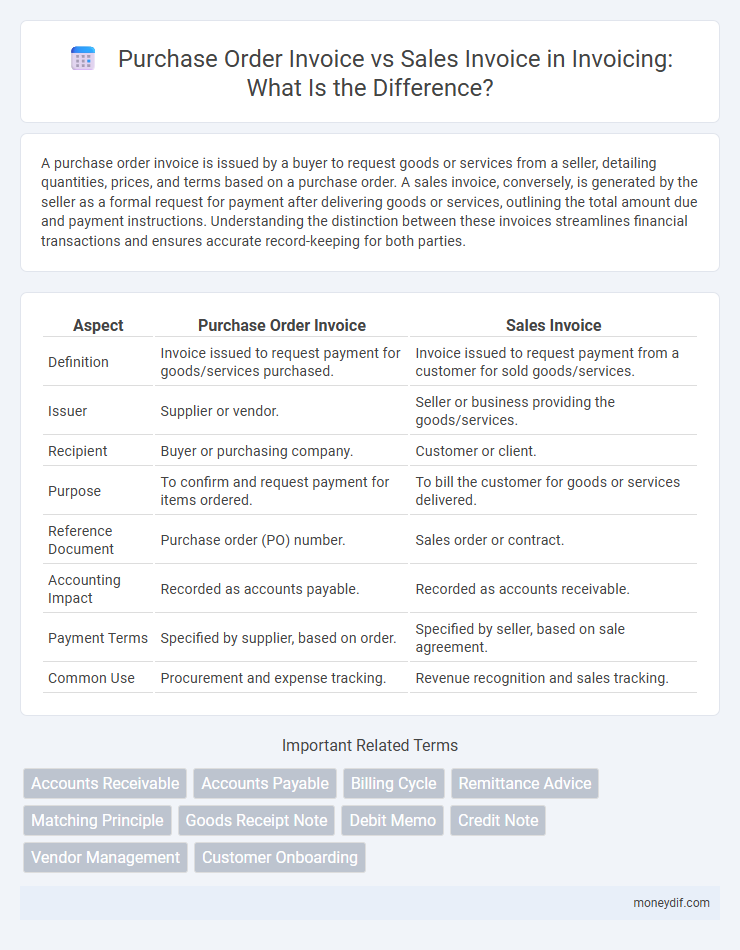

A purchase order invoice is issued by a buyer to request goods or services from a seller, detailing quantities, prices, and terms based on a purchase order. A sales invoice, conversely, is generated by the seller as a formal request for payment after delivering goods or services, outlining the total amount due and payment instructions. Understanding the distinction between these invoices streamlines financial transactions and ensures accurate record-keeping for both parties.

Table of Comparison

| Aspect | Purchase Order Invoice | Sales Invoice |

|---|---|---|

| Definition | Invoice issued to request payment for goods/services purchased. | Invoice issued to request payment from a customer for sold goods/services. |

| Issuer | Supplier or vendor. | Seller or business providing the goods/services. |

| Recipient | Buyer or purchasing company. | Customer or client. |

| Purpose | To confirm and request payment for items ordered. | To bill the customer for goods or services delivered. |

| Reference Document | Purchase order (PO) number. | Sales order or contract. |

| Accounting Impact | Recorded as accounts payable. | Recorded as accounts receivable. |

| Payment Terms | Specified by supplier, based on order. | Specified by seller, based on sale agreement. |

| Common Use | Procurement and expense tracking. | Revenue recognition and sales tracking. |

Understanding Purchase Order Invoices vs. Sales Invoices

Purchase order invoices are issued by buyers to confirm the details of goods or services requested, serving as a formal request for payment upon delivery. Sales invoices, generated by sellers, document the sale transaction and request payment from the buyer based on the agreed terms. Understanding the distinction helps businesses streamline transaction tracking, ensure accurate accounting, and maintain clear communication between purchasing and sales departments.

Definition of Purchase Order Invoice

A purchase order invoice is a financial document issued by a supplier that references a purchase order (PO) to confirm the goods or services delivered and request payment. It serves as a critical link between the buyer's purchase order and the supplier's sales invoice, ensuring accuracy in transaction details such as quantities, prices, and terms. This invoice type streamlines accounts payable processes by matching purchase orders with received invoices for effective financial reconciliation.

Definition of Sales Invoice

A sales invoice is a document issued by a seller to a buyer detailing the products or services provided, including quantities, prices, and total amount due. It serves as a legal record of the transaction and a request for payment. Unlike a purchase order invoice, which originates from the buyer's order request, a sales invoice confirms the sale and triggers the payment process.

