A consular invoice is a document required by the consulate of the importing country, containing detailed information about the shipment, its value, and the exporter to verify and approve the goods before shipment. A customs invoice, on the other hand, is used primarily by customs authorities to assess duties and taxes and ensure compliance with import regulations. While both invoices include shipment details, the consular invoice focuses on consular approval, whereas the customs invoice emphasizes customs clearance and duty calculation.

Table of Comparison

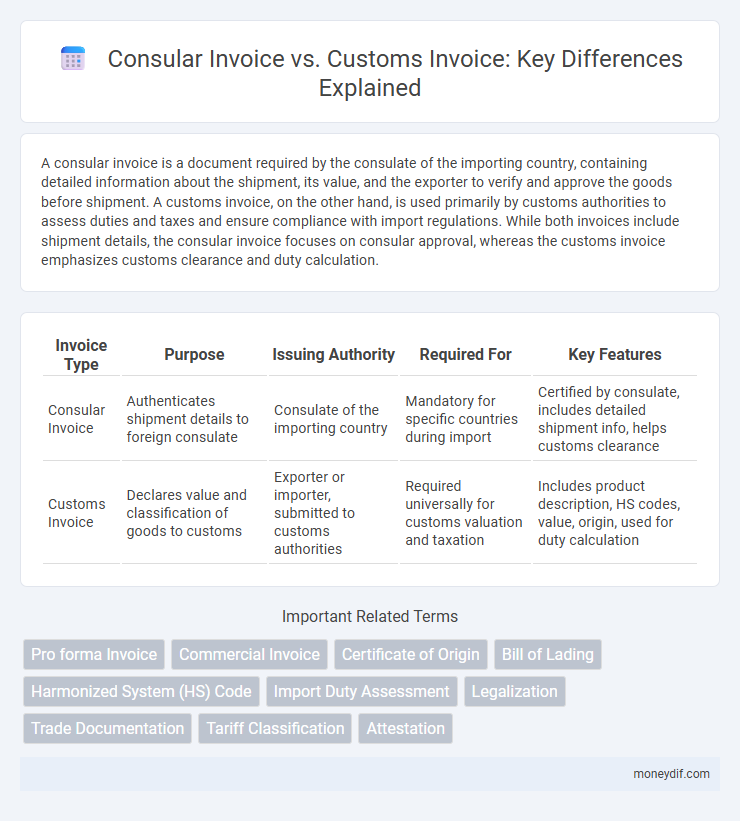

| Invoice Type | Purpose | Issuing Authority | Required For | Key Features |

|---|---|---|---|---|

| Consular Invoice | Authenticates shipment details to foreign consulate | Consulate of the importing country | Mandatory for specific countries during import | Certified by consulate, includes detailed shipment info, helps customs clearance |

| Customs Invoice | Declares value and classification of goods to customs | Exporter or importer, submitted to customs authorities | Required universally for customs valuation and taxation | Includes product description, HS codes, value, origin, used for duty calculation |

Introduction to Consular and Customs Invoices

Consular invoices are documents certified by the consulate of the importing country, verifying the value and details of the goods for customs authorities. Customs invoices, on the other hand, are commercial invoices used primarily for customs clearance, detailing product information, value, and origin without requiring consular attestation. Both invoices streamline cross-border trade by providing essential information for import duties, taxes, and regulatory compliance.

Definition of Consular Invoice

A consular invoice is a document certified by the consulate of the importing country, providing detailed information about the goods being shipped to facilitate customs clearance and verify the authenticity of the shipment. It differs from a customs invoice, which is primarily used by customs authorities to assess duties and taxes based on the declared value and description of the goods. The consular invoice includes specifics like the exporter, importer, consignee, product quantity, price, and origin, ensuring compliance with the importing country's trade regulations.

Definition of Customs Invoice

A Customs Invoice is a detailed document required by customs authorities to assess and verify the value, quantity, and description of goods imported or exported, ensuring accurate duty and tax calculation. Unlike a Consular Invoice, which must be certified by the consulate of the importing country, a Customs Invoice primarily serves to facilitate customs clearance and compliance with international trade regulations. It includes essential data such as product codes, country of origin, and transaction values to streamline border inspections and legal documentation.

Purpose of Consular Invoice

The purpose of a Consular Invoice is to authenticate and verify the shipment details for customs authorities in the importing country, facilitating smoother clearance and compliance with local regulations. Unlike a Customs Invoice, which primarily contains commercial transaction details for tariff assessment, the Consular Invoice is certified by the consulate of the importing country to ensure accuracy and prevent fraud. This document helps reduce delays and penalties during the import process by providing official validation of goods' value, quantity, and description.

