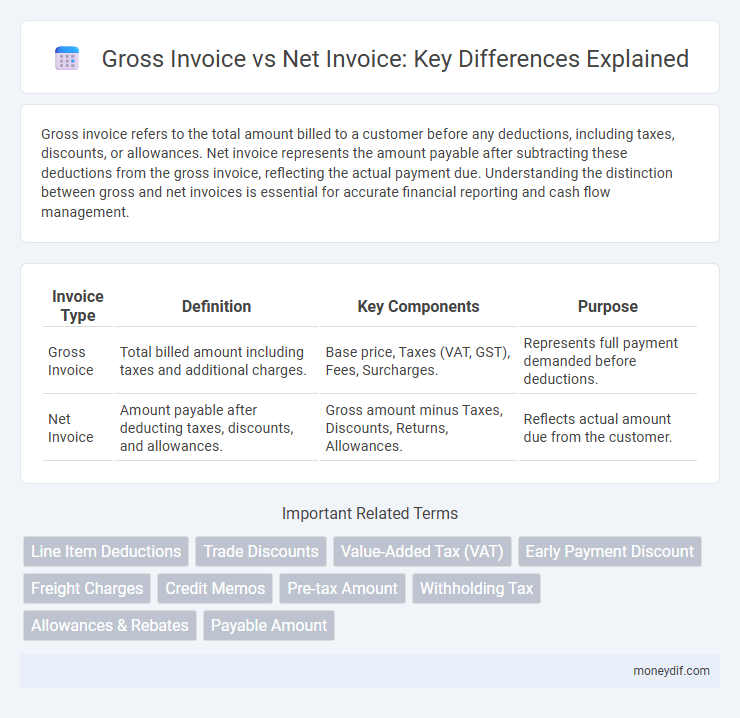

Gross invoice refers to the total amount billed to a customer before any deductions, including taxes, discounts, or allowances. Net invoice represents the amount payable after subtracting these deductions from the gross invoice, reflecting the actual payment due. Understanding the distinction between gross and net invoices is essential for accurate financial reporting and cash flow management.

Table of Comparison

| Invoice Type | Definition | Key Components | Purpose |

|---|---|---|---|

| Gross Invoice | Total billed amount including taxes and additional charges. | Base price, Taxes (VAT, GST), Fees, Surcharges. | Represents full payment demanded before deductions. |

| Net Invoice | Amount payable after deducting taxes, discounts, and allowances. | Gross amount minus Taxes, Discounts, Returns, Allowances. | Reflects actual amount due from the customer. |

Introduction to Gross Invoice and Net Invoice

Gross Invoice represents the total amount billed to a customer before any deductions, including taxes, discounts, or allowances. Net Invoice refers to the final amount payable after subtracting all applicable deductions from the gross invoice value. Understanding the distinction between gross and net invoices is essential for accurate financial reporting and cash flow management.

Definition: What is a Gross Invoice?

A gross invoice represents the total amount billed to a customer before any deductions such as taxes, discounts, or allowances are applied. It reflects the full value of goods or services provided, including all applicable charges. Understanding a gross invoice is essential for accurate financial reporting and billing transparency.

Definition: What is a Net Invoice?

A net invoice refers to the final amount payable by the buyer after deducting any discounts, returns, or allowances from the gross invoice total. It excludes taxes or additional fees that may be listed separately, reflecting the actual cost owed for goods or services rendered. Understanding the net invoice is crucial for accurate payment processing and financial reconciliation in business transactions.

Key Differences Between Gross Invoice and Net Invoice

Gross invoice represents the total amount billed before any deductions, including taxes, discounts, and allowances, providing a comprehensive view of the transaction value. Net invoice reflects the amount payable after subtracting taxes, discounts, and other reductions, indicating the actual payment required from the buyer. Understanding the distinction aids in accurate financial reporting, tax calculation, and cash flow management for businesses.

