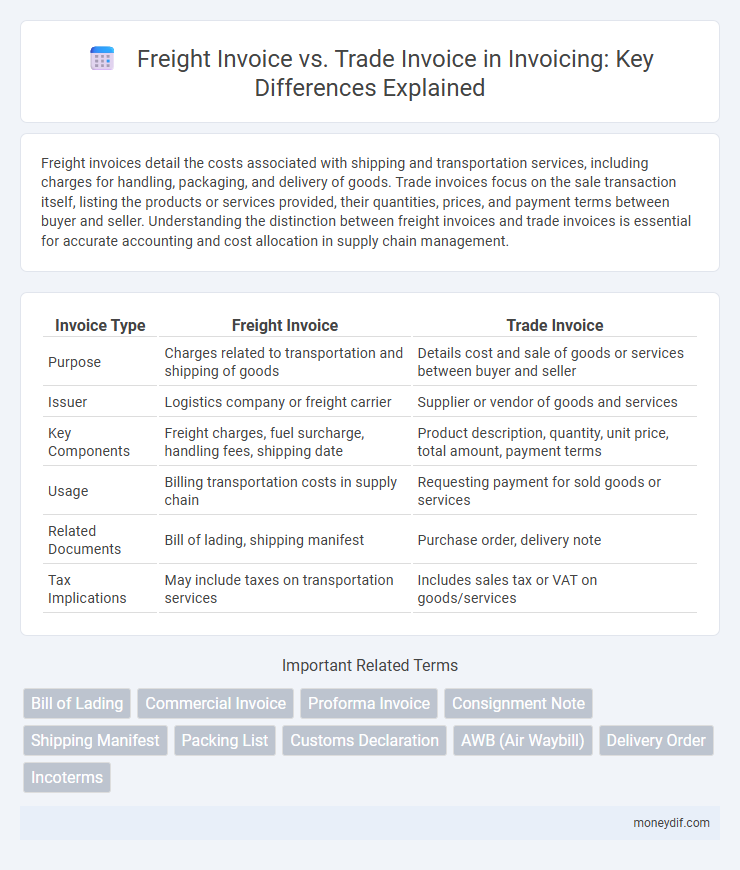

Freight invoices detail the costs associated with shipping and transportation services, including charges for handling, packaging, and delivery of goods. Trade invoices focus on the sale transaction itself, listing the products or services provided, their quantities, prices, and payment terms between buyer and seller. Understanding the distinction between freight invoices and trade invoices is essential for accurate accounting and cost allocation in supply chain management.

Table of Comparison

| Invoice Type | Freight Invoice | Trade Invoice |

|---|---|---|

| Purpose | Charges related to transportation and shipping of goods | Details cost and sale of goods or services between buyer and seller |

| Issuer | Logistics company or freight carrier | Supplier or vendor of goods and services |

| Key Components | Freight charges, fuel surcharge, handling fees, shipping date | Product description, quantity, unit price, total amount, payment terms |

| Usage | Billing transportation costs in supply chain | Requesting payment for sold goods or services |

| Related Documents | Bill of lading, shipping manifest | Purchase order, delivery note |

| Tax Implications | May include taxes on transportation services | Includes sales tax or VAT on goods/services |

Understanding Freight Invoices

Freight invoices detail the charges associated with transporting goods, including shipping, handling, and logistics fees, making them essential for cost tracking in supply chain management. These invoices often include specifics such as carrier information, freight class, weight, and delivery terms, distinguishing them from trade invoices that focus on the sale price of the goods themselves. Understanding freight invoices is crucial for accurate financial reconciliation and ensuring transparency between shippers and carriers.

What is a Trade Invoice?

A Trade Invoice is a detailed document issued by a seller to a buyer, outlining the goods or services provided along with their prices, quantities, and payment terms. It serves as a legal record for commercial transactions and is essential for accounting, customs clearance, and tax purposes. Unlike a Freight Invoice, which specifically covers transportation and shipping charges, a Trade Invoice encompasses the full scope of the sale.

Key Differences Between Freight and Trade Invoices

Freight invoices detail charges related to the transportation and logistics services, including shipping fees, handling, and insurance costs, whereas trade invoices focus on the sale of goods, listing product descriptions, quantities, prices, and terms of sale. Freight invoices serve as proof of delivery and cost confirmation for shipping providers, while trade invoices act as sales contracts and payment requests between buyers and sellers. Understanding these distinctions is crucial for accurate accounting, regulatory compliance, and efficient supply chain management.

