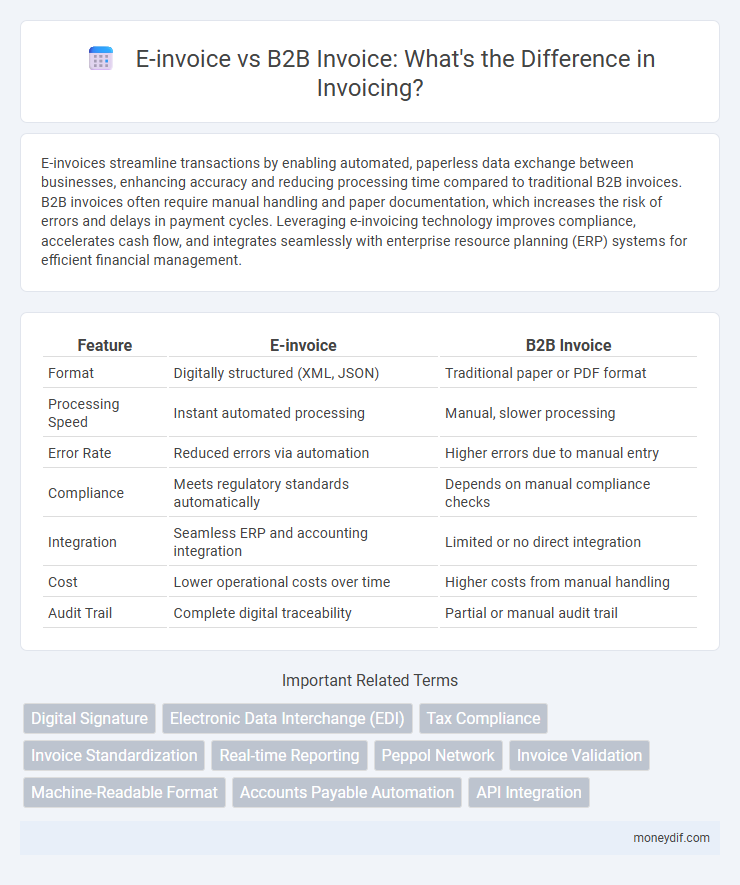

E-invoices streamline transactions by enabling automated, paperless data exchange between businesses, enhancing accuracy and reducing processing time compared to traditional B2B invoices. B2B invoices often require manual handling and paper documentation, which increases the risk of errors and delays in payment cycles. Leveraging e-invoicing technology improves compliance, accelerates cash flow, and integrates seamlessly with enterprise resource planning (ERP) systems for efficient financial management.

Table of Comparison

| Feature | E-invoice | B2B Invoice |

|---|---|---|

| Format | Digitally structured (XML, JSON) | Traditional paper or PDF format |

| Processing Speed | Instant automated processing | Manual, slower processing |

| Error Rate | Reduced errors via automation | Higher errors due to manual entry |

| Compliance | Meets regulatory standards automatically | Depends on manual compliance checks |

| Integration | Seamless ERP and accounting integration | Limited or no direct integration |

| Cost | Lower operational costs over time | Higher costs from manual handling |

| Audit Trail | Complete digital traceability | Partial or manual audit trail |

Introduction to E-Invoice and B2B Invoice

E-invoices are digital invoices exchanged electronically between businesses, ensuring faster processing and enhanced accuracy compared to traditional paper methods. B2B invoices specifically refer to transactions between businesses, often requiring compliance with regulatory standards and integration with enterprise resource planning (ERP) systems. The adoption of e-invoicing in B2B transactions streamlines payment cycles, reduces errors, and supports real-time audit capabilities.

Key Differences Between E-Invoice and B2B Invoice

E-invoices are digital documents generated, transmitted, and stored electronically using standardized formats and platforms, ensuring real-time processing and compliance with tax authorities. B2B invoices, while often digital, primarily refer to billing transactions between businesses without mandatory integration into government e-invoicing systems or standardized data exchange protocols. Key differences include automation level, legal compliance requirements, and data interoperability, with e-invoicing offering enhanced accuracy, faster validation, and reduced processing costs in B2B transactions.

Legal and Regulatory Requirements

E-invoices comply with strict legal frameworks, ensuring authenticity, integrity, and non-repudiation through digital signatures and certified platforms mandated by tax authorities. B2B invoices must follow specific regulatory requirements, including VAT reporting and electronic archiving, to maintain audit trails and facilitate cross-border transactions. Adherence to jurisdictional standards like the EU's e-invoicing directive or India's GST e-invoice system is critical for legal validity and avoiding penalties.

Workflow and Automation Comparison

E-invoice workflows streamline document exchange through automated data capture and real-time validation, significantly reducing manual entry errors compared to traditional B2B invoices that often rely on manual processing and paper-based communication. Automation in E-invoicing leverages integration with ERP systems and digital signature technologies, enhancing efficiency and compliance, whereas B2B invoice workflows typically require manual approval and reconciliation efforts. The adoption of E-invoicing accelerates payment cycles and improves transparency by enabling seamless electronic data interchange (EDI) between trading partners.

