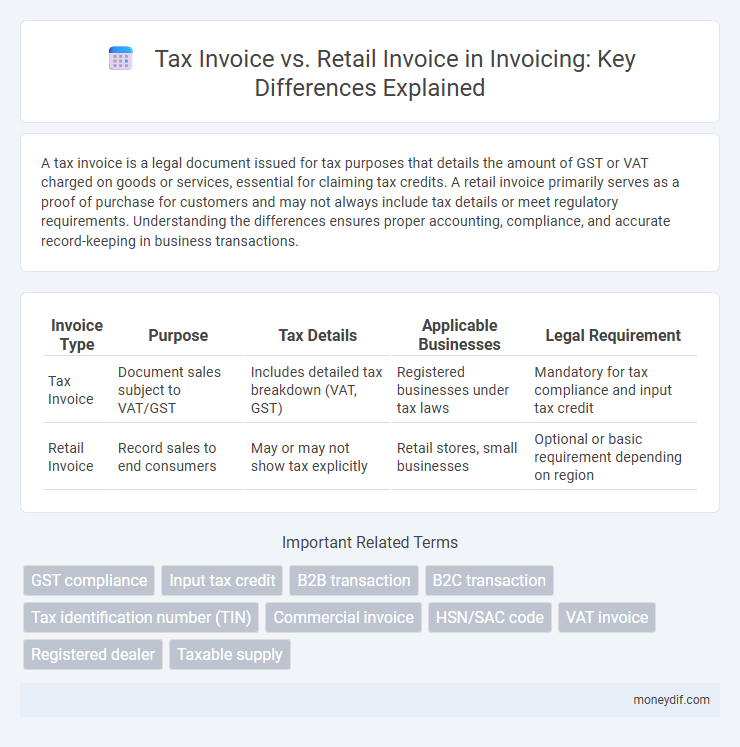

A tax invoice is a legal document issued for tax purposes that details the amount of GST or VAT charged on goods or services, essential for claiming tax credits. A retail invoice primarily serves as a proof of purchase for customers and may not always include tax details or meet regulatory requirements. Understanding the differences ensures proper accounting, compliance, and accurate record-keeping in business transactions.

Table of Comparison

| Invoice Type | Purpose | Tax Details | Applicable Businesses | Legal Requirement |

|---|---|---|---|---|

| Tax Invoice | Document sales subject to VAT/GST | Includes detailed tax breakdown (VAT, GST) | Registered businesses under tax laws | Mandatory for tax compliance and input tax credit |

| Retail Invoice | Record sales to end consumers | May or may not show tax explicitly | Retail stores, small businesses | Optional or basic requirement depending on region |

Introduction to Tax Invoice and Retail Invoice

A tax invoice is a legally recognized document issued by a registered supplier that details the goods or services provided, including applicable tax amounts such as GST or VAT, essential for claiming input tax credits. A retail invoice serves as a sales receipt primarily for customers, listing purchased items and their prices but typically does not include detailed tax information required for tax credit purposes. Understanding the distinct roles and regulatory requirements of tax invoices and retail invoices is crucial for compliance in financial record-keeping and tax reporting.

Definition of Tax Invoice

A tax invoice is a legal document issued by a registered supplier that details the sale of goods or services and includes the applicable Goods and Services Tax (GST) or Value Added Tax (VAT) amounts. It serves as proof of transaction for tax authorities and buyers, enabling input tax credit claims and ensuring compliance with tax regulations. Retail invoices, by contrast, are simpler receipts provided to end consumers without detailed tax breakdowns or legal requirements for tax authorities.

Definition of Retail Invoice

A retail invoice is a sales document issued by a retailer to the customer at the point of sale, detailing the purchased goods or services along with their prices, quantities, and total amount payable. Unlike a tax invoice, it may not include detailed tax breakdowns such as GST or VAT, and is primarily used for everyday retail transactions rather than for business-to-business compliance. Retail invoices serve as proof of purchase and are essential for returns, warranty claims, and customer records.

Key Differences Between Tax Invoice and Retail Invoice

A tax invoice includes detailed tax information such as GST or VAT registration numbers and specifies the tax amount charged, which is essential for input tax credit claims by businesses. A retail invoice, typically issued to end consumers, contains basic transaction details like item description, quantity, price, and total amount without mandatory tax registration details. The key differences lie in the purpose, level of tax details, and legal requirements for compliance and tax reporting.

Legal Requirements for Tax and Retail Invoices

Tax invoices must comply with specific legal requirements such as displaying the seller's Tax Identification Number (TIN), invoice serial number, date of issue, detailed description of goods or services, and the amount of tax charged. Retail invoices, while also required to provide proof of purchase, typically follow less stringent regulations and do not always mandate the inclusion of tax details or the seller's TIN. Compliance with these legal standards ensures the validity of tax invoices for input tax credit claims, whereas retail invoices primarily serve as receipts for consumer transactions.

When to Use a Tax Invoice vs. Retail Invoice

A tax invoice must be issued when a business sells goods or services subject to GST or VAT and the buyer is eligible to claim input tax credits, typically in B2B transactions. A retail invoice is used for sales directly to end consumers who are not registered for GST or VAT, where no input tax credit applies, mainly in B2C contexts. Knowing the difference is crucial for compliance, as tax invoices require detailed tax information, while retail invoices are simpler and serve as proof of purchase for consumers.

