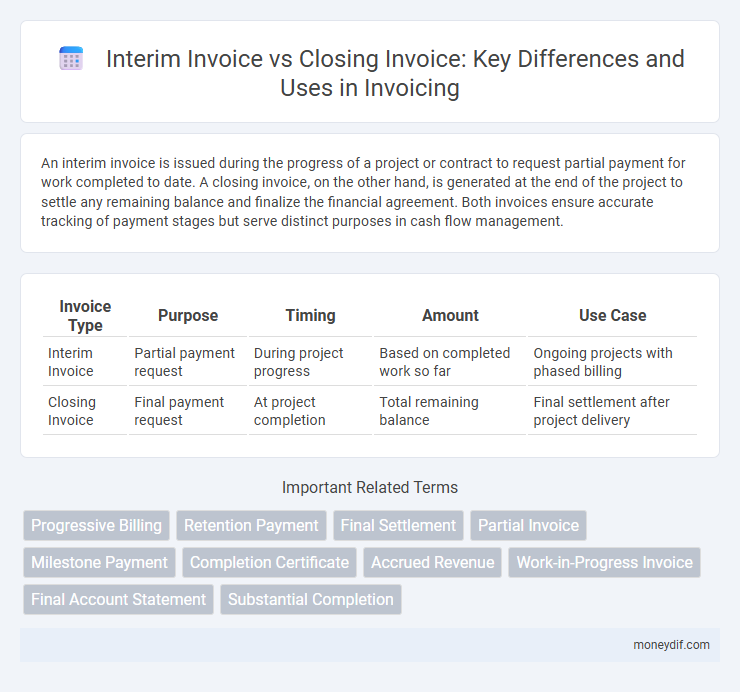

An interim invoice is issued during the progress of a project or contract to request partial payment for work completed to date. A closing invoice, on the other hand, is generated at the end of the project to settle any remaining balance and finalize the financial agreement. Both invoices ensure accurate tracking of payment stages but serve distinct purposes in cash flow management.

Table of Comparison

| Invoice Type | Purpose | Timing | Amount | Use Case |

|---|---|---|---|---|

| Interim Invoice | Partial payment request | During project progress | Based on completed work so far | Ongoing projects with phased billing |

| Closing Invoice | Final payment request | At project completion | Total remaining balance | Final settlement after project delivery |

Definition of Interim Invoice

An interim invoice is a partial billing statement issued during the course of a project or contract to request payment for completed work up to a specific point. It helps maintain cash flow by breaking down large projects into manageable payment stages before the final amount is settled. This differs from a closing invoice, which is issued at the end of a project to invoice the total remaining balance.

Definition of Closing Invoice

A closing invoice is the final billing document issued at the completion of a project or contract, summarizing all previous interim invoices and any remaining costs to settle the total amount owed. It serves as a comprehensive financial statement that confirms project completion and final payment reconciliation. Unlike interim invoices, which are issued periodically to cover partial work done, the closing invoice finalizes the transaction and closes the account.

Key Differences Between Interim and Closing Invoices

Interim invoices request partial payment based on work completed during specific stages of a project, facilitating cash flow and progress tracking. Closing invoices are issued at the project's completion, summarizing total costs and finalizing all outstanding balances for accurate financial closure. Key differences include timing, payment scope, and purpose, with interim invoices managing ongoing payments and closing invoices confirming full settlement.

Benefits of Using Interim Invoices

Interim invoices improve cash flow management by providing regular payments during ongoing projects, reducing financial strain on businesses. They enable precise tracking of project progress, ensuring stakeholders are aware of completed milestones and costs incurred up to that point. This approach enhances transparency, minimizes disputes, and supports better budgeting and forecasting throughout the project lifecycle.

Advantages of Closing Invoices

Closing invoices provide comprehensive final payment details, ensuring all project costs are consolidated and discrepancies are minimized. They streamline accounting processes by offering a clear, complete financial summary which enhances cash flow management and audit accuracy. Utilizing closing invoices reduces the risk of outstanding balances and supports transparent client communication.

When to Use an Interim Invoice

An interim invoice is used during a project or service delivery when payments are required before the completion of the entire contract, providing a way to manage cash flow and maintain project momentum. It is ideal for long-term projects with multiple milestones, allowing clients to pay incrementally based on work completed or delivered stages. Utilizing interim invoices ensures transparency in billing and reduces financial risk by securing partial payments throughout the project timeline.

When to Issue a Closing Invoice

A closing invoice should be issued when a project or contract reaches completion and all deliverables have been fulfilled, ensuring all final costs are accurately reflected. This invoice consolidates previous interim invoices and reconciles any outstanding balances, providing a comprehensive financial summary for the client. Timely issuance prevents payment delays and confirms that no further charges will be billed.

Impact on Cash Flow Management

Interim invoices provide regular cash inflows during a project, improving liquidity and enabling better cash flow forecasting. Closing invoices finalize the payment process, consolidating outstanding amounts and ensuring accurate financial reconciliation. Effective management of both invoice types prevents cash flow disruptions and supports continuous operational funding.

Common Industries Using Interim and Closing Invoices

Construction, manufacturing, and consulting industries frequently use interim invoices to manage payments throughout project milestones, ensuring steady cash flow and resource allocation. Closing invoices are common in real estate, legal services, and event management, where a final comprehensive statement consolidates all charges after project completion. Both invoice types facilitate precise financial tracking and improve transparency between clients and service providers.

Legal and Compliance Considerations

Interim invoices require strict adherence to contract terms and local tax regulations to ensure accurate partial payment documentation, minimizing risks of disputes and compliance breaches. Closing invoices must comprehensively reflect the final project scope, including all adjustments and withheld amounts, to satisfy legal obligations and facilitate audit trails. Proper issuance and record-keeping of both invoice types support regulatory compliance and provide enforceable proof of transaction completion.

Important Terms

Progressive Billing

Progressive billing enables phased payments through interim invoices reflecting partial project completion, while closing invoices finalize total costs after project completion.

Retention Payment

Retention payment ensures project quality by withholding a percentage of the contract value until completion, typically released after final inspection. Interim invoices include retention amounts deducted from payments during project progress, while closing invoices settle and release the total retained sum after project completion.

Final Settlement

The final settlement reconciles the interim invoice amounts with the closing invoice to ensure accurate payment reflecting completed work and agreed terms.

Partial Invoice

A partial invoice represents an interim invoice billing for completed work portions before project completion, whereas a closing invoice finalizes the total contract amount after all work is finished.

Milestone Payment

Milestone payments are typically tied to interim invoices that correspond to specific project phases, whereas closing invoices finalize all payments after project completion.

Completion Certificate

A Completion Certificate validates project completion, triggering the switch from interim invoice payments to the final closing invoice settlement.

Accrued Revenue

Accrued revenue represents earnings recognized before issuing an interim invoice or final closing invoice, reflecting revenue earned but not yet billed.

Work-in-Progress Invoice

A Work-in-Progress Invoice serves as an interim invoice to bill partial project costs before project completion, whereas a closing invoice finalizes all outstanding charges upon project completion.

Final Account Statement

The Final Account Statement reconciles differences between the interim invoice and the closing invoice by accurately reflecting all contract adjustments, variations, and outstanding payments to ensure complete financial closure.

Substantial Completion

Substantial Completion marks the stage when the project is sufficiently finished for use, triggering the interim invoice to cover work completed to date, while the closing invoice settles all remaining balances upon final project acceptance.

interim invoice vs closing invoice Infographic

moneydif.com

moneydif.com