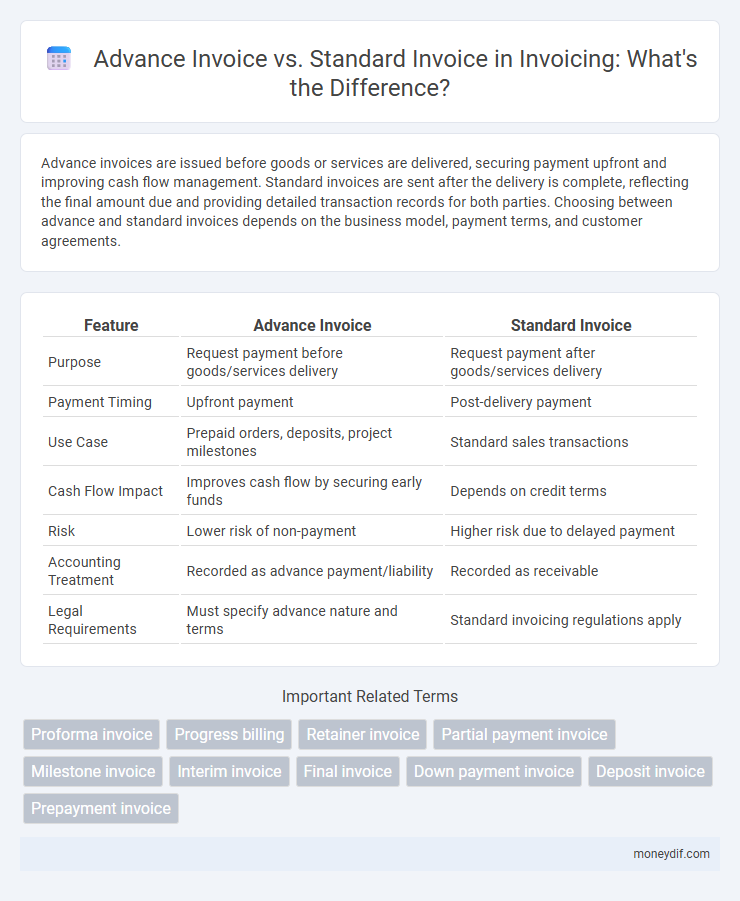

Advance invoices are issued before goods or services are delivered, securing payment upfront and improving cash flow management. Standard invoices are sent after the delivery is complete, reflecting the final amount due and providing detailed transaction records for both parties. Choosing between advance and standard invoices depends on the business model, payment terms, and customer agreements.

Table of Comparison

| Feature | Advance Invoice | Standard Invoice |

|---|---|---|

| Purpose | Request payment before goods/services delivery | Request payment after goods/services delivery |

| Payment Timing | Upfront payment | Post-delivery payment |

| Use Case | Prepaid orders, deposits, project milestones | Standard sales transactions |

| Cash Flow Impact | Improves cash flow by securing early funds | Depends on credit terms |

| Risk | Lower risk of non-payment | Higher risk due to delayed payment |

| Accounting Treatment | Recorded as advance payment/liability | Recorded as receivable |

| Legal Requirements | Must specify advance nature and terms | Standard invoicing regulations apply |

Introduction to Invoice Types

Advance invoices require payment before goods or services are delivered, providing businesses with upfront cash flow and reducing credit risk. Standard invoices are issued after delivery, specifying the amount due and payment terms, commonly used for completed transactions. Understanding the distinction helps businesses manage billing cycles effectively and optimize cash management.

What is an Advance Invoice?

An advance invoice is a billing document issued before goods or services are delivered, requesting partial or full payment upfront. It enables businesses to secure funds prior to order fulfillment, improving cash flow management and reducing credit risk. Unlike a standard invoice, which is generated after delivery, an advance invoice acts as a payment request in advance, often used in industries with large projects or customized orders.

What is a Standard Invoice?

A standard invoice is a detailed document issued after goods or services have been delivered, specifying the final amount due for payment. It includes essential information such as the invoice number, date, billing details, itemized list of products or services, quantities, prices, taxes, and total payable amount. This type of invoice serves as an official request for payment and is commonly used in regular business transactions to record completed sales.