Key Differences Between Purchase Order and Sales Invoice

Purchase order invoices initiate the procurement process by detailing requested goods or services, quantities, agreed prices, and delivery terms, serving as a buyer's formal authorization. Sales invoices, issued by the seller, document completed transactions, specifying sold items, pricing, payment terms, and total amount due for goods or services delivered. Key differences include the purchase order's role in order approval and commitment to buy, while the sales invoice functions as a request for payment after fulfillment.

Purpose of a Purchase Order Invoice

A Purchase Order Invoice serves as an essential document that confirms the buyer's request for specific goods or services, detailing quantities, prices, and terms agreed upon with the supplier. It facilitates accurate tracking of orders and ensures that payments are made only for authorized and received items, streamlining accounts payable processes. This invoice type also helps businesses maintain compliance with procurement policies and supports efficient inventory management.

Purpose of a Sales Invoice

A sales invoice serves as a formal request for payment issued by a seller to a buyer, detailing the products or services provided, quantities, prices, and terms of sale. Its primary purpose is to document the transaction, facilitate accurate accounting, and ensure timely payment processing. Unlike a purchase order invoice that initiates the purchase request, a sales invoice confirms delivery and payment expectations.

Essential Elements of Each Invoice Type

Purchase order invoices include essential elements such as the purchase order number, vendor details, item descriptions, quantities, agreed prices, delivery terms, and payment conditions to verify order fulfillment. Sales invoices focus on customer information, sales date, product or service details, unit prices, total amounts due, tax calculations, payment methods, and invoice numbers for accurate billing and accounting. Both invoice types require clear identification and transaction-specific data to facilitate smooth financial reconciliation and legal compliance.

Workflow from Purchase Order to Sales Invoice

The workflow from purchase order to sales invoice involves first generating a purchase order to request goods or services from a supplier, establishing the terms and quantities agreed upon. Upon delivery and verification of the purchased items, a purchase order invoice is created, confirming the receipt and payment obligation. This invoice then facilitates the creation of a sales invoice, where the seller bills the customer based on the purchase order details, ensuring accuracy and traceability throughout the transaction process.

Common Use Cases in Business Transactions

A purchase order invoice is generated by a buyer to confirm and document goods or services ordered, serving as a request for payment and verification in procurement processes. A sales invoice is issued by a seller to record the sale transaction and demand payment from the buyer, detailing quantities, prices, and terms of the sale. Common use cases include purchase order invoices in supplier payments and budget management, while sales invoices are essential for revenue tracking and accounts receivable in business transactions.

Best Practices for Managing Both Invoice Types

Effective management of purchase order invoices and sales invoices requires clear organization and accurate record-keeping to ensure smooth transaction tracking and reconciliation. Implementing automated invoice matching systems helps minimize errors by verifying purchase orders against sales invoices for consistency in quantities, prices, and terms. Regular audits and timely communication between procurement and sales teams optimize cash flow and promote compliance with internal controls and external regulations.

Important Terms

Accounts Receivable

Accounts Receivable tracks outstanding payments from sales invoices generated after purchase orders are fulfilled and invoiced, ensuring accurate cash flow management and financial reconciliation.

Accounts Payable

Accounts Payable manages purchase order invoices to verify vendor payments, while sales invoices primarily relate to accounts receivable processes tracking customer payments.

Billing Cycle

The billing cycle defines the periodic interval for generating purchase order invoices and sales invoices, ensuring accurate reconciliation of owed amounts and payments between buyers and sellers.

Remittance Advice

Remittance advice facilitates accurate payment reconciliation by detailing invoices linked to purchase orders for buyers and sales invoices for sellers.

Matching Principle

The Matching Principle requires recognizing expenses in the same period as the related purchase order invoice and matching them with corresponding sales invoices to accurately reflect revenue and costs.

Goods Receipt Note

A Goods Receipt Note (GRN) verifies physical receipt of items against a purchase order invoice, ensuring accurate inventory updates and payment processing, while sales invoices document the billing details for goods sold to customers.

Debit Memo

A debit memo adjusts discrepancies between purchase order invoices and sales invoices by increasing the amount owed or correcting billing errors.

Credit Note

A credit note adjusts discrepancies in purchase order invoices by offsetting amounts owed between suppliers and buyers, while in sales invoices it serves to correct billing errors or returned goods.

Vendor Management

Vendor management improves purchase order accuracy by reconciling purchase order invoices with corresponding sales invoices to ensure consistent transaction records and payment validation.

Customer Onboarding

Customer onboarding streamlines the reconciliation process by aligning purchase order invoices with corresponding sales invoices to ensure accurate order fulfillment and billing.

purchase order invoice vs sales invoice Infographic

moneydif.com

moneydif.com