Components of a Tax Invoice

A tax invoice contains specific components such as the seller's name, address, GST number, invoice number, date of issue, description of goods or services, quantity, unit price, total amount, taxable value, applicable tax rate, and the total tax amount payable. These elements ensure compliance with tax regulations and facilitate input tax credit claims. Retail invoices typically lack detailed tax elements and focus mainly on transaction summary and payment details.

Components of a Retail Invoice

A retail invoice typically includes key components such as the seller's name, address, and GSTIN, along with the buyer's details if applicable, date of sale, invoice number, and a detailed description of goods or services supplied including quantity, unit price, and total amount. It also features applicable taxes like GST or VAT separately and the final payable amount, often with payment terms stated clearly. Unlike a tax invoice required for business transactions, retail invoices are designed for direct consumer sales and may not include supplier's tax identification in all cases.

Impact on GST and Taxation

Tax invoices are mandatory for businesses registered under GST, as they document the GST charged and enable input tax credit claims, directly impacting compliance and tax liability. Retail invoices typically do not contain GST details or tax components, primarily used for consumer sales where GST input credit is not claimed. The presence or absence of GST information in these invoices determines the extent of taxation reporting and credit mechanisms in the supply chain.

Choosing the Right Invoice Type for Your Business

Choosing the right invoice type for your business depends on the transaction specifics and legal requirements; tax invoices are essential for businesses registered for VAT or GST and must include details such as tax identification numbers, itemized taxable amounts, and tax rates. Retail invoices, on the other hand, are typically used for direct consumer sales without tax breakdowns and focus on simplicity and customer convenience. Understanding the differences ensures compliance with tax regulations and accurate financial reporting.

Important Terms

GST compliance

GST compliance mandates issuing a tax invoice for business-to-business transactions, detailing GSTIN, taxable value, and GST charged, ensuring input tax credit claims are valid. Retail invoices, used primarily in business-to-consumer sales, focus on item details and total price but often omit GST specifics required for formal tax credit claims.

Input tax credit

Input tax credit is claimable only when a valid tax invoice is issued by a registered supplier, whereas retail invoices generally lack the required details for claiming such credit.

B2B transaction

B2B transactions require tax invoices detailing GST and supplier information to enable input tax credit claims, unlike retail invoices primarily used for sales records without tax credit eligibility.

B2C transaction

A B2C transaction typically generates a retail invoice, which serves as proof of purchase without detailed tax breakdowns, whereas a tax invoice is issued primarily in B2B transactions to document GST or VAT components for input tax credit claims. Retail invoices focus on straightforward sales documentation for end consumers, while tax invoices provide comprehensive tax details necessary for regulatory compliance and accounting purposes.

Tax identification number (TIN)

A Tax Identification Number (TIN) is essential for issuing a tax invoice, as it verifies the taxpayer's registration for value-added tax (VAT) or other sales taxes, ensuring compliance with tax authorities. Retail invoices may not always require a TIN, especially for casual or low-value transactions, but tax invoices must display the TIN to enable buyers to claim input tax credits.

Commercial invoice

A commercial invoice serves as a customs declaration document for international shipments, detailing the transaction between exporter and importer with item descriptions, quantities, and values essential for calculating duties and taxes. In contrast, a tax invoice focuses on complying with tax regulations by including GST or VAT details for domestic sales, while a retail invoice caters to end consumers, highlighting purchase specifics without tax breakdowns needed for business accounting.

HSN/SAC code

HSN (Harmonized System of Nomenclature) and SAC (Service Accounting Code) codes are essential for categorizing goods and services on tax invoices, ensuring compliance with GST regulations and facilitating accurate tax calculation. Retail invoices may include these codes, but tax invoices specifically require HSN/SAC codes to enable proper tax reporting and input tax credit claims under GST law.

VAT invoice

A VAT invoice is a specific type of tax invoice that includes detailed information such as the VAT amount charged, seller and buyer details, and the tax registration number, which is essential for businesses to reclaim input VAT. Retail invoices, on the other hand, are simpler documents issued primarily to end consumers, showing the total payable amount without VAT breakdown, and are generally not used for tax credit claims.

Registered dealer

A registered dealer issues a tax invoice that details the Goods and Services Tax (GST) charged, enabling input tax credit claims, while a retail invoice is primarily for final consumers without GST components. Tax invoices must include the dealer's GSTIN, invoice number, date, and details of taxable supply, distinguishing them from retail invoices used in regular sales transactions.

Taxable supply

Taxable supply refers to goods or services subject to Value Added Tax (VAT) or Goods and Services Tax (GST), requiring issuers to provide a tax invoice that details the VAT amount, supplier's registration number, and transaction specifics for tax deduction and compliance purposes. In contrast, a retail invoice is issued for final consumer sales, typically without detailed tax information, serving primarily as a proof of purchase rather than a tax credit document.

Tax invoice vs Retail invoice Infographic

moneydif.com

moneydif.com