Data Security and Compliance

E-invoices enhance data security by utilizing encryption and secure transmission protocols, reducing the risk of data breaches compared to traditional B2B invoices. Compliance with regulations such as GDPR and e-invoicing standards like PEPPOL ensures legal validity and audit readiness. Automated validation and secure archiving further strengthen compliance and protect sensitive financial information in B2B transactions.

Integration with Accounting Systems

E-invoices offer seamless integration with accounting systems through standardized XML or JSON formats, enabling automated data capture and reducing manual entry errors. B2B invoices often require customized interfaces or middleware for compatibility with diverse ERP platforms, which can increase processing time and costs. Efficient integration enhances real-time financial reporting and accelerates payment cycles in both invoicing methods.

Cost Efficiency and ROI

E-invoices significantly reduce processing costs by automating data entry and minimizing paper usage compared to traditional B2B invoices, leading to faster payment cycles and improved cash flow. Implementing e-invoicing solutions enhances ROI through lower administrative overhead and decreased error rates, resulting in substantial operational savings. Businesses that adopt e-invoicing experience higher cost efficiency by streamlining invoice processing and accelerating financial reconciliation.

Adoption Challenges and Solutions

E-invoice adoption faces challenges such as integration with existing enterprise resource planning (ERP) systems, compliance with diverse regulatory standards, and ensuring data security during transmission. B2B invoice processes often involve manual handling and paper-based workflows, leading to inefficiencies and errors, which e-invoicing seeks to eliminate. Solutions include standardized e-invoice formats like XML or UBL, cloud-based platforms facilitating seamless integration, and robust encryption protocols ensuring secure, real-time data exchange between trading partners.

Industry Use Cases and Examples

E-invoices streamline transactions by enabling automated data exchange between businesses, reducing manual errors, and accelerating payment cycles in industries like manufacturing and retail. B2B invoices, often tailored to specific contractual terms, are prevalent in sectors such as logistics and wholesale, where detailed itemization and compliance documentation are critical. For instance, automotive suppliers leverage e-invoicing for real-time order tracking, while construction firms rely on B2B invoices to manage multi-tier subcontractor payments efficiently.

Future Trends in Electronic Invoicing

Future trends in electronic invoicing emphasize automated data exchange through blockchain technology, enhancing security and transparency in both E-invoice and B2B invoice processes. Artificial intelligence integration improves fraud detection and error reduction, streamlining transactional workflows across international supply chains. Regulatory compliance increasingly mandates real-time reporting and standardized digital formats, driving widespread adoption of interoperable e-invoicing platforms globally.

Important Terms

Digital Signature

Digital signatures enhance security and authenticity in e-invoices, ensuring tamper-proof B2B transactions and compliance with legal standards.

Electronic Data Interchange (EDI)

Electronic Data Interchange (EDI) streamlines B2B invoicing by automating e-invoice transmission, enhancing accuracy, compliance, and payment efficiency.

Tax Compliance

E-invoice systems enhance tax compliance by automating real-time transaction reporting compared to traditional B2B invoices, reducing errors and improving regulatory transparency.

Invoice Standardization

Invoice standardization enhances accuracy and efficiency by aligning e-invoices with B2B invoice formats, enabling seamless digital transaction processing and compliance across business networks.

Real-time Reporting

Real-time reporting in e-invoicing enables instantaneous submission and verification of invoices with tax authorities, reducing errors and enhancing compliance compared to traditional B2B invoicing methods. This process streamlines financial workflows by providing immediate access to transaction data, improving transparency and accelerating reconciliation between businesses.

Peppol Network

The Peppol Network facilitates seamless electronic invoicing by standardizing B2B invoice transmission across international borders, enhancing interoperability and compliance with e-invoicing regulations. Leveraging Peppol's secure infrastructure reduces manual processing errors and accelerates invoice approval cycles, significantly optimizing cash flow management for businesses.

Invoice Validation

Invoice validation ensures accuracy and compliance by cross-checking invoice data against purchase orders and tax regulations, which is crucial for both e-invoices and B2B invoices to prevent discrepancies and payment delays. E-invoice validation leverages automated digital verification processes for real-time error detection, while B2B invoice validation often involves manual or semi-automated checks tailored to business-specific contractual terms.

Machine-Readable Format

Machine-readable formats in e-invoices enable seamless automated processing and validation, enhancing efficiency and accuracy compared to traditional B2B invoice formats.

Accounts Payable Automation

Accounts Payable Automation enhances efficiency by integrating E-invoice processing, which standardizes digital invoices for easy validation, compared to traditional B2B invoices that often require manual handling and data entry. Implementing E-invoicing within Accounts Payable workflows reduces errors, accelerates payment cycles, and improves compliance with regulatory standards, significantly lowering operational costs for businesses.

API Integration

API integration streamlines E-invoice processing by enabling real-time data exchange and compliance verification compared to traditional B2B invoice methods.

E-invoice vs B2B invoice Infographic

moneydif.com

moneydif.com