Key Differences Between Advance and Standard Invoices

Advance invoices request partial or full payment before goods or services are delivered, ensuring cash flow and commitment from clients, while standard invoices are issued post-delivery or completion. Advance invoices often include detailed terms about payment schedules and deposits, whereas standard invoices specify due dates and payment methods after service fulfillment. Understanding these distinctions helps businesses manage cash flow, reduce credit risk, and maintain clear financial communication with clients.

When to Use an Advance Invoice

An advance invoice is used when payment is required before goods or services are delivered, ensuring cash flow and commitment from the client. This type of invoice is ideal for custom orders, large projects, or when suppliers need to secure funds for upfront costs. Standard invoices are typically issued after delivery or service completion, reflecting the actual amount due.

When to Use a Standard Invoice

A standard invoice is used when the goods or services have been fully delivered or completed, and payment is requested after fulfillment. It ensures accurate tracking of completed transactions and aligns with typical accounting practices for final billing. This type of invoice supports clear financial reporting by reflecting the exact amount due post-delivery.

Legal and Tax Implications

Advance invoices require clear indication of payment received before goods or services are delivered, impacting VAT reporting and compliance with local tax laws. Standard invoices document completed transactions, allowing for straightforward revenue recognition and tax declarations under generally accepted accounting principles. Misclassification between advance and standard invoices can lead to legal disputes and potential tax penalties, emphasizing the need for accurate invoicing practices aligned with jurisdiction-specific regulations.

Pros and Cons of Advance Invoices

Advance invoices provide businesses with upfront payment, improving cash flow and reducing credit risk, especially in projects requiring significant initial investment. However, they may deter customers who prefer paying after service delivery, and managing advance payments can complicate accounting processes. Unlike standard invoices issued after goods or services, advance invoices necessitate clear terms to avoid disputes and ensure customer trust.

Pros and Cons of Standard Invoices

Standard invoices provide a clear and detailed record of completed sales transactions, ensuring accurate billing and easier financial reconciliation. They facilitate better cash flow management by specifying payment terms and due dates, but may delay payment since amounts are based on delivered goods or services rather than upfront deposits. However, these invoices might increase the risk of non-payment or late payment compared to advance invoices, which require partial or full payment before delivery.

Choosing the Right Invoice Type for Your Business

Choosing the right invoice type is crucial for effective cash flow management and accurate accounting. Advance invoices request payment before goods or services are delivered, ensuring upfront capital, while standard invoices bill clients after delivery, allowing for payment on agreed terms. Selecting between advance and standard invoices depends on your business model, client relationship, and risk tolerance, optimizing financial stability and operational efficiency.

Important Terms

Proforma invoice

A Proforma invoice serves as a preliminary bill of sale sent to buyers before the shipment of goods, differing from an advance invoice which specifically requests prepayment, while a standard invoice is issued after goods or services are delivered to demand payment.

Progress billing

Progress billing schedules payments based on project milestones, distinguishing advance invoices, issued before work begins to secure funds, from standard invoices, which bill completed work stages.

Retainer invoice

A retainer invoice secures upfront payment for future services, differing from a standard invoice that bills completed work and an advance invoice that requests partial payment before service delivery.

Partial payment invoice

Partial payment invoices allow clients to pay a portion of the total amount upfront, differing from advance invoices which request full payment before service, and standard invoices which require full payment after delivery. Utilizing partial payment invoices improves cash flow management and reduces financial risk compared to relying solely on advance or standard invoices.

Milestone invoice

A milestone invoice requests partial payment upon completing specific project phases, while an advance invoice bills clients before work begins and a standard invoice charges after services are fully delivered.

Interim invoice

An interim invoice requests partial payment before project completion, differentiating from an advance invoice issued as prepayment and a standard invoice invoiced upon full delivery.

Final invoice

A final invoice consolidates payments by deducting the advance invoice amount from the total due, whereas a standard invoice requests full payment without prior adjustments.

Down payment invoice

A down payment invoice records partial upfront payments, differs from a standard invoice by reflecting an advance payment before full delivery, and contrasts with an advance invoice that may request funds without linking to specific goods or services.

Deposit invoice

A deposit invoice requests partial payment before service or product delivery, while a standard invoice demands full payment after completion, and an advance invoice covers payments made ahead of any billable work or goods provided.

Prepayment invoice

A prepayment invoice requires payment before goods or services are delivered, contrasting with a standard invoice issued after delivery, while an advance invoice specifies partial payment ahead of completion.

advance invoice vs standard invoice Infographic

moneydif.com

moneydif.com