postage, and administrative overhead, making it a more sustainable and scalable solution for businesses.

Benefits of Electronic Invoicing

Electronic invoicing significantly reduces processing time and minimizes human errors compared to paper invoices, leading to improved accuracy and faster payment cycles. It enhances security through encrypted digital transmission and automated audit trails, ensuring compliance with regulatory standards. Cost savings are substantial due to reduced paper usage, printing, postage, and storage expenses, making electronic invoicing a more sustainable and efficient solution for businesses.

Advantages of Traditional Paper Invoices

Traditional paper invoices provide a tangible record that enhances trust and accountability for businesses and customers, enabling easy physical archiving and straightforward signature verification. They are universally accepted across all industries and regions, requiring no special technology or software for processing, which simplifies usage in areas with limited digital infrastructure. Paper invoices also reduce cybersecurity risks by eliminating concerns over data breaches and electronic fraud, preserving sensitive financial information in a controlled physical environment.

Cost Comparison: Electronic vs Paper Invoicing

Electronic invoicing significantly reduces costs by eliminating paper, printing, and postage expenses, leading to average savings of 60-80% compared to traditional paper invoices. Automation in electronic invoicing decreases manual processing time and errors, which further cuts operational costs by approximately 50%. Organizations adopting electronic invoicing report faster payment cycles and improved cash flow, enhancing overall financial efficiency.

Impact on Workflow and Efficiency

Electronic invoices streamline workflow by enabling automated data entry, reducing manual errors, and accelerating approval processes, leading to enhanced operational efficiency. Paper invoices require manual handling, increasing processing time and the likelihood of mistakes, which slows down payment cycles and burdens administrative resources. Transitioning to electronic invoicing integrates seamlessly with digital accounting systems, improving accuracy and enabling real-time tracking of invoice status.

Environmental Considerations

Electronic invoices significantly reduce paper consumption, lowering deforestation and waste production compared to traditional paper invoices. Digital invoicing decreases the carbon footprint by eliminating the need for physical transportation and storage, contributing to more sustainable business practices. Adopting electronic invoicing supports environmental conservation efforts by minimizing resource use and promoting energy efficiency throughout the billing process.

Security and Compliance Aspects

Electronic invoices employ advanced encryption protocols and secure digital signatures to protect sensitive financial data, significantly reducing the risk of fraud and unauthorized access compared to paper invoices. Compliance with regulations such as GDPR, HIPAA, and e-invoicing standards like PEPPOL ensures electronic invoices maintain data integrity and meet audit requirements. Paper invoices, while tangible, are more susceptible to loss, tampering, and non-compliance with evolving digital record-keeping mandates.

Transitioning from Paper to Electronic Invoices

Transitioning from paper invoices to electronic invoices significantly reduces processing time and minimizes errors by automating data entry through advanced OCR and integration with accounting software. Electronic invoices enhance payment tracking and compliance with tax regulations via real-time digital records, supporting audit readiness and financial transparency. Businesses adopting electronic invoicing experience cost savings from reduced paper usage, storage expenses, and faster invoice reconciliation cycles.

Choosing the Right Invoicing Solution for Your Business

Electronic invoices streamline payment processing by reducing errors and accelerating transaction times, making them ideal for businesses aiming to improve cash flow and operational efficiency. Paper invoices, while traditional, often incur higher costs due to printing, mailing, and storage, posing challenges for scalability and environmental sustainability. Selecting the right invoicing solution depends on factors such as business size, volume of transactions, integration capabilities with accounting software, and the need for real-time tracking and compliance with digital invoicing regulations.

Important Terms

E-invoicing platform

E-invoicing platforms streamline the issuance, delivery, and storage of electronic invoices, reducing errors and processing time compared to traditional paper invoices. Electronic invoices enhance compliance with tax regulations, improve cash flow management, and support sustainability by eliminating paper waste.

Digital signature

Digital signatures enhance electronic invoices by ensuring data integrity, authenticity, and non-repudiation, significantly reducing the risk of fraud compared to paper invoices. Electronic invoicing with digital signatures streamlines processing, accelerates payment cycles, and supports compliance with legal regulations such as eIDAS in the EU.

PDF invoices

Electronic invoices streamline financial processes by enabling faster delivery, automated data entry, and enhanced accuracy compared to traditional paper invoices that require manual handling and physical storage. PDF invoices serve as a versatile format bridging both methods, offering the clarity of paper invoices with the convenience of digital distribution and archival.

OCR (Optical Character Recognition)

OCR technology significantly improves the efficiency and accuracy of processing electronic invoices compared to manual handling of paper invoices by automating data extraction and reducing human errors.

AP automation

AP automation using electronic invoices streamlines processing, reduces errors, cuts costs, and accelerates payment cycles compared to manual paper invoice handling.

XML invoice format

XML invoice format enables precise data structuring for electronic invoices, facilitating automated processing, improved accuracy, and seamless integration with accounting systems compared to paper invoices. Electronic invoicing using XML reduces operational costs, accelerates transaction cycles, and enhances compliance with tax regulations by ensuring standardized digital documentation.

Tax compliance

Electronic invoices enhance tax compliance by ensuring accurate, real-time data reporting and reducing errors compared to paper invoices.

Workflow digitization

Workflow digitization enhances efficiency by automating electronic invoice processing, reducing errors and accelerating approval cycles compared to manual handling of paper invoices. Electronic invoices enable seamless data integration, real-time tracking, and compliance with tax regulations, significantly cutting operational costs linked to printing, mailing, and storage of paper invoices.

Archival requirements

Electronic invoices must comply with legal archival requirements, ensuring digital storage integrity, readability, and accessibility over time as mandated by regulations such as the European Union's eIDAS or the U.S. IRS standards. Unlike paper invoices stored physically, electronic invoices benefit from encrypted digital preservation, automated backup systems, and easier retrieval processes, significantly reducing risks of loss or damage while supporting audit trails and compliance verification.

Green accounting

Green accounting evaluates the environmental impact of business practices, highlighting that electronic invoices significantly reduce carbon emissions and paper waste compared to traditional paper invoices. Transitioning to electronic invoicing supports sustainable operations by minimizing resource consumption and enhancing efficiency in financial transactions.

Electronic invoice vs Paper invoice Infographic

moneydif.com

moneydif.com