Core Components of a Freight Invoice

A Freight Invoice primarily includes core components such as shipment details, carrier information, freight charges, and payment terms, which distinguish it from a Trade Invoice that centers on product price and quantities. Key elements like bill of lading number, weight, distance, and fuel surcharges are critical for accurate freight billing and reconciliation. Proper documentation of these components ensures compliance with logistics standards and facilitates efficient audit processes in transportation management.

Essential Elements of a Trade Invoice

A trade invoice must include essential elements such as the seller and buyer's contact details, detailed descriptions of goods or services, unit prices, quantities, total amounts, payment terms, and invoice date. This document serves as a legal proof of sale and facilitates customs clearance and financial record-keeping. Unlike a freight invoice, which primarily details shipping costs and logistics, a trade invoice focuses on the commercial transaction and product valuation.

When to Use Freight vs Trade Invoices

Freight invoices are used specifically to bill transportation and shipping charges associated with moving goods, essential when logistics costs must be itemized separately from product pricing. Trade invoices are issued for the sale of goods themselves, detailing quantities, descriptions, and prices for commercial transactions between buyers and sellers. Use freight invoices to clarify shipping expenses after goods are dispatched, while trade invoices apply at the point of sale or order fulfillment to document the merchandise transaction.

Legal and Compliance Aspects

Freight invoices detail charges related to transportation services and must comply with international shipping regulations and customs documentation to avoid legal disputes. Trade invoices represent the transaction value of goods sold and require adherence to commercial laws, tax regulations, and import-export compliance standards. Both types of invoices are crucial in maintaining accurate financial records and ensuring regulatory compliance in cross-border trade.

Impact on Accounting and Taxation

Freight invoices detail transportation costs and directly affect accounting by increasing the cost of goods sold and impacting inventory valuation, which can influence taxable income calculations. Trade invoices record the sale of goods or services, triggering revenue recognition and determining sales tax liability essential for accurate tax reporting. Proper classification and processing of both invoice types ensure compliance with accounting standards and tax regulations, minimizing risks of errors and financial discrepancies.

Common Challenges in Invoice Management

Freight invoices and trade invoices often present common challenges in invoice management, such as discrepancies in billing amounts, delayed approvals, and lack of standardized formats. Handling inaccurate freight charges and ambiguous trade item descriptions frequently causes payment delays and disputes. Efficient invoice reconciliation requires robust validation processes and integration with shipment tracking data to reduce errors and improve cash flow.

Tips for Accurate Invoice Preparation

Ensure precise item descriptions and quantities when preparing freight invoices to avoid discrepancies in shipping costs. For trade invoices, accurately detail product specifications, unit prices, and payment terms to streamline customs clearance and payment processes. Verify all invoice data against purchase orders and delivery receipts to minimize errors and disputes.

Important Terms

Bill of Lading

The Bill of Lading serves as a crucial shipping document linking the Freight Invoice, which details transportation charges, to the Trade Invoice, which specifies the value of goods sold in international trade.

Commercial Invoice

Commercial invoices serve as official trade documents detailing transaction specifics, distinguishing them from freight invoices which focus solely on shipping costs and services related to cargo transportation.

Proforma Invoice

A Proforma Invoice is a preliminary bill of sale sent to buyers in international trade, distinctly different from a Freight Invoice that details shipping charges and a Trade Invoice which formalizes the sale of goods including terms and payment details.

Consignment Note

A Consignment Note serves as proof of goods shipment detailing freight charges for the Freight Invoice, while the Trade Invoice itemizes the goods' sale price for the buyer.

Shipping Manifest

A Shipping Manifest details cargo specifics for transport, serving to verify Freight Invoices that bill shipping charges, while Trade Invoices document the commercial transaction between buyer and seller.

Packing List

A packing list details the shipped goods' contents and quantities, serving as a key document referenced in both freight invoices for shipping charges and trade invoices for sales transactions to ensure accuracy and compliance.

Customs Declaration

Customs declarations require accurate differentiation between freight invoices detailing shipping costs and trade invoices specifying product values to ensure proper tariff classification and duty assessment.

AWB (Air Waybill)

An Air Waybill (AWB) is a crucial shipping document that serves as a freight invoice for transportation charges, while a trade invoice details the commercial transaction between buyer and seller, including product prices and terms.

Delivery Order

A Delivery Order authorizes shipment release, linking the Freight Invoice for transportation costs and the Trade Invoice for the goods' purchase price.

Incoterms

Freight invoices detail shipping and logistics costs under Incoterms, while trade invoices outline the commercial value and terms of goods sold between buyer and seller.

Freight Invoice vs Trade Invoice Infographic

moneydif.com

moneydif.com