Purpose of Customs Invoice

A Customs Invoice serves as an essential document used primarily for the accurate assessment of duties, taxes, and customs clearance procedures. It provides detailed information about the shipment, such as description, quantity, value, and origin of goods, ensuring compliance with import regulations. Unlike a Consular Invoice, which is certified by the consulate of the importing country, a Customs Invoice focuses on facilitating customs authorities' evaluation and clearance processes.

Key Differences: Consular vs Customs Invoice

Consular invoices are documents required by the consulate of the importing country, detailing shipment information for verification and approval before shipment, while customs invoices are used primarily by customs authorities to assess duties and taxes upon import. Consular invoices often include detailed product descriptions, quantities, and values certified by the consulate, whereas customs invoices focus on compliance with customs regulations and accurate tariff classification. The key difference lies in the consular invoice's role in pre-shipment consular approval versus the customs invoice's function in import clearance and duty calculation.

Required Information on Consular Invoice

A consular invoice requires detailed information including the shipper's name and address, consignee details, detailed description of the goods, their quantity, value, and origin, as well as the shipment's destination. This document must be certified by the consulate of the importing country, serving as a specialized customs invoice to comply with specific regulations. Unlike a standard customs invoice, the consular invoice ensures accuracy for tariff and import duty assessments and prevents shipment delays.

Required Information on Customs Invoice

A Customs Invoice must include key details such as the supplier's and buyer's full names and addresses, a detailed description of the goods, the quantity, unit price, total value, country of origin, and the harmonized system (HS) code. It also requires shipping terms, currency of the transaction, and the invoice date to comply with customs regulations. This comprehensive information ensures accurate assessment of duties and smooth clearance of goods through customs.

When to Use Consular vs Customs Invoice

Consular invoices are required when shipping goods to countries that mandate pre-approval and certification by their consulate to ensure accurate valuation and compliance with import regulations. Customs invoices are used for general customs clearance purposes in most countries, detailing the transaction to determine duties and taxes without requiring consular endorsement. Use consular invoices when exporting to nations with strict consulate requirements, while customs invoices suffice for standard international trade where such certification is not mandatory.

Impact on International Trade Compliance

Consular invoices require authentication by the exporting country's consulate, ensuring regulatory compliance and reducing risks of shipment delays or penalties in international trade. Customs invoices, tailored for accurate declaration of goods' value and classification, facilitate efficient customs clearance and help prevent undervaluation or misclassification that can lead to fines. Both invoices play critical roles in meeting specific trade compliance requirements and optimizing cross-border transaction transparency.

Important Terms

Pro forma Invoice

A Pro forma Invoice serves as a preliminary bill of sale sent to buyers before the shipment is dispatched, detailing the goods and estimated costs, often required by customs for import clearance. Unlike a Consular Invoice, which is certified by the destination country's consulate and used for verifying shipment details and calculating duties, a Customs Invoice primarily functions as an official document submitted to customs authorities to assess tariffs and facilitate the import-export process.

Commercial Invoice

A commercial invoice details the transaction between buyer and seller, while a consular invoice requires embassy certification for customs clearance, and a customs invoice is specifically formatted for tax and import duty assessment by customs authorities.

Certificate of Origin

A Certificate of Origin verifies the product's country of manufacture, distinguishing it from a Consular Invoice required by the importing country's consulate for customs clearance, while a Customs Invoice details product value and description for tariff assessment.

Bill of Lading

A Bill of Lading serves as a shipment receipt and contract of carriage, while a Consular Invoice is required by some countries' consulates for customs clearance, and a Customs Invoice provides detailed transaction data for customs valuation and duty assessment.

Harmonized System (HS) Code

Harmonized System (HS) Code is a standardized numerical method used internationally for classifying traded products, essential for both Consular Invoice and Customs Invoice to accurately determine customs duties and ensure regulatory compliance.

Import Duty Assessment

Consular invoices require certification by the embassy and often affect Import Duty Assessment more rigorously than customs invoices, which are prepared by the exporter without official embassy validation.

Legalization

Legalization ensures the authenticity of consular invoices issued by foreign consulates, whereas customs invoices are verified by customs authorities to determine accurate import duties and compliance.

Trade Documentation

Trade documentation includes essential papers like Consular Invoices and Customs Invoices, each serving distinct roles; a Consular Invoice is authenticated by the consulate of the importing country to verify shipment details and value, while a Customs Invoice is used by customs authorities to assess duties and taxes based on product descriptions and declared values. Accurate preparation of both documents ensures compliance with international trade regulations and facilitates efficient customs clearance.

Tariff Classification

Tariff classification determines the applicable duties by analyzing product descriptions on consular invoices, which are certified by foreign consulates, versus customs invoices issued by importers or exporters for customs clearance.

Attestation

Attestation ensures the authenticity of a Consular Invoice, which is certified by the consulate for international shipments, whereas a Customs Invoice is directly used by customs authorities to assess and verify goods for import duties and regulations.

Consular Invoice vs Customs Invoice Infographic

moneydif.com

moneydif.com