Components Included in Gross Invoice

Gross invoice includes the total amount billed before any deductions, encompassing the net invoice value, applicable taxes, service charges, and any additional fees or surcharges. It reflects the comprehensive cost of goods or services provided, ensuring all components such as VAT, sales tax, and shipping charges are incorporated. This full amount represents the total payable sum before applying discounts, credits, or withholdings.

Components Included in Net Invoice

A Net Invoice includes the total invoice amount minus any deductions such as taxes, discounts, and advances paid, reflecting the actual payable sum by the buyer. It excludes indirect costs like VAT, sales tax, or withholding tax that are accounted for separately in the Gross Invoice. Understanding components like subtotal, applied discounts, and tax deductions is crucial for accurately interpreting the Net Invoice amount in financial transactions.

Importance of Gross and Net Invoices in Accounting

Gross invoices display the total amount owed before deductions such as discounts, taxes, or returns are applied, essential for understanding revenue potential and cash flow projections. Net invoices reflect the actual amount receivable after adjustments, crucial for accurate financial reporting and tax calculations. Both gross and net invoices are vital in accounting to ensure precise profit analysis and compliance with regulatory standards.

Common Use Cases for Gross Invoice vs Net Invoice

Gross invoice is commonly used in sales transactions where taxes and additional charges are included in the total amount payable, providing a clear overview of the full cost to the buyer. Net invoice is preferred in B2B transactions, contracts, or wholesale deals where taxes, discounts, or credits are calculated separately to reflect the precise amount owed after adjustments. Service industries and international trade often utilize net invoices to facilitate transparent tax reporting and compliance with regulatory requirements.

Tax Implications: Gross vs Net Invoicing

Gross invoices include the total amount charged before any deductions, reflecting the full cost plus applicable taxes such as VAT or sales tax, which must be remitted to tax authorities. Net invoices show the amount payable after subtracting taxes, discounts, or withholding amounts, often used for internal accounting or when tax obligations are settled separately. Understanding the distinction between gross and net invoicing is crucial for accurate tax reporting, compliance, and cash flow management.

Choosing the Right Invoicing Method for Your Business

Gross invoice includes the total amount before deducting taxes, discounts, or other adjustments, providing a comprehensive view of the transaction value. Net invoice reflects the final amount payable after applying deductions such as VAT, discounts, and withholding taxes, making it essential for accurate cash flow management. Selecting between gross and net invoices depends on your business model, tax compliance requirements, and the clarity needed for stakeholders in financial reporting.

Important Terms

Line Item Deductions

Line Item Deductions directly reduce the Gross Invoice amount to calculate the Net Invoice, impacting the final payable value.

Trade Discounts

Trade discounts represent reductions from the gross invoice price, leading to the net invoice value that customers are ultimately liable to pay. These discounts are not recorded separately in accounting books but are reflected directly by subtracting the trade discount from the gross amount to arrive at the net invoice total.

Value-Added Tax (VAT)

Value-Added Tax (VAT) is calculated on the gross invoice amount, including all taxable goods and services, whereas the net invoice excludes VAT and reflects the base price before tax.

Early Payment Discount

Early Payment Discount reduces the Gross Invoice amount, resulting in a lower Net Invoice value when payment is made within the discount period.

Freight Charges

Freight charges are typically included in the gross invoice value but excluded from the net invoice total, which reflects the amount payable after deducting taxes, discounts, and freight costs.

Credit Memos

Credit memos adjust the Gross Invoice by deducting returns or discounts, resulting in the Net Invoice amount used for final billing and accounting.

Pre-tax Amount

The pre-tax amount is the value of goods or services before taxes, typically reflected as the Gross Invoice total, while the Net Invoice amount excludes taxes and any additional fees.

Withholding Tax

Withholding tax is typically calculated on the gross invoice amount, reducing the net invoice payment received by the vendor.

Allowances & Rebates

Allowances and rebates reduce the gross invoice amount, resulting in a lower net invoice value for accurate financial reporting and payment processing.

Payable Amount

The payable amount is the net invoice value derived after deducting taxes, discounts, and adjustments from the gross invoice total.

Gross Invoice vs Net Invoice Infographic

moneydif.com

moneydif.com