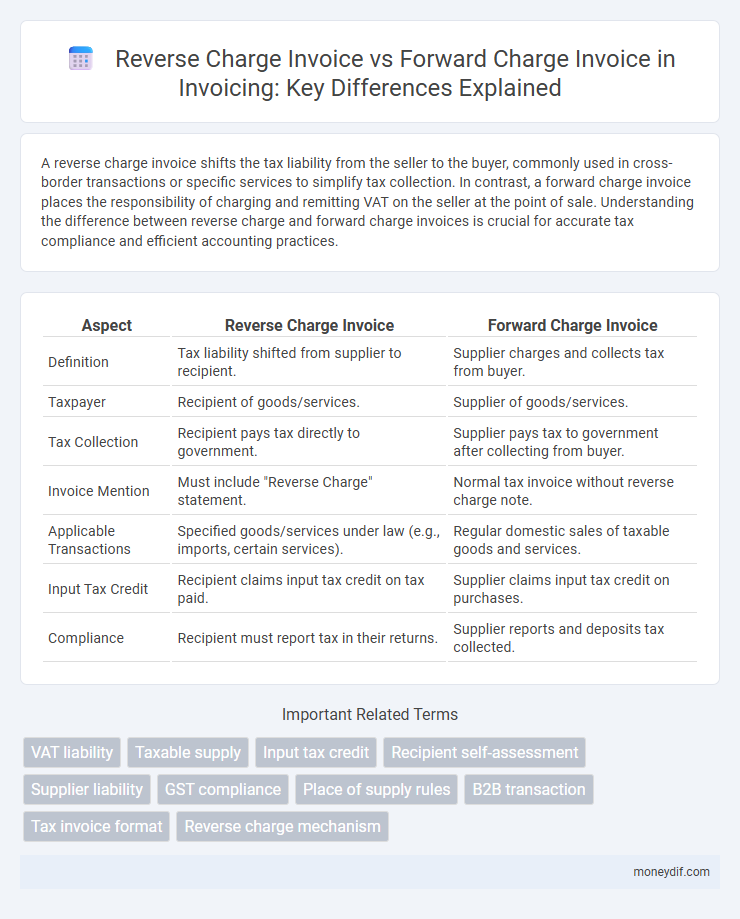

A reverse charge invoice shifts the tax liability from the seller to the buyer, commonly used in cross-border transactions or specific services to simplify tax collection. In contrast, a forward charge invoice places the responsibility of charging and remitting VAT on the seller at the point of sale. Understanding the difference between reverse charge and forward charge invoices is crucial for accurate tax compliance and efficient accounting practices.

Table of Comparison

| Aspect | Reverse Charge Invoice | Forward Charge Invoice |

|---|---|---|

| Definition | Tax liability shifted from supplier to recipient. | Supplier charges and collects tax from buyer. |

| Taxpayer | Recipient of goods/services. | Supplier of goods/services. |

| Tax Collection | Recipient pays tax directly to government. | Supplier pays tax to government after collecting from buyer. |

| Invoice Mention | Must include "Reverse Charge" statement. | Normal tax invoice without reverse charge note. |

| Applicable Transactions | Specified goods/services under law (e.g., imports, certain services). | Regular domestic sales of taxable goods and services. |

| Input Tax Credit | Recipient claims input tax credit on tax paid. | Supplier claims input tax credit on purchases. |

| Compliance | Recipient must report tax in their returns. | Supplier reports and deposits tax collected. |

Introduction to Reverse Charge and Forward Charge Invoices

Reverse charge invoices shift the tax liability from the supplier to the buyer, commonly used in cross-border transactions within the EU to simplify VAT collection. Forward charge invoices require the supplier to charge and collect VAT from the buyer, which is the standard VAT invoicing method for domestic sales. Understanding the distinction between reverse charge and forward charge invoices is crucial for compliance with tax regulations and accurate VAT reporting.

What is a Reverse Charge Invoice?

A Reverse Charge Invoice shifts the tax liability from the seller to the buyer, requiring the buyer to report and pay the applicable VAT directly to the tax authorities. This mechanism is commonly used in cross-border transactions within the European Union and in specific domestic scenarios to prevent tax evasion and simplify tax collection. Unlike a Forward Charge Invoice, where the seller charges and remits VAT, the Reverse Charge Invoice omits VAT from the seller's invoice, placing the responsibility on the purchaser.

What is a Forward Charge Invoice?

A Forward Charge Invoice is a billing document issued by a seller to a buyer that includes the applicable value-added tax (VAT) or sales tax, which the buyer pays directly to the seller. This type of invoice is common in domestic transactions where the seller is responsible for collecting and remitting the tax to the authorities. Forward charge invoices detail the taxable amount, tax rate, and total payable, ensuring compliance with tax regulations and clear payment obligations.

Key Differences Between Reverse Charge and Forward Charge

Reverse charge invoices shift the tax liability from the supplier to the recipient, commonly used in cross-border services and specific domestic transactions to simplify tax collection and reduce evasion. Forward charge invoices place the tax obligation on the supplier who collects and remits GST or VAT directly to the tax authorities, typical for most domestic sales of goods and services. Key differences revolve around who is responsible for tax payment, invoice issuance, and compliance procedures under GST or VAT frameworks.

Legal Requirements for Reverse Charge Invoices

Reverse charge invoices must comply with specific legal requirements, including clear identification of the reverse charge mechanism on the invoice, such as explicit mention of "reverse charge" and the appropriate GST or VAT registration numbers of both supplier and recipient. These invoices do not show the tax amount charged by the supplier but require the recipient to self-account for the tax, ensuring compliance with tax regulations and avoidance of tax evasion. Failure to meet these legal mandates can result in penalties and invalidation of input tax credits for the recipient.

When to Use Forward Charge Invoicing

Forward charge invoicing is used when the supplier is responsible for charging and collecting VAT from the customer, typically in domestic transactions where the supplier and buyer are in the same VAT jurisdiction. It applies to the sale of goods or services where the supplier must include the VAT amount on the invoice, reflecting the transaction value and tax rate applicable. This method ensures compliance with standard tax regulations, particularly when dealing with taxable supplies within a single country.

Tax Implications for Both Invoicing Methods

Reverse charge invoices shift the responsibility of VAT payment from the supplier to the recipient, reducing the supplier's tax compliance obligations and mitigating VAT fraud risks, particularly in cross-border EU transactions. Forward charge invoices require the supplier to charge and collect VAT from the buyer, increasing the supplier's tax reporting duties and cash flow impact due to upfront VAT collection and remittance. Understanding VAT treatment differences in reverse charge versus forward charge invoicing ensures accurate tax filings, compliance with local tax laws, and effective cash flow management for both parties.

Common Scenarios for Reverse Charge Application

Reverse charge invoices commonly apply in cross-border transactions within the European Union, where the buyer accounts for VAT instead of the seller. This mechanism also applies to domestic supplies of specific goods and services, such as construction services or electronic devices sold by unregistered dealers. In these scenarios, reverse charge shifts the VAT liability to the recipient, simplifying tax compliance and reducing fraud risks.

Documentation and Record-Keeping Best Practices

Maintain detailed documentation for both reverse charge and forward charge invoices, including supplier details, tax rates, and transaction dates to ensure compliance with tax authorities. For reverse charge invoices, record the recipient's tax liability and ensure the tax is accounted for in the purchaser's tax return, while forward charge invoices require accurate display of tax charged by the supplier. Implement a systematic record-keeping system that allows easy retrieval of invoice copies, audit trails, and proof of tax payment to minimize discrepancies and support tax audits.

Choosing the Right Invoicing Method for Your Business

Selecting the appropriate invoicing method--reverse charge invoice or forward charge invoice--depends on your business's tax obligations and the nature of the transaction. Reverse charge invoices shift VAT liability to the recipient, commonly used in cross-border B2B transactions within the EU to simplify tax reporting. Forward charge invoices assign VAT responsibility to the supplier, making it essential for businesses to understand local tax regulations to ensure compliance and accurate accounting.

Important Terms

VAT liability

VAT liability shifts to the buyer under a reverse charge invoice, while the seller is responsible for VAT payment under a forward charge invoice.

Taxable supply

A reverse charge invoice shifts the tax liability from the supplier to the recipient for a taxable supply, whereas a forward charge invoice assigns tax responsibility to the supplier issuing the invoice.

Input tax credit

Input tax credit eligibility depends on whether a reverse charge invoice or forward charge invoice is issued, with reverse charge requiring the recipient to pay GST and claim credit, while forward charge involves the supplier charging GST directly to the recipient.

Recipient self-assessment

Recipient self-assessment requires the buyer to account for VAT under the reverse charge mechanism, shifting tax liability from the supplier to the recipient, unlike the forward charge invoice where the supplier charges and collects VAT. This process enhances VAT compliance by ensuring accurate tax reporting and payment on cross-border transactions and certain domestic services.

Supplier liability

Supplier liability under reverse charge invoice shifts tax payment responsibility from the supplier to the recipient, whereas under forward charge invoice, the supplier is directly liable for charging and remitting the tax.

GST compliance

GST compliance mandates that businesses correctly classify transactions as either reverse charge or forward charge invoices to ensure accurate tax reporting and payment. Under reverse charge mechanism, the recipient of goods or services is liable to pay GST directly to the government, whereas in forward charge, the supplier is responsible for charging and remitting GST on the invoice value.

Place of supply rules

Place of supply rules determine the location where a transaction is taxed, influencing whether reverse charge or forward charge invoicing applies in cross-border and intra-state transactions. Reverse charge invoices obligate the recipient to pay tax when the supplier is outside the recipient's jurisdiction, whereas forward charge invoices require the supplier to collect and remit tax when supplying goods or services within their own tax territory.

B2B transaction

In B2B transactions, a reverse charge invoice shifts the VAT liability from the seller to the buyer, commonly used in cross-border or specific domestic supplies to simplify tax compliance. A forward charge invoice requires the seller to charge and collect VAT from the buyer, standard in most domestic sales where the seller is responsible for VAT reporting.

Tax invoice format

Reverse charge invoices require the recipient to pay the tax directly to the government, while forward charge invoices mandate the supplier to collect and remit the tax.

Reverse charge mechanism

The reverse charge mechanism shifts VAT liability from the supplier to the recipient, requiring a reverse charge invoice that differs from a forward charge invoice where the supplier charges and collects VAT.

Reverse charge invoice vs Forward charge invoice Infographic

moneydif.com

moneydif.com